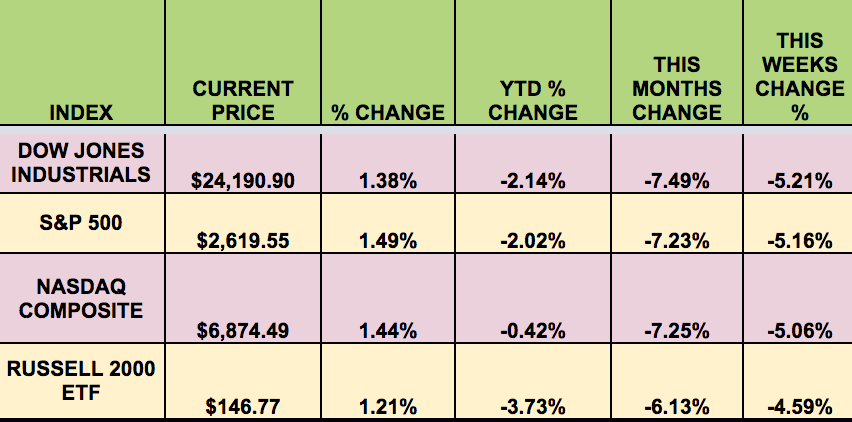

Markets: It was another down week, with all 4 indexes losing ground, due to ongoing investor fears about rising interest rates, less liquidity in the market, and falling oil prices. It could have been worse, but Friday’s rally gained back ~1%-plus.

All 4 indexes are now in the red year to date, with the Nasdaq holding up the best.

“Monday was the worst day for markets in recent memory. The Dow plunged almost 1,600 points before recovering slightly. It closed down 1175 points, the worst single-day point decline in Dow history. Its 4.6% fall was the biggest percentage decline since August 2011, during the European debt crisis.” (Source: CNN)

“The S&P 500 Index fell 6.2 percent in two days, its biggest such decline since August 2015, after yields on 10-Year Treasuries rose to a four-year high of 2.84 percent on Friday.” (Source: Bloomberg)

