Stocks backed off from last week’s high yesterday, as investor sentiment worsened following Friday’s jobs data. But more downside may be coming.

The broad stock market index lost 0.34% on Tuesday (Sept. 7), as it bounced from the resistance level of around 4,550. Last Thursday (Sept. 2), the index reached a new record high of 4,545.85. This morning, the market opened virtually flat. However, it retraced the overnight decline.

The index remains elevated after the recent run-up, so we may see some more profound profit-taking action at some point.

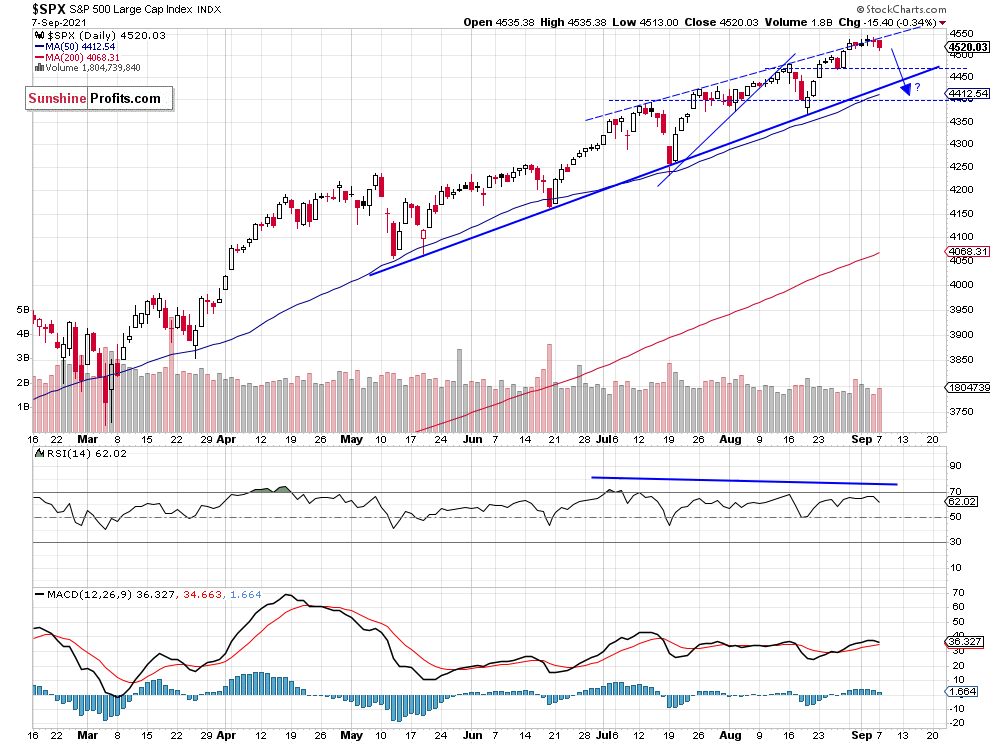

The nearest important support level of the broad stock market index remains at 4,500, and the next support level is at 4,465-4,470, marked by the previous Thursday’s low. On the other hand, the nearest important resistance level is at 4,550. The S&P 500 bounced from its four-month-long upward trend line recently, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Continues To Climb Along Trend Line

