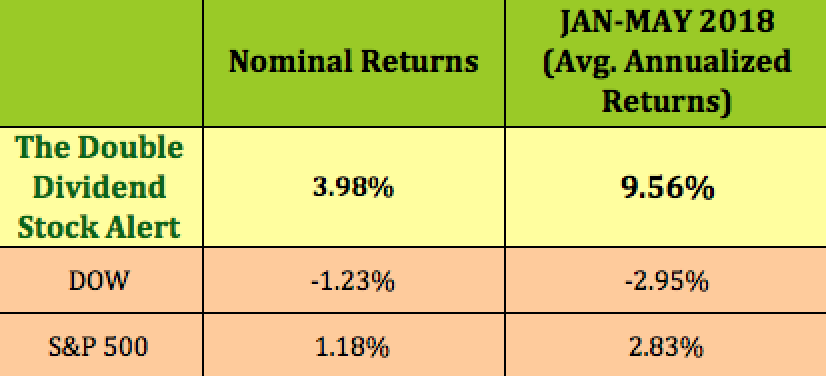

How is your portfolio handling the up and down market of 2018?

Click here to learn how Selling Options can take advantage of higher Volatility, giving you more downside protection and more income.

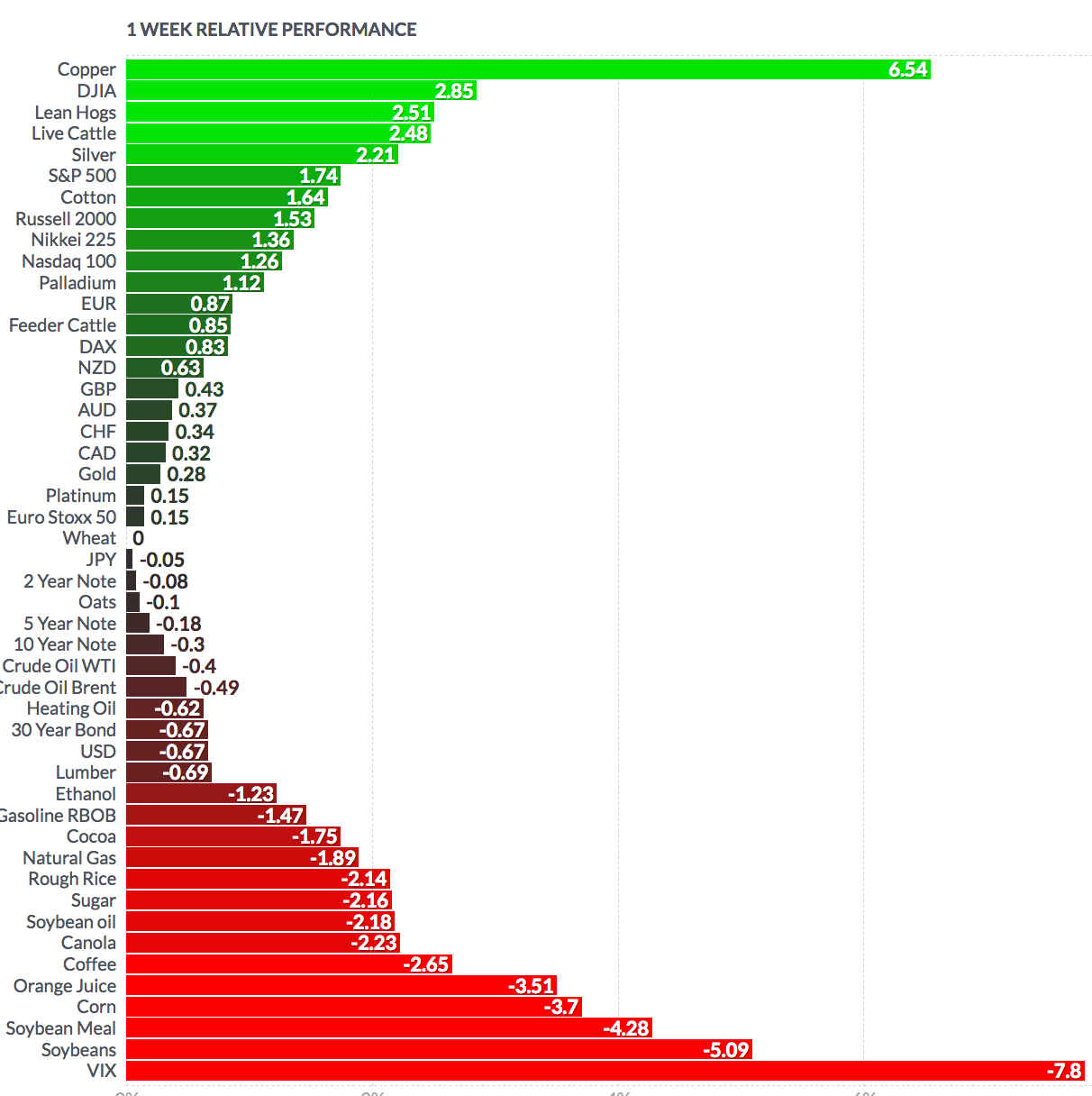

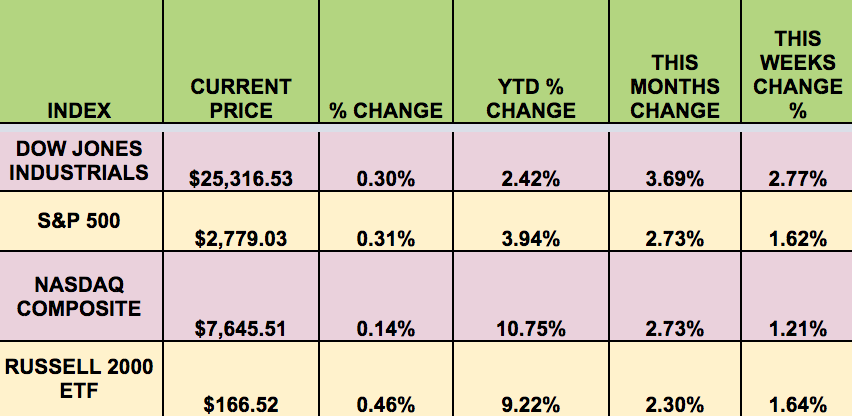

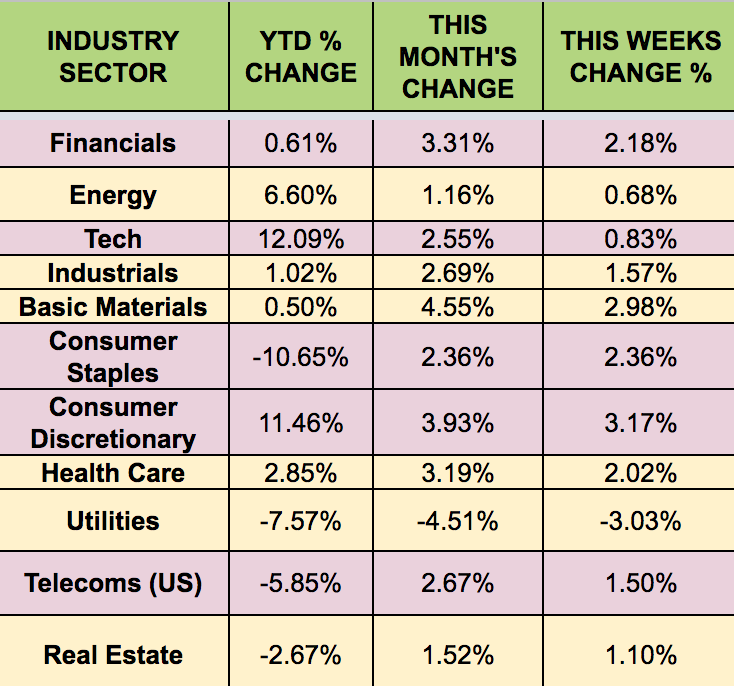

Markets: It was a big up week for the market, with solid gains across the board. The Dow bounced back from last week’s loss, logging its best week since March, to lead all 4 indexes. Investors shrugged off global trade tensions, and focused on better earnings – Wall Street estimates 2018 earnings growth of 22.2%, according to Thomson Reuters. A retreat by the dollar also perked up Basic Materials stocks – the sector was up 2.98% this week.

“Wall Street’s three major indexes rose on Monday, led by a rally in tech stocks, pushing the NASDAQ to a record closing high as investors bet on a continuation of strong economic growth, while falling oil prices weighed on the energy sector.

