Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

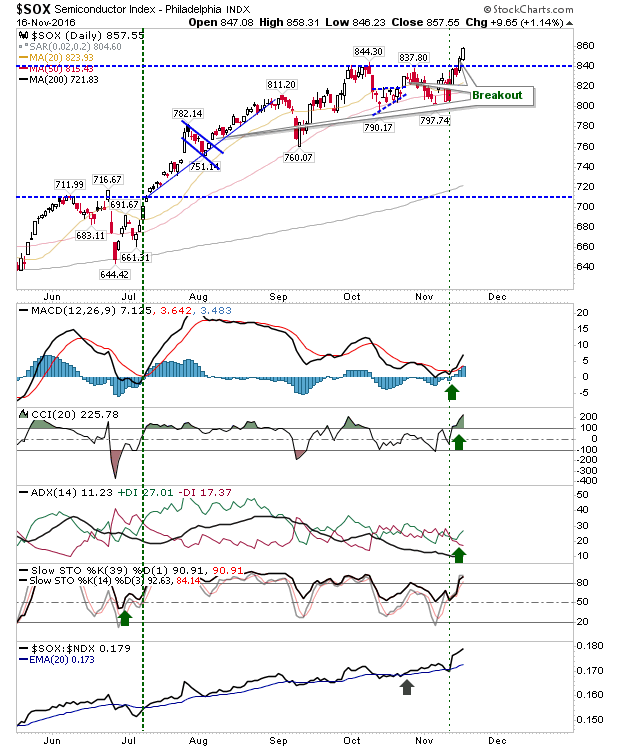

While Trump's election provided the catalyst to stimulate frenzied buying, it has been Semiconductors which have done most of the hard work.

Thursday's gain provided a cushion to the consolidation built up since September. Since the election result the buying in the markets has looked panicked, but action in this index looks very controlled. This is good news for Semiconductor stocks, but it should be good news for the NASDAQ and NASDAQ 100.

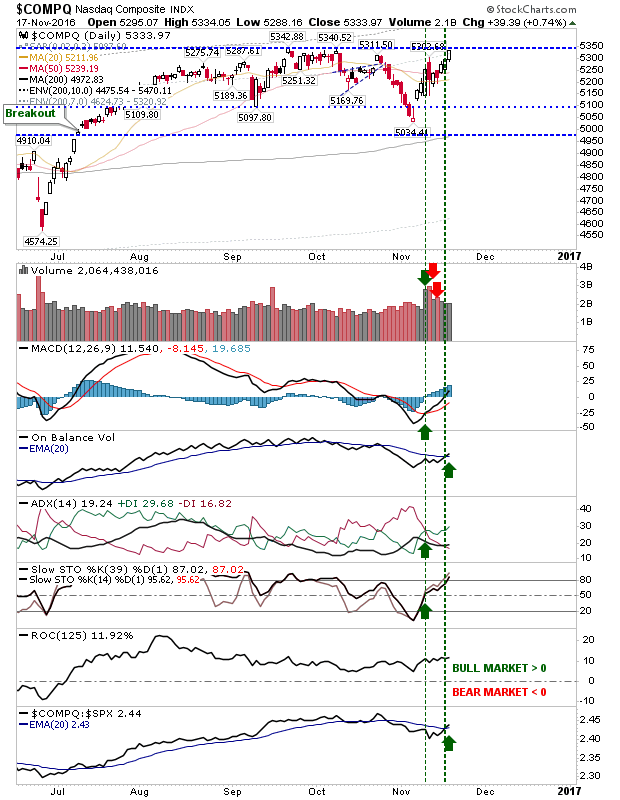

Of the NASDAQ, it's approaching resistance from September. Action in the Semiconductor Index, along with net bullish technicals, suggests further gains could be on the table.

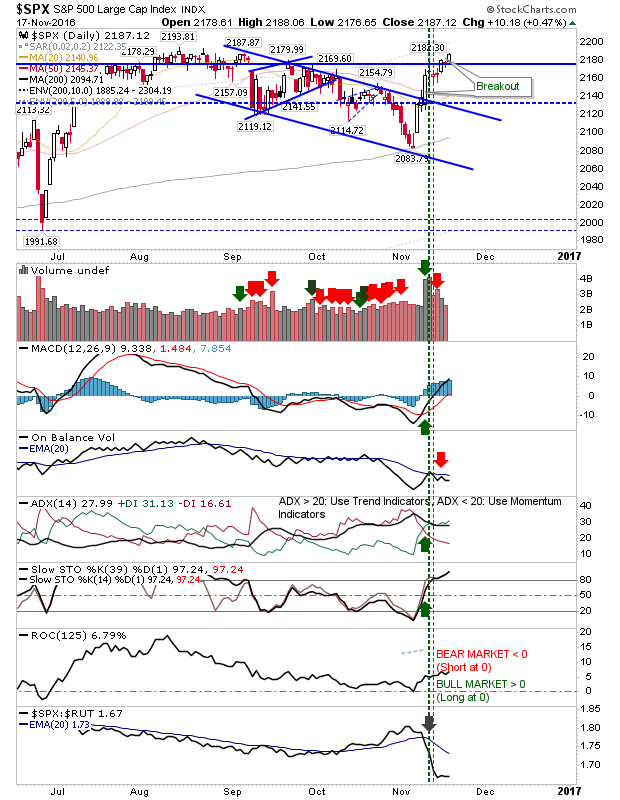

The S&P poked its head above the September swing high associated with the downward channel, but it hasn't yet fully cleared market congestion from August.

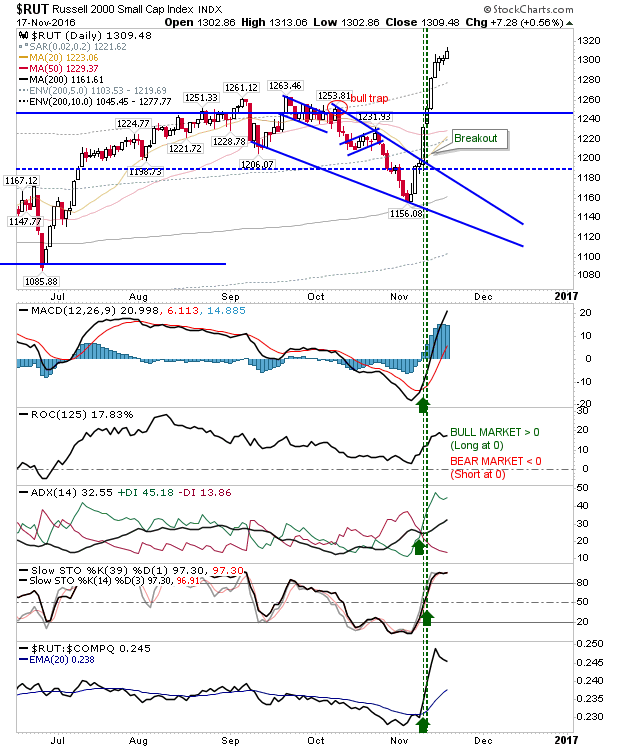

Meanwhile, the Russell 2000 has been tearing away from 1,263 resistance. It has moved from 1,150s to 1,300s in a very short space of time. Some consolidation has to be on the table soon, so those looking to buy would probably be best to wait.

There wasn't a whole lot of action on Thursday – given what's happened since election day – but who knows what Friday will bring. Some easing feels inevitable, but if it can hold near recent highs it could set things up for a very positive end-of-year 'Santa' rally.