Tuesday delivered small gains which kept the rally chugging along but there wasn't much to add on today's action.

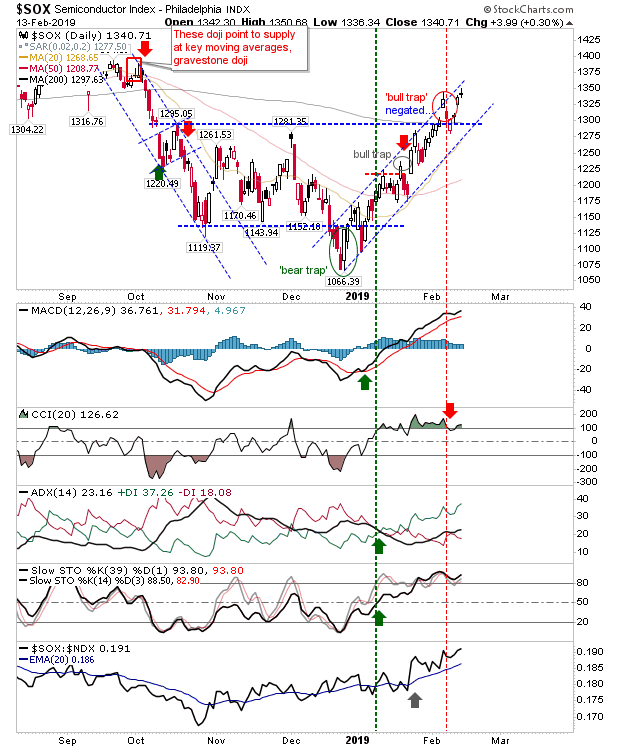

Probably the most important action was the break of the 'bull trap' in the Semiconductor Index. The 200-day MA has been comfortably breached and now the index has to work against Fall 2018 supply. This move above the 200-day MA should help the Nasdaq and Nasdaq 100 in their 200-day MA challenges.

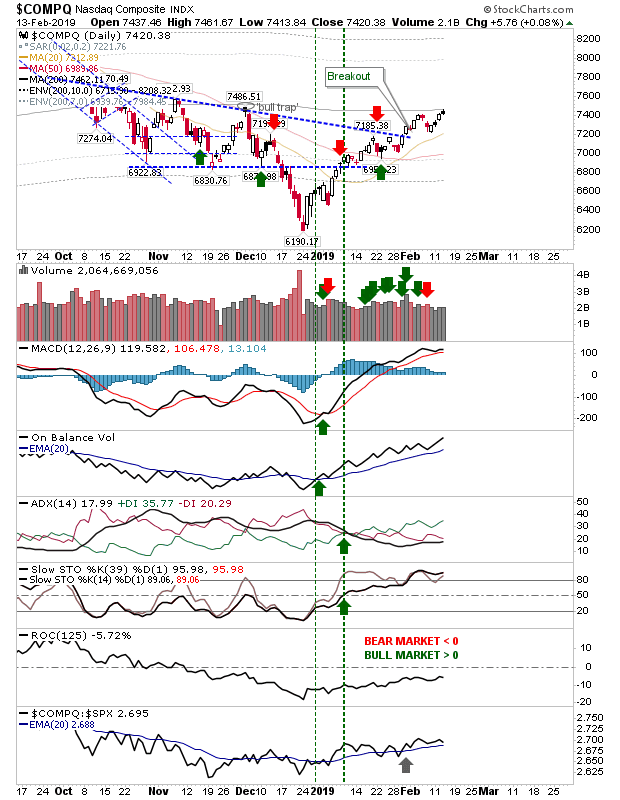

The Nasdaq is up against the 200-day MA and will be looking to the Semiconductor Index to help drive a push above the 200-day MA.

