Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

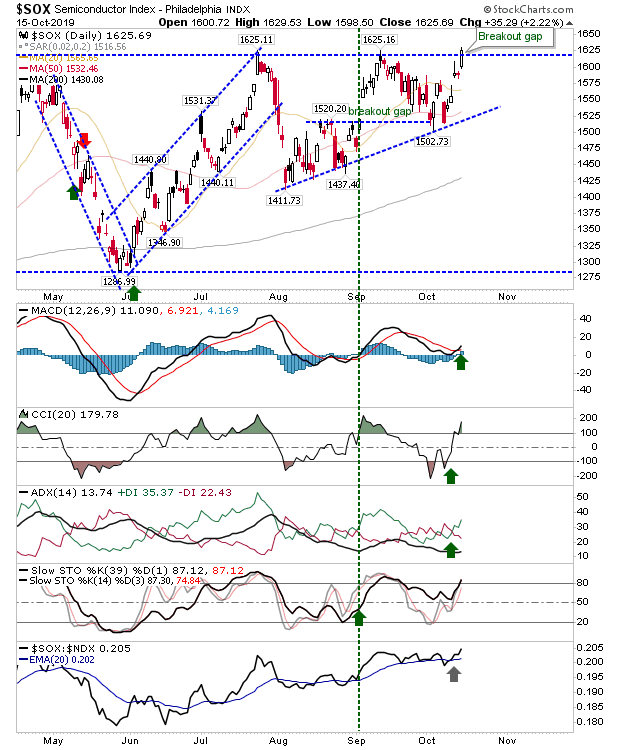

There is a potential lead-ut for other indices with the Semiconductor Index breaking resistance yesterday. This will help the NASDAQ and NASDAQ 100 mount a challenge of resistance.

