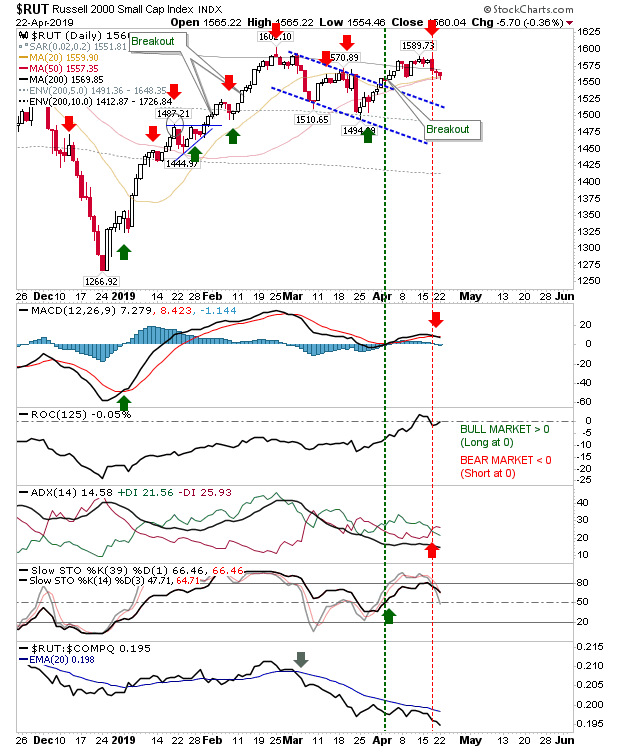

I would like the Russell 2000 to regain its leadership, something it lost in March. The February high rebuttal off the 200-day MA remains the high for the index in 2019, but something more is required to see a reversal in the relative performance loss.

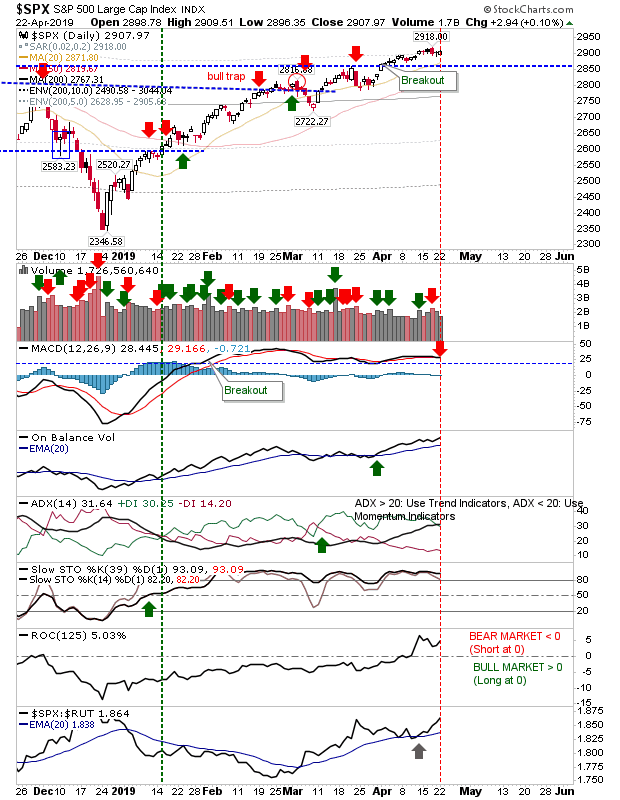

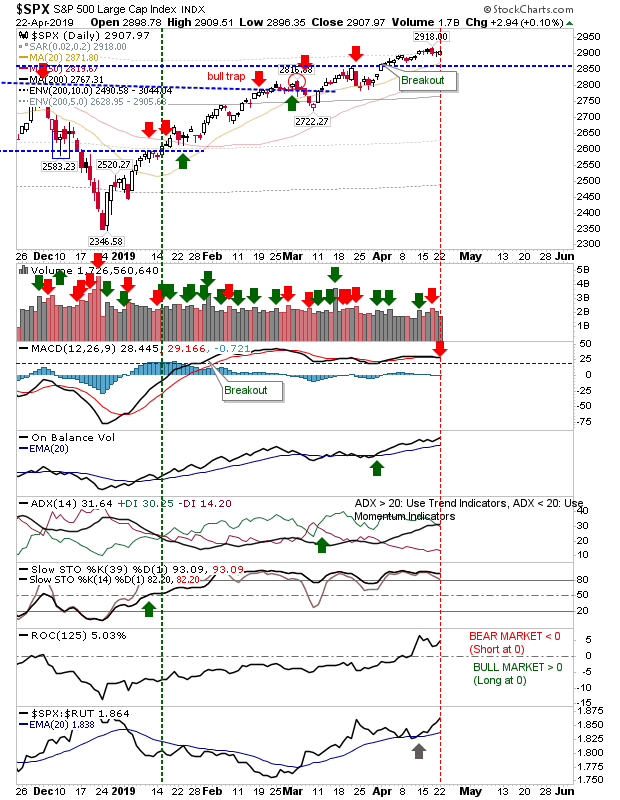

The S&P isn't doing a whole lot, but this lack of movement has helped the index outperform the Russell 2000. Despite this, the index has shifted to a 'sell' trigger in the MACD.

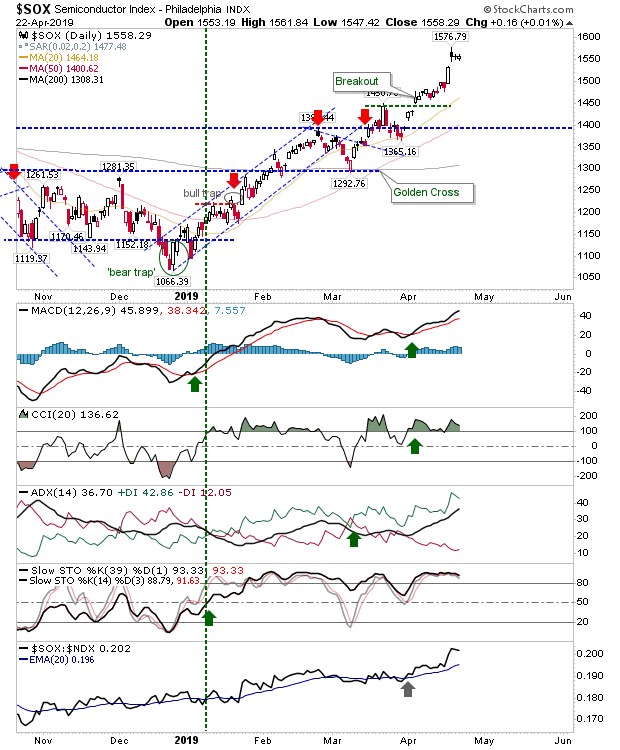

The Semiconductor Index bucked the trend a little yesterday. The potential 'shooting star' from last Wednesday never materialized and this is good news for semiconductor stocks, the NASDAQ and the NASDAQ 100.

The NASDAQ has benefited (a little) from gains in the Semiconductor Index. While the index hasn't done a whole lot in recent weeks it has enjoyed good technical strength, bar a flat-lined 'sell' trigger in the MACD.

For today, I would like to see the Russell 2000 regain some of the momentum lost in recent weeks, starting with a successful defense of converged 20-day and 50-day MAs.