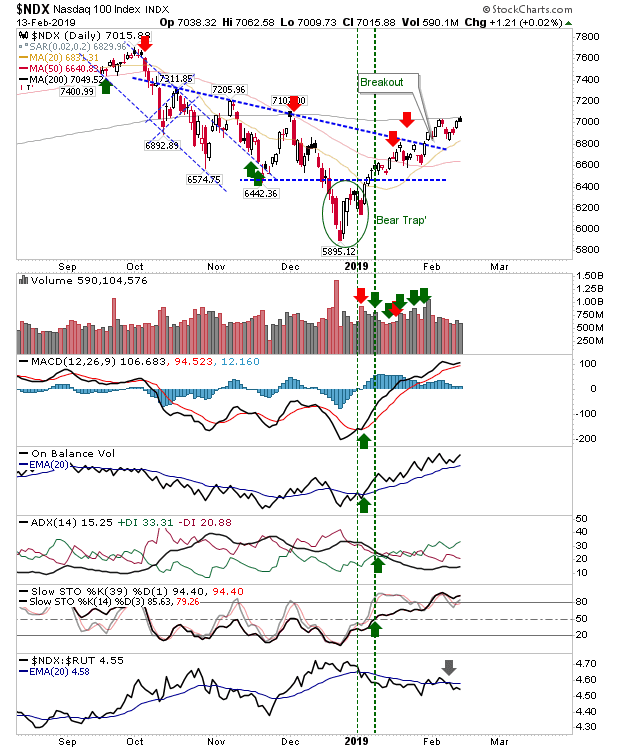

Same story for the Nasdaq 100

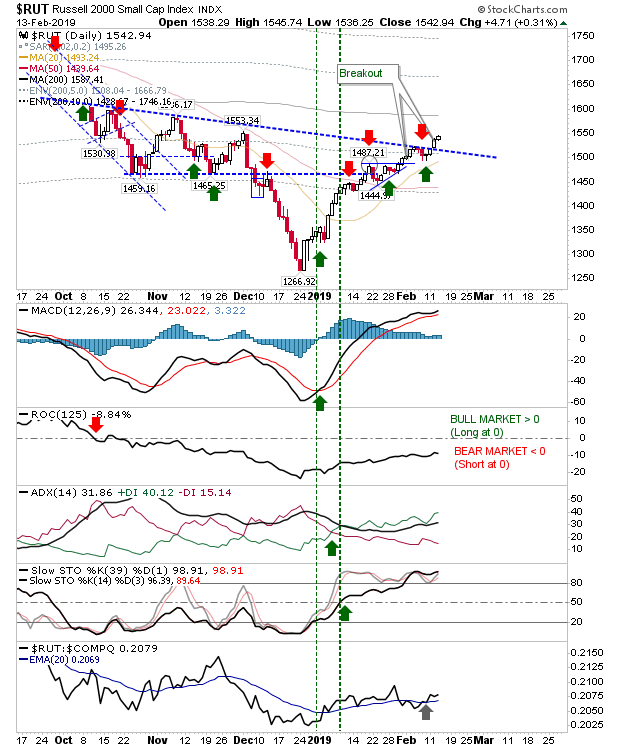

The Russell 2000 had breached declining resistance yesterday and now it has a bit of room before it runs into resistance at the 200-day MA.

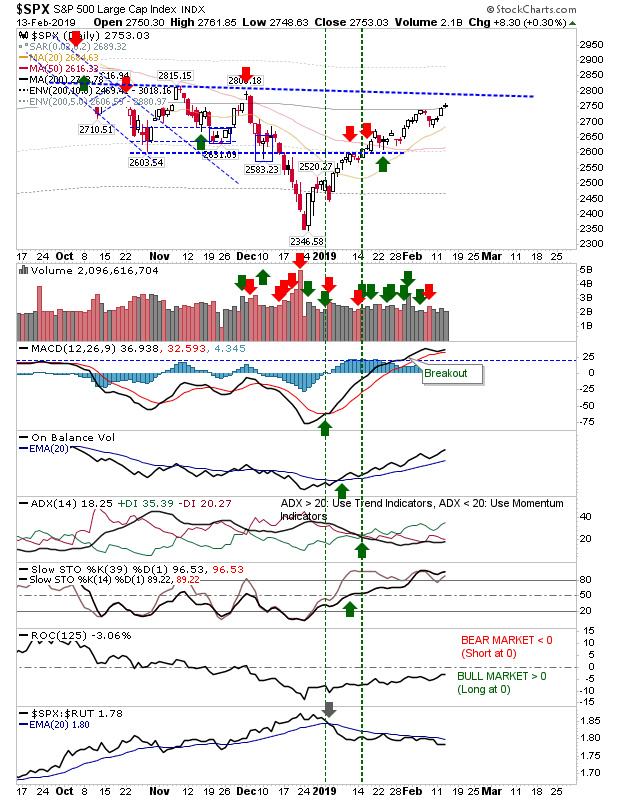

The S&P closed a little bit above over its 200-day MA, but there wasn't much conviction to the break. On the plus side, there is room to run to resistance which will help existing longs, particularly those who bought the January breakout retest and can now trail stops below the 200-day MA.

For tomorrow, bulls can look to trade a break through thSmall Gains Keep Rally Ticking Overe 200-day MAs for the Nasdaq and Nasdaq 100. Existing holders of S&P 500 (NYSE:SPY) ETFs/funds can look to a challenge of declining resistance as the upside target. Similarly, traders in Russell 2000 (NYSE:IWM) ETFs/funds can play for a move to the 200-day MA. Those of a short persuasion can look to the Nasdaq and Nasdaq 100 for reversals from their 200-day MAs should Thursday's action start weak.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.