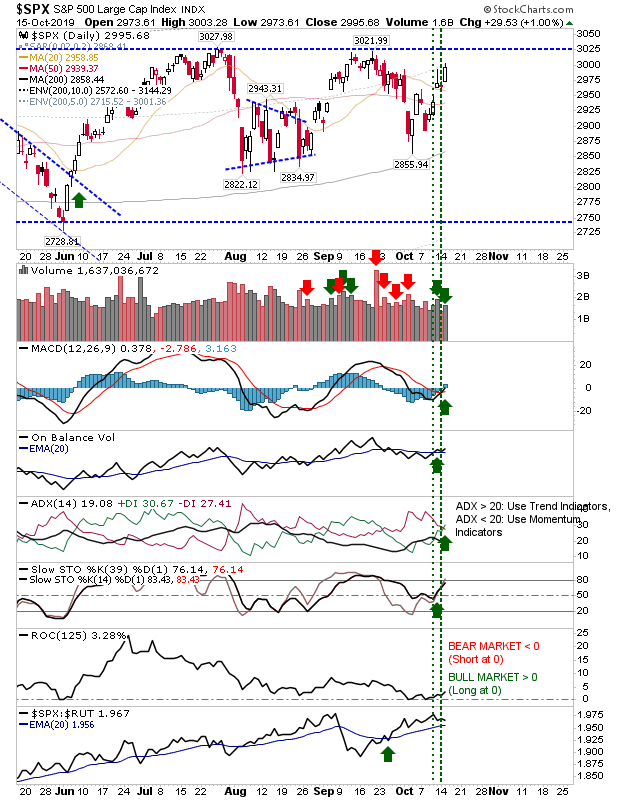

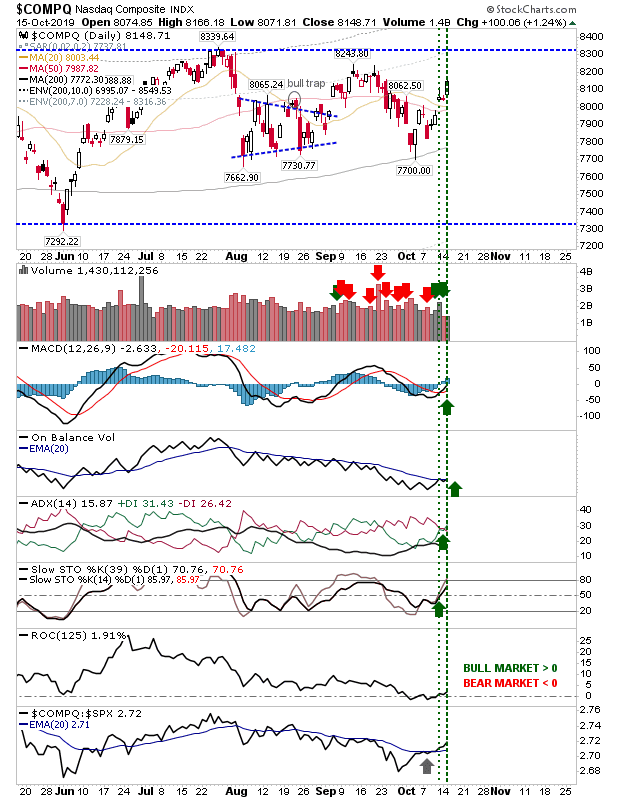

Large Caps enjoyed higher volume accumulation as money flowed into defensive stocks. With the exception of the Semiconductor Index, other indices are still range bound so again, the importance of up or down days won't become apparent until the trading ranges are breached.

We will start with the Semiconductor Index. The index has breached 1,625 with a return to net bullish technicals.

While still range bound, the S&P is enjoying a relative performance advantage against the Russell. Yesterday's buying registered as an accumulation day even if the index is still at least a week away from challenging resistance.

The NASDAQ, while not enjoying a bullish accumulation day, did do enough yesterday to see an On-Balance-Volume 'buy' trigger which left technicals net positive. Relative performance improved and with the breakout in the Semiconductor Index the opportunity for further gains in this index increased and should be watched.

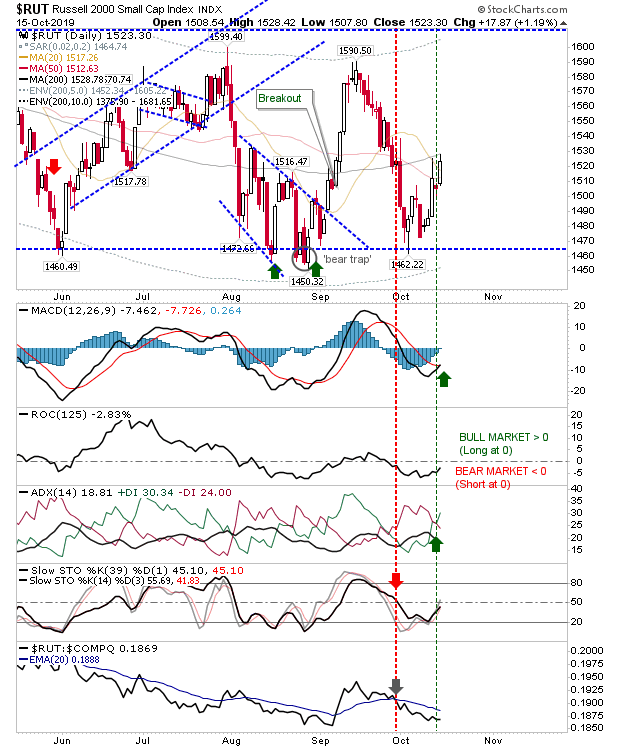

The Russell 2000 delivered a MACD trigger 'buy' but still has to get past its 200-day MA. The gain was enough to put some distance from support, but vulnerabilities remain. Technicals are a mix of bullish and bearish, but bears probably still have an edge.

For today, bulls should pay attention to the NASDAQ, assuming the Seminconductor Index holds its breakout. Shorts have the Russell 2000 to work with, placing stops above the 200-day MA.