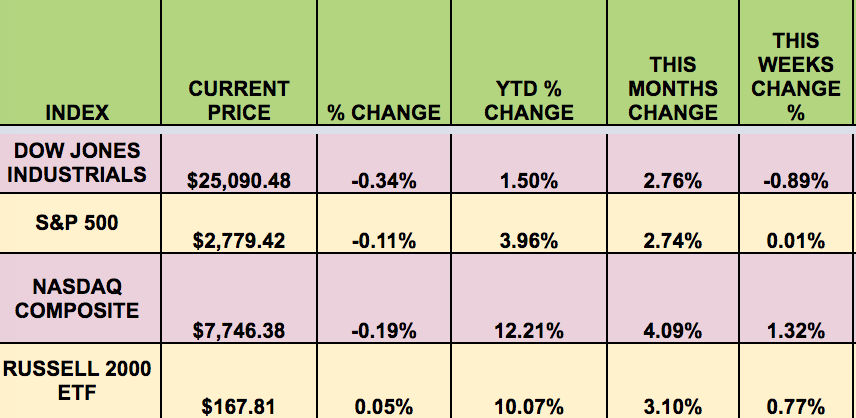

Markets: It was a mixed week for the market, with the Dow losing ground, the S&P 500 flat, and the NASDAQ and Russell 2000 both gaining. Investors were battling falling oil prices and renewed trade war tensions, in addition to the Fed rate hike.

The White House unveiled an initial list of strategically important goods that would be subject to a 25 percent tariff effective July 6, and China’s Commerce Ministry responded with its own list of U.S. imports targeting soybeans, aircraft, autos and chemicals. (Reuters)

"We will immediately introduce taxation measures of the same scale and the same strength,” the ministry said in an English-language statement. "All the economic and trade achievements previously reached by the two parties will no longer be valid at the same time,” the ministry said, calling the U.S. behavior “short-sighted.”

In May, Beijing and the U.S. agreed to “meaningful increases” in U.S. agriculture and energy exports to China. However, the White House subsequently said it would still pursue tariffs on Chinese goods that were proposed in April, causing trade relations to deteriorate. (Source:CNBC)

A federal judge on Tuesday approved the blockbuster merger between AT&T and Time Warner, rebuffing the government’s effort to stop the $85.4 billion deal, in a decision that is expected to unleash a wave of corporate takeovers. The judge, Richard J. Leon of United States District Court in Washington, said the Justice Department had not proved that the telecom company’s acquisition of Time Warner would lead to fewer choices for consumers and higher prices for television and internet services.

The merger creates a media and telecommunications powerhouse, reshaping the landscape of those industries. The combined company would have a library that includes HBO’s hit “Game of Thrones” and channels like CNN, along with vast distribution reach through wireless and satellite television services across the country. (Source: NY Times)

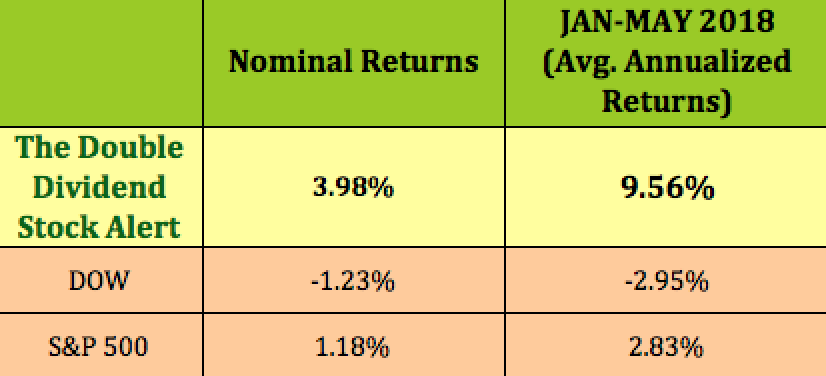

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: VGR, CPTA, FSIC. GLAD, GOOD, GAIN, TUP, RPT, SUNS, OFS.