“The jobs report is looking in the rear-view mirror while the protectionist actions last week will impact the future,” Invesco’s chief global market strategist said. “Investors may be caught off guard if there is a negative impact to economic growth this year from protectionism."

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: GME, MPW, ARCC, ARR, GLPI, IRM, NEWT, NMFC, OXSQ, RWT, SAR, SOHO, TCRD, TCP.

Volatility: The VIX fell 9.5% this week, ending the week at $12.18.

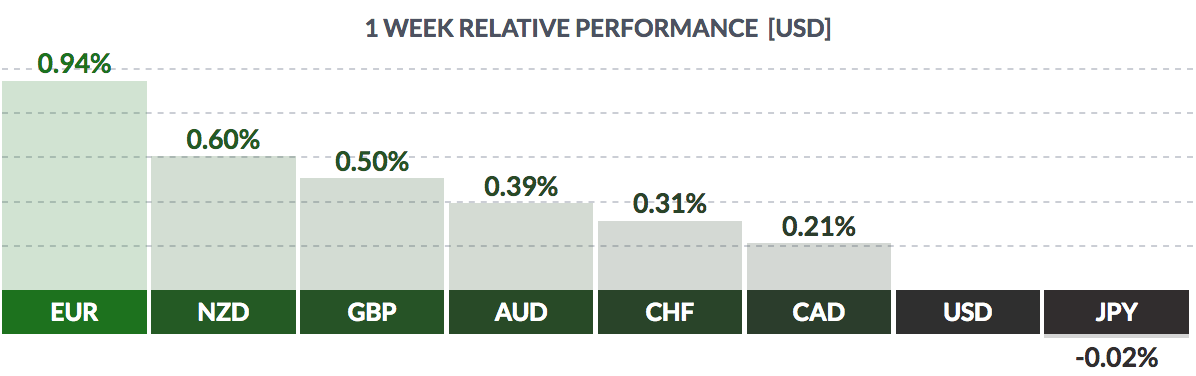

Currency: The dollar fell vs. most major currencies this week, except the yen.

Market Breadth: 27 of the DOW 30 stocks rose this week, vs. 13 last week. 81% of the S&P 500 rose this week, vs. 48% last week.

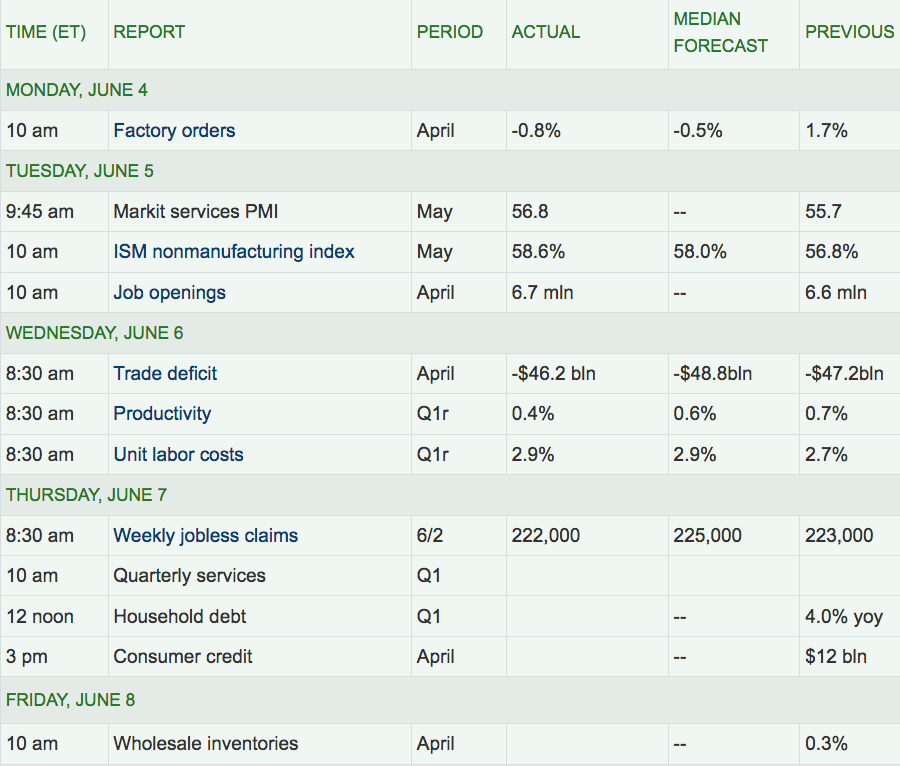

Economic News: Factory Orders fell -0.8% in May, more than forecast, while Productivity rose 0.4%, also missing forecasts. Unit labor costs grew 2.9% in Q1, vs. 2.7% in Q4 ’17.

