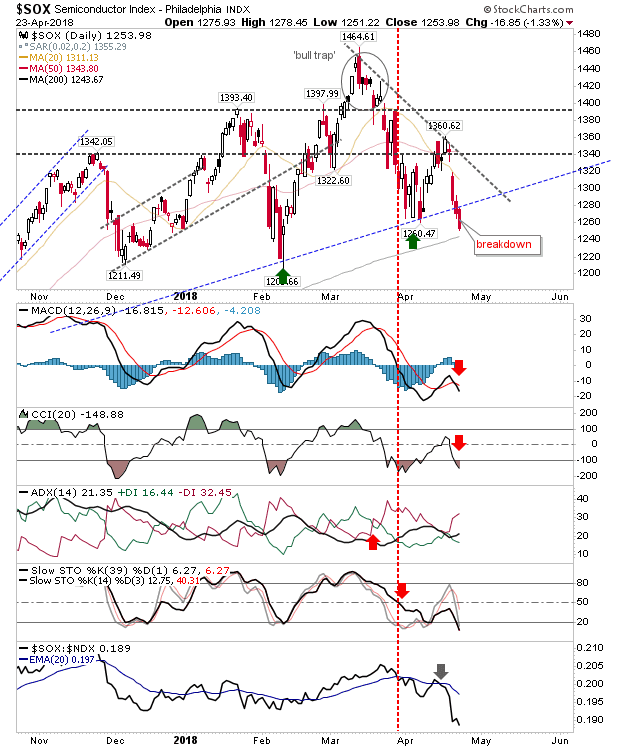

Modest losses yesterday with most indices holding the status quo from Friday. The one exception was the Semiconductor Index as it lost over 1% in a confirmed break of support. However, it does have the 200-day MA for a likely test today. All technicals are negative and relative performance took another step lower but no change there.

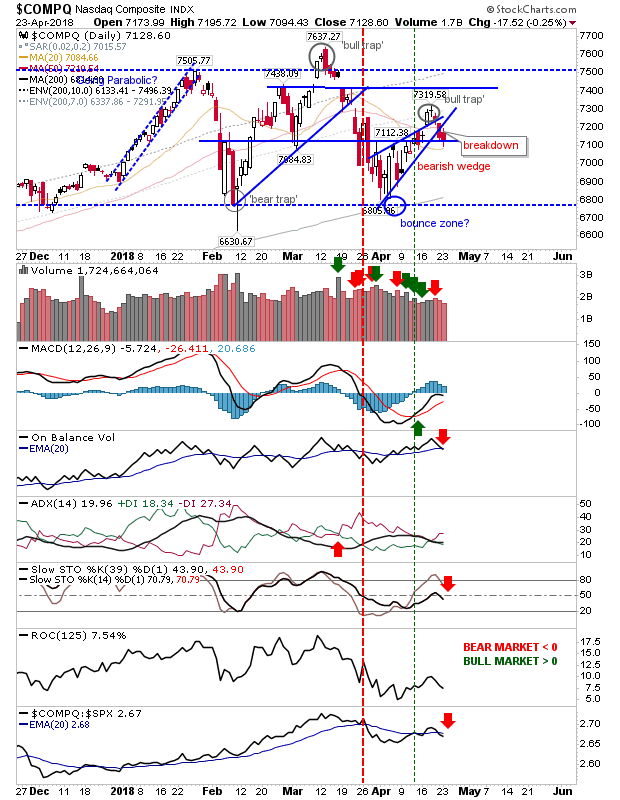

The NASDAQ broke bearish wedge support but is resting on a minor support level. Yesterday saw a new On-Balance-Volume 'sell' trigger but the 6,800/7,500 trading range is more important than any technical measure at this time; at the moment, the index looks ready to test 6,800 support.

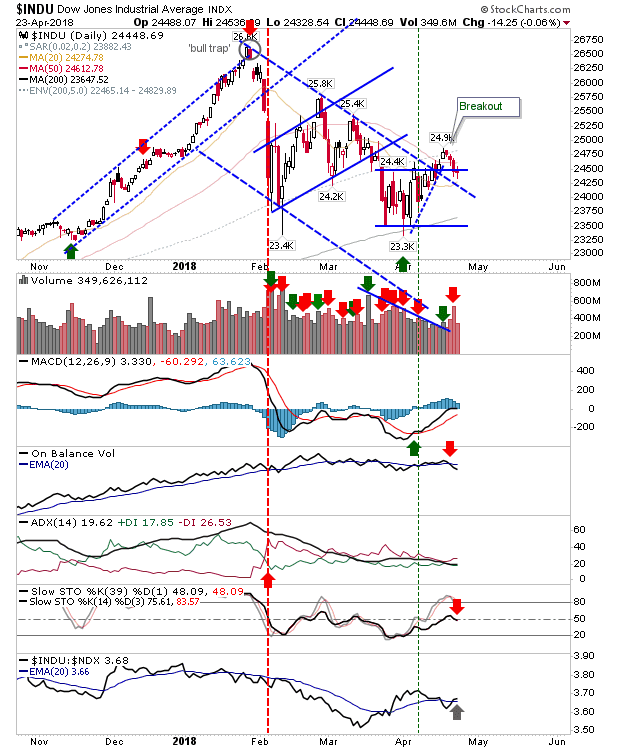

The Dow Jones is still holding its breakout in a hat-tip to longs - one of the few bullish setups at the moment.

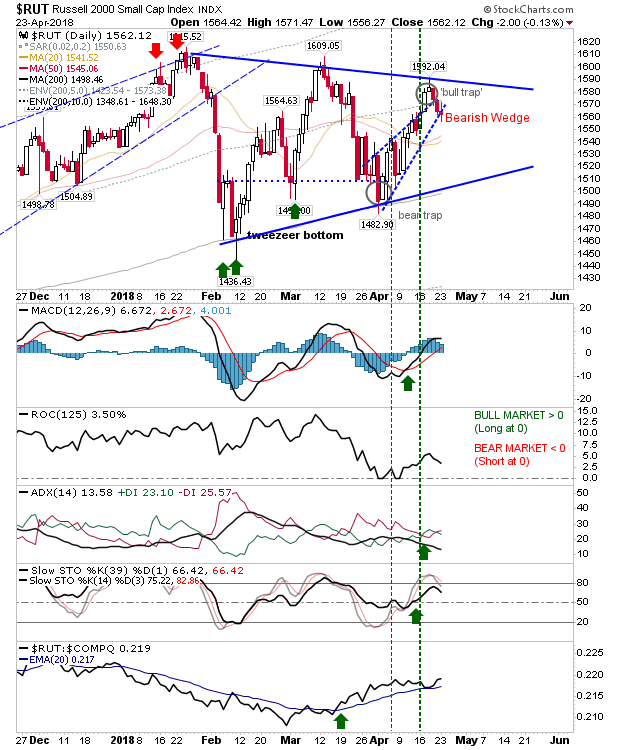

The Russell 2000 is resting on a bearish wedge support. If it follows action of the NASDAQ there should be a similar breakdown and a move down to (triangle) support.

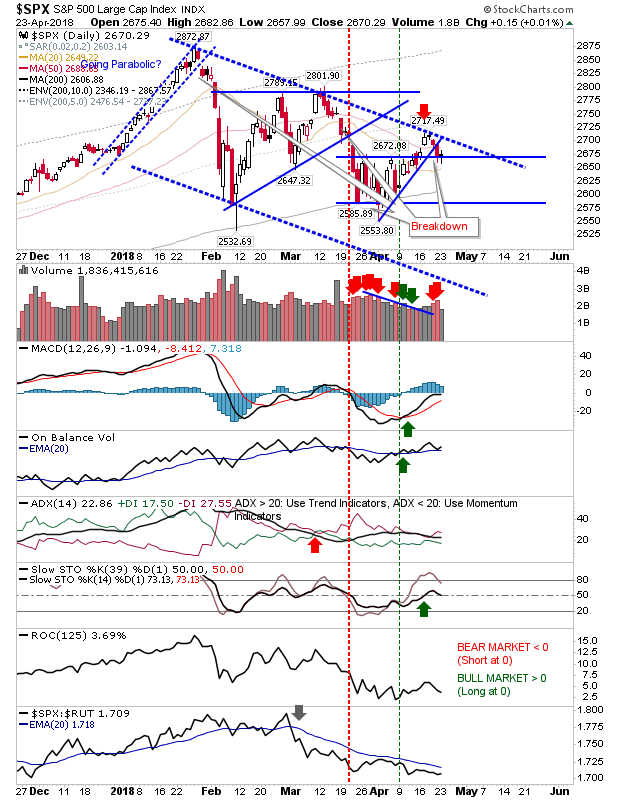

The S&P may be the sleeper long play. It's trading inside its downward channel following a break of internal channel support; however, it's resting on a horizontal support level just below channel resistance. Technicals are more bullish than negative and 20-day and 50-day MAs are also nearby. A strong day today could see a rally up to and past channel resistance in a new breakout.

For today, aggressive longs can look to buy a Semiconductor test of the 200-day MA or the mini-pullback in the Dow Jones. Shorts can look to the wedge breakdown in the NASDAQ. However, the best play may prove to be a buy of the S&P.