Volatility: The VIX fell 1.6% this week, ending the week at $11.98.

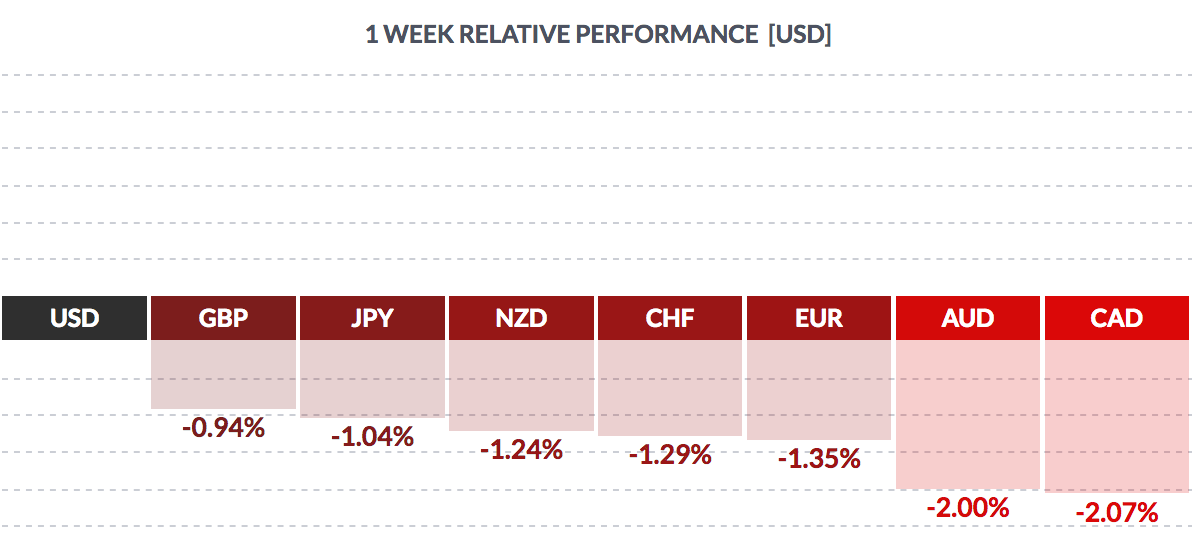

Currency: The dollar rose vs. most major currencies this week, as the Fed raised its rate.

Market Breadth: 9 of the DOW 30 stocks rose this week, vs. 27 last week. 50% of the S&P 500 rose this week, vs. 81% last week.