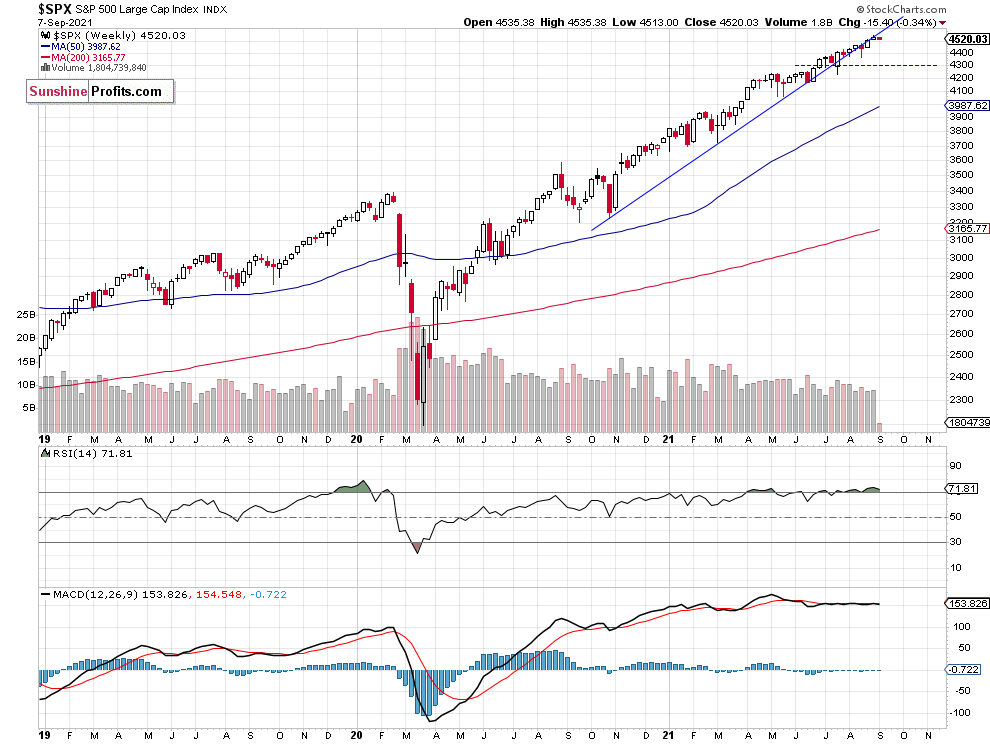

The S&P 500 index remains close to its almost year-long upward trend line. The nearest important medium-term support level remains at 4,300, as we can see on the weekly chart:

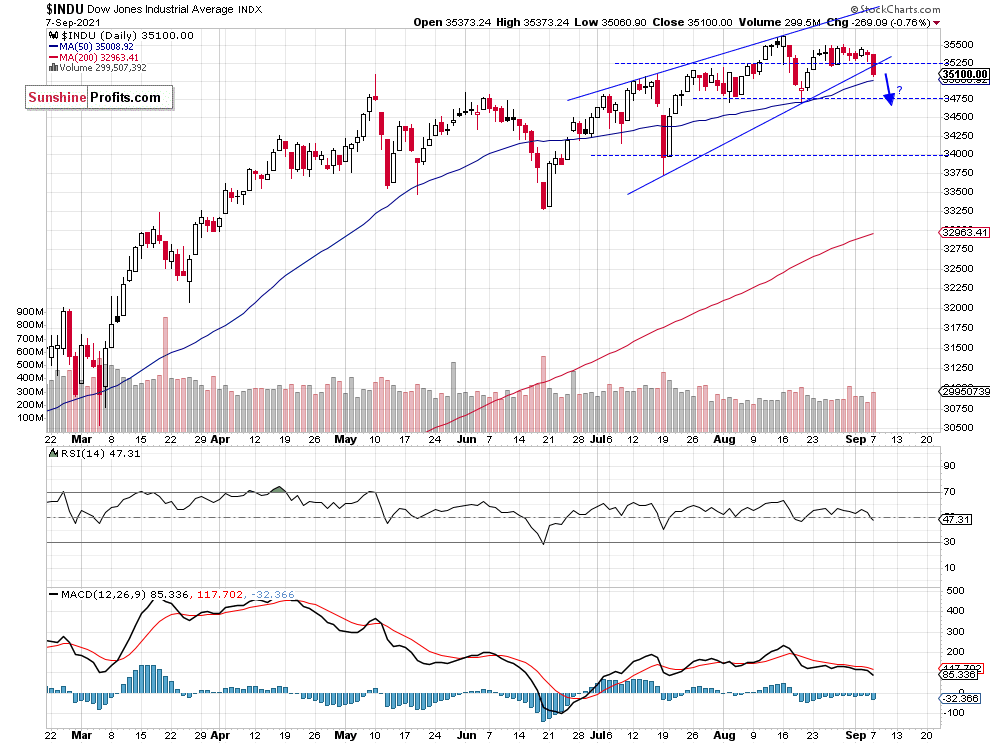

Dow Jones Broke Down

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index broke below a potential two-month-long rising wedge downward reversal pattern yesterday. It remains relatively weaker, as it didn’t reach a new record high like the S&P 500 and the NASDAQ Composite. The support level remains at around 35,000, as we can see on the daily chart:

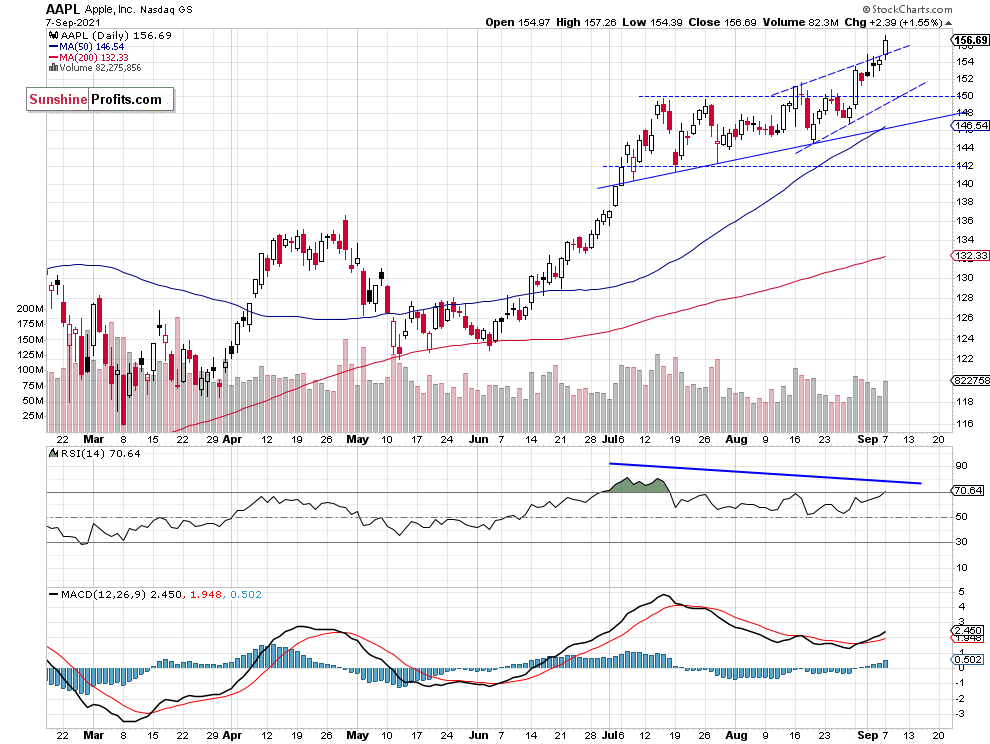

Apple Reached Yet Another Record High

Apple (NASDAQ:AAPL) stock weighs around 6.3% in the S&P 500 index, so it is important for the whole broad stock market picture. Yesterday it reached a new record high of $157.26. We can still see negative technical divergences between the price and indicators and a potential topping pattern. The two-month-long upward trend line remains at around $145, and the nearest important support level is now at $150-152.

Is Short Position Still Justified?

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on Aug. 12 at the level of 4,435. The position was profitable before the recent run-up. We still think that a speculative short position is justified from the risk/reward perspective. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index remains relatively close to its last week’s record high of 4,545.85. However, we can see some short-term profit-taking action, although yesterday’s decline has been stopped by the relatively strong tech sector. Today we will most likely see a neutral opening of the trading session followed by another profit-taking action.

The market seems short-term overbought, and we may see some profit-taking action soon. Therefore, we think that the short position is justified from the risk/reward perspective.

Here’s the breakdown:

- The market extended its advance last week, as the S&P 500 index broke above the 4,500 level.

- Our speculative short position is still justified from the risk/reward perspective.

- We are expecting a 5% or bigger correction from the new record high.