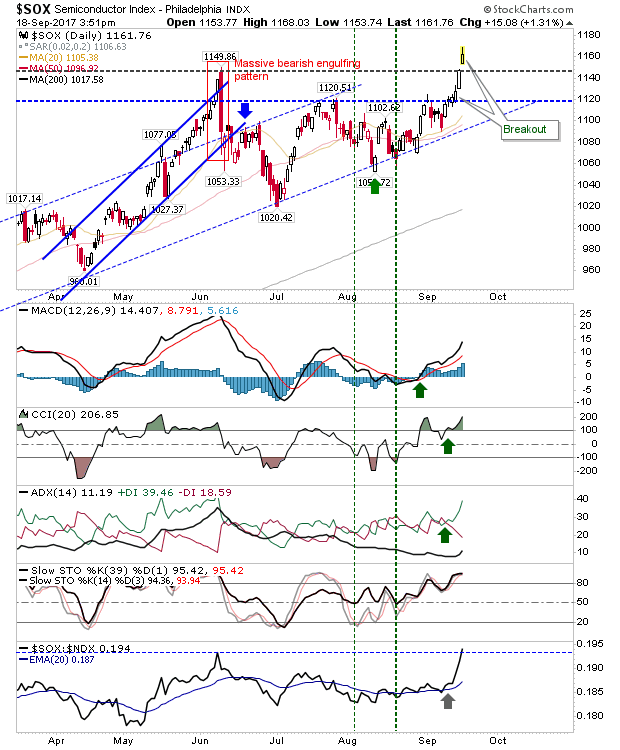

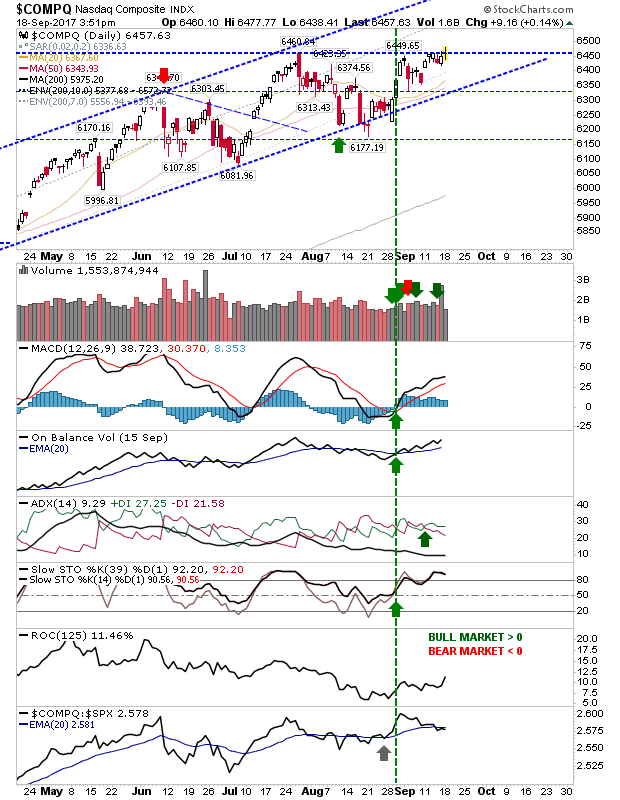

It was somewhat disappointing not to see the Nasdaq and Nasdaq 100 make the break from resistance. However, the Semiconductor Index did manage a breakout of 1,150. There was some weakness into the close but the fact the bearish engulfing pattern has been negated means the bearish overhang created by this pattern has been consumed.

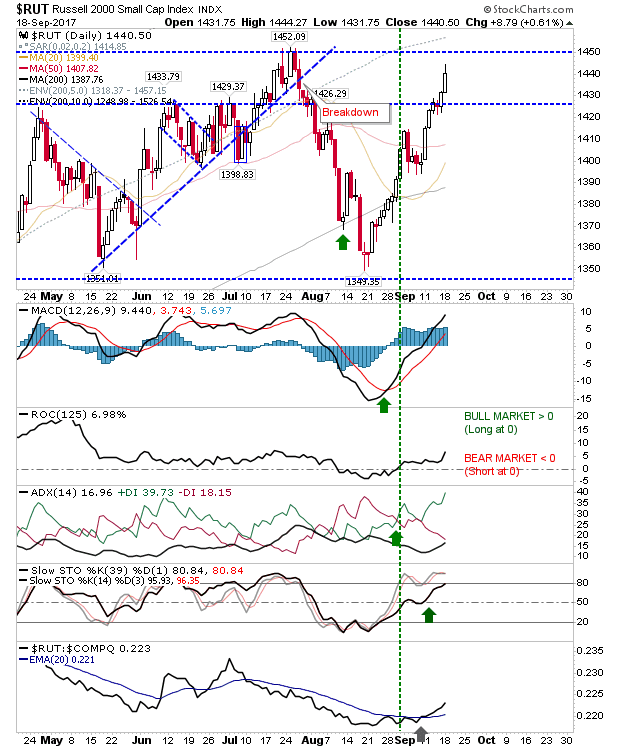

The Russell 2000 made respectable gains as it works toward July highs. I would expect a reversal off 1,450 resistance but if such losses can hold above 1,430, then it will set up a bullish handle for the next swing higher.

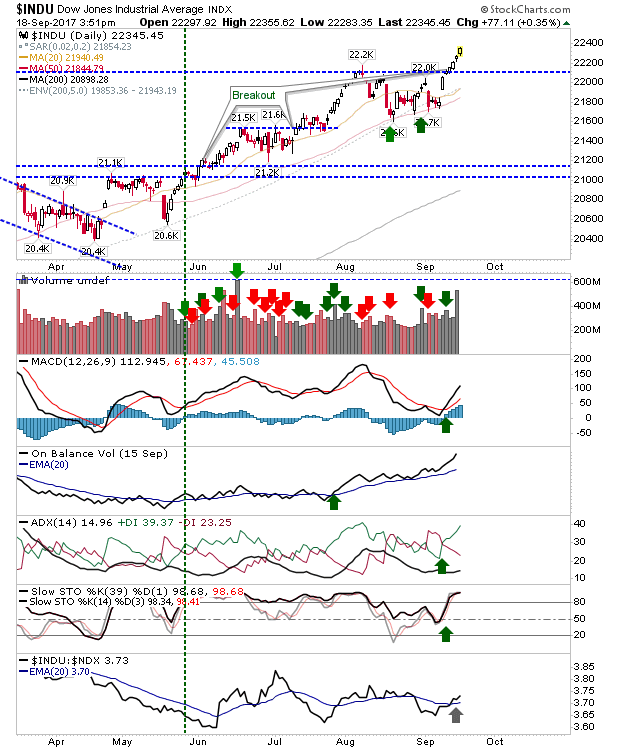

Large Caps had the best of today's action, benefitting from cleared resistance with no overhead supply it was essentially 'free' gains for longs.

While Tech indices remain primed for a move higher.

For Tuesday, keep an eye on the Nasdaq and Nasdaq 100. Small-cap traders should perhaps look to take some profits on a hit of 1,450. Large-cap traders have no real reason to sell yet.