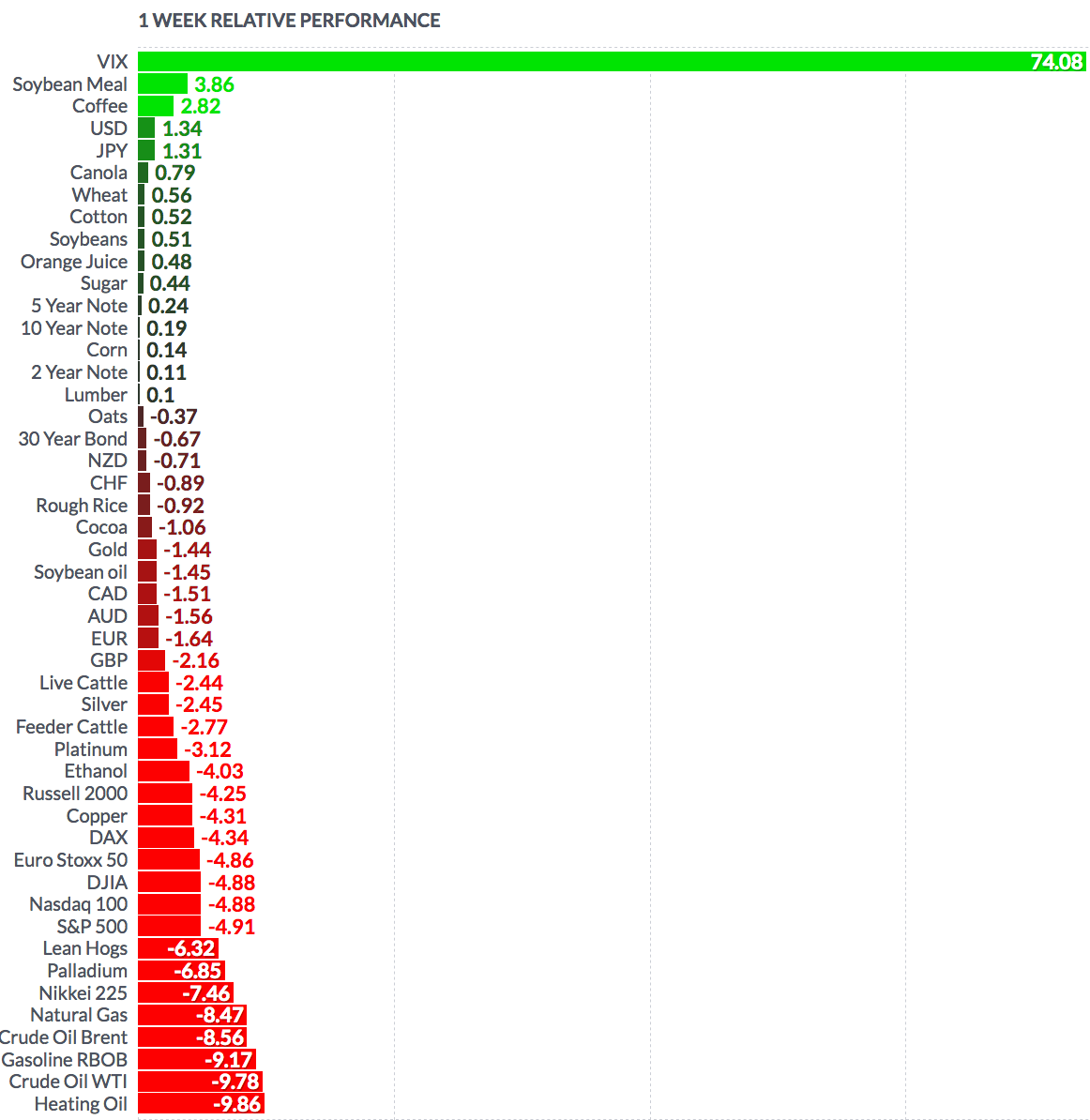

The VIX reflected that turmoil, hitting 37.32, and is now the highest it’s been since August 24, 2015, the last time the Dow plunged 1,000 points in a day. A big reason for the sudden surge in volatility is that stocks have been calm for months, which has kept the VIX lower in value.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Corenergy Infras (NYSE:CORR), Goldman Sachs (NYSE:GS) Capital I Securities-Backed Series 2004-6 Trust (NYSE:JBK), Enbridge Inc (NYSE:ENB), LSC Communications Inc (NYSE:LKSD), Five Oaks Invst (NYSE:OAKS), UMH Properties Inc (NYSE:UMH), Gladstone Investment Corporation (NASDAQ:GAIN), Gladstone Capital Corporation (NASDAQ:GLAD), Gladstone Commercial Corporation (NASDAQ:GOOD), Capitala Finance Corp (NASDAQ:CPTA), LTC Properties Inc (NYSE:LTC).

Volatility: The VIX rose 69% this week, ending at $29.06, its highest point since the August 2015 Chinese currency devaluation scare. The VIX jumped 116% on Monday — the highest daily % change ever recorded. It’s the biggest move since February 2007, when the index rose 64%.

“Volatility has returned to equities so far this year, including Fridays session, the S&P 500 has had 7 trading days where it moved at least 1%. So far these swings have been biased toward the downside: Four of them have been drops of at least that magnitude including Mondays session, the biggest percentage decline since August 2011 while the other two were 1% moves higher. The Dow has also seven 1% sessions in 2018, with the same directional breakdown.” (Source: MarketWatch)

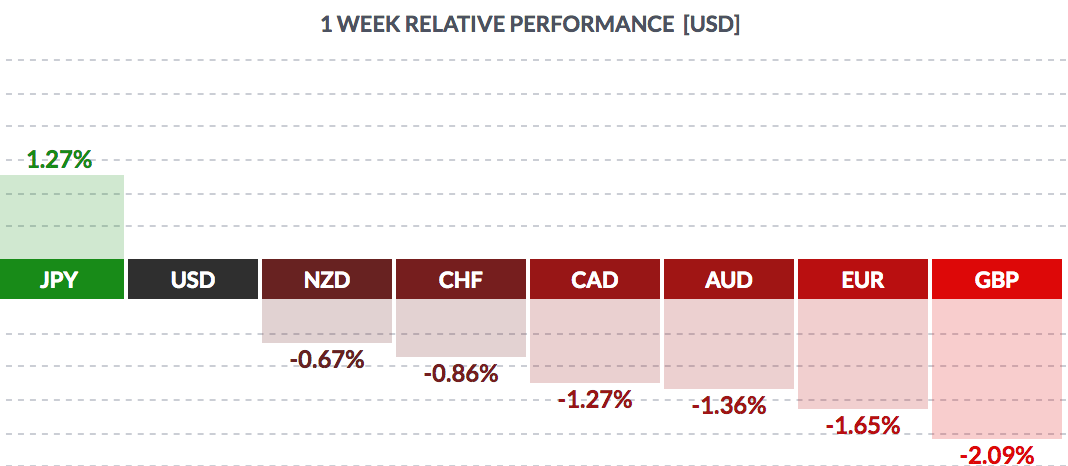

Currency: The dollar rose vs. most major currencies again this week, except the yen.

Market Breadth: In another awful week for market breadth, none of the DOW 30 stocks rose this week, vs. 1 last week. Only 7% of the S&P 500 rose, vs. 8% last week.

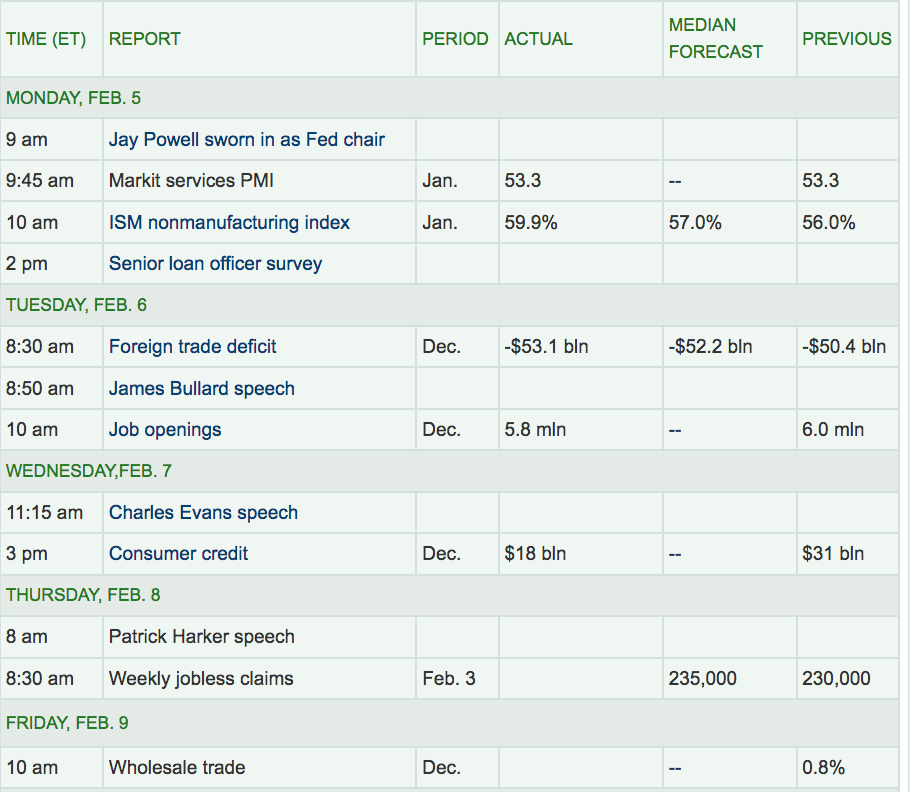

Economic News: Jobless Claims hit 221K, lower than the 235K forecasted. The ISM Non-Mfg. index hit its highest point in its 20-year history. Job Openings fell .2M in December.

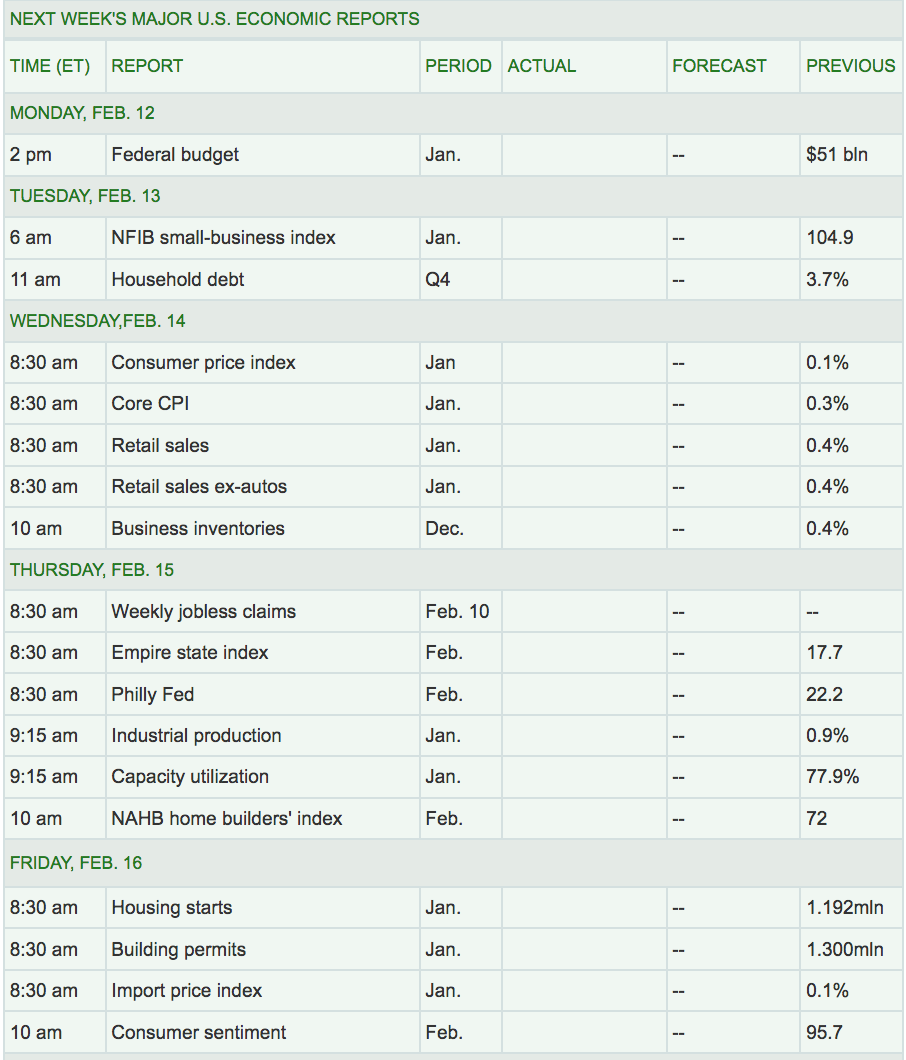

Week Ahead Highlights: Q4 earnings season continues, with 2 DOW stocks reporting - Cisco, and Coke; and 18% of the S&P 500 reporting, including Pepsi, MetLife (NYSE:MET), Oxidental, Hilton.

Next Week’s US Economic Reports: There will be multiple Housing-related reports out next week, in addition to Jan. figures for Retail Sales, Consumer Prices, and Industrial Production.

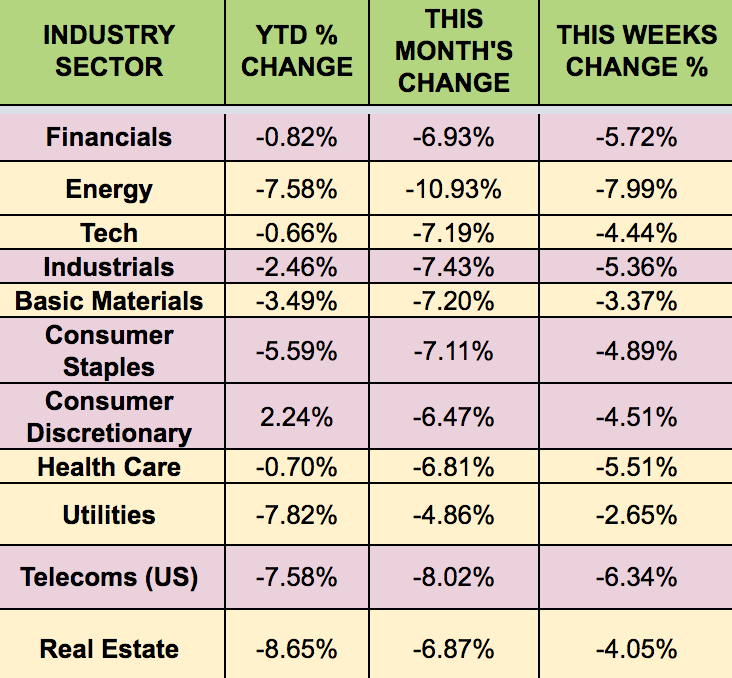

Sectors: It was another broad-based rout this week, with all sectors losing ground. Energy and Telecoms were the hardest hit, with Utilities holding up the best.

Futures: Crude Oil WTI Futures fell -9.86%, their worst week since January 2016. Baker Hughes said the rig count rose by 26 to 791 – the Permian Basin saw its tally rise by 10 to 437. Natural Gas Futures also fell -8.47% this week.