Inspiration

Limit your size in any position so that fear does not become the prevailing instinct guiding your judgement. – Joe Vidich

Opening Calls

A rise in coronavirus cases in the United States is creating a little unease about the speed with which the country can reopen. Asian markets turned lower today, while European shares are drifting lower in opening trade. Both the FTSE 100 and the pound are lower ahead of the Bank of England meeting. Wall Street is setup for a lower open as investors await the latest jobless claims figures for insight on the economic recovery.

Bank of England

We are looking for the Bank of England to top up its bond buying program from between £100-£150 billion pounds ($125-188 billion). The central data-point behind the likely decision is the -20.4% plunge in April GDP. All the data for April looks ugly and there isn't enough data for the recovery, because the UK has been so late to reopen the economy. That leaves the Bank of England approximating, based on the speed of current bond purchases, when they might want to stop, which we think is probably September/October. The pound has been trading softly into the decision on the prospect for the extra money printing. Upside shocks are possible if the votes are not unanimous, or if changes are deferred to the next meeting.

Trading Opportunities

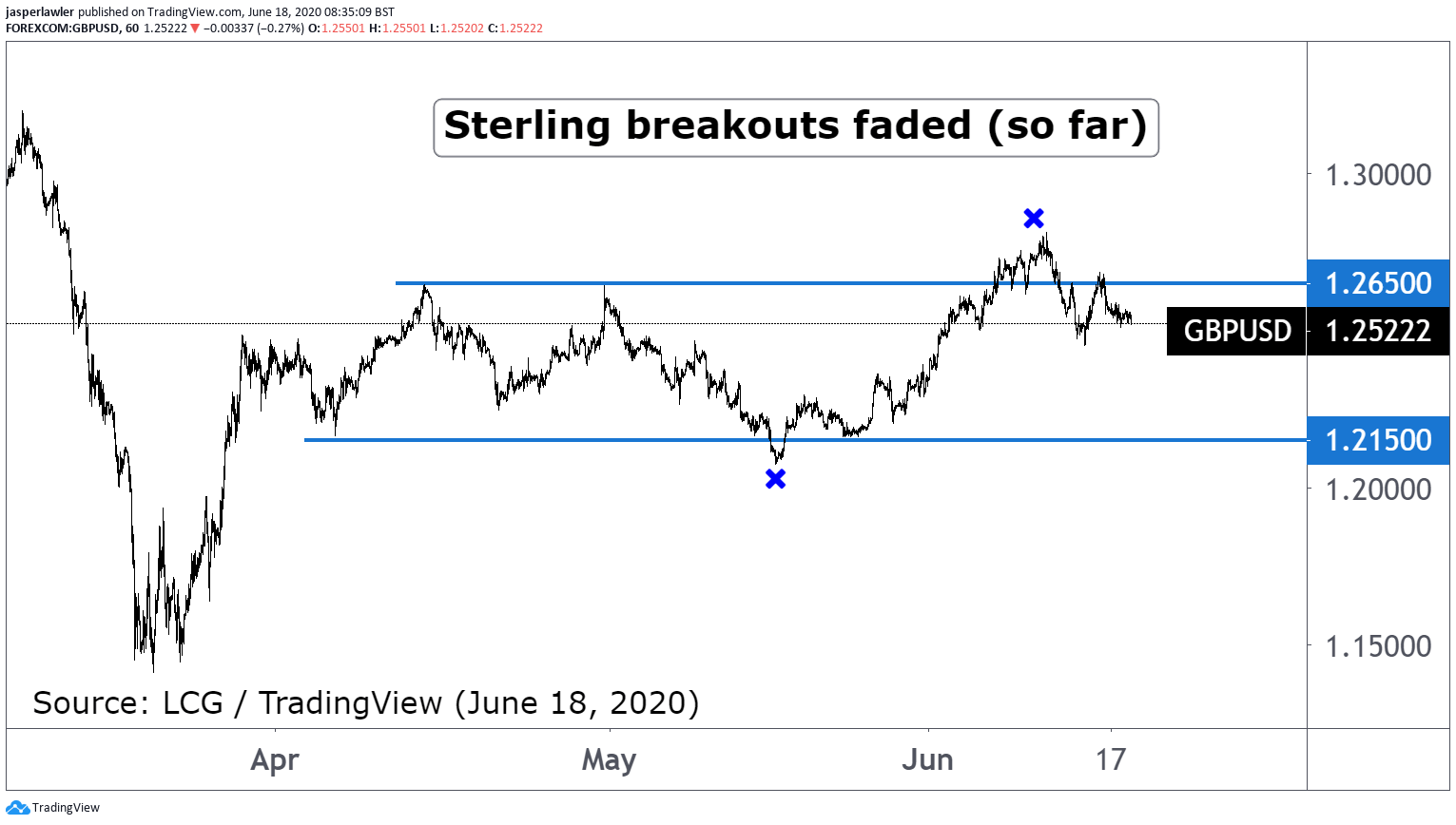

So far the pound hasn't been able to sustain a break lower or higher from its 1.215 to 1.265 price range.