Last week brought a shock to traders reared on sub-1% daily swings as profit taking losses of 2%+ swept the board on Thursday in the face of Trump uncertainty. It's a bizarre market given uncertainty is the enemy of the market and the world is full of uncertainty yet market participants were happy to bid up Trump's election.

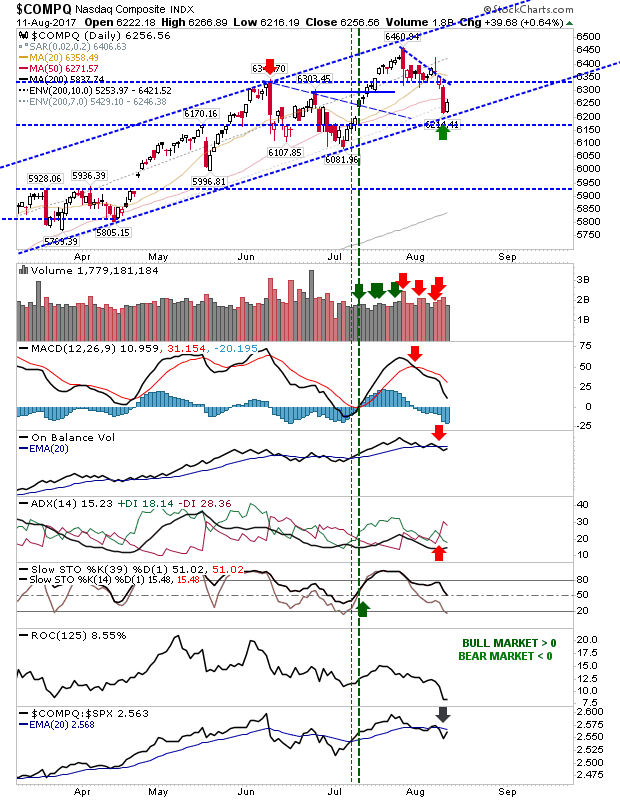

It's not all doom and gloom. The NASDAQ made a recovery just above channel support. It might be a little early for a bounce but Friday's action should be respected. MACD, On-Balance-Volume and ADX are bearish but stochastics are at a bull market support level. If looking long side then risk is measured by a loss of 6,215.

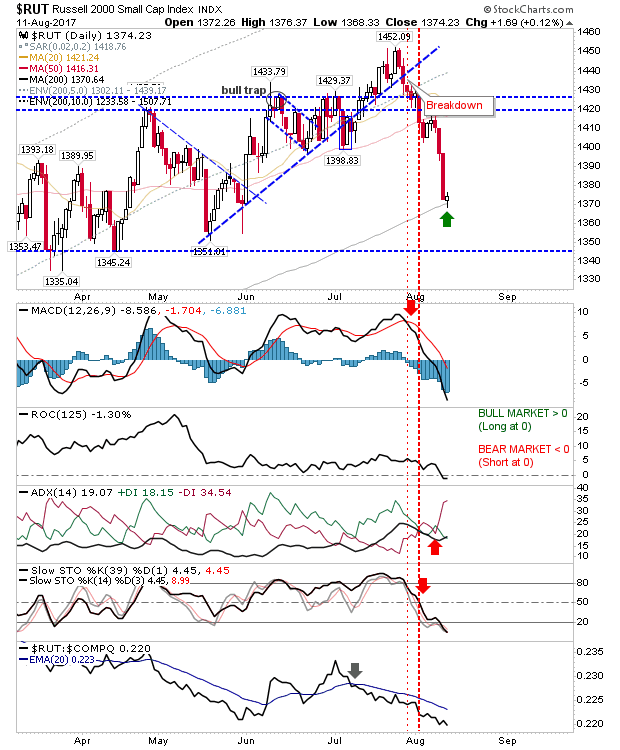

The other index offering a long opportunity is the Russell 2000. Small Caps experienced the brunt of the selling last week but the 200-day MA is offering itself as support. Using Friday's low as a place for stops will offer a relatively low risk (if high whipsaw risk) long opportunity. Technicals are negative but stochastics are deeply oversold.

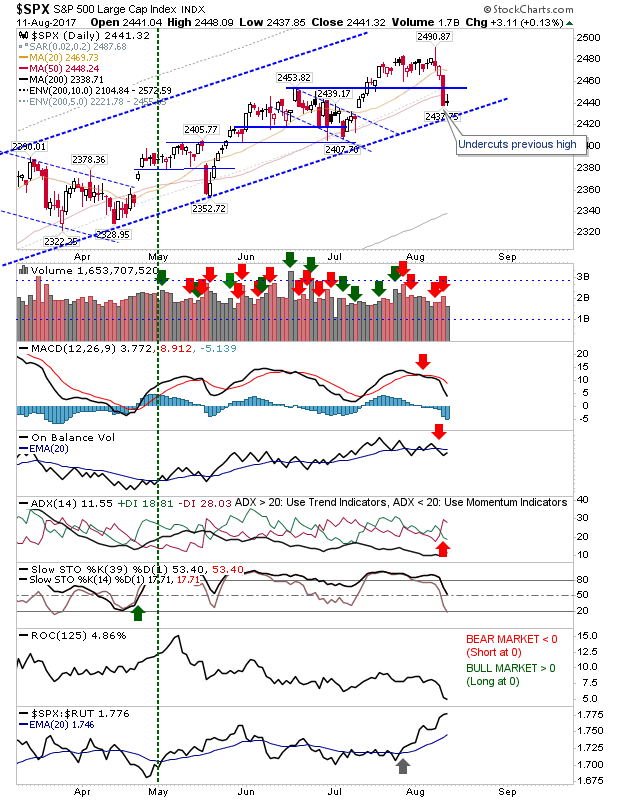

The S&P may also have a long opportunity. The Thursday-Friday combination has the look of a bullish harami cross (one of the more reliable bounce patterns). If playing a long side bounce, place stops on a loss of 2,435.

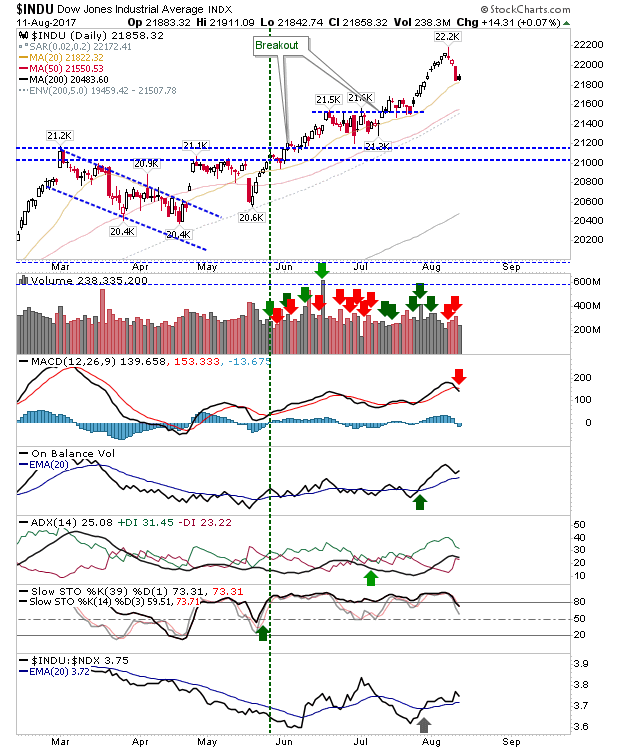

The Dow has mostly ignored the carnage around it. Watch rallies for new shorting opportunities – I can't see this index bucking the trend for long. Friday saw a MACD trigger 'sell' but other technicals are hanging on.

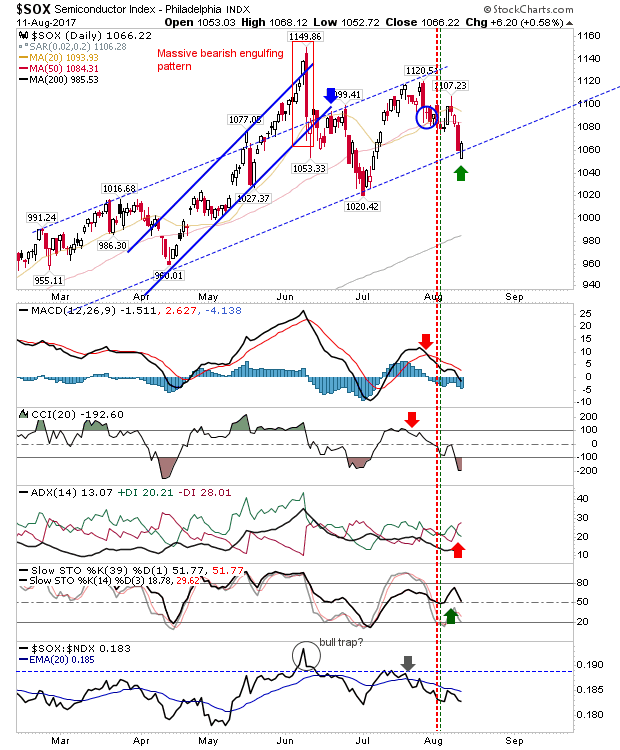

On a final note, the Semiconductor Index is also offering itself as a long side opportunity. Friday's recovery was at channel support and stochastics held the bullish midline typical of bullish markets. June's bearish engulfing pattern still looks dominant but the index has found buyers on moves back to 1,000.

Premarket is again important as long opportunities are on offer but are heavily dependent on channel support holding – gap downs could be taken as value plays but don't hold if markets fail to recover in the first half hour.