Investing.com’s stocks of the week

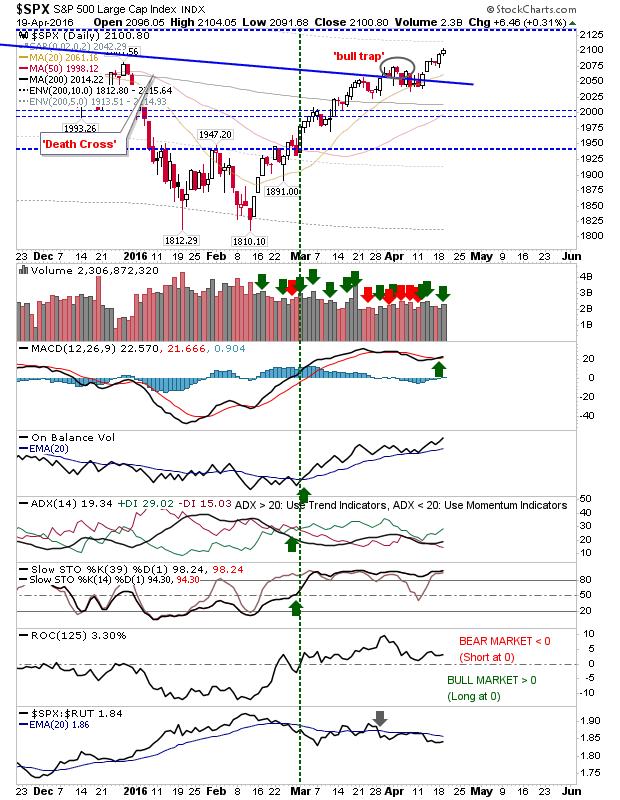

It was a Tale of Two Cities as Large Caps kept bullish momentum running yesterday with higher volume accumulation, while Techs - influenced by Semiconductors - edged lower.

The S&P 500 maintained bullish technicals as it added a few points to yesterday's gain. A push to challenge 2,140 looks well on the cards.

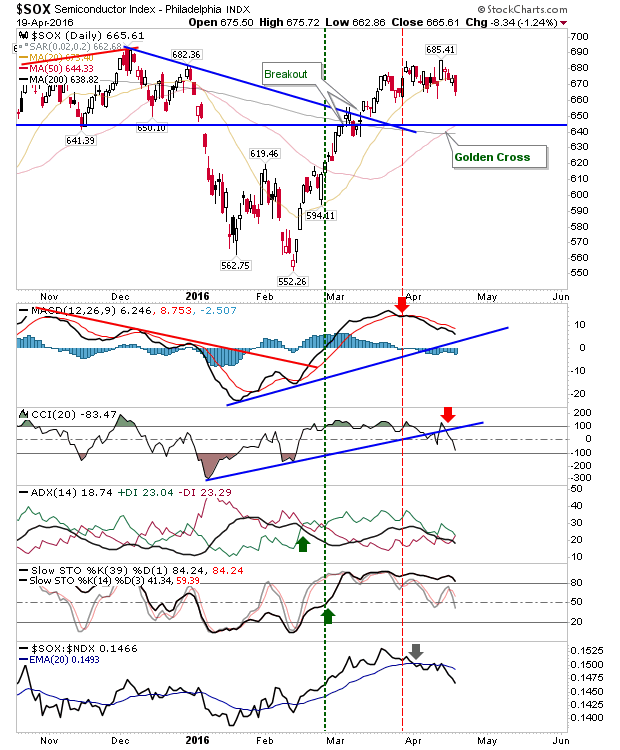

What could hold things back are the Tech indices. The Semiconductor Index had a weak day with over a 1% loss. Relative performance continues to fall off sharply.

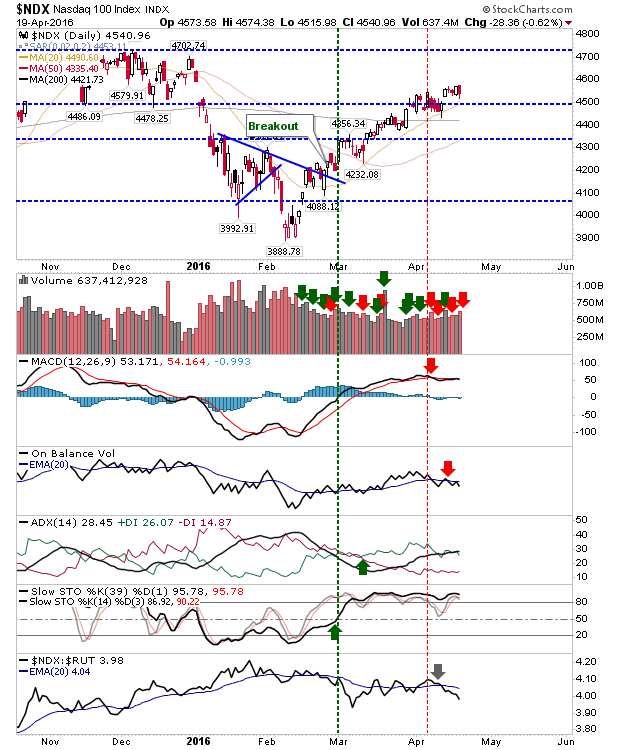

The NASDAQ indices are suffering as a result. There is still a risk for further losses, but they could still go on to surprise. While these are weak, tech indices will struggle for traction. Because of weakness in Semiconductors, the NASDAQ and NASDAQ 100 suffered relative distribution, but the indices are caught in a no-man's land.

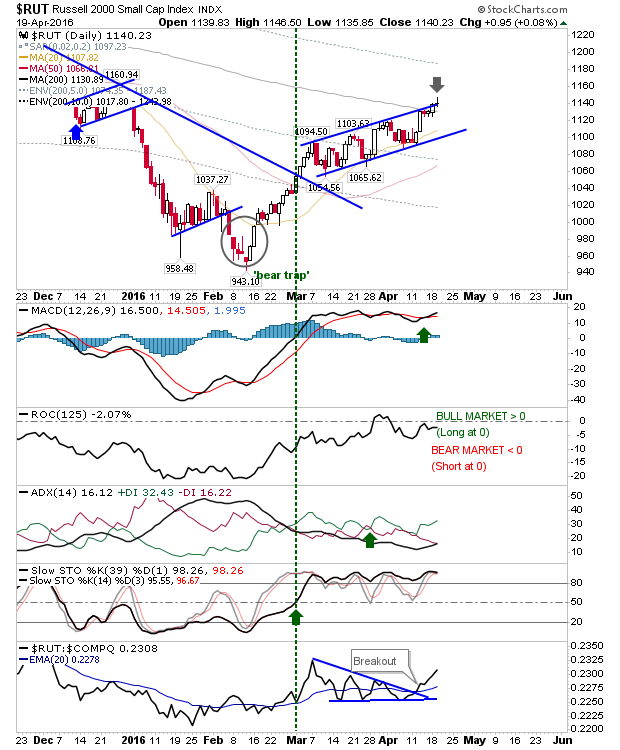

The Russell 2000 is caught in the middle with its reversal doji at channel resistance. The best that could come out of this is that this frustration turns itself into a general loss.