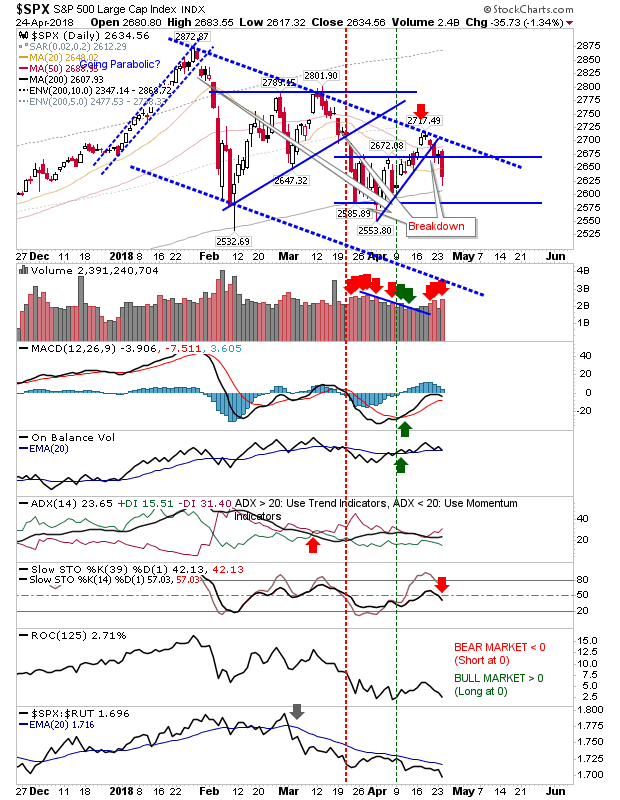

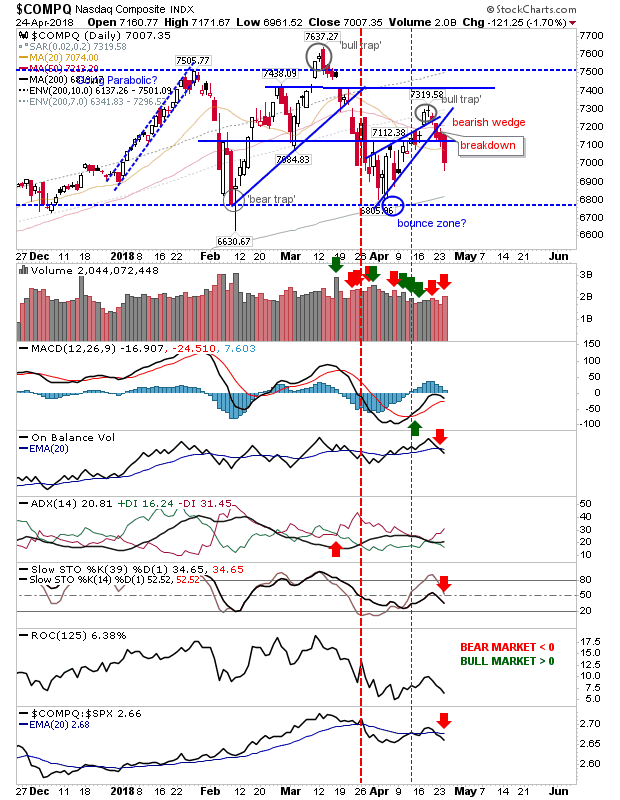

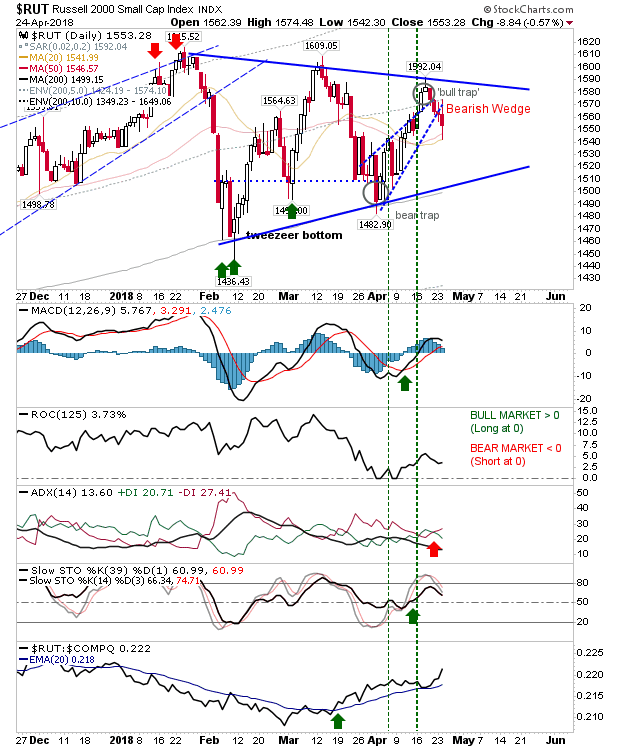

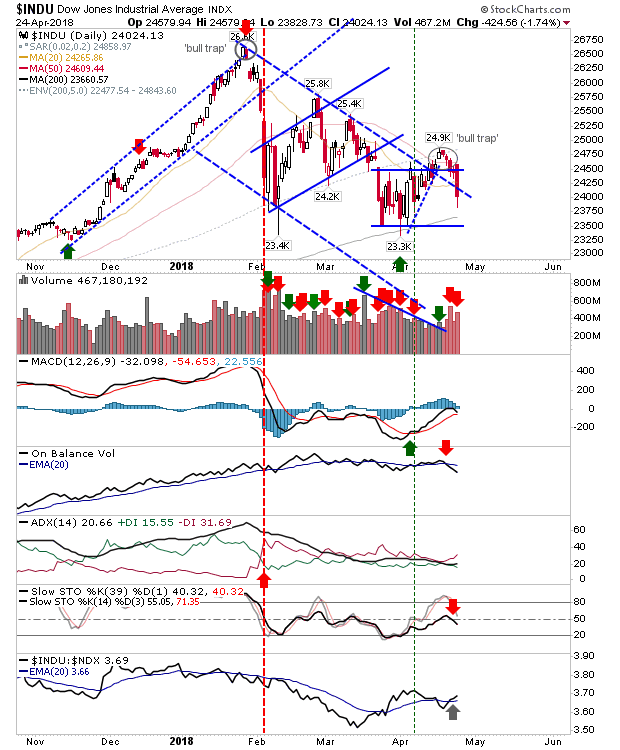

There was no sleeper (long) play for the S&P yesterday as sellers took control across all indices. Losses of between 1-2% took effect in Large Cap, Small Cap and Technology indices.

The S&P cut clean through horizontal support, 20-day and 50-day MAs, but was never able to challenge channel resistance. Look for a move down to channel support. Technicals are a mix of bullish and bearish signals.

The NASDAQ took a larger hit as the 'bull trap' played to form. The obvious target is the 200-day MA which would come close to a trading range support test.

The Russell 2000 did find support at 20-day and 50-day MAs in one of the better relative performance actions on the day. If longs wanted a play for today, Wednesday, (given the S&P proved to be a bust yesterday) then Small Caps could be it.

The Dow Jones Index could be the short play for the coming days. Yesterday's action left a 'bull trap' as the index fell back inside its earlier channel. Again, look for a move to lower channel support as is common in 'bull traps'.

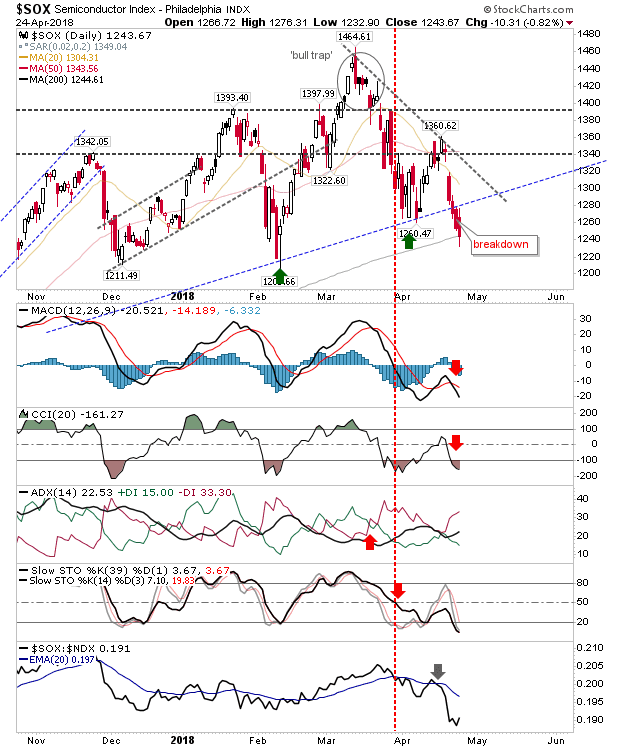

The one long play which may yet yield dividends is the Semiconductor Index. Yesterday's action didn't look like it was going to stop at the 200-day MA but so far it has honored this moving average.

For today, shorts can look to the Dow Jones Index. Longs can look to the Semiconductor Index and Russell 2000.