Dow falls fifth session in a row

US stocks extended losses Monday as uncertainty about US-China trade dispute after China announced it would retaliate to $50 billion US tariffs on Chinese imports undermined investor confidence. The S&P 500 lost 0.2% to 2773.87. Dow Jones industrial fell 0.4% to 24987.47, fifth decline in a row. The NASDAQ Composite index, however, rose less than 0.1% to 7747.03. The dollar weakening continued: The ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched down to 94.731 but is rising currently. Stock index futures indicate lower openings today.

DAX leads major European indices losses

European stock indices fell on Monday as US-China trade spat continued and concerns intensified German coalition may break down on migrant policy disagreement. The British pound turned lower against the dollar while euroclimbed, and both currencies are moving lower currently. The Stoxx Europe 600 index lost 0.8%. The DAX 30 dropped 1.4% to 12834.11 and France’s CAC 40 fell 0.9%. UK’s FTSE 100 slid less than 0.1% to 7631.33. Indices opened 0.7% - 1.5% lower today.

Asian indices drop as US threatens more tariffs

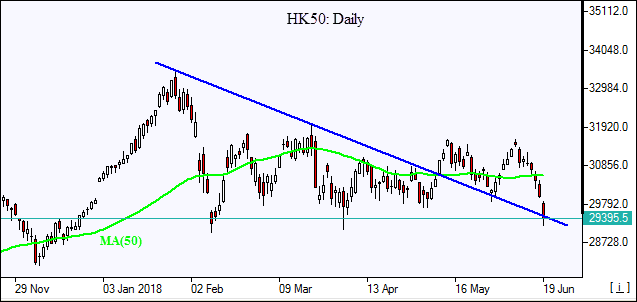

Asian stock indices are in red today as President Trump asked his administration to identify $200 billion in imports from China for additional 10% tariffs if China doesn’t revoke its $50 billion retaliatory tariffs on US imports. Nikkei fell 0.9% to 22482.89 as yen accelerated its climb against the dollar. Chinese stocks are sharply lower: the Shanghai Composite Index is down 3.8% and Hong Kong’s Hang Seng Index is 2.7% lower. Australia’s ASX All Ordinaries Index is down 0.03% despite the Australian dollar’s continued slump against the US dollar.

Brent slip

Brent Oil Futures prices are pulling back today as traders expect OPEC and Russia crude oil output increases. Prices ended higher Monday: August Brent crude settled 2.6% higher at $75.34 a barrel on Monday.