Investing.com’s stocks of the week

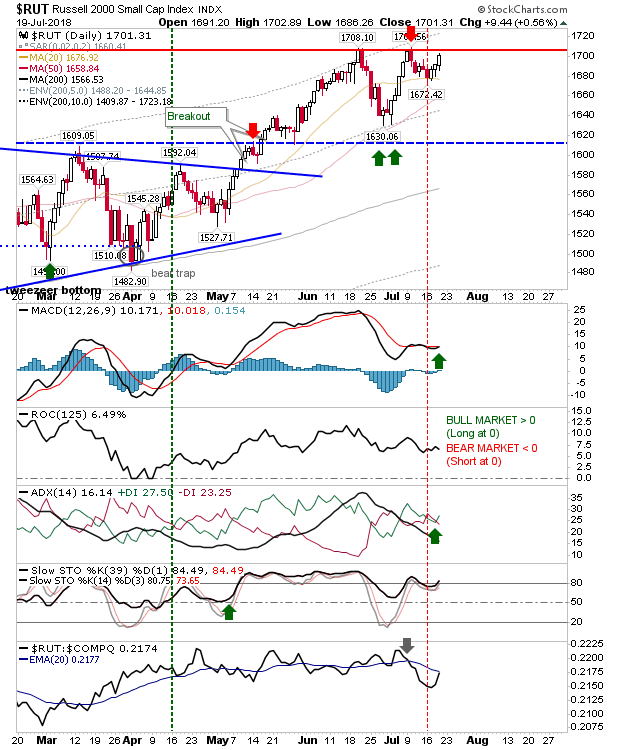

There wasn't a whole lot going on yesterday except Small Caps were able to attract some buyers despite finishing below resistance; bulls have been taking advantage of the 20-day MA test. Thursday's action coincided with 'buy' signals in the MACD and +DI/-DI.

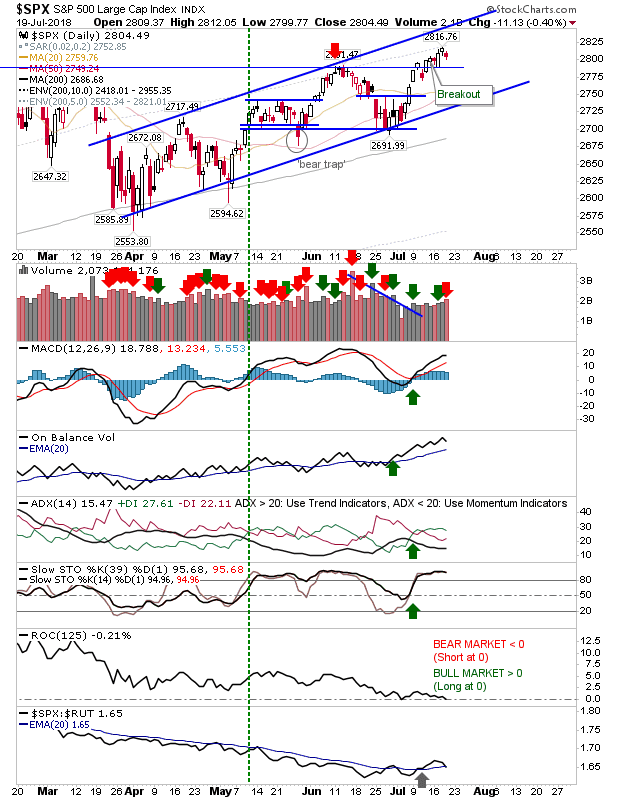

The S&P 500 held its breakout and Thursday''s losses - despite higher volume selling - didn't do a whole lot of damage.

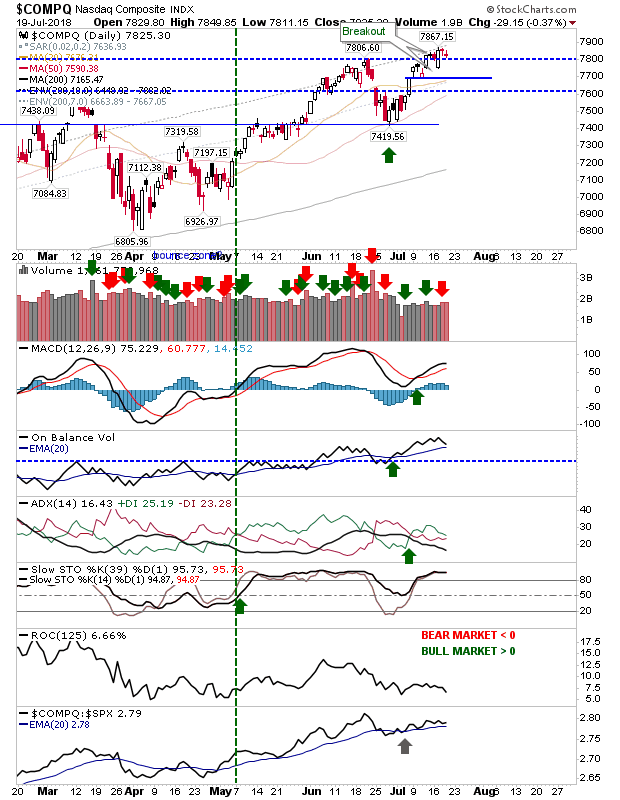

The NASDAQ Composite also held its breakout but has less wiggle room than the SPX. The index has a slight advantage in relative performance against the SPX. Those believing in the breakout could be buyers here but don't hang on if there is an acceleration down through 7,800.

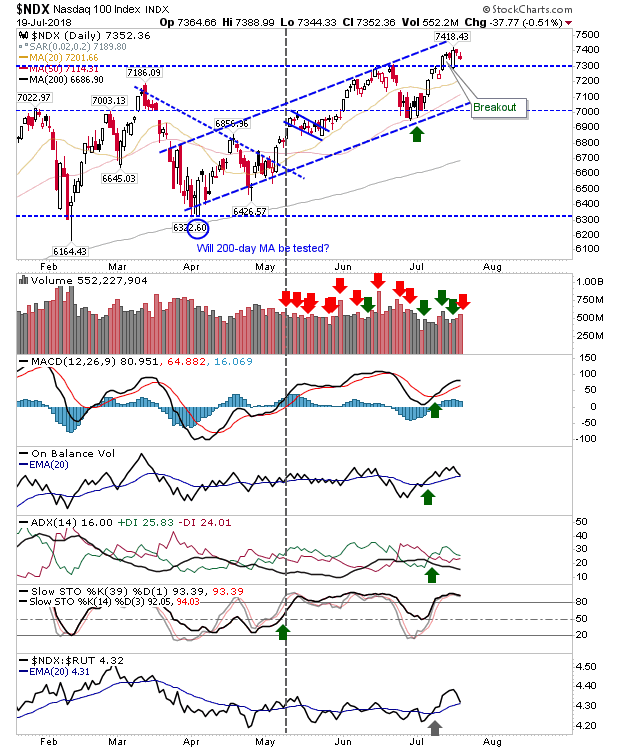

The NASDAQ 100 has more wiggle room and despite some relative performance loss there does appear to be a turnaround. Again, the index clocked up some distribution selling but it was not convincing.

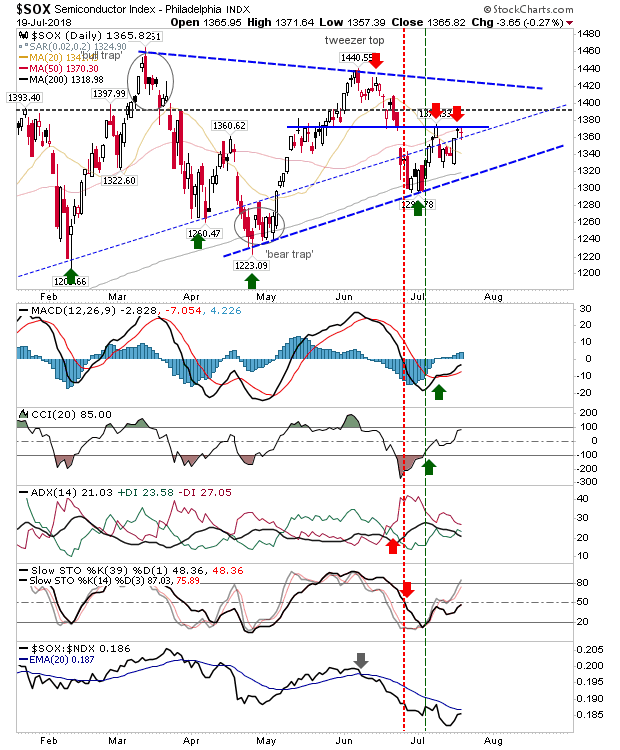

The Semiconductor Index is still the watch index for Tech indices. I have redrawn it as a consolidation triangle with minor resistance at 1,375; the index suggests a second shorting opportunity with the 50-day MA lending weight to this play. How this plays out will influence the breakouts for the NASDAQ and NASDAQ 100.

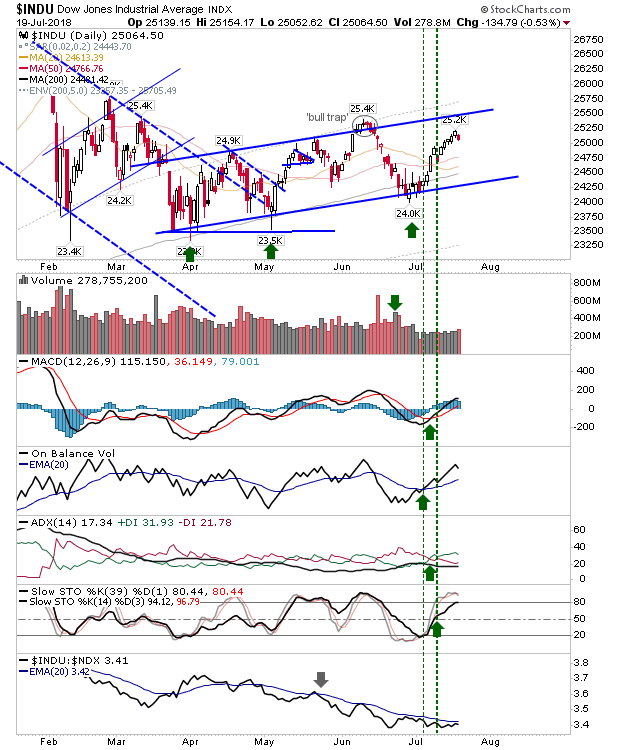

The Dow Jones drifted back a little but remains in course for channel resistance.

For Friday, look to the Russell 2000 to break to new highs and for the NASDAQ, NASDAQ 100 and S&P 500 to hold their breakouts. The margins are fine but if the Russell 2000 can regain some relative momentum it may be the value play into the Fall.