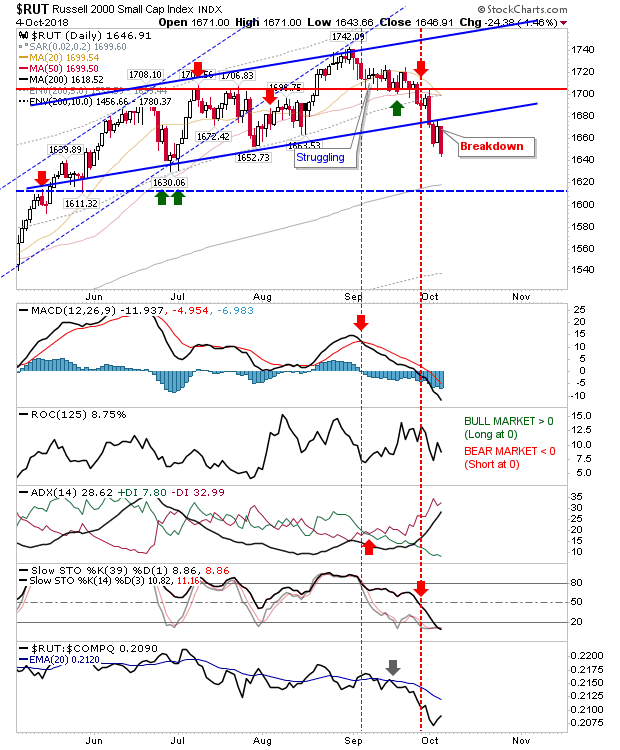

Small Caps weren't able to recover the channel and another 1%+ loss was chalked up. It's looking ever more likely a tag of the 200-day MA is on the cards. Relative performance actually ticked up despite the loss but Thursday was an ugly day.

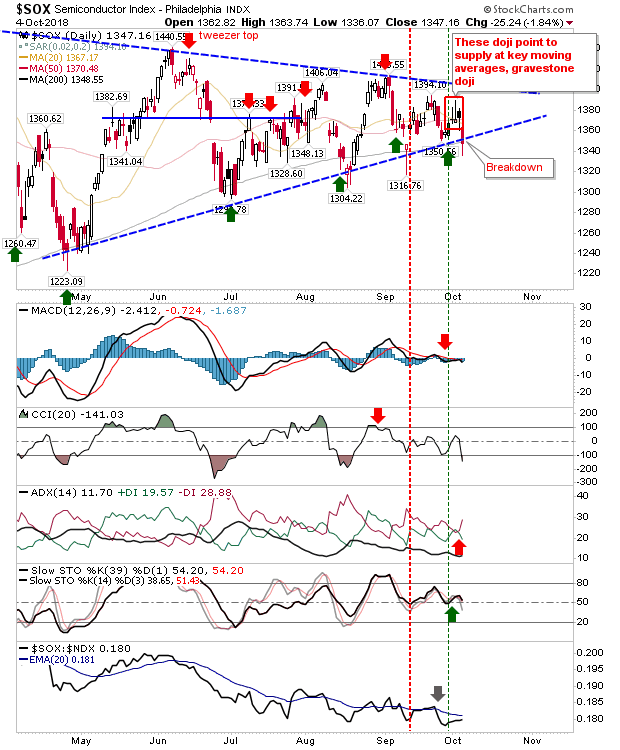

The Semiconductor Index looks to be breaking support. The Chinese spy attack is interesting although not directly attributed to Thursday's loss. With Small Caps leading lower it won't be long for Tech stocks and indices are following behind.

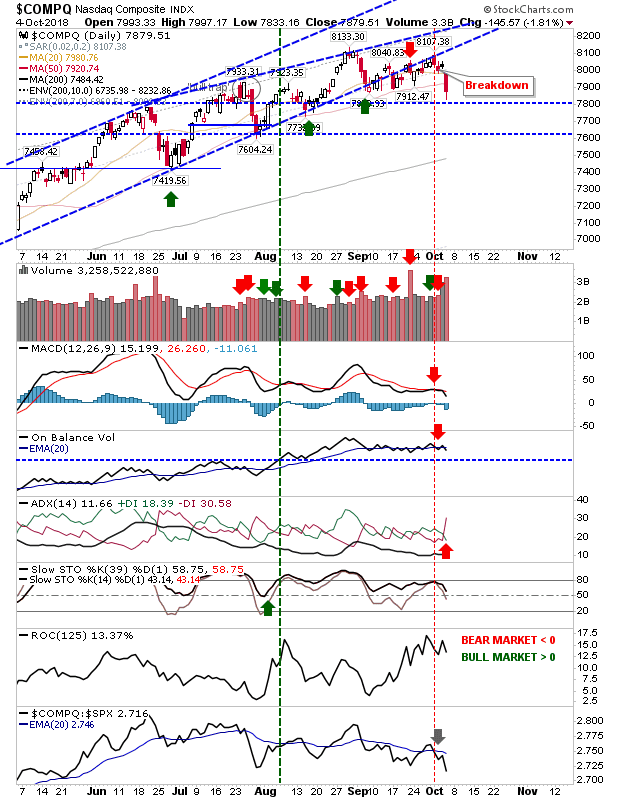

The NASDAQ cracked below its 50-day MA as it engages in a slow reversal. A loss of 7,800 opens up a move to the 200-day MA. Volume rose in confirmed distribution as sellers swamped early action. Technicals show three bearish flags to one bullish.

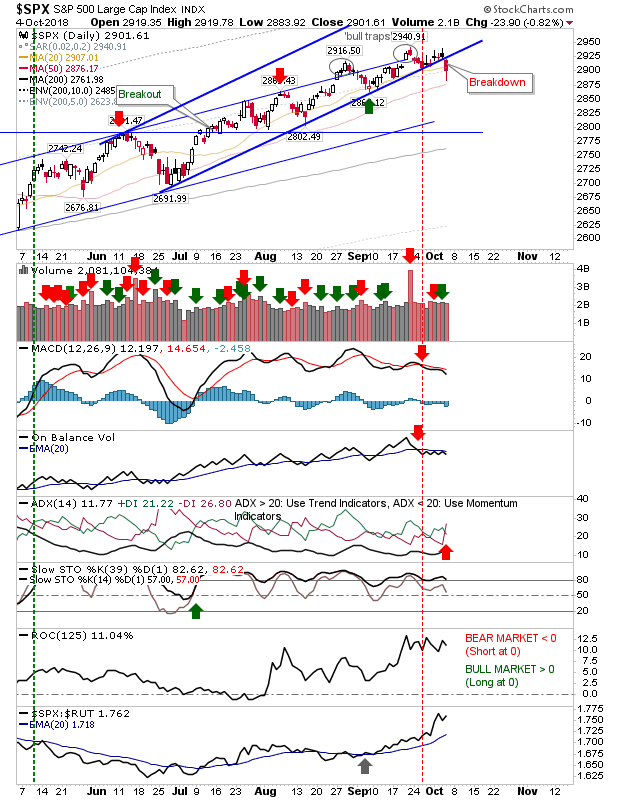

The S&P looks to be following other markets and has broken rising channel support. This was accompanied by a new 'sell' trigger in +DI/-DI to accompany earlier 'sell' triggers from On-Balance-Volume and MACD. The caveat is the strong surge in relative strength as it effectively sucks all the bullish air out of the room.

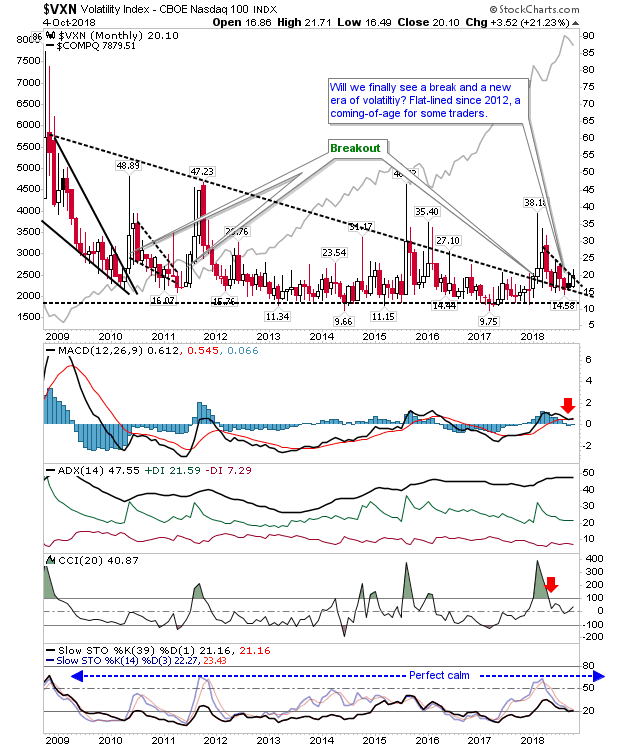

The other watch is the volatility index. Things are bubbling up towards a volatility volcano – the question is whether it will trigger now or later. Volatility has spent a long time in the doldrums and now it's a question as to when the next sustained surge will emerge; it came close in 2015/16 but it died before it managed to build any momentum.

For Friday, shorts will be keen to see an acceleration lower in the Russell 2000 having seen Wednesday's attempted recovery fail. New shorts can fish in the NASDAQ 100 and Semiconductor Index although given the risk:reward, a considerable move lower is required for such trades to be profitable.