Thursday offered a bright start for markets but the Russell 2000 struggled to enjoy the fruits and by market close, things were looking a little more somber. Best of the action belonged to Large Caps but it was Tech indices that started the day brightest.

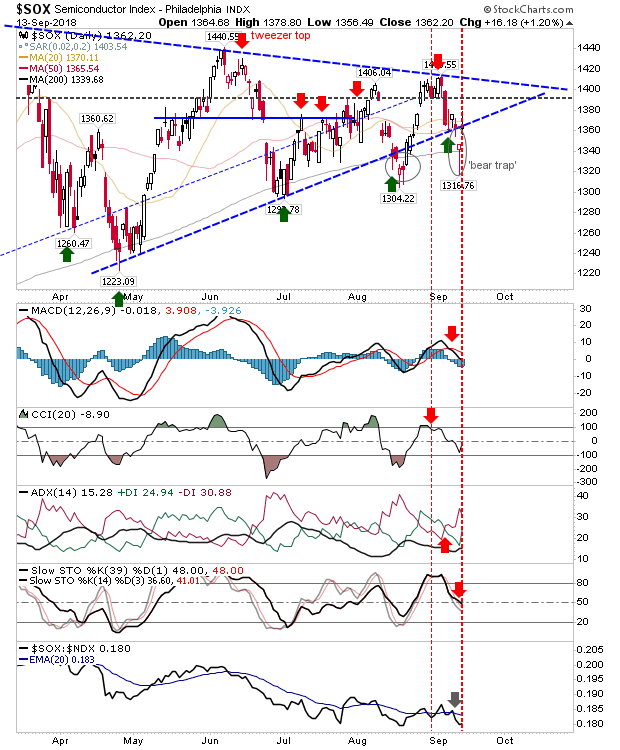

The Semiconductor Index gapped higher and returned inside the consolidation triangle. Had it closed near the day's highs it would have ranked as a bullish 'morning star' candlestick pattern but instead it registers as a 'bear trap'. However, this wasn't enough to stop a net turn in technicals in favor of bears. A loss on Friday would put the 'bear trap' under threat.

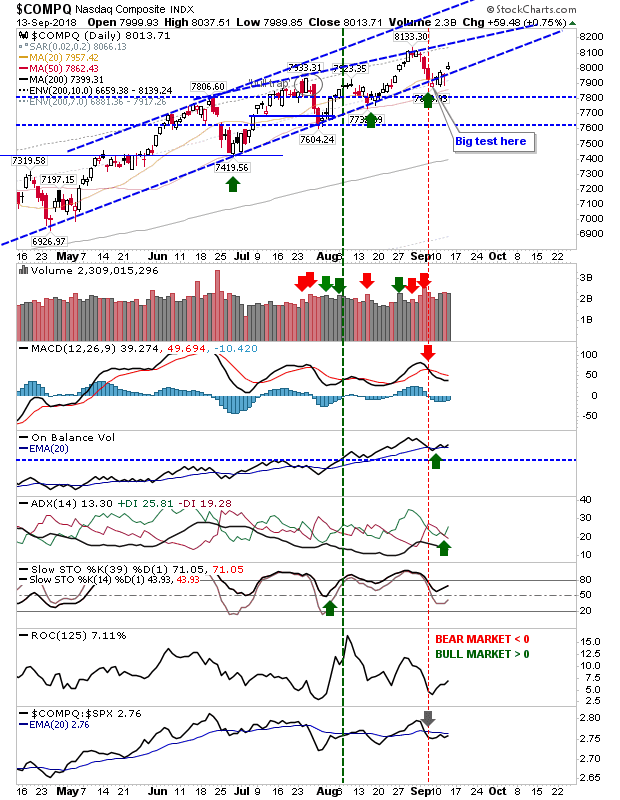

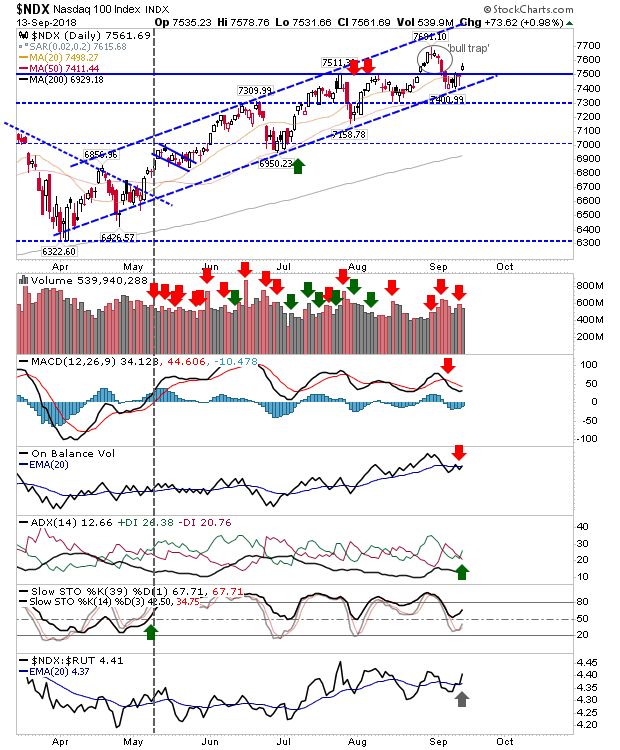

The Nasdaq Composite and Nasdaq 100 didn't do much beyond the morning gap but it did take indices away from support. However, given how much the Semiconductor index lost during the day, there is a threat that could spill over to Tech Indices and these gaps could quickly close and sellers again pressure channel support.

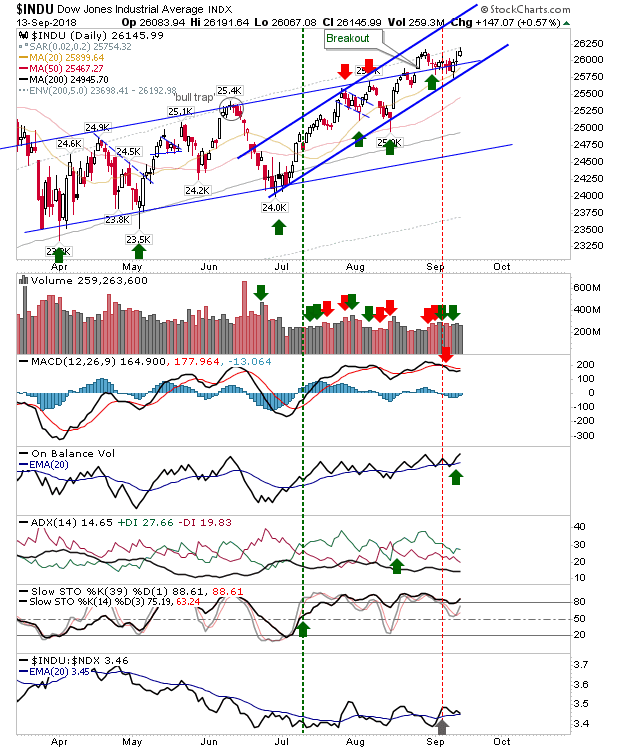

Large Caps rallied alongside Tech indices but volume did manage to rise in accumulation, maintaining the bullish trend in On-Balance-Volume. Both indices are near all-time highs and one more day of gains will probably be enough to achieve.

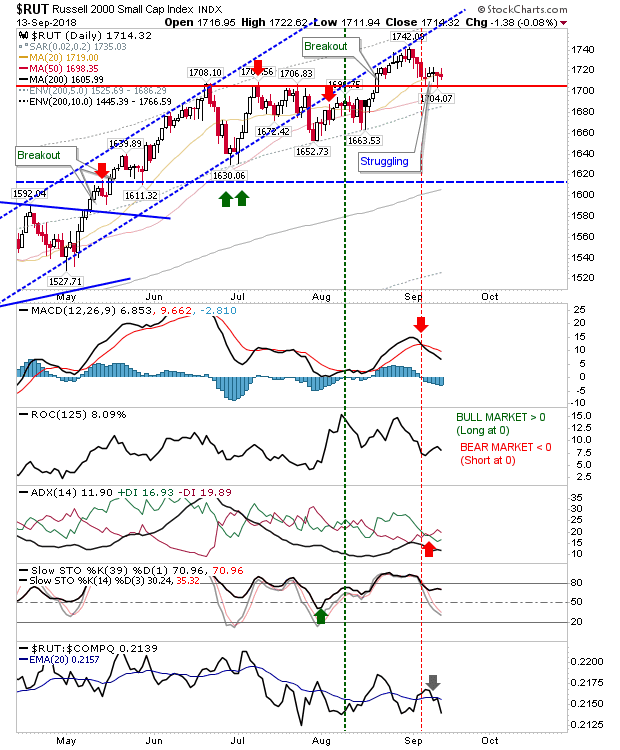

One index that is struggling is the Russell 2000. Small Caps is a key leader in a secular rally and this rally has been going 9 years. But there are signs – for Small Caps at least – that this may be changing. The Russell 2000 spent a fifth day posting a neutral doji as it failed to attract any meaningful buyers but so far has resisted sellers. Technicals are mixed but relative performance has shifted back toward bears. Nobody knows what will happen on Friday, next week, next month or next year but if I was to have a hunch I would look for sellers to take this lower before new all-time highs are delivered.

On Friday, bulls have a slight edge for Tech and Large Caps but it will likely be Small Caps that will do the leading lower.