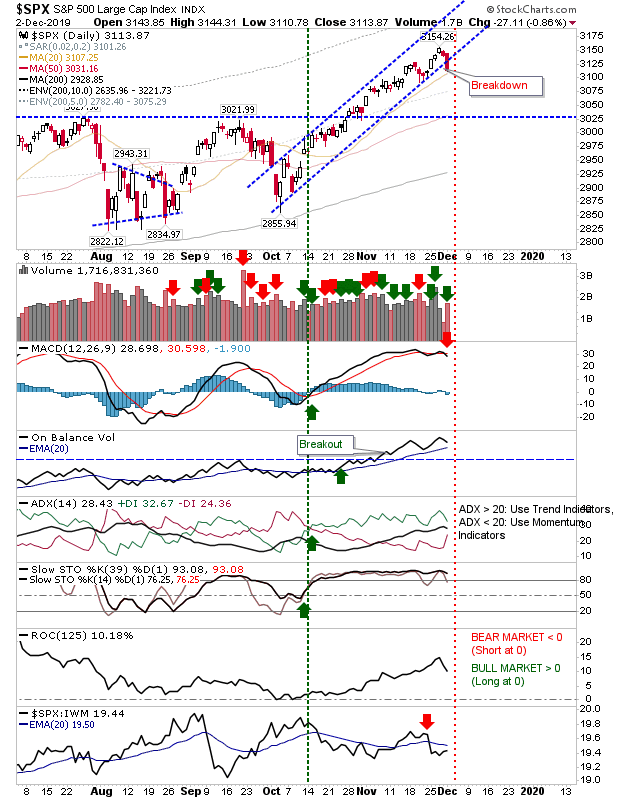

It was no surprise yesterday to see indices fall to—or out of—their narrow channels as traders looked to consolidate the advance. In the case of the S&P this resulted in a fresh MACD trigger 'sell' and higher volume distribution.

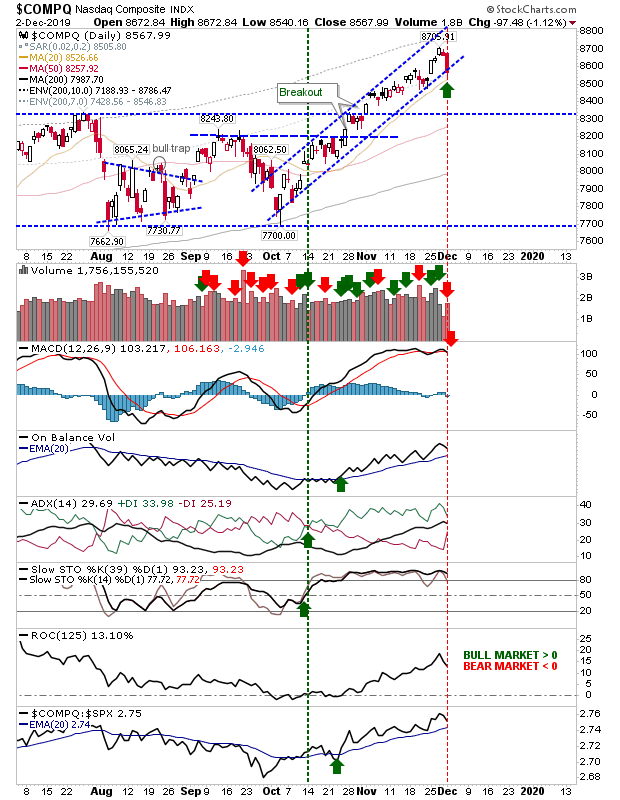

NASDAQ losses didn't undercut the rising channel, but the index will be vulnerable to further losses today. However, until that happens, support holds and aggressive buyers can take interest.

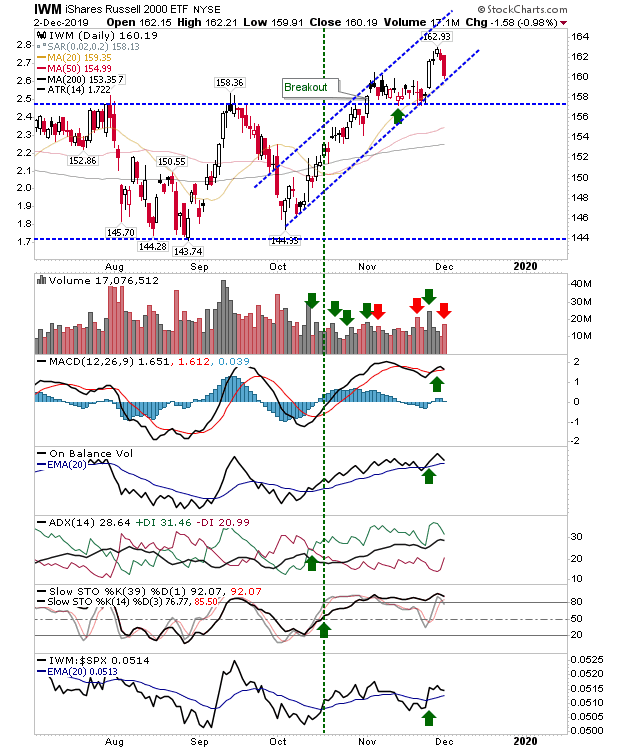

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) continues to trade inside its rising channel. Unlike the NASDAQ or S&P, it has not yet seen a MACD 'sell'—although volume did register as distribution.

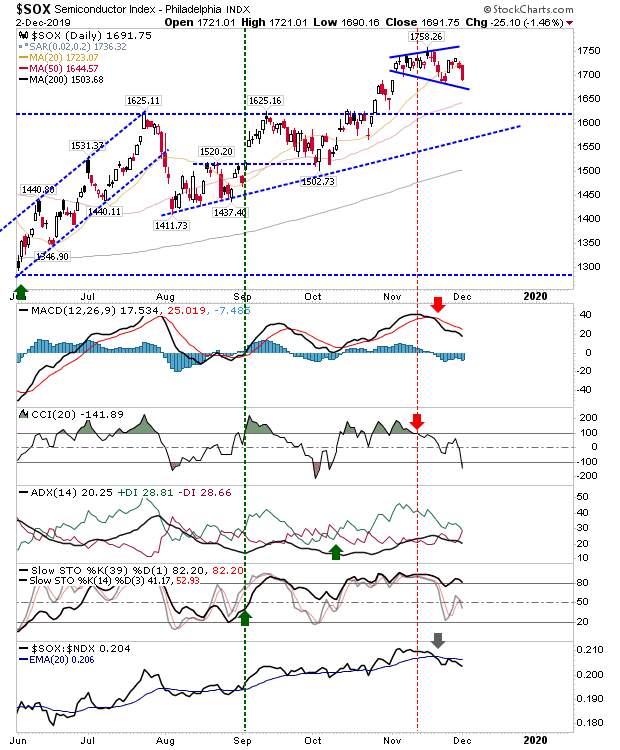

With the broadening wedge in the Semiconductor Index, it's looking like prices are pressuring the lower half of this wedge. This could lead to channel breakdowns for the NASDAQ and NASDAQ 100.

Volatility picked up over the course of 2018 but has found some stability over the latter part of 2019. We are looking at a possible swing low for the CBOE NASDAQ 100 Volatility Index and potentially a rough-and-tumble introduction for 2020 (note: this is a monthly chart).

For the remainder of 2019 we may see some sideways consolidation as traders digest September-December gains. However, I suspect prices won't linger around here for long before rallies resume.