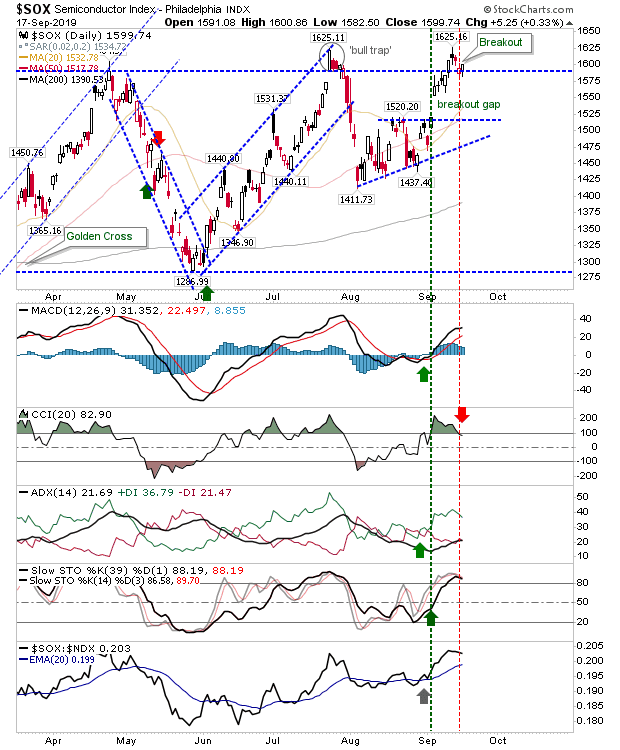

Another good day for Semiconductors yesterday, after the attack on the 'bull trap' found support at breakout support. This will help the NASDAQ and NASDAQ 100. There was a 'sell' trigger in the CCI, but other technicals are bullish and relative performance is very strong. This is also bullish for the economy.

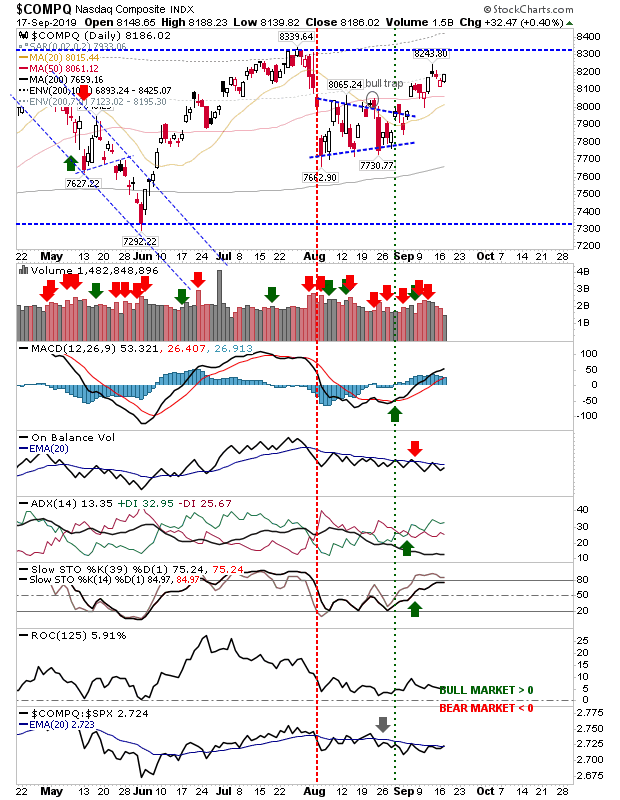

The NASDAQ made small gains but it hasn't yet reached channel resistance, and until it does it won't be able to attract sideline money waiting for the all-time high announcement. But for those watching semiconductors, the chance of this happening is quite high.

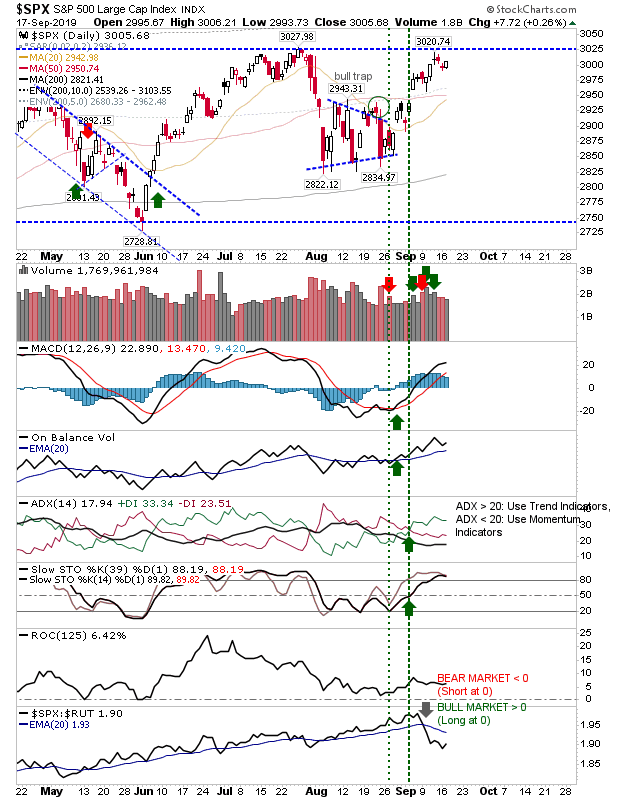

The S&P is closer to the breakout but buying volume was light. Technicals are, however, healthy—and favor a breakout.

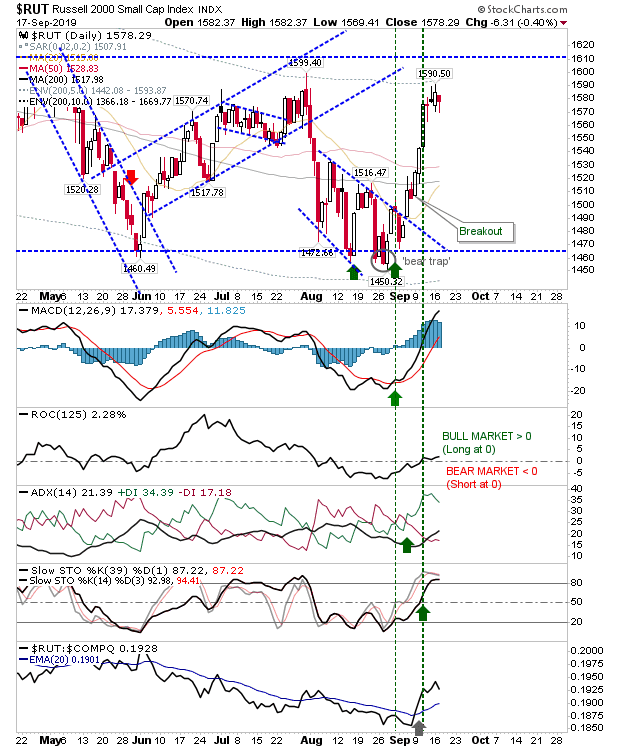

The Russell 2000 is consolidating near its high after a powerful bounce from support. Like the NASDAQ it hasn't yet reached the breakout zone but since the surge it has made a marked improvement in relative performance (vs the NASDAQ).

For today, markets are building towards a significant breakout to end the near 2-year consolidation. It's significance will likely be ignored in the face of oil price coverage, but there is a key moment in the making.