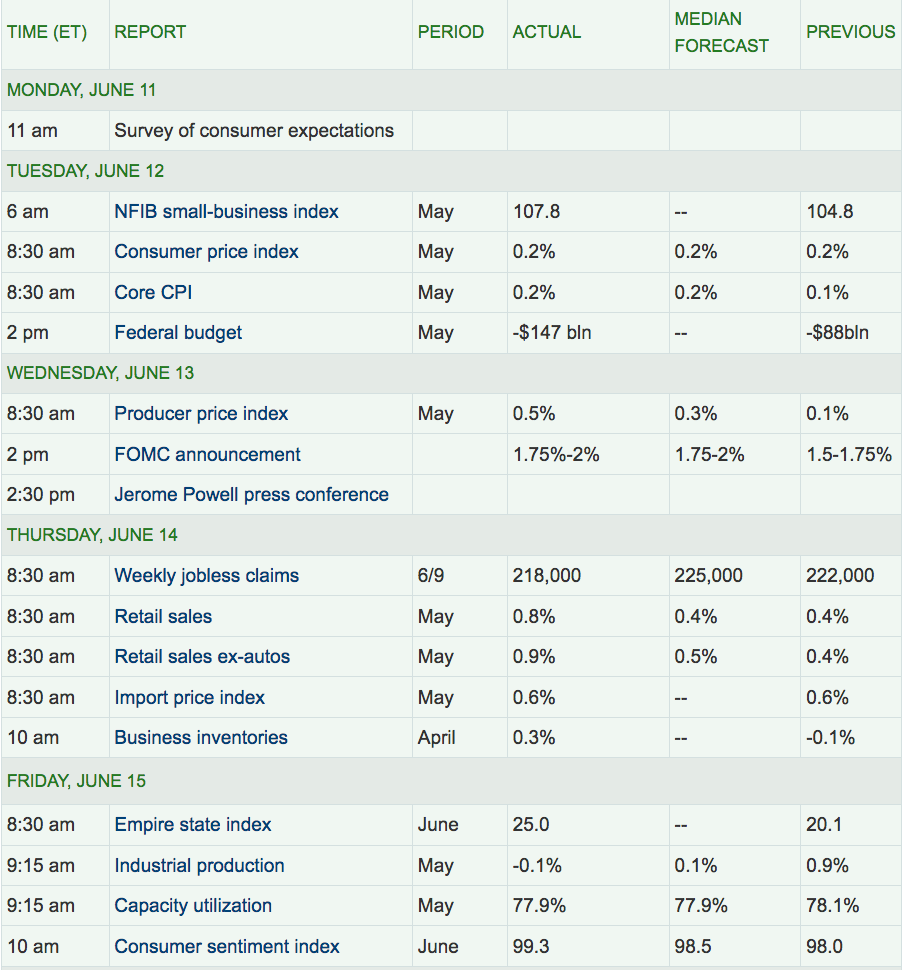

Economic News:

“Policy makers at the US Federal Reserve raised the target for the Federal Reserve’s benchmark rate by 0.25%, taking it to the highest since 2008, at 1.75% to 2%. This is the Fed’s seventh rate increase since 2015. They are also shrinking the Fed’s massive holdings of government debt and mortgage-backed securities, which were purchased to lift the economy out of the recession that ran from late 2007 to 2009.

As higher rates start to take hold, the repercussions are being felt in the US and overseas. The retreat from emerging markets remains relatively modest, with weekly flows to bond and equity funds down less than 10% from their peaks, according to EPFR Global.

But it has coincided with – and partially fueled – a stronger dollar, contributing to currency crises in countries such as Argentina, Turkey and Brazil. It has also prompted central banks elsewhere, including in Indonesia, Malaysia and Hong Kong, to raise their own interest rates in defense.” (Source: BBC)

The European Central Bank signaled that any interest rate hike was still far away, even as it moved to end its 2.55 trillion euro stimulus program by the end of the year. The ECB’s statement came as a relief, especially after the Federal Reserve raised rates for the second time this year on Wednesday and hinted at two more hikes by the end of 2018. (Reuters)

Retail sales rose 0.8% in May, the government reported Thursday — much better than expected. Spending was up 5.9% from a year ago. And the gains were broad: Spending surged at clothing stores, at restaurants and at home-improvement stores. (SOURCE: CNN)

U.S. inflation accelerated in May to the fastest pace in more than six years, reinforcing the Federal Reserve’s outlook for gradual interest-rate hikes while eroding wage gains that remain relatively tepid despite an 18-year low in unemployment.

The consumer price index rose 0.2% from the previous month and 2.8 percent from a year earlier, matching estimates, a Labor Department report showed Tuesday. The annual gain was the biggest since February 2012 and follows a 2.5 percent increase in April. Excluding food and energy, the core gauge was up 0.2 percent from the prior month and 2.2 percent from May 2017, also matching the median estimates of economists. The pickup in headline inflation partly reflects gains in fuel prices, though the annual gain in the core measure — seen by officials as a better gauge of underlying inflation trends — was the most since February 2017.

