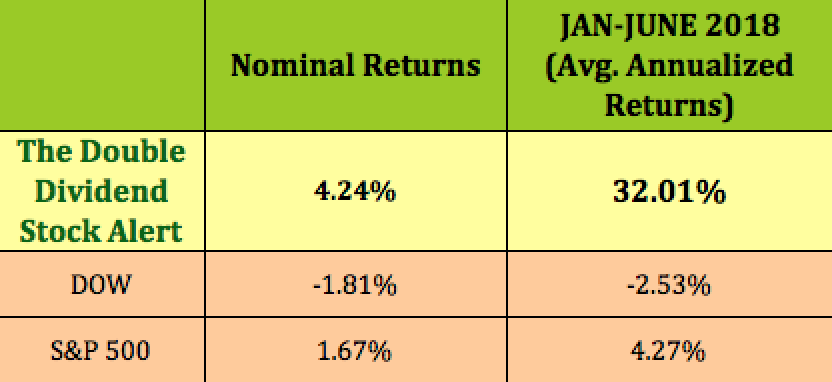

How is your portfolio handling the up and down market of 2018?

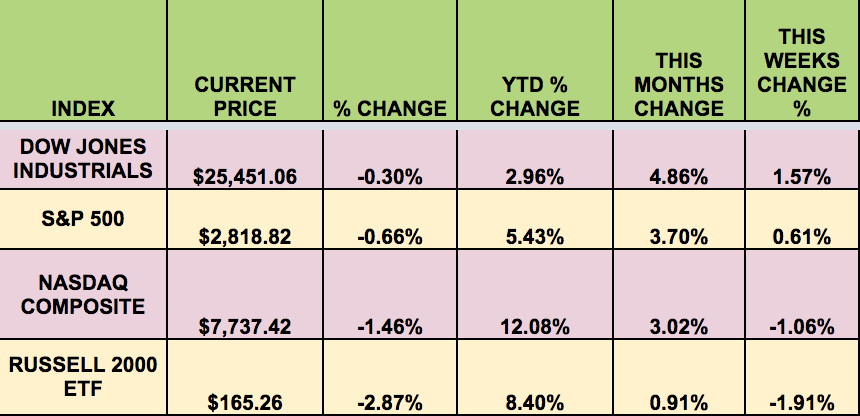

Markets: It was another mixed week for the market, with the Dow leading, and the S&P 500 making gaining, while the NASDAQ got clobbered by Facebook's (FB) plunge, the Russell small caps lost nearly -2%.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: AGNC, CLDT, CLNC, EPR, GEL, OHI, ORC, TGE, TLP, TRGP, WES, CPLP, CAPL, CVI.

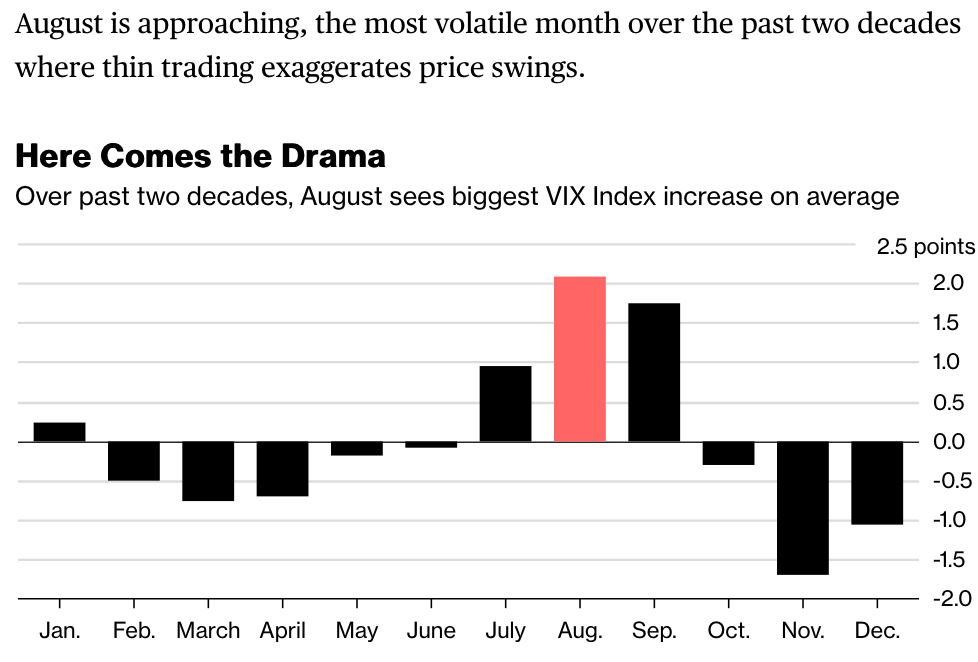

Volatility: The VIX rose 3.2% this week, ending the week at $13.03.

