Most major global equity indices traded in positive waters yesterday and today in Asia, with the drivers being a trade accord between the EU and the UK, the passage of a fiscal-aid bill in the US into law, and the launch of a cross-border European vaccination program.

BREXIT DEAL, US FISCAL STIMULUS, AND COVID VACCINATIONS LIFT MARKET SENTIMENT

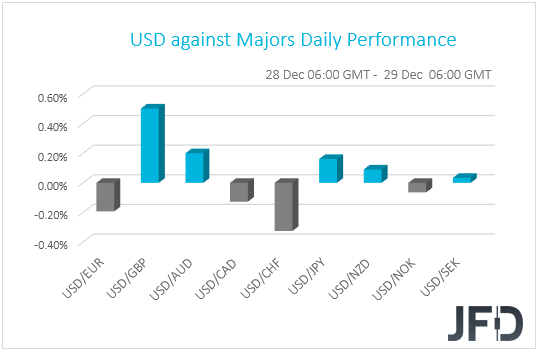

The US dollar traded mixed against the other G10 currencies on Monday and during the Asian trading Tuesday. It gained against GBP, AUD, JPY, and NZD in that order, while it underperformed versus CHF, EUR, CAD, and NOK. The greenback was found virtually unchanged against SEK.

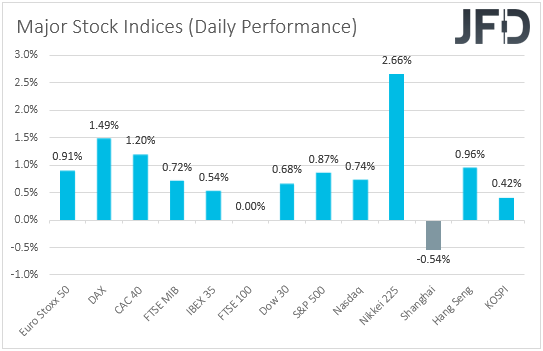

The strengthening of the Swiss franc, combined with the weakening of the risk-linked Aussie and Kiwi, suggests that markets traded in a risk-off fashion yesterday. However, the weakening of the Japanese yen points otherwise. Thus, in order to get a clearer picture with regards to the broader market sentiment, we prefer to turn our gaze to the equity world. There, major EU and US indices were a sea of green, with all three of Wall Street’s main indices hitting fresh record highs. The UK FTSE 100 was closed in celebration of the Boxing Day. The upbeat investor morale rolled over into the Asian session today as well. Although China’s Shanghai Composite slid 0.54%, Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s KOSPI gained 2.66%, 0.96%, and 0.42%, respectively.

It seems that the catalyst behind the optimism was not a single event, rather than a blend of developments. Last Thursday, the UK eventually reached a trade deal with the EU, eliminating the risk of a no-deal Brexit in two days. On top of that, last week, the US Congress voted in favor of a USD 2.3trln spending package, which includes a USD 892bln coronavirus-aid bill. Although President Trump initially refused to sign the proposal into law, he changed his mind and singed it on Sunday, restoring employment benefits to millions of Americans and averting a government shutdown. The launch of a cross-border European vaccination program may have also helped market sentiment, as it raised hopes of a coronavirus-free world in a few months, which could result a strong economic rebound.

All this comes in line with our view for higher equities in the near-term. Remember, we’ve been highlighting that the vaccinations, a stimulus package in the US, and a Biden Presidency, may continue benefiting risk assets. Why Biden? Because we expect him to adopt a softer stance on global trade than Trump did. The Brexit accord paints an even brighter picture. Yesterday, we said that in the absence of any major economic and political events on this week’s schedule, financial markets may trade in a quiet mode. However, if we were to assign a direction to the risks, it would be to the upside, inline with our broader view. Sometimes thin liquidity results in violent swings in the markets, and thus, we would stay careful, despite the almost empty agenda.

EURO STOXX 50 – TECHNICAL OUTLOOK

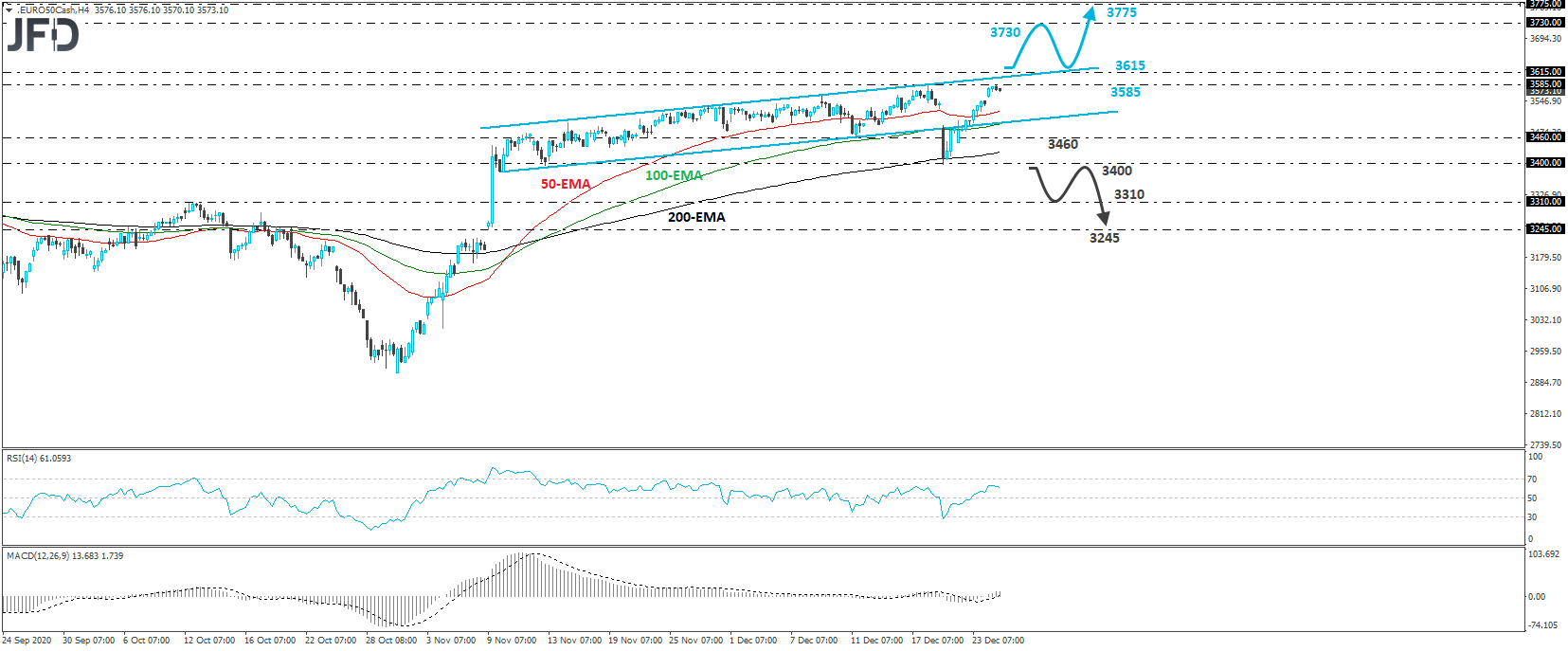

The Euro Stoxx 50 cash index traded higher yesterday but hit resistance near the 3585 barrier, and then, it retreated somewhat. Overall, most of the price action has been contained within a rising channel since November 9th, and thus, we would consider the near-term outlook to be positive.

A clear and decisive move above the 3615 zone, defined by the inside swing low of January 31st, may paint an even brighter picture, and perhaps sent the index towards the peak of February 24th, at around 3730. If that area is not able to stop the advance, its break may pave the way towards the low of the day before, near 3775.

In order to start examining the bearish case, at least in the short run, we would like to see a clear dip below 3400, a territory marked as a support by the lows of November 12th and December 21st. The share price would already be below the lower end of the aforementioned channel, while the dip would also confirm a forthcoming lower low. We may then experience declines towards the 3310 hurdle, marked by the inside swing high of October 12th, the break of which may extend the fall towards the low of November 9th, at 3245.

AUD/JPY – TECHNICAL OUTLOOK

AUD/JPY traded slightly lower yesterday, after hitting resistance at 78.88. That said, it found support at 78.45 and then, it rebounded. Overall, the pair continues to print higher highs and higher lows above the upside support line drawn from the low of November 4th, and therefore, we would see decent chances for the rate to trade higher in the short run.

A clear break above 78.88 would confirm a forthcoming higher high and may encourage the bulls to drive the action towards the 79.45 obstacle, which is defined as a resistance by the inside swing low of April 12th, 2019. If that zone is not able to stop the advance, then we may see extensions towards the high of April 23rd, 2019, at around 79.90, or towards the psychological round figure of 80.00.

On the downside, a dip below the low of December 21st, at 77.50, would not only confirm the break below the pre-mentioned upside line, but it would also confirm a forthcoming lower low on the 4-hour and daily charts. The bears could then dive towards the 76.87 support level, marked by the low of December 7th, where another break may extend the decline towards the low of November 27th, at around 76.50.

AS FOR TODAY’S EVENTS

Yesterday, the US House of Representatives had voted in favor if increasing payments to qualified Americans to USD 2000 from USD 600, sending the measure on the Senate. The Senate is due to convene today, and it remains to be seen whether the chamber will also approve the change. That said, although President Trump supports the change, other Republicans don’t. And having in mind that the Senate is controlled by Republicans, the chances of the proposal being approved are very slim.

As for the data, we only get the API (American Petroleum Institute) report on crude oil inventories for last week, but as it is always the case, no forecast is available.