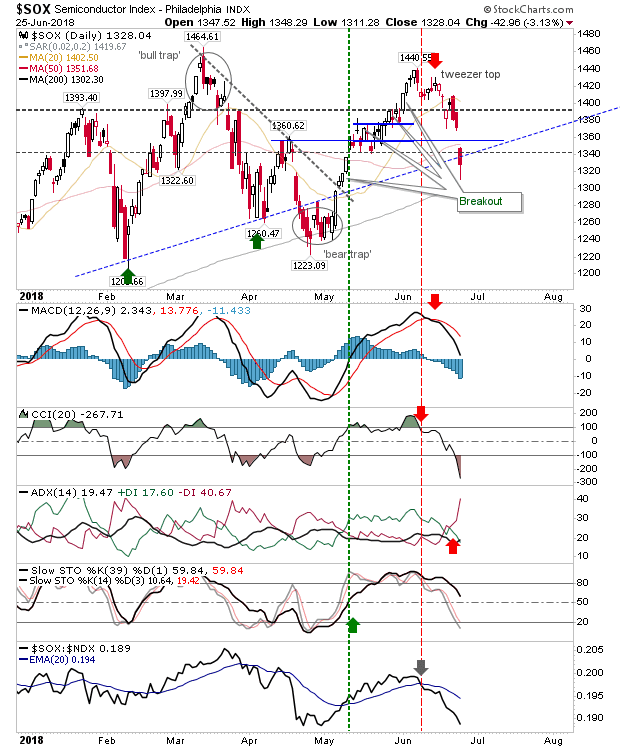

It was a worse than expected day yesterday for Semiconductors as a sizable gap down and run close to the 200-day MA drove the index through many potential support levels. Shorts will be looking to attack the next bounce with a close of yesterday's morning gap, the first short entry opportunity (for those who didn't take the 'tweezer top' short).

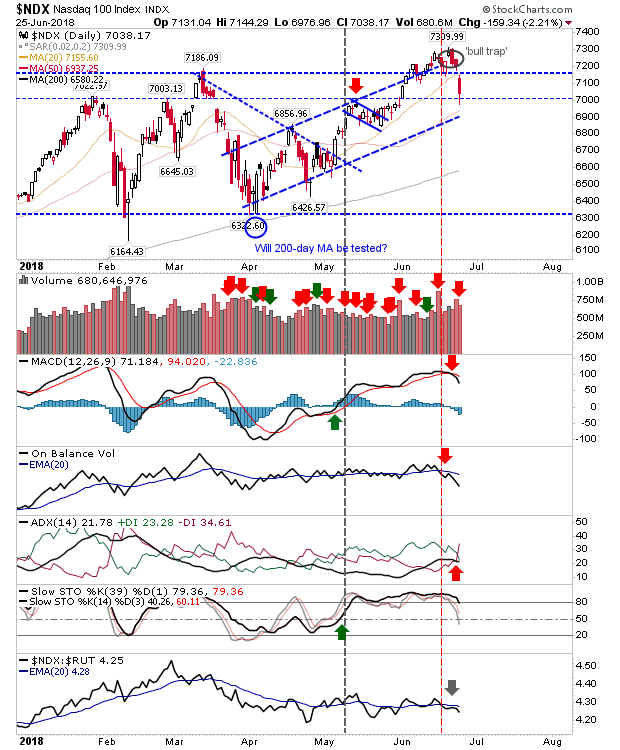

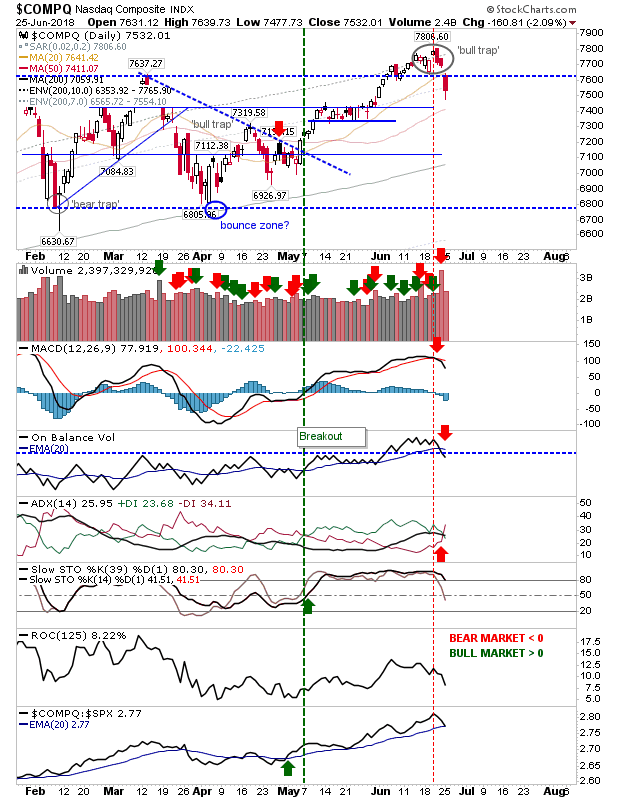

What this also does is it creates 'bull traps' for both the NASDAQ and NASDAQ 100 which are themselves potential shorting opportunities. Those who are looking to short may wish to wait until there is a rally back to resistance marked by the March swing high.

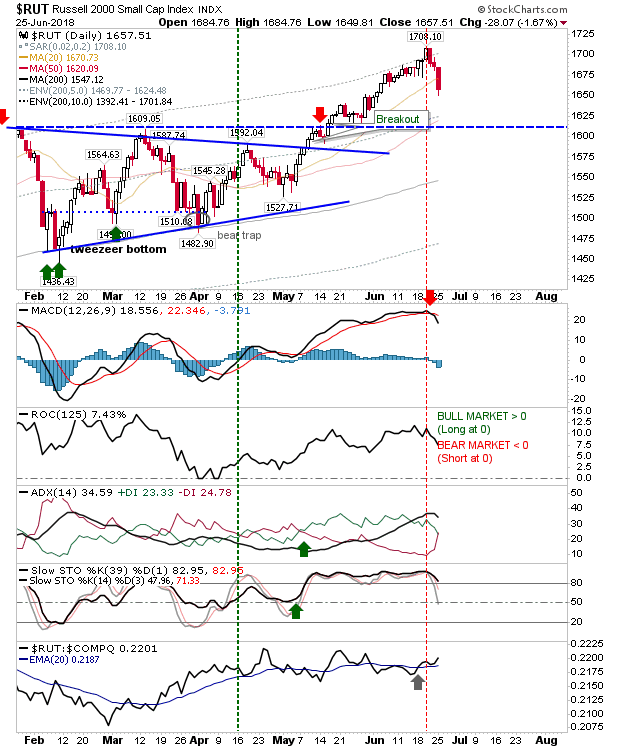

There wasn't much joy for other indices. Losses accelerated for the Russell 2000 as it cut through its 20-day MA. The 50-day MA along with horizontal support is the next port of call; the next bounce will be a chance to take profits if holding long positions.

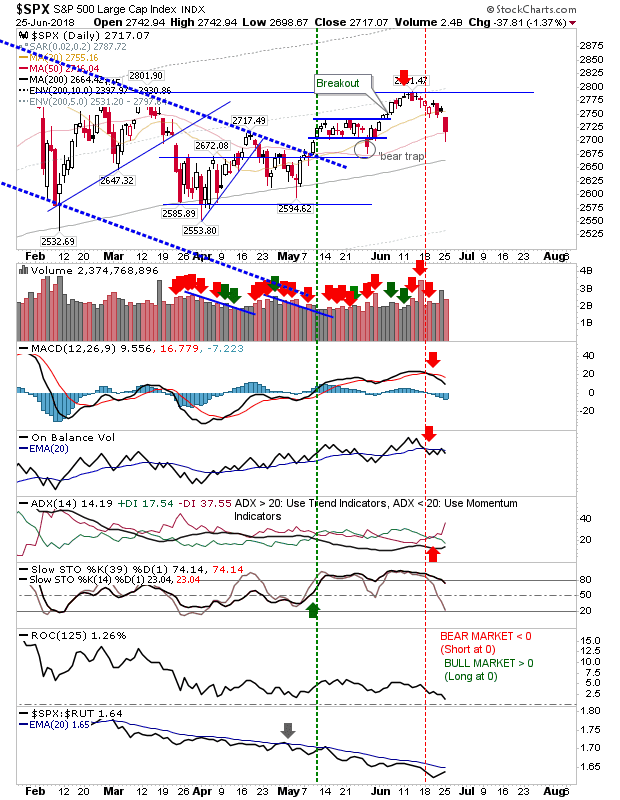

The S&P drifted deeper inside its consolidation which makes any potential trade more difficult to call. There may be a bounce at the 200-day MA but there is also a chance for an immediate bounce at the 50-day MA given the afternoon recovery to this level.

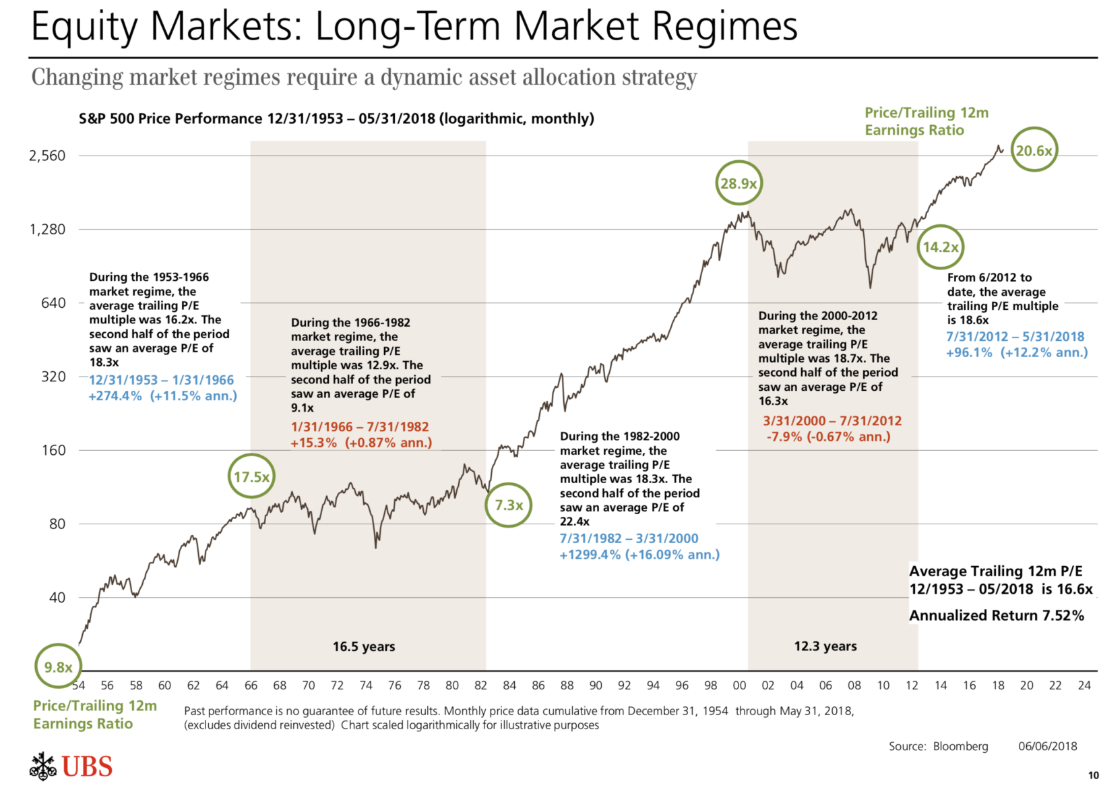

For today, early strength will offer an opportunity for buyers to trade an S&P bounce but it could be a scrappy affair. Similar gains which lead to gap closures for the NASDAQ and NASDAQ 100 will then give shorts something to work with. Those looking beyond the next few days can take confidence in this chart, source Bloomberg, provided by Barry Ritholtz.