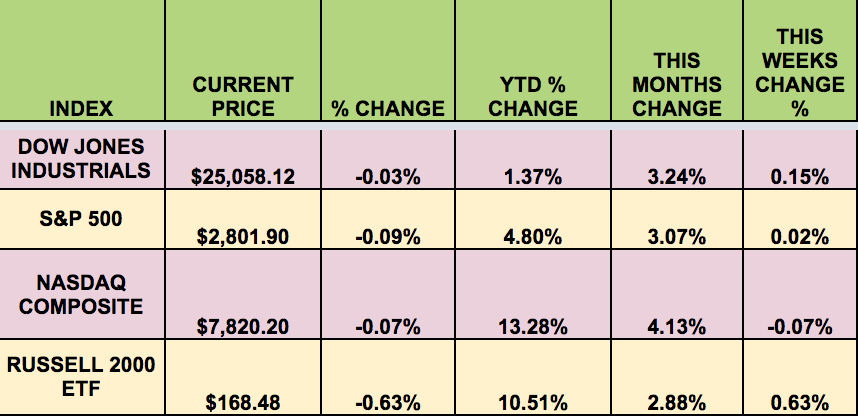

Markets: It was a mixed week for the market, with the Dow Jones, the S&P 500, and the NASDAQ all roughly flat, while the Russell small caps notched a gain. Strong earnings reports from MSFT and other major firms failed to counter investor trade war jitters, which were fueled Friday by another round of rhetoric from the White House, in addition to warnings from US firms about tariffs dampening profits.

GE warned that it expects tariffs on its imports from China to raise its costs by up to $400M and Alcoa (NYSE:AA) said the tariffs led to an extra $15M in costs. US automakers have also been warning about the negative impact of tariffs, with 40% of the parts in GM’s U.S.-sold vehicles coming from outside the US, vs. 45% for FCA and 20% for Ford.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: SKIS, TAX.

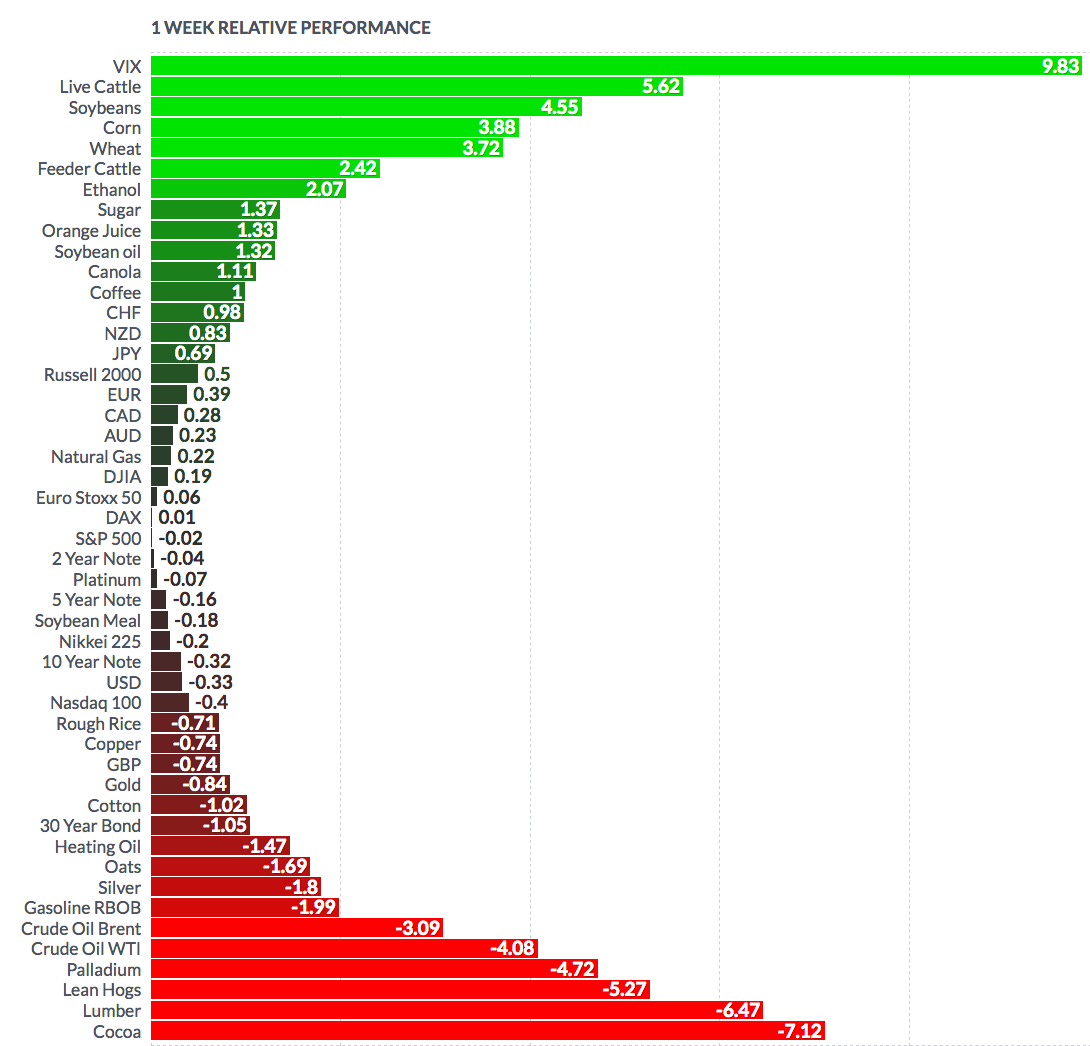

Volatility: The VIX rose 5.3% this week, ending the week at $12.63.

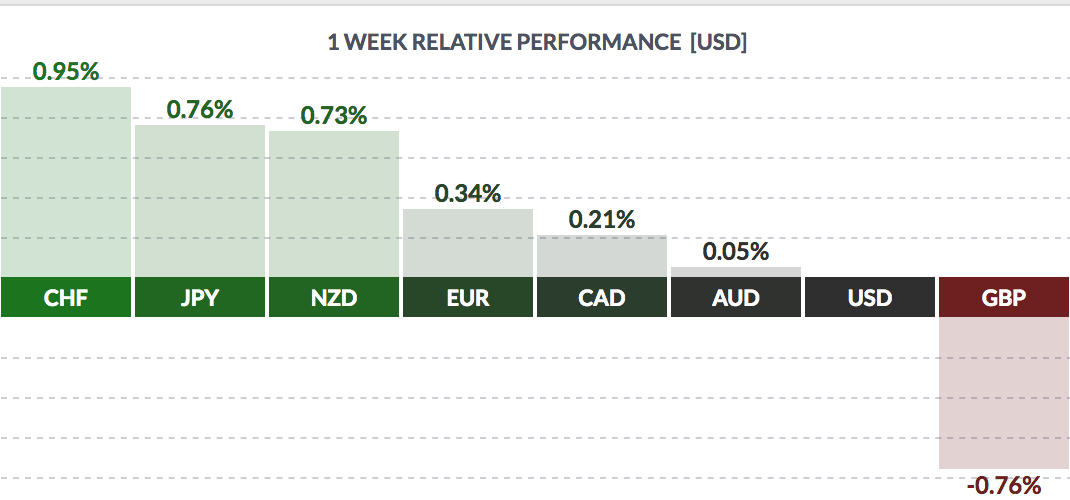

Currency: The dollar fell vs. other major currencies this week.

Market Breadth: 14 of the DOW 30 stocks rose this week, vs. 26 last week. 56% of the S&P 500 rose this week, vs. 64% last week.

