Market sentiment buoyed by GDP upgrade

US stocks continued advancing on Thursday against the background of Q2 GDP upgrade. The dollar weakened: the dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 93.11. The Dow average rose 0.2% to 22381.0 supported by 2.2% increase in McDonald's (NYSE:MCD) shares. The S&P 500 added 0.1% settling at record high 2510.06 led by material shares. The Nasdaqindex inched up less than 0.1% closing at 6453.45.

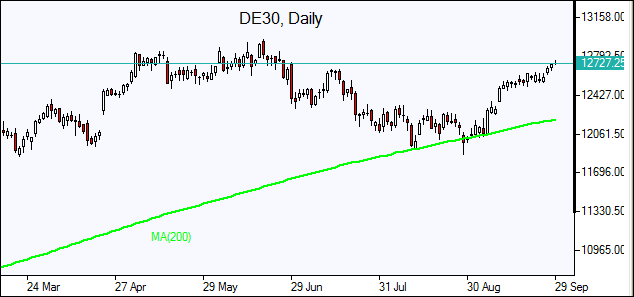

Industrial shares lead European market advance

European stocks advanced on Thursday led by industrial shares. Both euro and British Pound rebounded against the dollar. The Stoxx Europe 600 closed 0.2% higher. Germany’s DAX 30 outperformed rising 0.4% to 12704.65. France’s CAC 40 rose 0.2% and UK’s FTSE 100 added 0.1% to 7322.82. Indices opened 0.2% - 0.3% higher today.

Asian markets advance

Asian stock indices are mostly higher today on the back of positive earnings and market sentiment. Nikkei ended marginally lower at 20356.28 recording 3.6% gain over a month as the yen weakened against the dollar and data showed rising inflation, industrial output and strong demand for labor in August. Chinese stocks are up ahead of manufacturing data due on Saturday ahead of a week-long holiday: theShanghai Composite Index is up 0.3% and Hong Kong’s Hang Seng Index is 0.2% higher. Australia’s All Ordinaries Index is up 0.2% as the Australian dollar extended losses against the greenback.

Oil extends losses

Oil futures prices are inching lower today. Prices extended losses yesterday: Brent for November settlement lost 0.9% to end the session at $57.41 a barrel on the London-based ICE Futures exchange on Thursday.