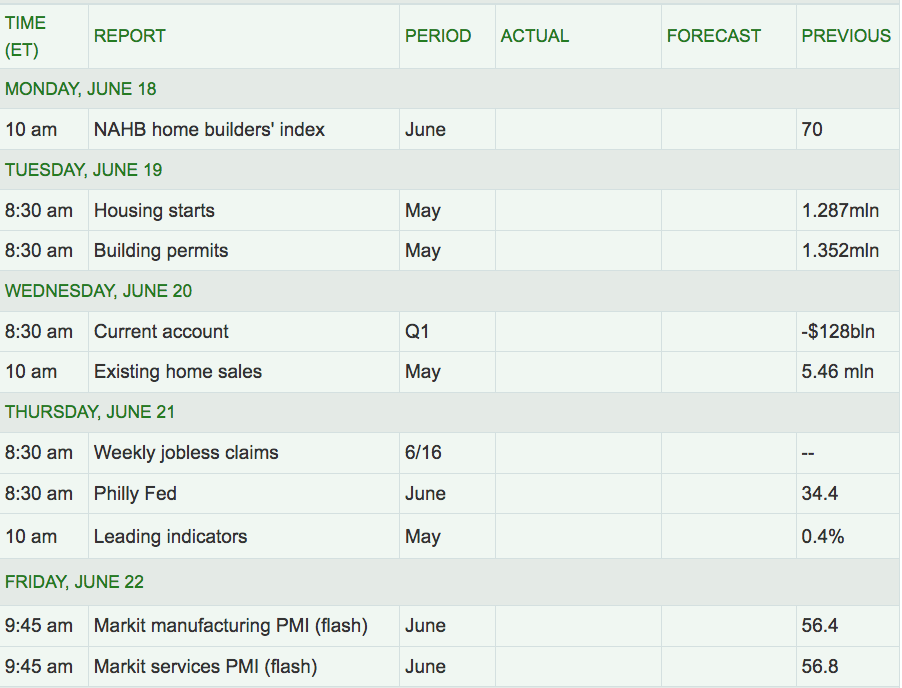

Week Ahead Highlights: It’ll be a slow data week, mainly featuring Housing reports. The focus will be on the OPEC meeting, in which OPEC, Russia and other producers are widely expected to begin easing their deal to limit output. The gathering is shaping up to be a contentious event, with lines drawn between countries that can benefit from an output boost and those with little to gain. Despite the discord, analysts think OPEC will reach a deal to moderately raise output over several months, with an option to hike further.