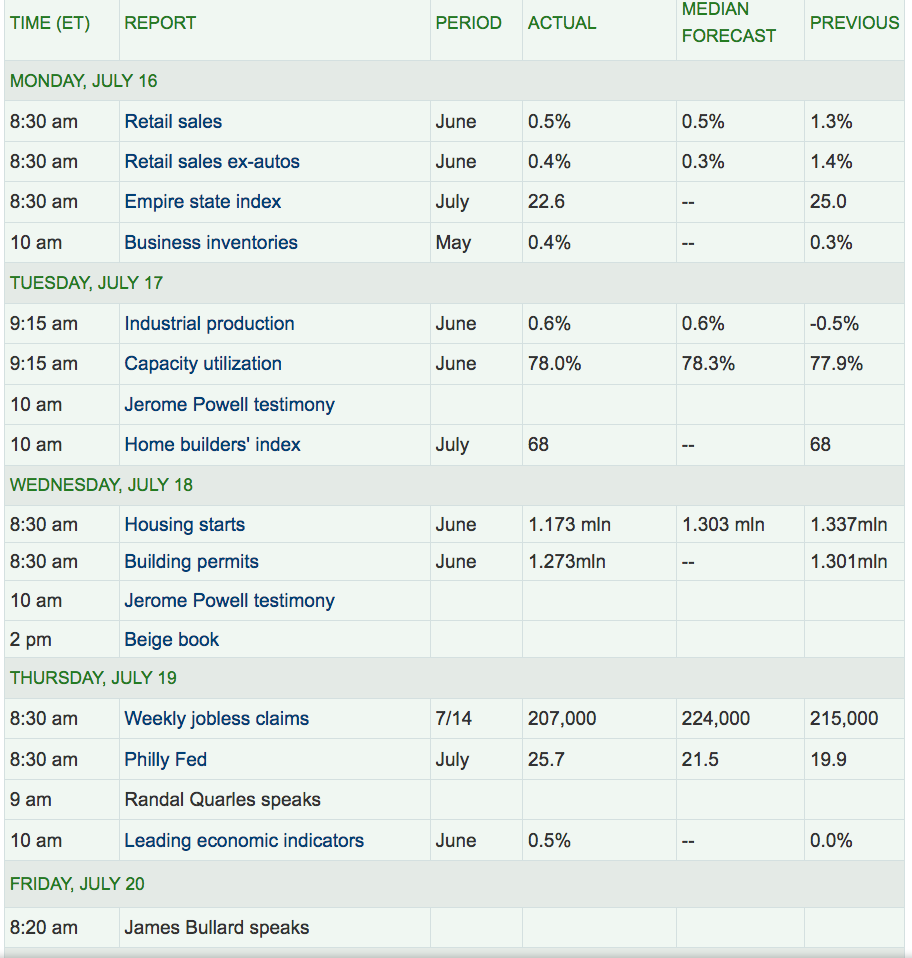

Economic News:

“U.S. industrial production increased in June, boosted by a sharp rebound in manufacturing and further gains in mining output, the latest sign of robust economic growth in the second quarter. Industrial production increased at a 6.0 percent annualized rate in the second quarter, faster than the 2.4 percent pace logged in the January-March period. Manufacturing output surged 0.8 percent in June after decreasing 1.0 percent in May. A 7.8 percent jump in motor vehicle production buoyed manufacturing output last month. Motor vehicle production declined 8.6 percent in May after a fire at a parts supplier caused a sharp drop in the assembly of trucks.” (Reuters)

“U.S. loan applications to refinance existing homes rebounded from their lowest levels in over 17-1/2 years last week, while home borrowing costs were mixed, data from the Mortgage Bankers Association showed on Wednesday. seasonally adjusted index on homeowners’ requests for refinancing rose 2.2 percent to 979.6 in the week ended July 13. The prior week’s figure of 958.5 was the lowest since December 2000.” (Reuters)

“U.S. home building fell 12.3%, to a nine-month low in June and permits declined for a third straight month, dealing a blow to the housing market as it struggles with a dearth of properties available for sale. Higher lumber prices and shortages of land and labor are constraining home building. The housing market is lagging overall economic growth, which appears to have accelerated in the second quarter after hitting a soft patch at the start of the year. (Reuters)

“A threat by the U.S. government to impose tariffs of up to 25 percent on imported auto parts could hit consumers in unexpected ways: higher repair costs, insurance premiums and even the theft of more cars for their parts, the industry said. A coalition of auto insurance groups said that hiking tariffs on imported auto parts by 25 percent could increase costs by 2.7 percent, or $3.4 billion annually, for personal auto insurance premiums.” (Reuters)

Jobless claims decreased by 8k to 207k, the lowest since 1969.