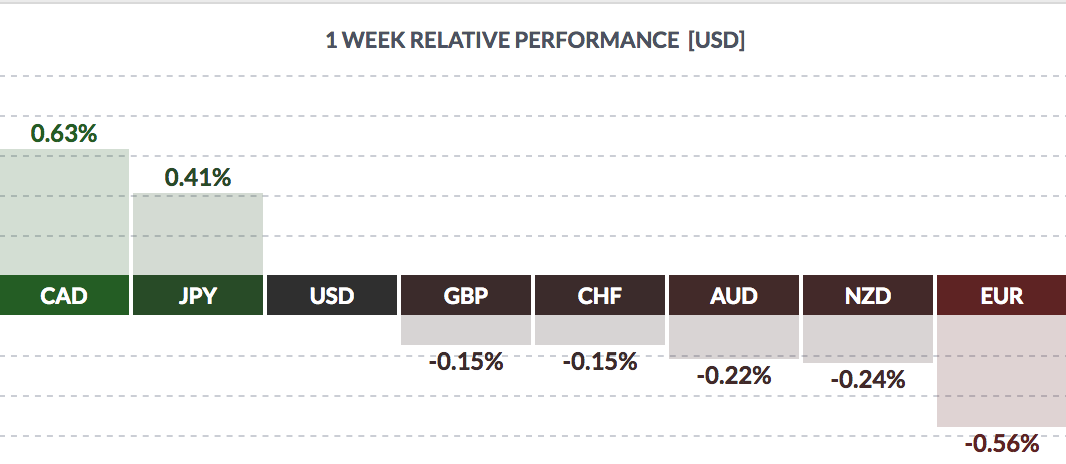

Currency: The dollar rose vs. other major currencies this week, except the Loonie and the yen.

“A rapid rise in the dollar has hurt second-quarter financial results and some U.S. companies are warning that the pressure could persist in future quarters. The U.S. dollar has risen 2.5 percent so far this year (DXY) against a basket major currencies with most of its gains coming in the second quarter. As a result companies are starting to reevaluate their currency hedging strategies.

Here are some of the U.S. companies blaming the stronger greenback for weaker revenue or profits:

Netflix Inc (NASDAQ:NFLX) said last week that current-quarter operating profit margins would be narrower than previously expected because of strength in the U.S. dollar. Most of Netflix’ growth comes from overseas, but the majority of its costs remain dollar-denominated.

Illinois Tool Works (NYSE:ITW) saw its shares tumble Monday after it slashed its full-year outlook, citing the strong dollar. It forecast a 12-cent per share negative currency impact compared with its previous forecast for the second half of the year.

Market Breadth: 23 of the DOW 30 stocks rose this week, vs. 14 last week. 61% of the S&P 500 rose this week, vs. 56% last week.

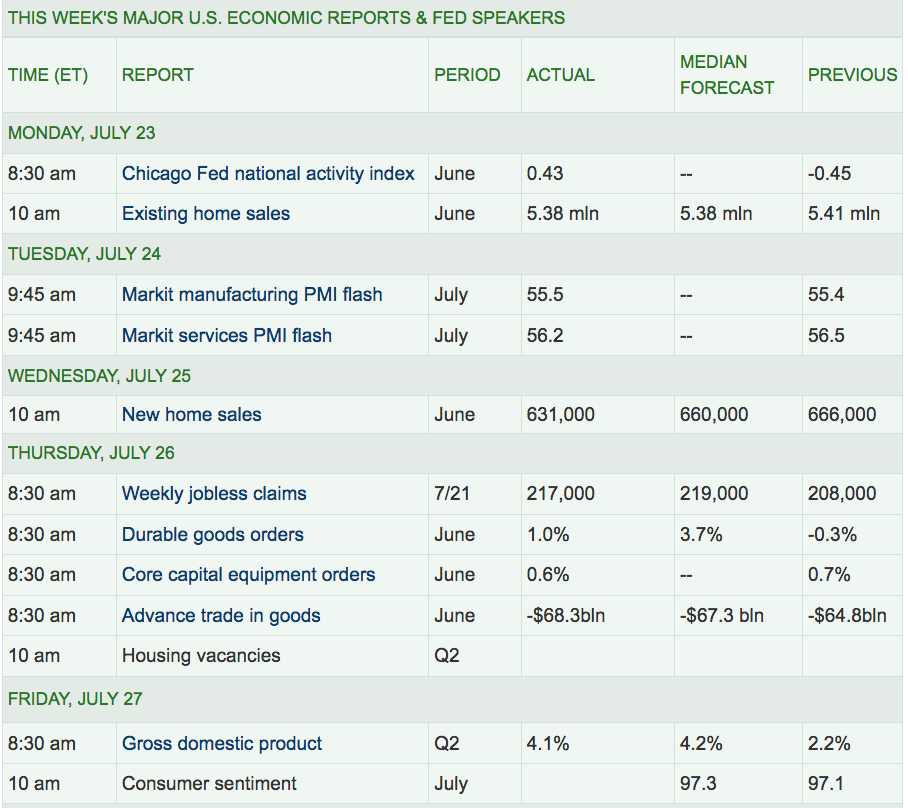

Economic News: Q2 ’18 GDP rose 4.1%, slightly below the 4.2% forecast, partially fueled by panicked stockpiling ahead of tariffs. Existing and New Home Sales both declined, along with Durable Goods Orders.

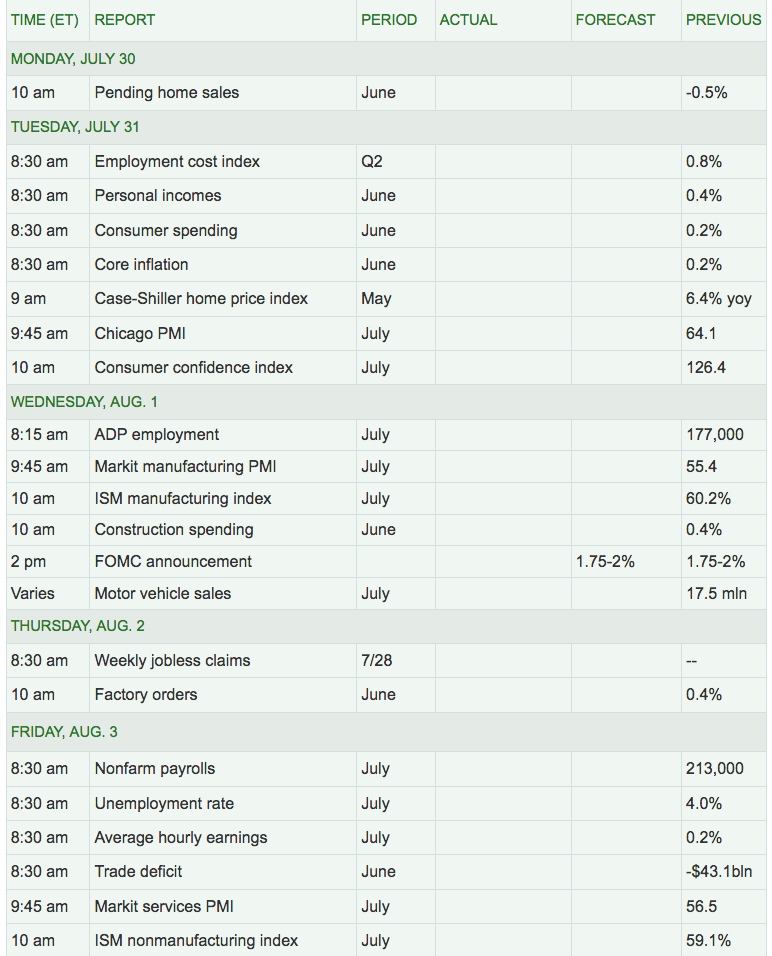

Week Ahead Highlights: It’ll be a heavy economic data week, with the Non-Farm Payrolls and the Unemployment rate coming out next Friday, plus several consumer-based reports. Q2 Earnings season rolls on, with 6 DOW components reporting, including AAPL, XOM, PG, and CAT. 29% of the S&P 500 will report, including PFE, CBS, and Berkshire Hathaway.

Next Week’s US Economic Reports:

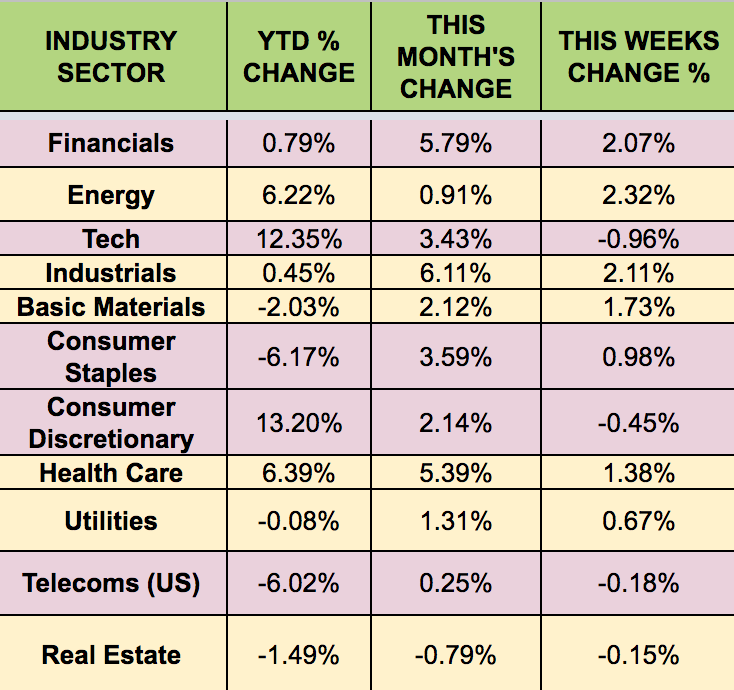

Sectors: The Financials sector led again this week, with Tech trailing.

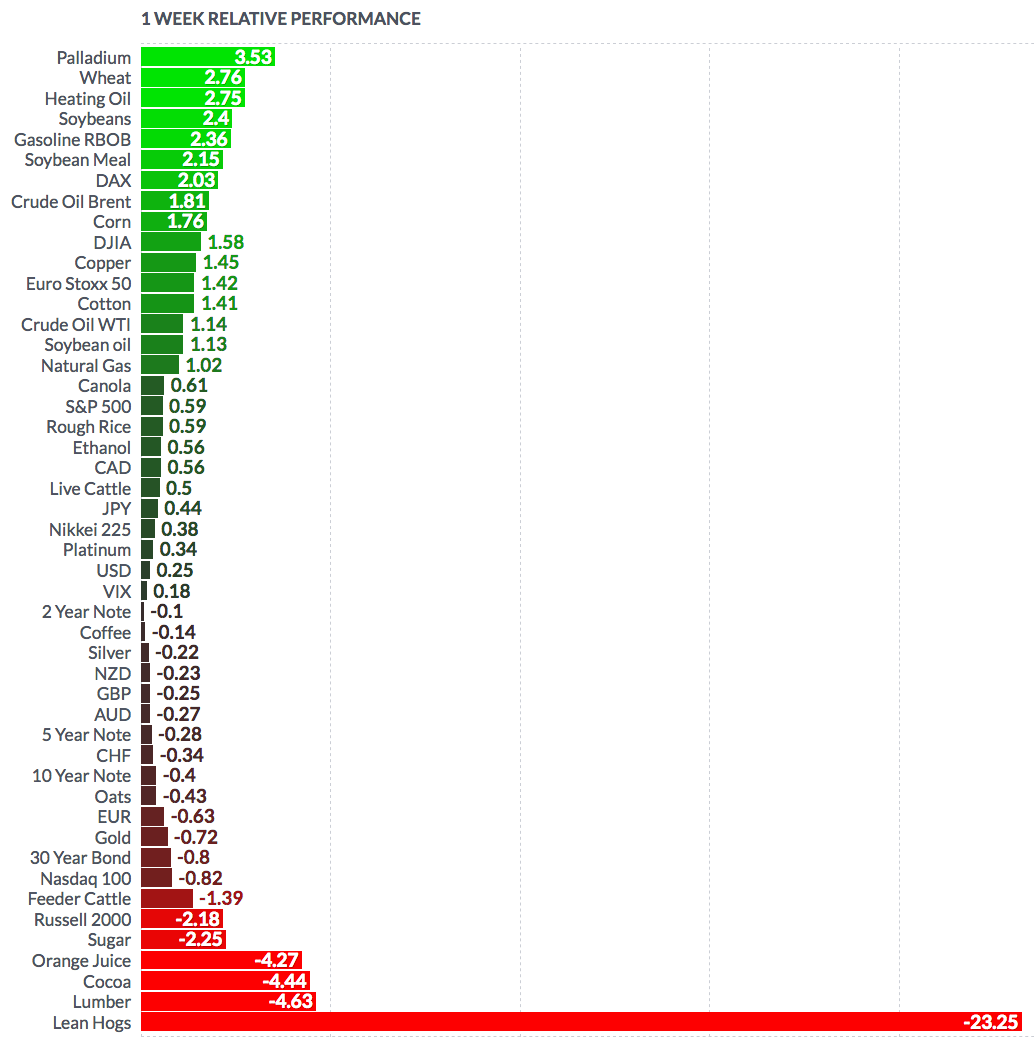

Futures:

WTI Crude finished the week at $69.04, with WTI futures up 1.14%. Natural Gas Futures 1.02%: