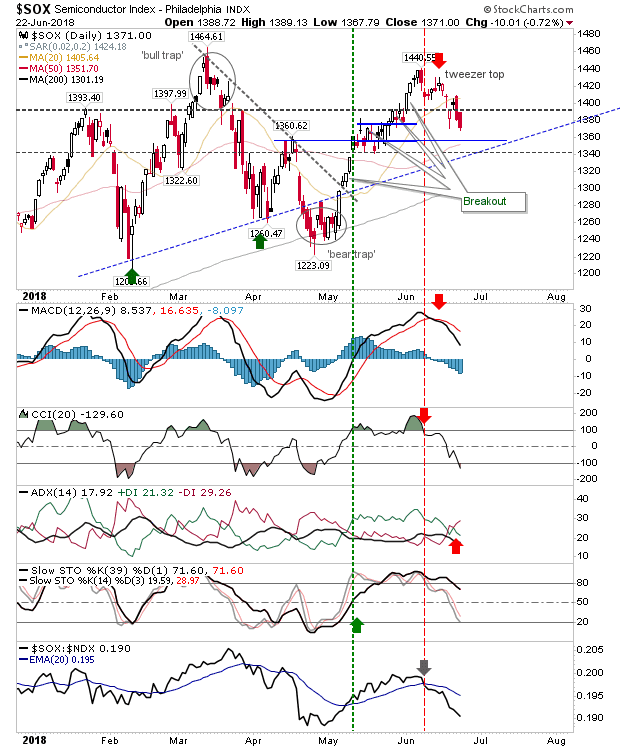

There was no real change on the end-of-week position of markets. The Semiconductor Index was the most active with an undercut close of the week's swing low. Next support level is the 50-day MA.

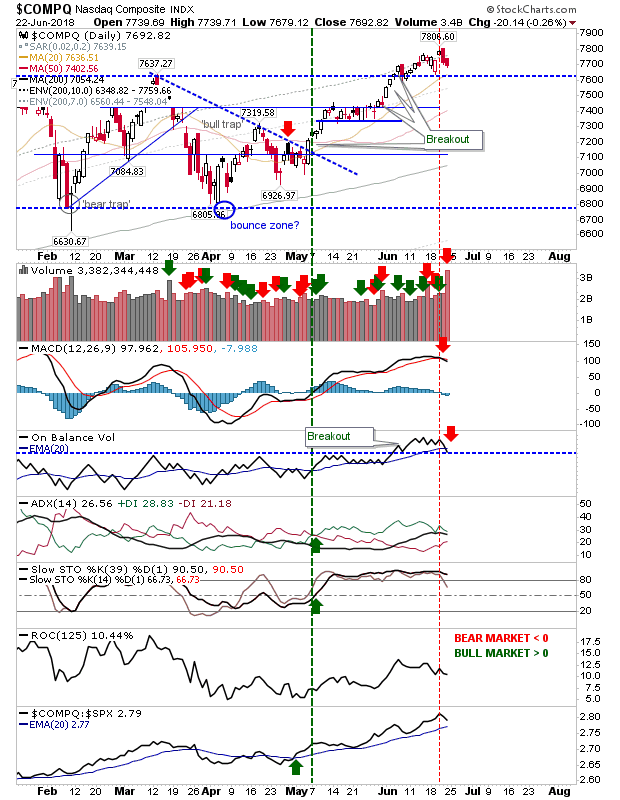

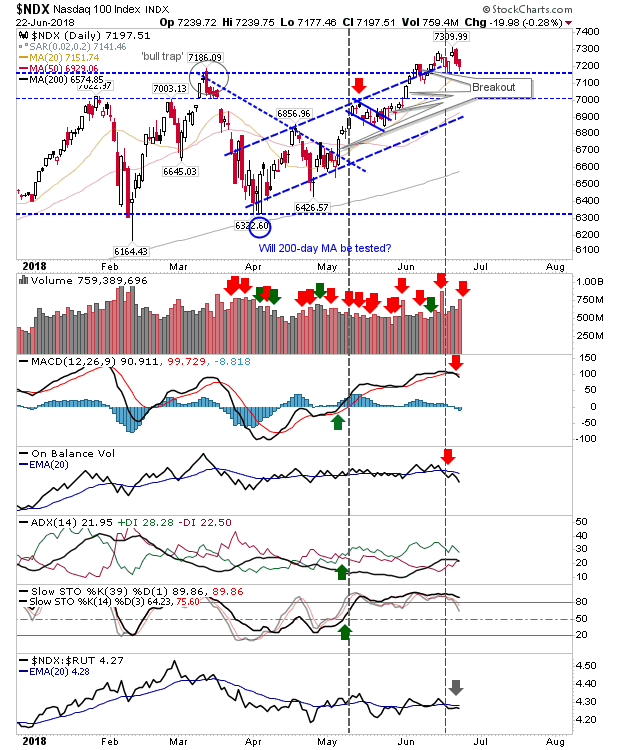

Despite the swing low undercut in the Semiconductor Index there were no breakout reversals for the NASDAQ or NASDAQ 100; indeed, the weakness may be viewed as a buying opportunity with a test of support.

