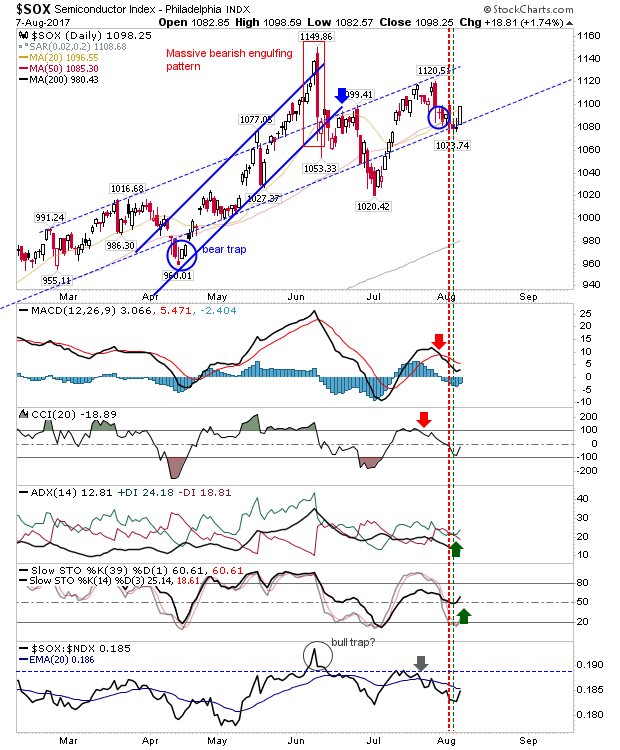

Indices experienced varying degrees of buying Monday, most of it relatively small. Biggest winner was the Semiconductor Index as it rallied from converged channel, 20-day, and 50-day MA support. This was accompanied by bullish upticks for both ADX and Stochastics.

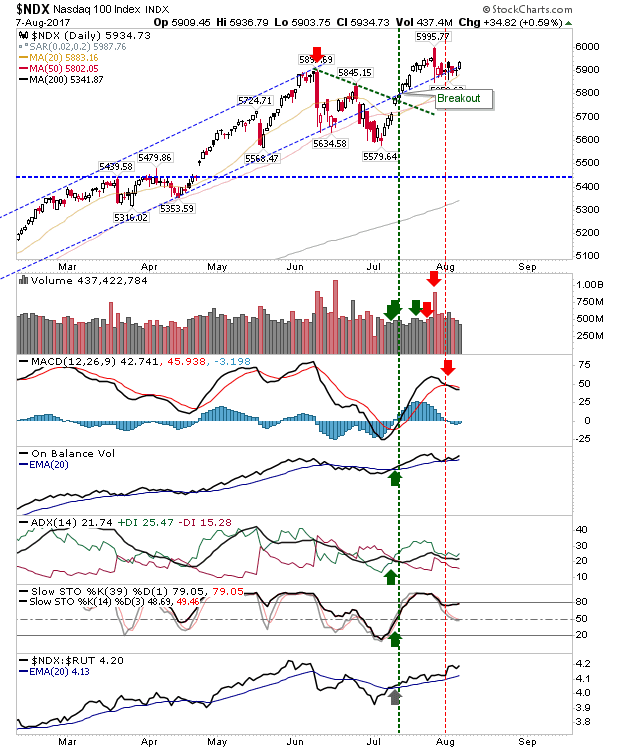

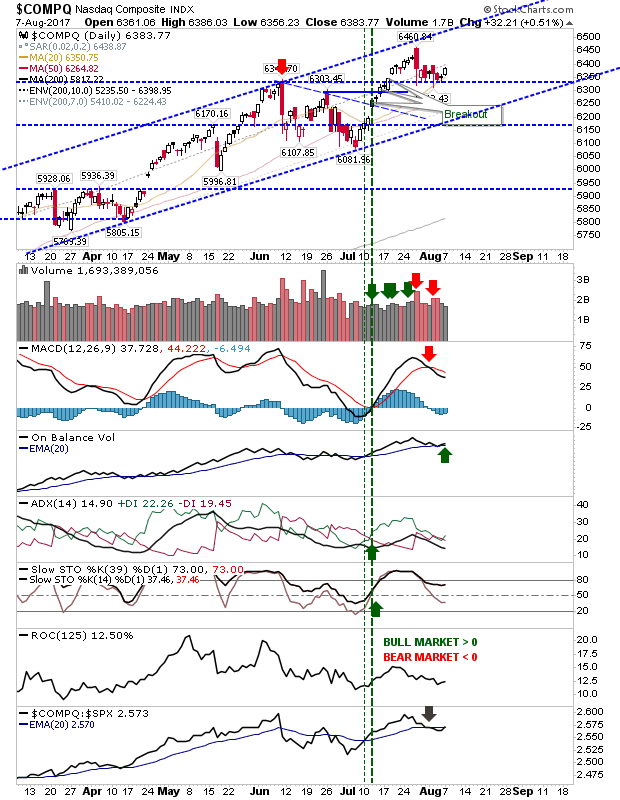

Beneficiaries of this were the NASDAQ and NASDAQ 100. While neither index was able to make a move above 1%, they both managed to defend support levels. The NASDAQ 100 held the earlier support channel with just MACD negative but improving.

While the NASDAQ defended 6,350 for an eighth day in a row, there was even a relative gain improvement against Large Cap stocks (i.e. S&P).

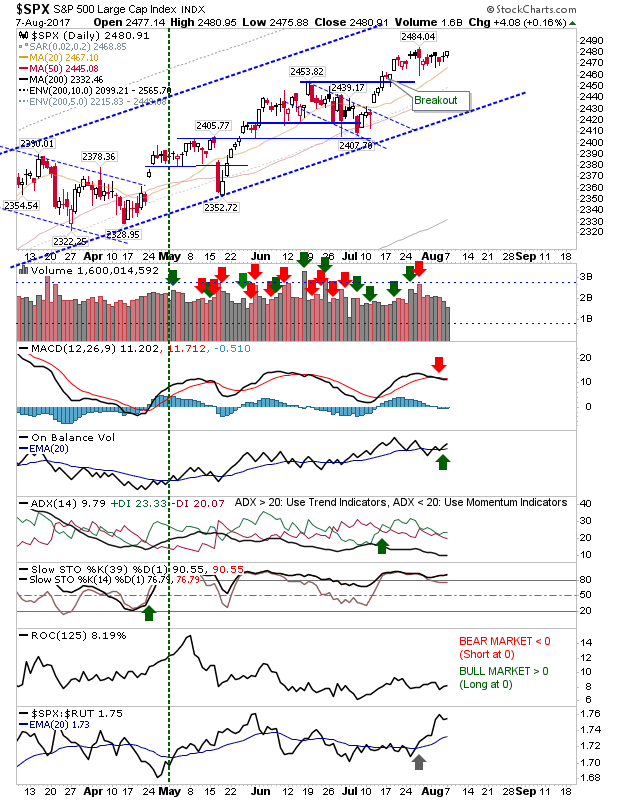

The S&P had a low key day: small gains and light volume kept attention away from this index. However, it's nicely primed to make another step higher and Tuesday could be the day it happens.

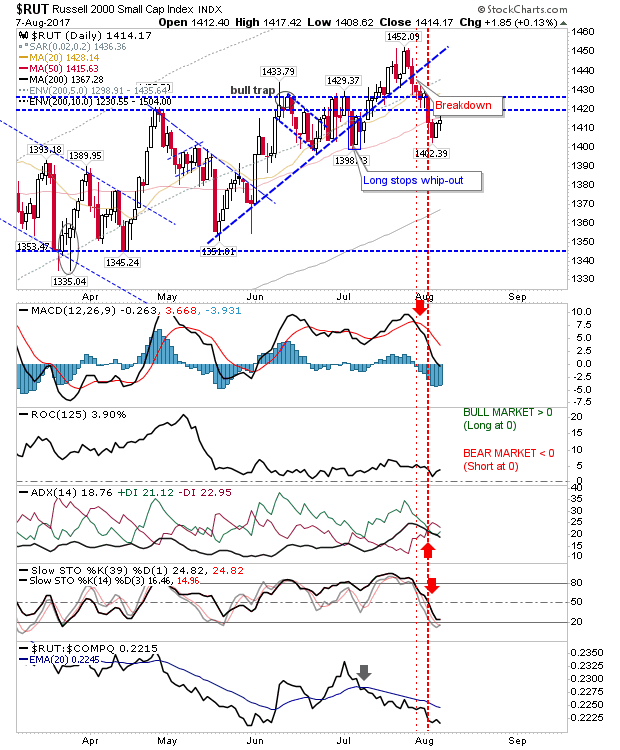

Finally, Small Caps rallied up to the 50-day MA but no further. Shorts may take a look with a stop above the 50-day MA.

For Tuesday, watch for a breakout in the S&P and further gains in the NASDAQ and NASDAQ 100. Any weakness will likely be felt in the Russell 2000. Watch pre-market for leads.