Sterling weakened broadly last week as Brexit anxiety intensified. In particular, selloff in the pound accelerated late Friday after the Independent poll showed that the "leave" camp got a 10 point lead over the "remain" camp. GBP/CHF lost -412 pts, or -3.0% over the week on safe haven flow into Swiss Franc too. Global stocks were also pressured with FTSE down -1.86%, DAX down -2.52%, CAC down -2.24%, DJIA down -0.67% and S&P 500 down -0.92% on Friday. Risk aversions seemed to have given bonds a boost with US 10 year yield closed sharply lower at 1.639%. WTI crude oil reached as high as 51.67 during the week and dropped sharply to close at 49.07. Gold extended recent rebound to close at 1275.9.

There will be four central bank meetings scheduled next week, including FOMC, BoJ, SNB and BoE. But there main focus will stay on the EU referendum in UK to be held on June 23. A poll of 2000 people by ORB for the Independent newspaper was released on Friday. The results showed that 55% of respondents supported "Brexit", up 4 points from the prior poll in April. 45% supported "remain", down 4 points from April poll. The 10 point lead was the largest on record by ORB for the newspaper. Prime minister David Cameron urged people to "forget about the polls" as there is going to be a "poll in 13 days' time".

Technically, the Swiss Franc was the third strongest major currency last week, only outshone by Kiwi which was boosted by RBNZ's standing pat, and Loonie on oil's intra-week surge. GBP/CHF's fall from 1.4611 accelerated last week and the development confirmed completion of the corrective rebound from 1.3412. Near term outlook will stay bearish for a test on 1.3412 low. Whether such level would hold will depend on the actual result of the referendum.

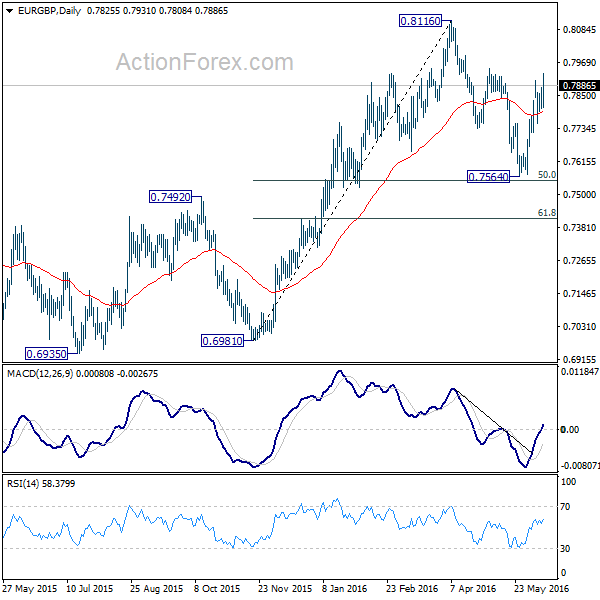

EUR/GBP's rebound from 0.7564 also extended higher last week and focus will be on 0.7946 resistance this week. Break will target a test on 0.8116 high. The cross will likely slow down as it approaches 0.8116 ahead of the referendum. Similar to GBP/CHF, whether 0.8116 resistance would hold will depend on the referendum.

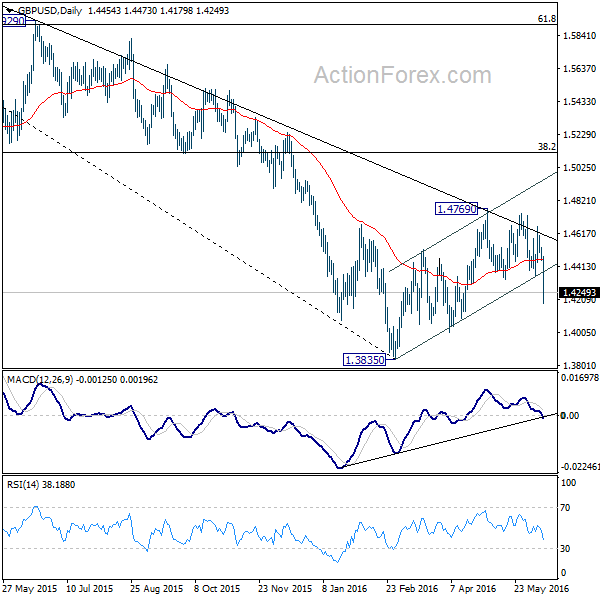

Development in GBP/USD is also similar as Friday's fall sent the pair sharply below near term rising channel. Corrective rise from 1.38356 should have completed with three waves up to 1.4769. GBP/USD should now target 1.4089 support next. There is prospect of testing 1.3835 too but that would depends on Dollar's overall strength. The referendum result will determine whether 1.3835 would hold or break.

Taking about dollar, the dollar index staged a strong rebound, thanks to weakness in Euro, after hitting 61.8% retracement of 91.91 to 95.96 at 93.46. That's so far in line with our view. That is, fall from 100.51 is seen as the third leg of consolidation pattern from 100.39. Such fall and the consolidation has likely completed at 91.91 already. For the near term, we'd expect more range trading between 93.46 and 95.96 first. Any breach of 93.46 should be brief. Upside breakout is expected at a later stage.

Regarding trading strategy, while the weakness in Sterling is tempting, we'll avoid it for the moment as the tide will quickly shift in case of a change in overall Brexit poll results. We sold CAD/JPY at 82.25 last week but the cross recovered. Nonetheless, WTI crude oil's breach of 50 handle was once again brief. And we continue to see bearish divergence condition in daily MACD. Thus, we'd expect a pull back oil to drag down Canadian dollar. Yen could also be give a boost on risk aversion or as BoJ stands pat this week. Thus, we'll stay short in CAD/JPY with stop at 85.50.