Don’t know the person that tweeted this, but the quote is supposedly from Stanley Druckenmiller, a well known and successful hedge-fund manager. No question there is some truth to this, as (I would think) liquidity creates opportunities for growth via lower interest rates, etc.

The big question in the mainstream financial media is the coronavirus impact. We’ve heard from Apple (NASDAQ:AAPL), Procter & Gamble (NYSE:PG) and Coca-Cola (NYSE:KO) the last few weeks. Coca-Cola finished at an all-time high on Friday, Feb. 21, 2020, after it broke out of a 20-year base in June, 2019. (KO is a perfect example of how technicals very often precede fundamentals.)

The action in Coca-Cola and Procter & Gamble (PG, which is a stock that has ascended into the Top 10 S&P 500 weights by market cap, have taken the coronavirus impact in stride.

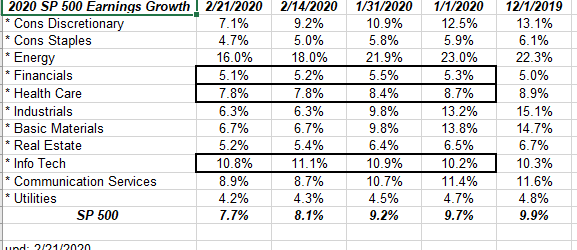

S&P 500 Earnings (by the numbers):

It was surprising to see the “rate-of-change” tick higher in the forward 4-quarter estimate given the coronavirus news, but the numbers are what they are.

How have the S&P 500 expected sector rates of growth changed for 2020?

For new viewers, what I look for is is slowing rates of decay in the weekly or monthly revisions OR outright positives revisions to forward growth rates. The Street is still spooked by China and what’s happening there.

Even with Apple’s preannouncement and lower revenue guide around the coronavirus, Tech is still looking strong for 2020.

Didn’t expect this graph though:

Fresh from Bespoke’s Weekly Report on February 21, 2020, this graph of China's CSI 300 notes that – seemingly – not even the Chinese are worried about Covid-19.

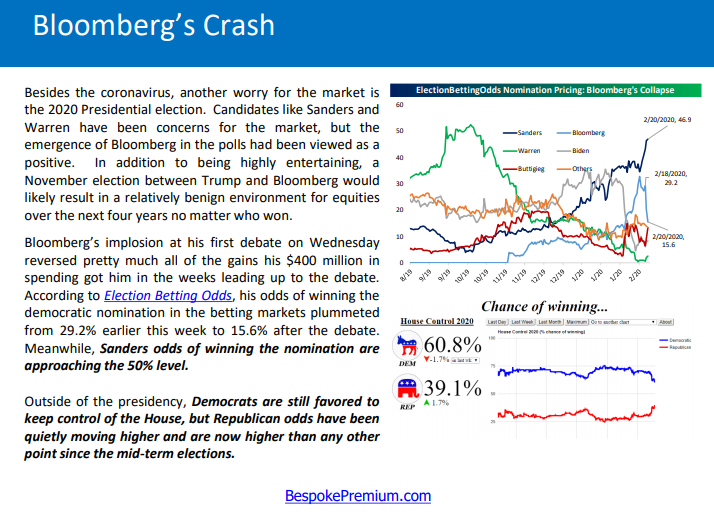

Presidential election odds: An interesting graph

This page from Bespoke’s Weekly Report (if you aren’t reading Bespoke you should be. For a reasonable cost, it is some of the best Street research week-in and week-out).

Note the bottom of the graph: since this blogger has clients on both sides of the aisle, it never really pays to talk politics but the potentially Republican flip of the House in November, is seeing the odds increase. Remember, this can all change too.

Just stay on top of it – politics matter because economics matters.

Summary / conclusion: Looking at S&P 500 earnings from a few different angles this week, with Walmart's (NYSE:WMT) earnings report from last Tuesday unofficially ending the Q4 ’19 earnings season. S&P 500 earnings for 2019 rose about 1%, the weakest rate of growth in years, and yet the S&P 500 rose 31% on the calendar year. Stan Druckenmiller’s quote above caught my eye since the FOMC / Fed cut the fed funds rate in 2019.

The largest market-cap weights in the S&P 500 and the NASDAQ 100 got cracked this week which was likely badly-needed anyway. During the worst of it on Friday, Feb. 21, 2020, both Tesla (NASDAQ:TSLA) and Coca-Cola managed to finish higher on the day.

There is no single theme to the earnings update this weekend. The impact of Covid-19 seems different for different stocks. The fact that Coke warned and yet closed very close to all-time-highs on a negative week is telling.

Take any opinion or comment as purely a personal perspective on the stock and bond markets. Conditions change rapidly within investing. My opinions are also not always updated either in a timely fashion or at all, although the comments on this site tend to reflect what portfolio positions and portfolio perspectives used currently for clients as much as possible.