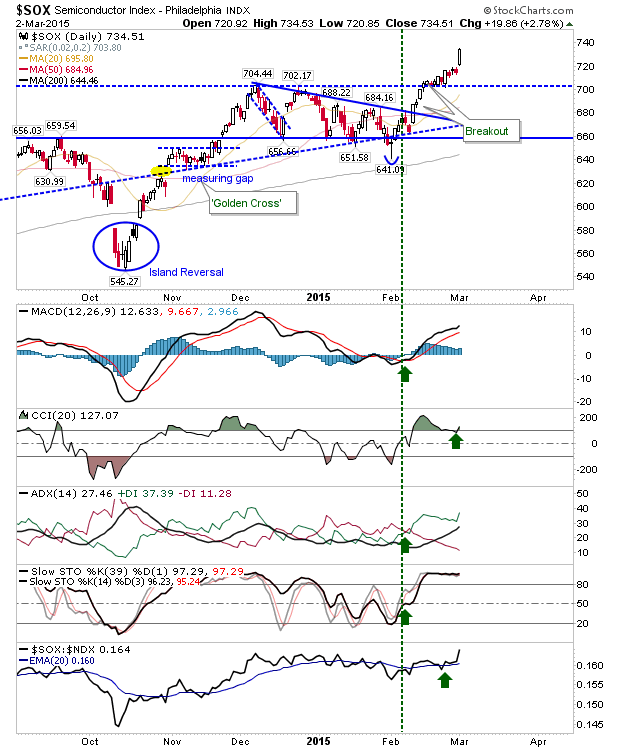

It was another good day yesterday for indices, but it was left to the Semiconductor Index to drive the biggest gain of the day. This is good news for NASDAQ and NASDAQ 100 bulls. The measured move target for this leg is 800.

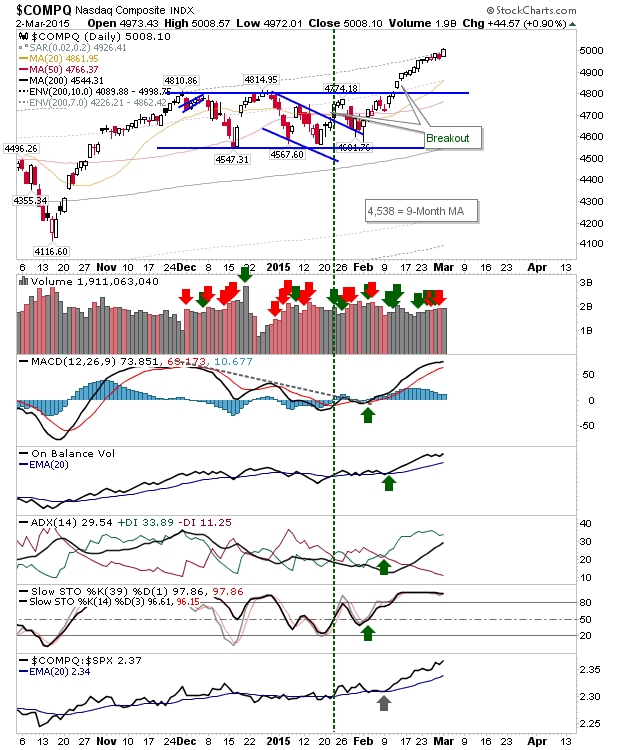

The NASDAQ is running along the upper 10% envelope relative to the 200-day MA. Monday's gain swallowed the loss from Friday in fairly short order.