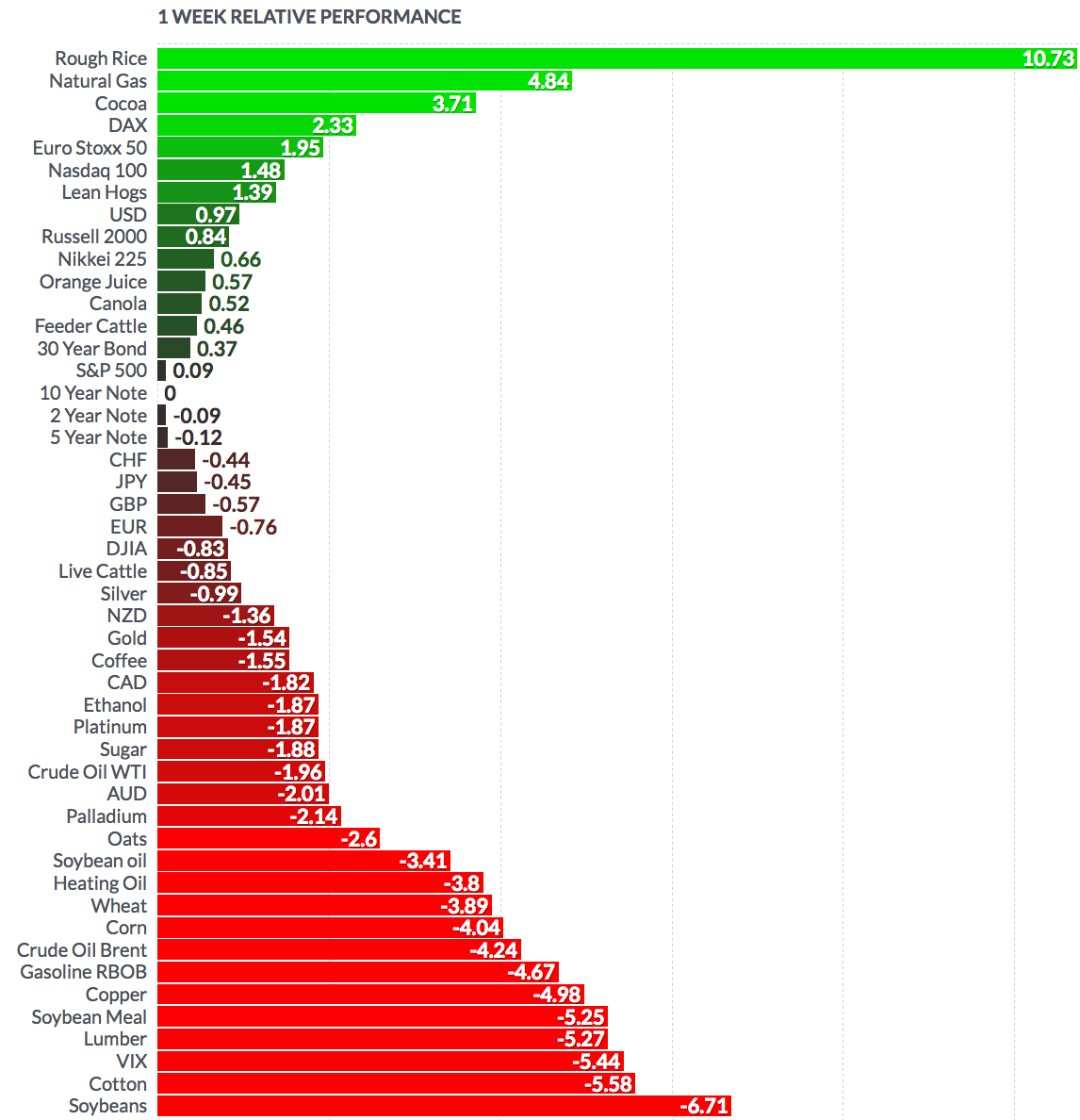

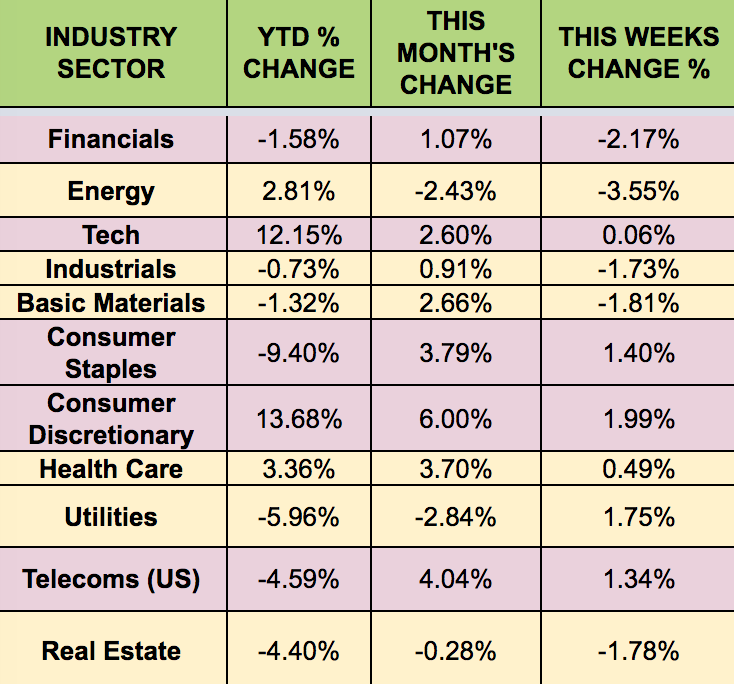

Sectors: The Consumer Discretionary and Utilities sectors led this week, while Energy trailed.

Futures:

WTI Crude finished the week down 1.96%, at $64.38/barrel, its lowest price in 5 weeks, while Natural Gas rose 4.84%: