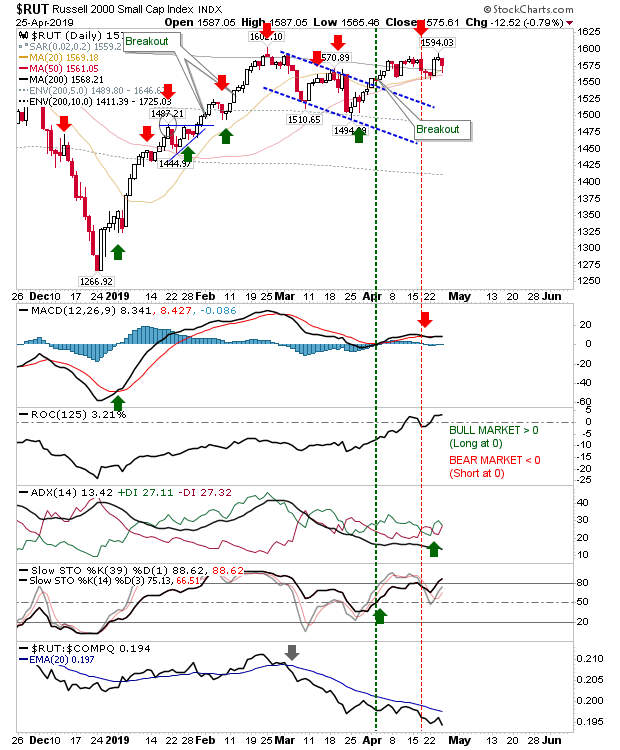

There wasn't a whole lot to Thursday's action despite the damage done to my monitored Shutterstock (NYSE:SSTK) following disappointed earnings. The Small Cap index fell back into converged 20-day, 50-day and 200-day MA.

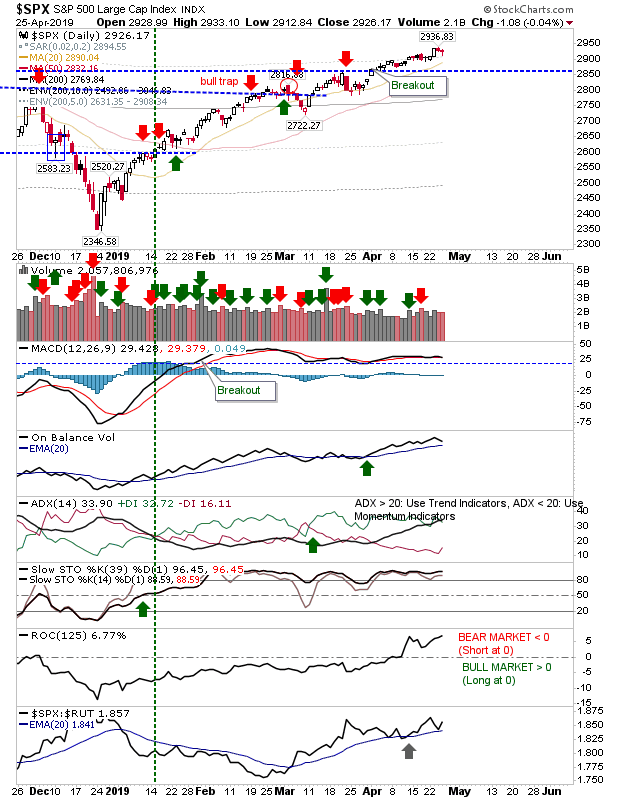

The S&P 500 lost a little ground on lighter volume but the minor gains of past few weeks have been using the 20-day MA to work support. Look for repeat as occurred in the latter part of March.

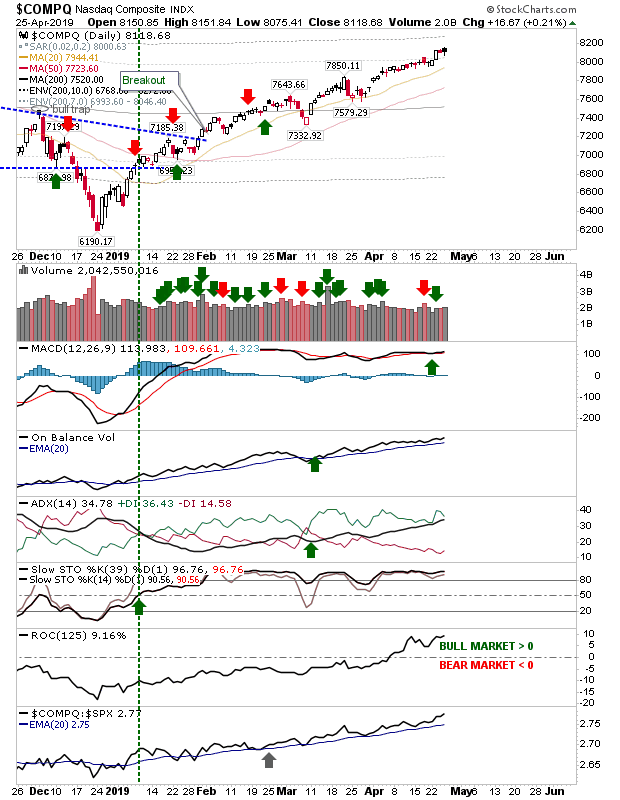

While the S&P 500 could use the 20-day MA to mount a demand bounce, the Nasdaq has a little more room to maneuver before an equivalent test can be mounted. Technicals are all net bullish.

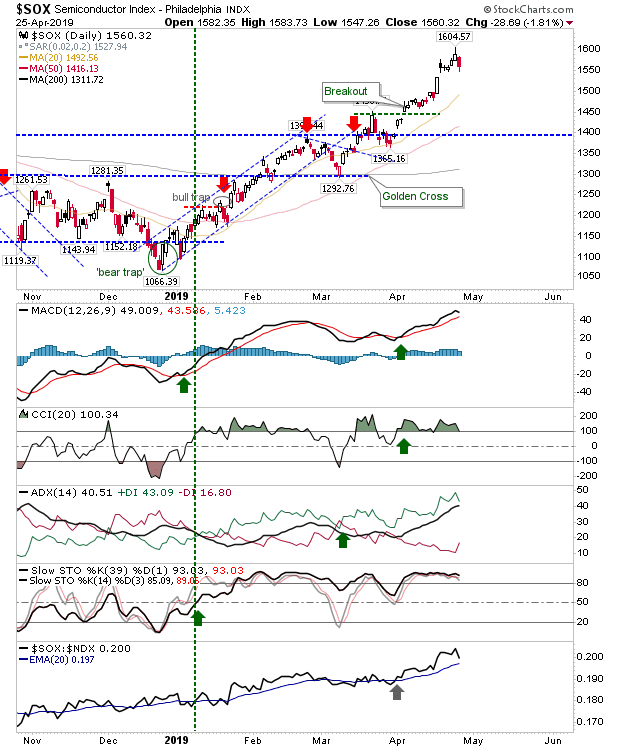

While the NASDAQ is holding ground, the Semiconductor Index lost nearly 2%; it remains well above its moving averages. Despite this, a test of the 20-day MA would be sufficient to be very damaging to supporting Tech indices, although it would help consolidated the advance off 1,293. Look for some solo downside to work as a test of the 20-day MA.

For today, attention can remain on the Semiconductor Index and supported NASDAQ and NSDAQ 100. Expectations are for more downside but there is plenty of room for a surprise.