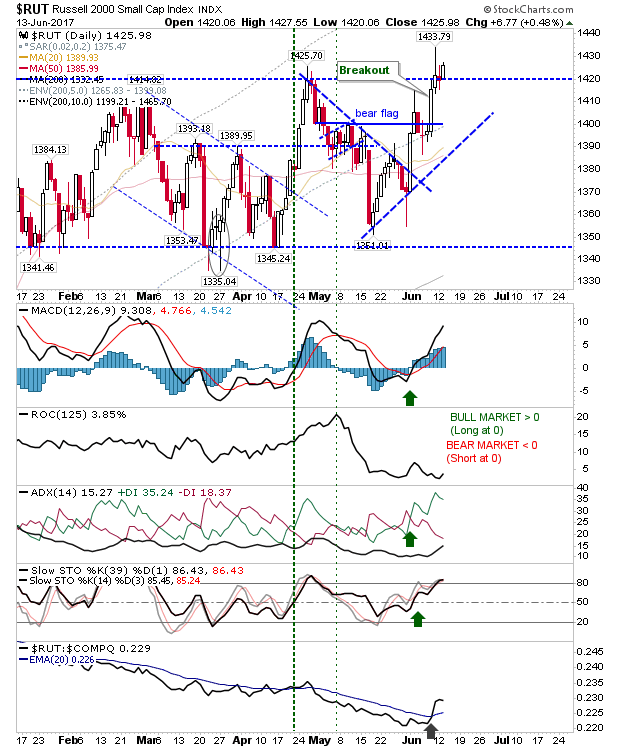

After Friday's sell-off, it was left to bulls to try and paint over the cracks. The Russell 2000 returned to its breakout with a small gain over 1,420. The spike high is still influential, but the move into the spike high weakens the significance of this typically bearish candlestick. Also, note the sharp rise in relative market performance against the NASDAQ.

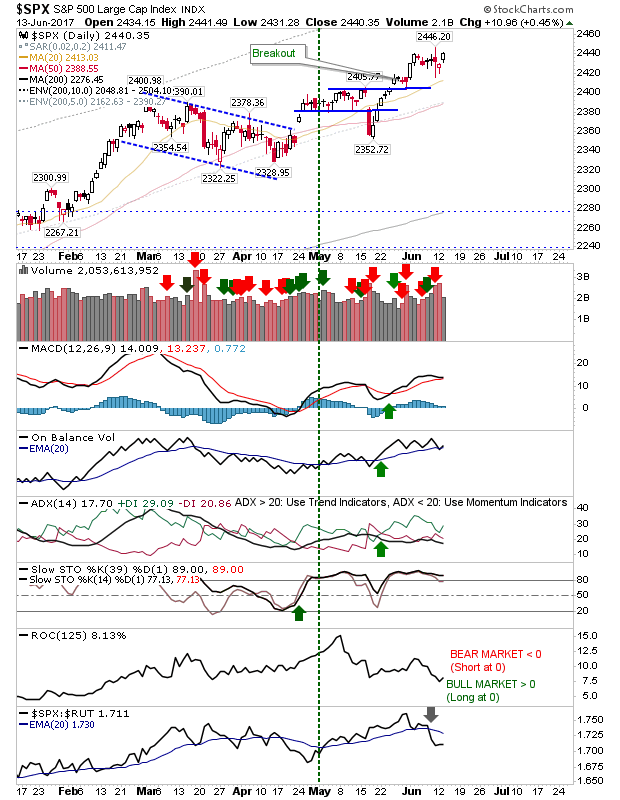

The S&P maintained its rally having successfully defended the May breakout. Monday's gain didn't knock out at 2,446 but it took a big step towards it. Volume was modest and technicals are positive. It could still make a new breakout if it can clear 2,446; action for the last couple of weeks is itself a consolidation and therefore ready to break.

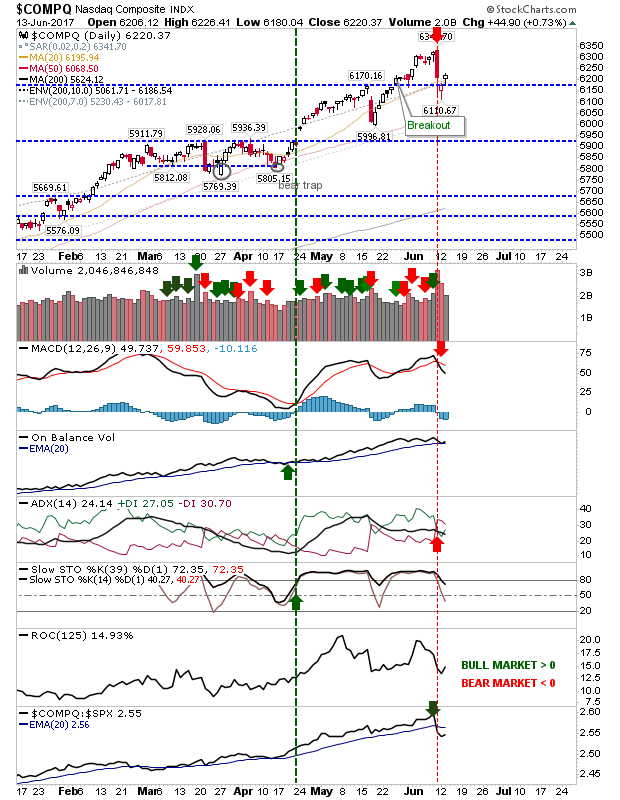

The NASDAQ experienced the greatest loss and only managed to bank the smallest gain yesterday. The Index has a long way to go to make back the loss but shorts will be looking for opportunities to attack - particularly if the positivity in the Russell 2000 reverses. Technicals have a 'sell' trigger in the MACD and bearish crossover in the -DI/+DI

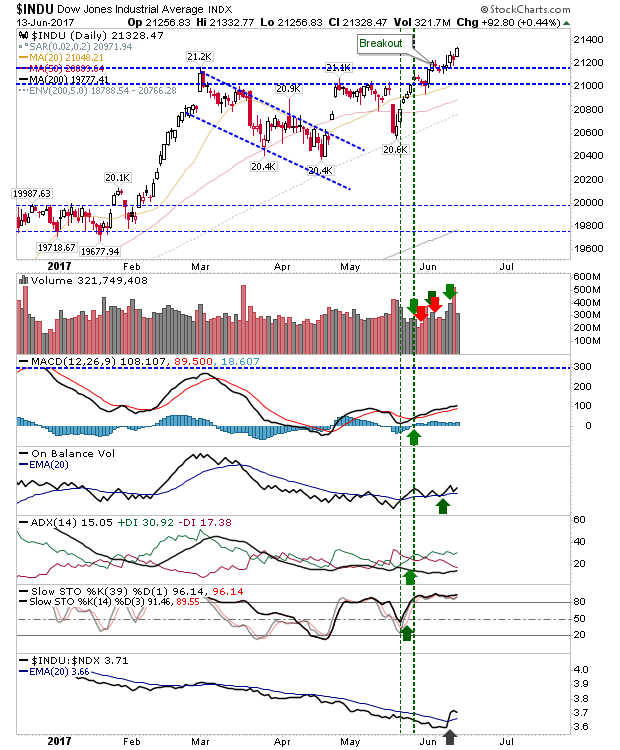

The Dow Jones was the only index to finish with a new 52-week high. While it's a limited index in the number of components, it was the index which had been in May primed for a breakout and in the last few weeks, delivered. Momentum traders may get more out of this in the coming weeks.

For today, Wednesday, bulls can look for further momentum gains in the Russell 2000, Dow Jones and S&P. Shorts will be looking for a doji or bearish candlestick which fails to challenge the highs of Friday's selloff in the NASDAQ and NASDAQ 100.