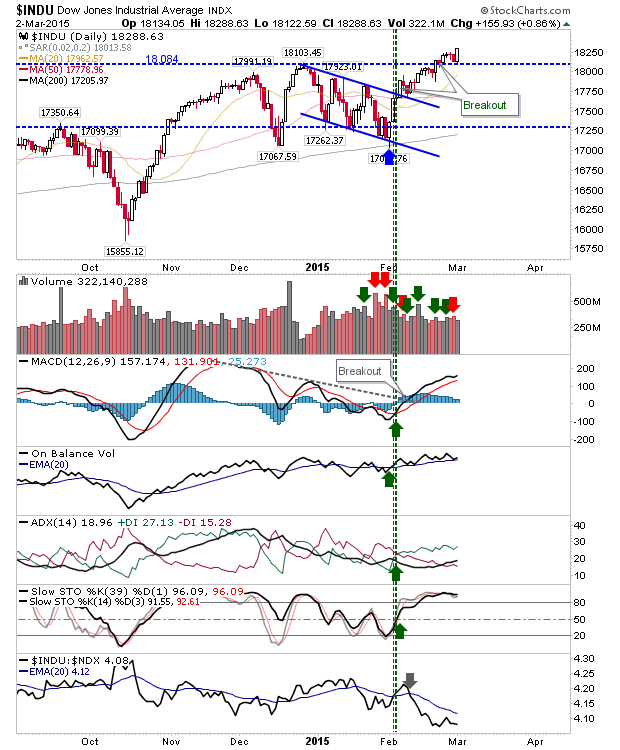

The Dow kicked off its rally off breakout support. Volume was a little disappointing given the advance, but price action is more important.

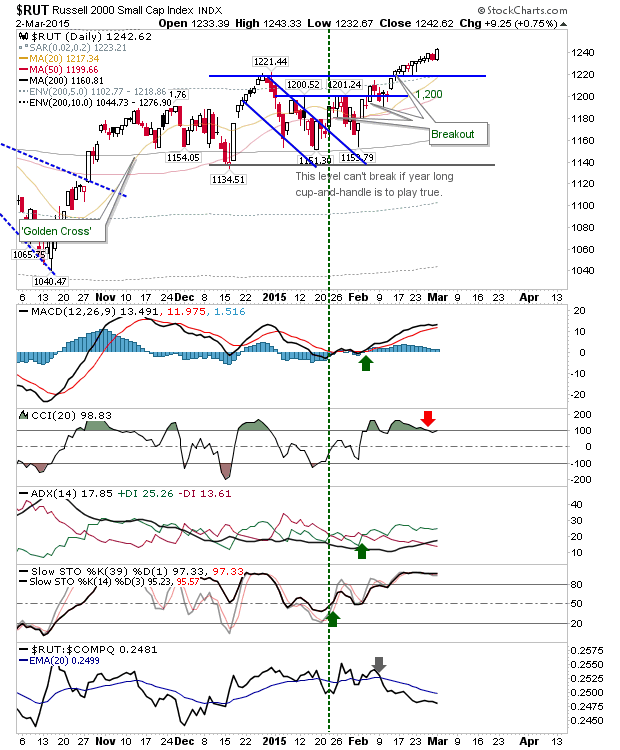

Small Caps pulled away from its breakout and support of 1,220. The Russell 2000 remains a key index for 2015, and it has done well so far.

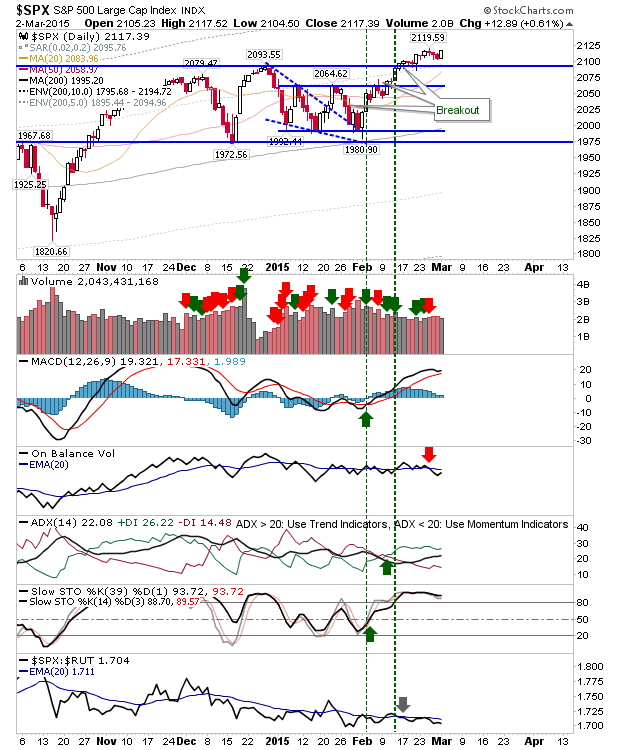

The S&P 500 also gained to finish at a new high, although the gain was more modest relative to other indices.

Indices are again well placed for further gains. Friday's losses were quickly erased, sucking what little confidence shorts may have gleaned from last week.