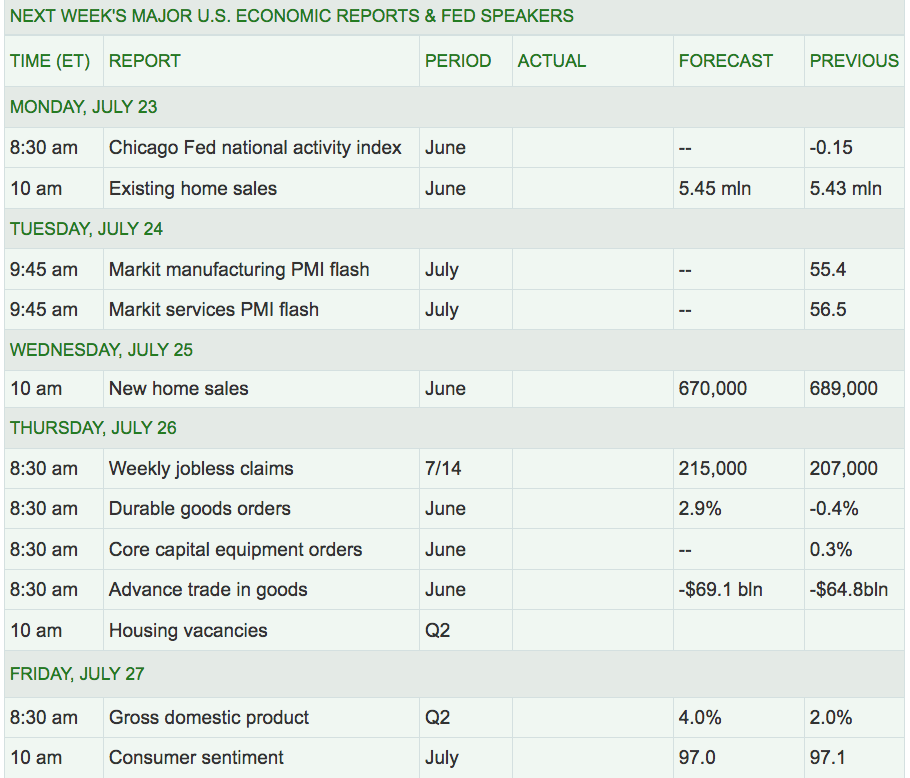

Week Ahead Highlights: Q2 earnings season moves into high gear next week, with 11 DOW stocks reporting, including Exxon Mobil (NYSE:XOM), Verizon Communications Inc (NYSE:VZ), Boeing (NYSE:BA), and Visa Inc (NYSE:V). There will be 36% of the S&P 500 stocks reporting, including McDonald’s (NYSE:MCD), Mastercard Inc (NYSE:MA), Facebook (NASDAQ:FB), and Intel (NASDAQ:INTC).

Microsoft Corporation (NASDAQ:MSFT) rose ~5% Friday, hitting an all-time high, after reporting another strong quarter of earnings, due to robust demand for its cloud services, which posted a revenue gain of 89%.

Next Week’s US Economic Reports:

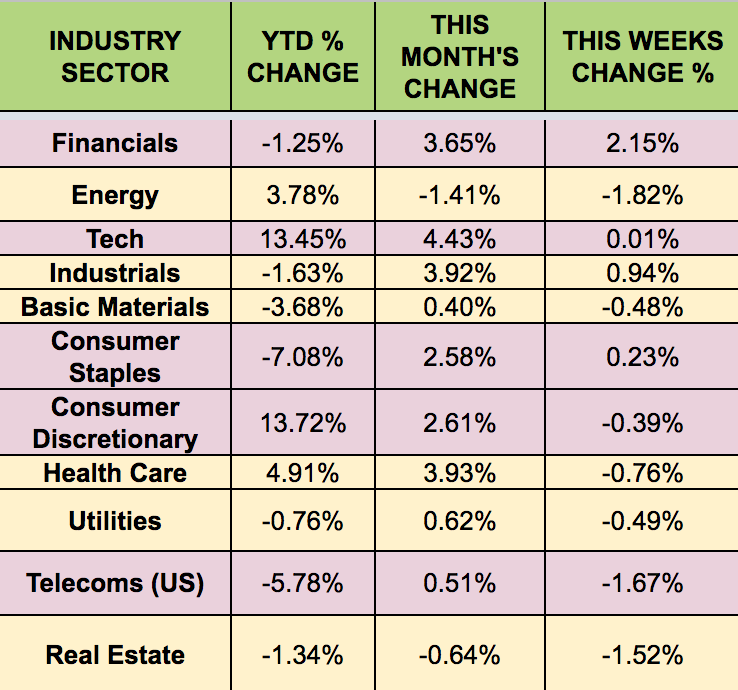

Sectors: The Financials sector led this week, with Energy and Telecoms trailing.

Futures:

WTI Crude finished the week at $68.07, with WTI futures down -4.08%. Natural Gas futures fell -0.22%: