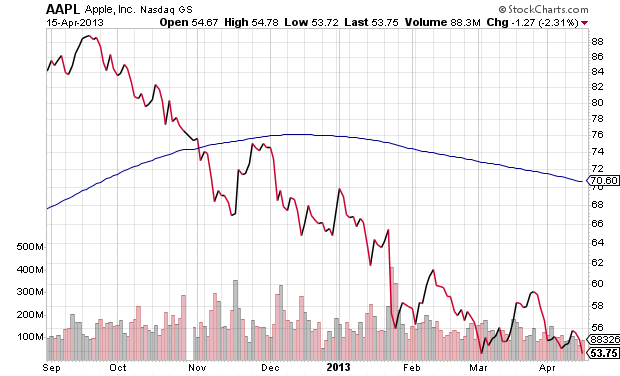

Apple (NASDAQ:AAPL) has been one of my largest individual holdings for the bulk of the post-recession stock bull. I believed in it when it was trading for one-tenth of its current value back in 2009. I even believed in it when it plummeted 40% in the winter of 2012-2013.

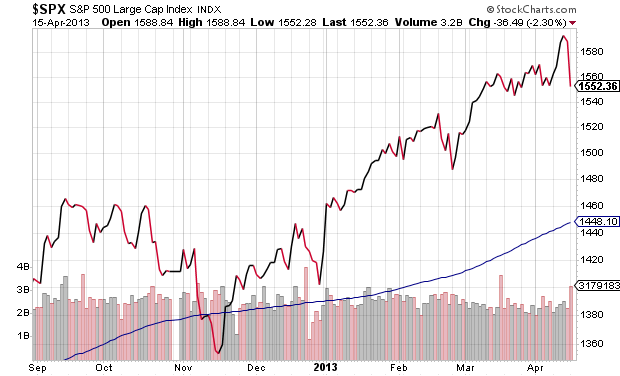

Back then, though, Apple’s troubles did not adversely affect the broader equity rally. On the contrary. The S&P 500 exhibited all of the signs of a powerful uptrend.

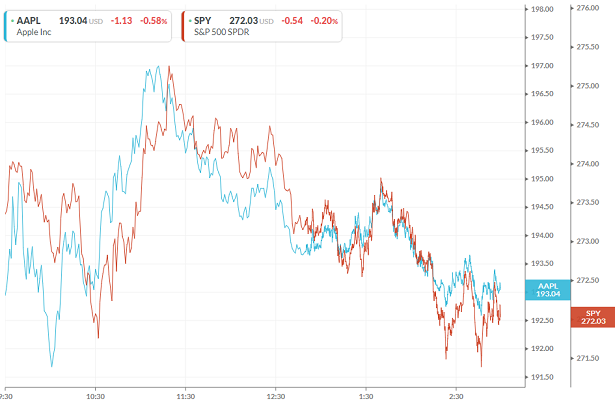

More recently, Apple has been moving in lockstep with the large-cap barometer. The circumstance may prove detrimental to those who think the current downtrend is little more than a hiccup.

The collective movement of thousands of individual securities rarely depends on an individual company or a single sector. The “FANG trade” — Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix, (NASDAQ:NFLX), Google Alphabet (NASDAQ:GOOGL) — actually began to unwind in July. And yet, the major indexes still logged new records in September.

Still, the shift away from prior market leaders in the technology and consumer discretionary segments burdened Apple tremendously. With FANG accounting for nearly 25% of the NASDAQ 100 proxy, Invesco QQQ Trust (NASDAQ:QQQ), Apple’s 13% weighting has become that much more critical for bull market well-being.

It’s not that Apple is incapable of bouncing back quickly. It recovered steep January losses in the month of February.

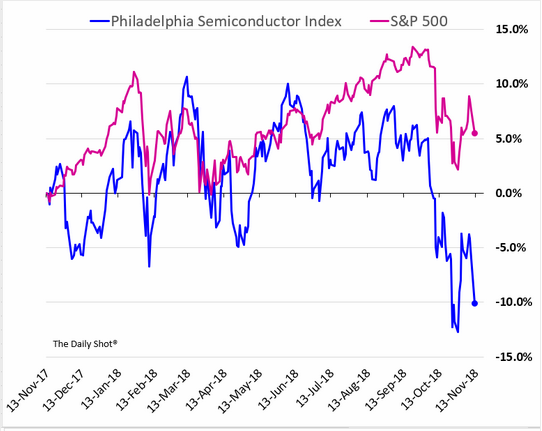

On the flip side, weakening iPhone sales have not been helpful for the semiconductor space. Indeed, 'chip' stocks often foreshadow economic downturns.

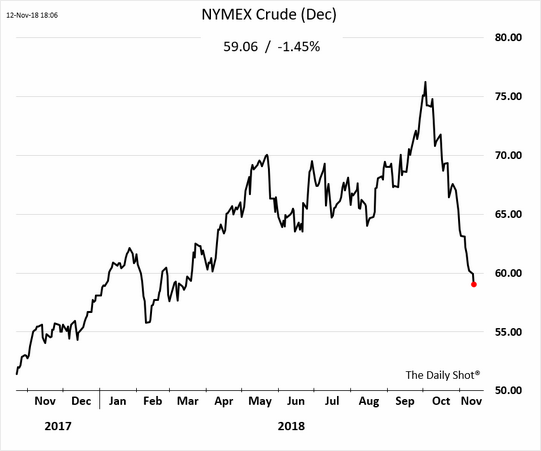

There are those who are focused so intently on recent strength of the domestic economy that they are unable to see the forest for the trees. For example, oil prices do not lose 25% in value in a matter of weeks when global demand is strong. Not ever. Nor is this merely a case of excess supply.

In truth, the world’s economy has been slowing to a crawl. The German economy contracted in the 3rd quarter. Meanwhile, China is dealing with a massive debt bubble and a trade war. (Note: China is the world’s largest importer of oil.)

Is it possible that the U.S. stock market is demonstrating that it cannot decouple from the rest of the world after all? Not only is the iShares MSCI All-World Index (NASDAQ:ACWI) negative on the year, but the slope of the global equity barometer is negative as well.

Rising interest rates have damaged bonds, preferreds and most income-oriented investments. Commodities have been rocked by a rising U.S. dollar. Clearly, none of these asset types have helped total return for diversified investors.

One also diversifies in the stock space. Foreign, domestic, large, small. Small company U.S. stocks are also negative for 2018. And with the 50-day moving average crossing below the 200-day moving average, the technical picture is relatively bleak.

Aren’t smaller companies supposed to benefit form a strong domestic economic backdrop? They’re not.

A diversified investor with a helping of large cap stocks, small cap stocks, foreign stocks, commodities, bonds, preferreds and/or other income producers had been relying on the influence of mega-caps like Facebook, Amazon and Apple. Bearish price depreciation in one or two of them might have been tolerable. Not all three.

Effective 11/1, I lowered the large-cap U.S. allocation from 55%-60% to 30%-35% for most of my retiree and near-retiree clients. The S&P 500 was at 2740. It closed yesterday’s session (11/14) at 2701.

The tactical asset allocation move was made in conjunction with a time-tested discipline that has outperformed the S&P 500 with less risk (e.g., drawdown, standard deviation, Sharpe, etc.) for 10 years, 20 years, 25 years and 90 years. Performance notwithstanding, balanced growth-and-income investors never invest 100% of their principal in large-cap equities. It follows that beating the U.S large-cap barometer is not the goal.

Nevertheless, I encourage readers to research the remarkable results for the monthly close of the 10-month moving average. My success at minimizing the bulk of the tech wreck’s decimation (2000-2002) as well as the financial system’s collapse (2008) is largely attributable to this approach.

U.S. stocks bounded dramatically higher as election uncertainty dissipated. That said, the enthusiasm does not appear to have held up. The S&P 500 benchmark appears as though it will retest the lows of late October.

We have already reduced stock risk to protect capital in the near-term. If the bull market finds itself again — if Apple gets its groove back — we would restore risk.

Until then, a risk-off positioning will remain. JPMorgan Ultra-Short Income (MI:JPST), PIMCO Enhanced Short Maturity (NYSE:MINT) and Invesco Ultra Short Duration (NYSE:GSY) are viable cash equivalents.

Disclosure Statement: ETF Expert is a web log (“blog”) that makes the world of ETFs easier to understand. Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc., and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert website. ETF Expert content is created independently of any advertising relationship.