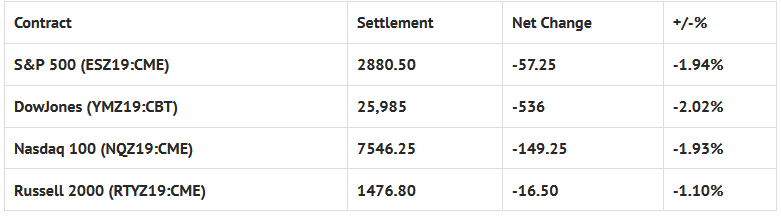

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed lower: Shanghai Composite -0.92%, Hang Seng +0.26%, Nikkei -2.01%

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Charles Evans Speaks 3:45 AM ET, Challenger Job-Cut Report 7:30 AM ET, Jobless Claims 8:30 AM ET, Randal Quarles Speaks 8:30 AM ET, PMI Services Index 9:45 AM ET, Factory Orders 10:00 AM ET, ISM Non-Mfg Index 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, Loretta Mester Speaks 12:10 PM ET, Fed Balance Sheet & Money Supply 4:30 PM ET, and Richard Clarida Speaks 6:35 PM ET.

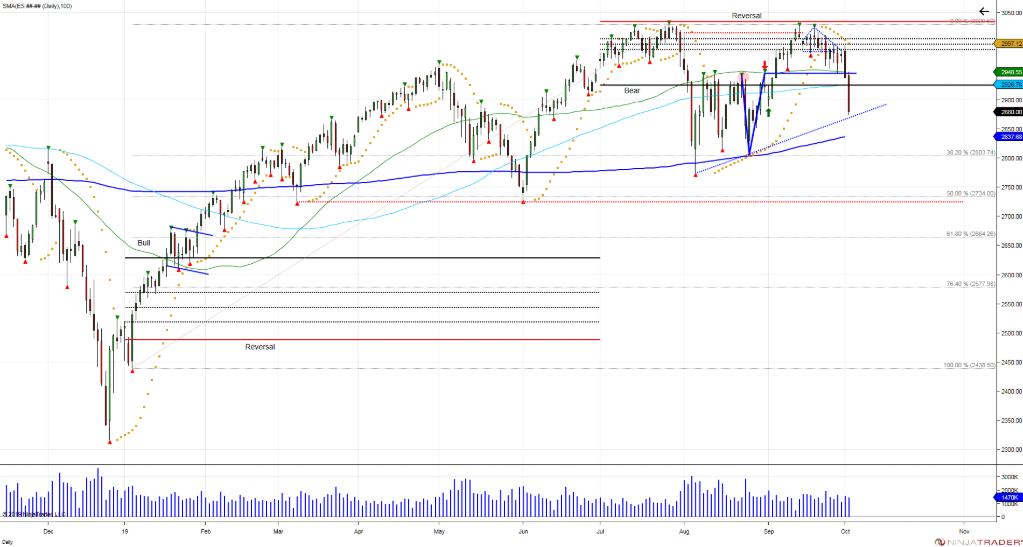

S&P 500 Futures: Fear & Uncertainty

Chart courtesy of Stewart Solaka @Chicagostock – All the shorts that were stopped out in September w/ move > 2926, are on the sidelines now as market falls back below, thus creating the waterfall effect (chase). Weekly close

During Tuesday nights Globex session, S&P 500 futures (ESZ19:CME) traded up to a high at 2949.00, up +11.25 handles, before selling off down to 2916.75, down -21 handles at 4:30 am CT, then printed 2923,25 on Wednesday’s 8:30 futures open, down -14.50 handles.

After the bell, the futures broke down to 2912.25 in the opening minutes, and then went on to make a sequence of lower lows, all the way down to 2898.75. The selling pressure continued, however, and after a quick pop up to 2908.50, the ES was again making new lows, this time double bottoming at 2887.75.

Rallies could not hold yesterday morning, and after another attempt to pull out of the nose dive, the futures were once again trading on new lows when wave after wave of sell programs began initiating. By 11:45 CT the ES had bottomed out at 2874.00, down -63.75 handles on the day, and down -75 handles from the Globex high.

Once the selling pressure died down, the futures staged rallied, forming a double top at 2885.50, and quickly pulled back down to 2877.75 just before 1:00 pm. Then, at 1:49, the ES traded back up to 2893.75 as President Trump held a joint news conference with President Sauli Niinistö of Finland, fielding mostly questions about impeachment.

In terms of the days overall tone, “scary” is the best way to describe yesterday’s fall. It was one non-stop sell program until the late day short covering, and then it got whacked again by the U.S European tariff headlines. In terms of the days overall trade, volume jumped substantially, with just over 2 million mini S&P futures contracts traded.