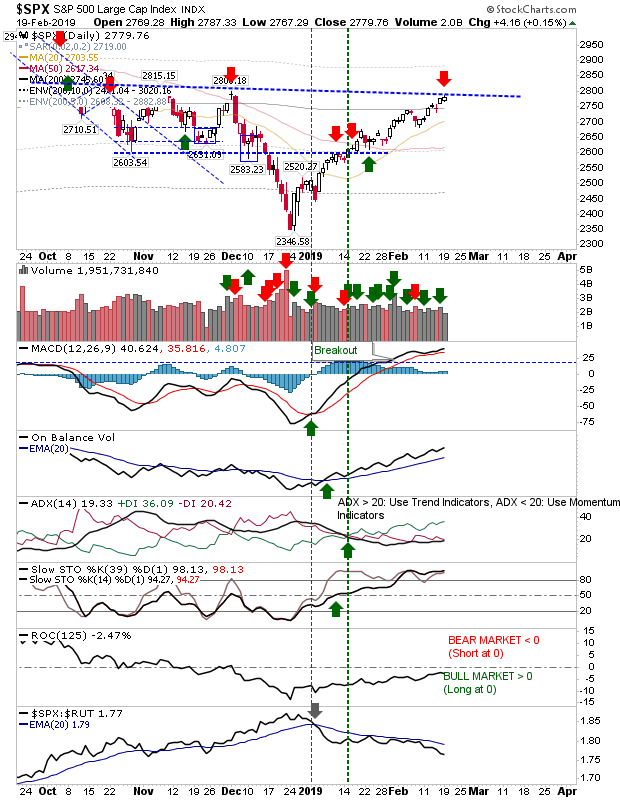

Indices continued to post small gains yesterday, which left the S&P nestled against resistance. I have marked the S&P as a possible short at such resistance as volume was lighter than usual.

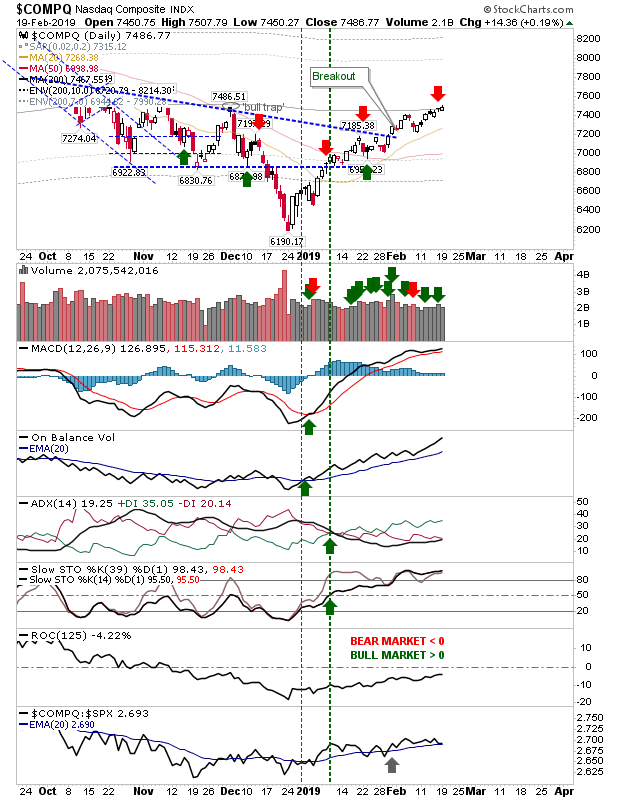

While the S&P parked itself at resistance, the NASDAQ started to edge past its 200-day MA. While gains were small, they were probably enough to scare shorts into covering or at least hold off on attacking their 200-day MAs. Technicals remain bullish but relative performance is slowly going against it.

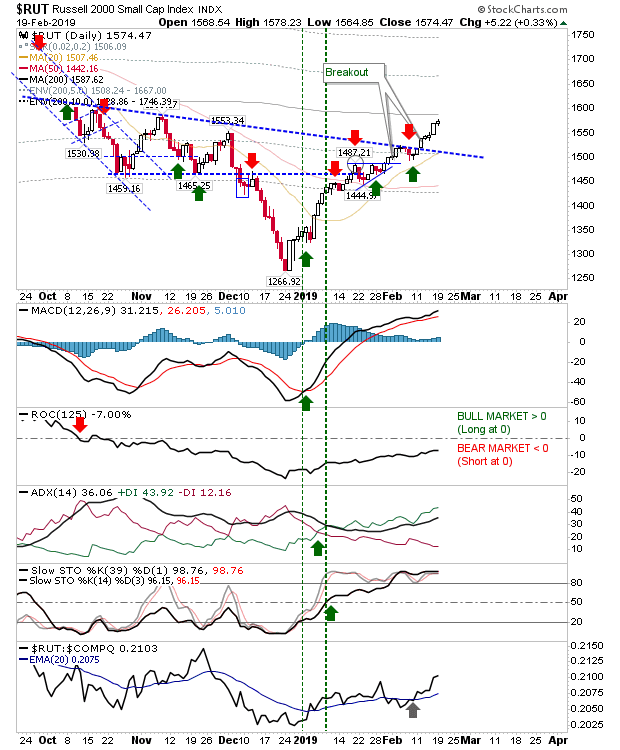

The Russell 2000 remains on course to test its 200-day MA as it makes its way to its next logical resistance.

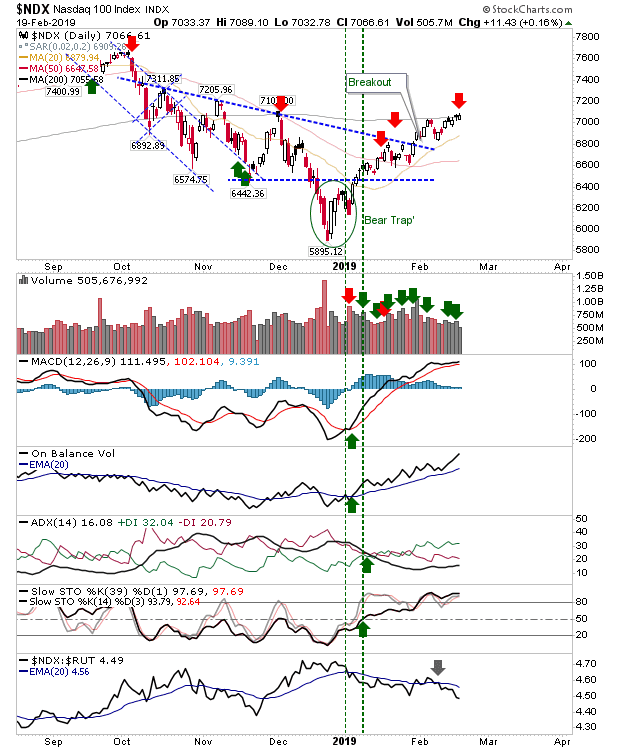

The NASDAQ 100 is still pinned by resistance of its 200-day MA. There has been an acceleration in the weakness relative to Small Caps but I would still view Semiconductors as the dominant influence and expect further gains.

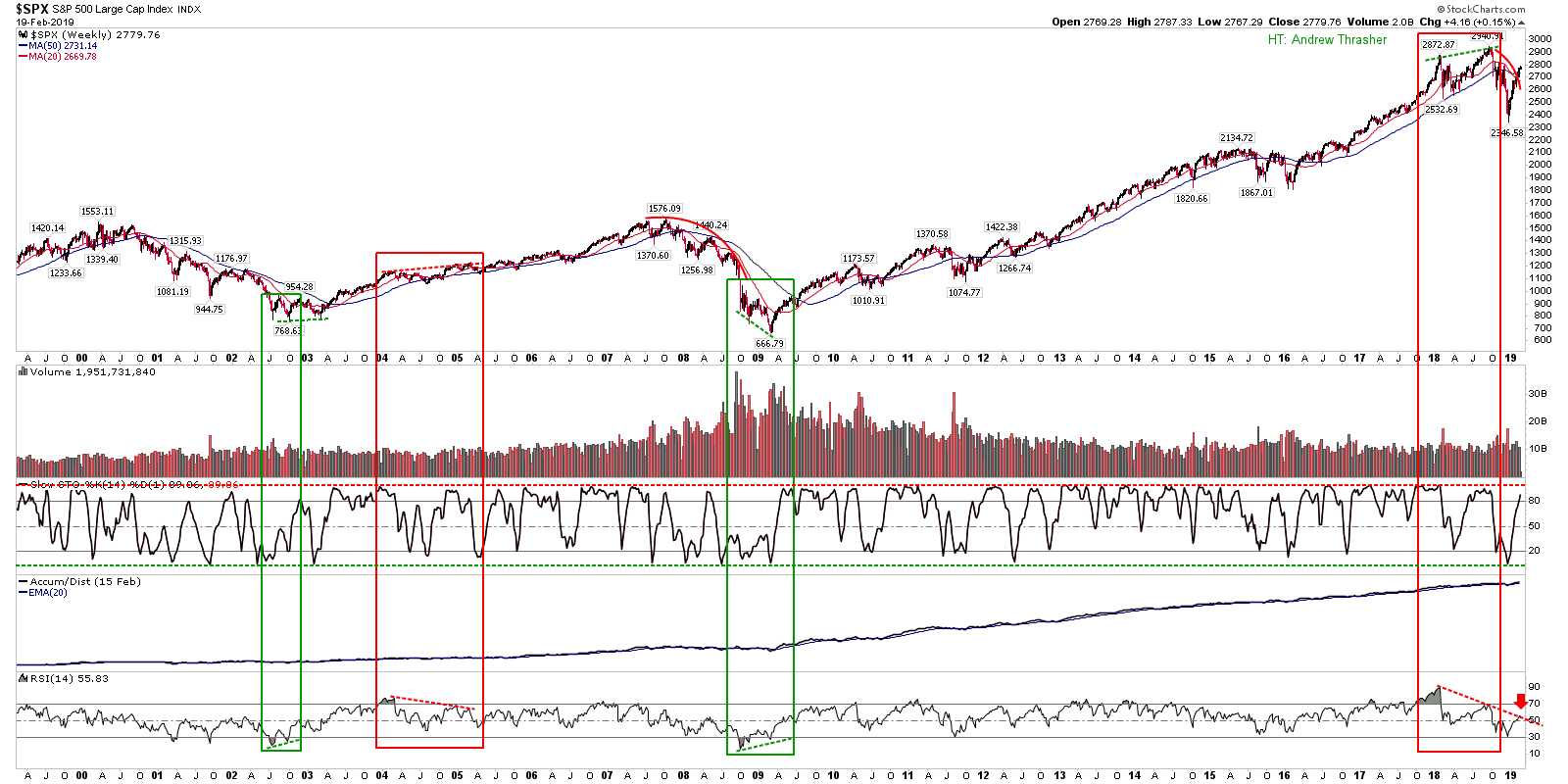

While it's still early, the S&P is coming up against weekly RSI resistance. If this is a bear rally then watch for a reversal soon (probably next week if it comes true).

For today, 200-day MA resistance is the watchword with indices undergoing tests of this key long term average.