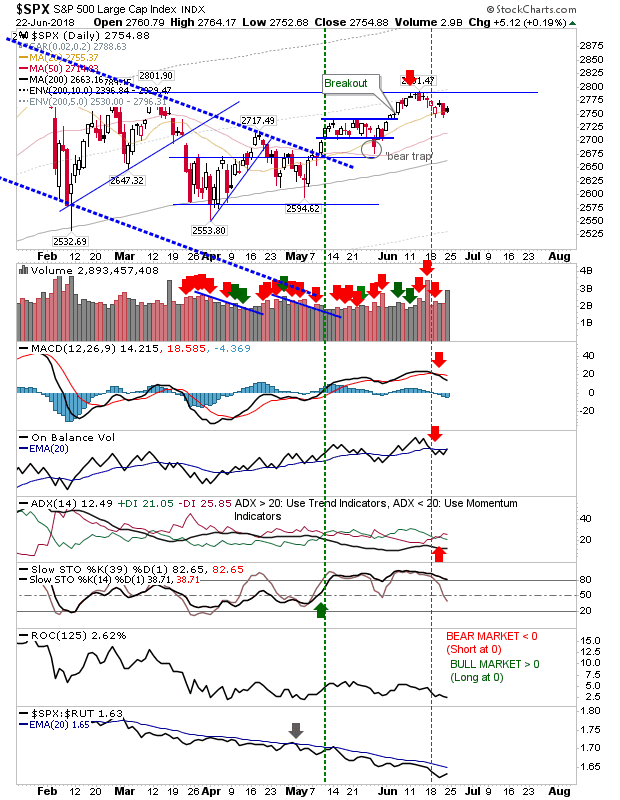

The S&P finished with inside day on the 20-day MA buy given stochastics are in mixed territory this isn't a reversal candlestick. Other technicals are bearish but longs can play for a buy at the 20-day MA.

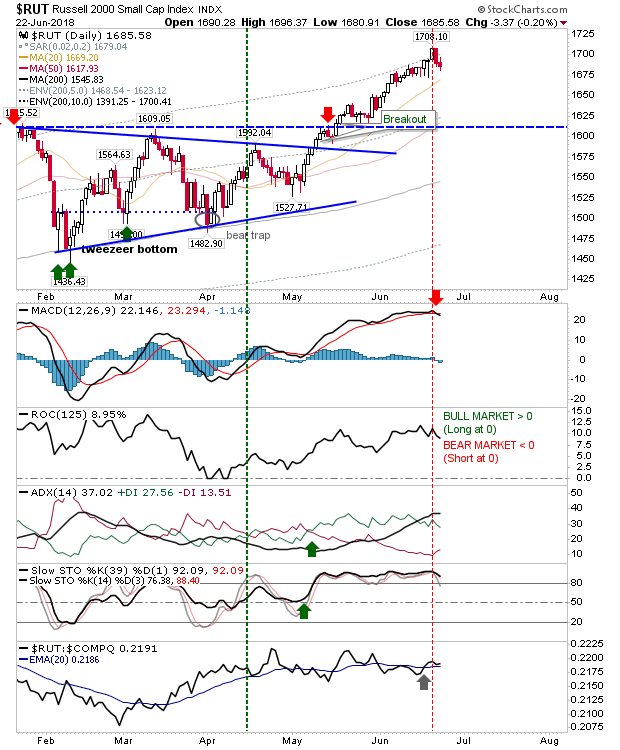

The Russell 2000 is coming off a high and still has room to fall down to nearest support at 20-day MA. Likely more profit taking to come here; aggressive shorts might try something here but it's not an ideal play.

For today, sellers may keep things moving with another round of losses. Watch for 'bull traps' in the NASDAQ and NASDAQ 100 which would be shorting opportunities. However, if buyers can step in at breakout support it might instead offer a long play. Not a whole lot going on in Large and Small Caps.