“Nine US states and the District of Columbia now allow for recreational marijuana use, and 30 allow for medical use. The emerging US industry took in nearly $9 billion in sales in 2017, according to BDS Analytics, which tracks the cannabis industry. Sales are equivalent to the entire snack bar industry, or to annual revenue from Pampers diapers.” (CNN)

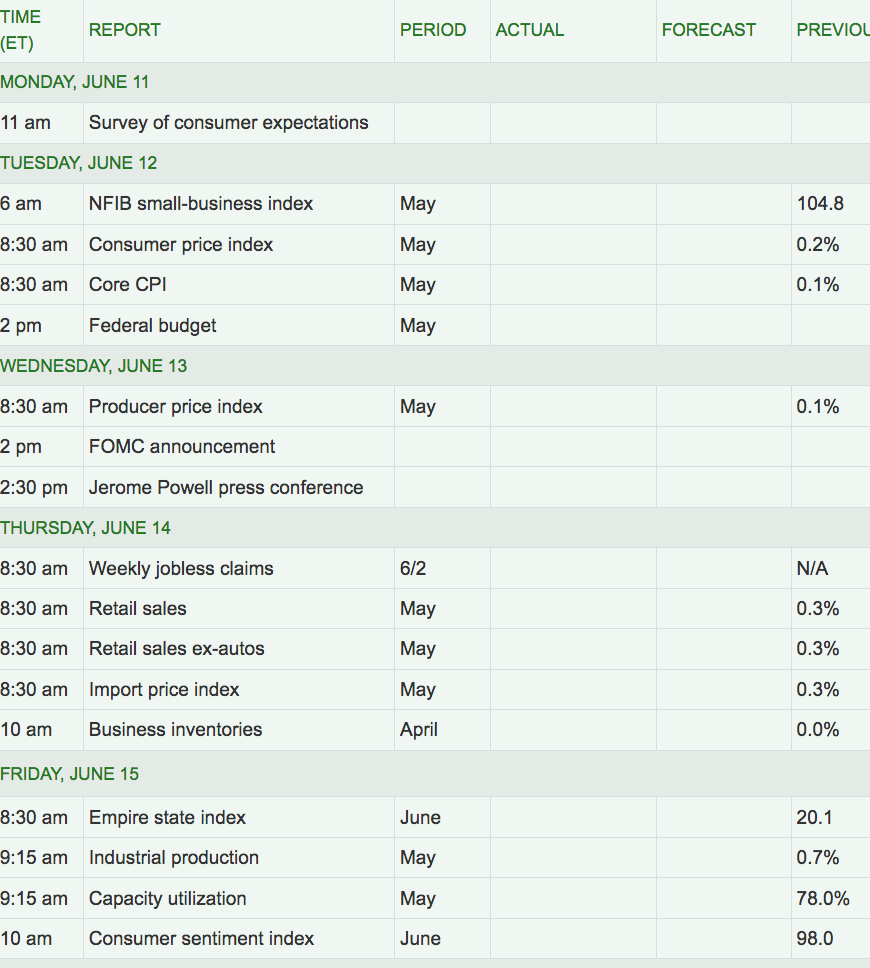

Week Ahead Highlights: It’ll be a busy week, with U.S. and European central bank meetings and a North Korea-U.S. summit set for June 12.

Next Week’s US Economic Reports: The Fed meets next week to decide on its rate – another hike is broadly expected by the market. There will also be a lot of consumer-based data out next week – the CPI, Retail Sales, and Consumer Sentiment.

Sectors: The Consumer Discretionary and Basic Materials sectors led this week, while Utilities trailed.

Futures:

WTI Crude finished the week down 0.4%, at $65.56/barrel, its lowest price in 4 weeks, while Natural Gas fell -1.89%: