Yesterday's action was more decisive towards bears, with volume rising in confirmed distribution.

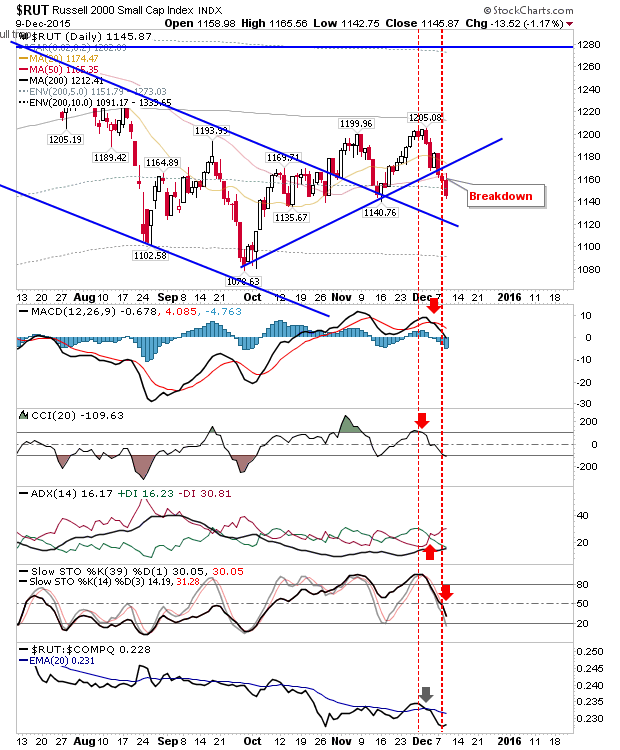

The Russell effectively confirmed the trendline break and is now looking at the 1,140 swing low which marks support of its trading range. Should this be lost, then the next step is a move towards 1,080. Technicals are all aligned in the bears' favour.

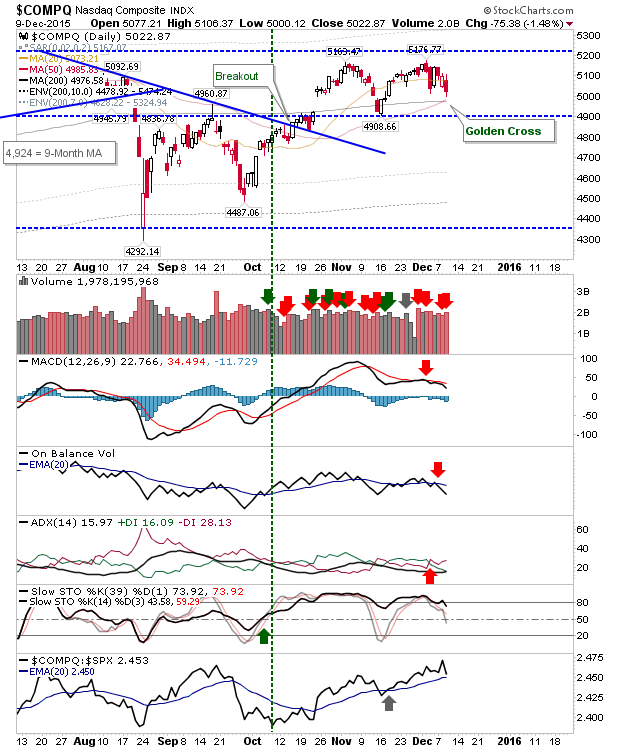

The NASDAQ has to deal with confirmed distribution selling as it comes up against the 'golden cross' of the 50-day and 200-day MA. Near term stochastics are not oversold, so there may be some overshoot through the 'Golden Cross' before buyers emerge. With the index showing good relative performance it would be surprising if buyers didn't show up soon.

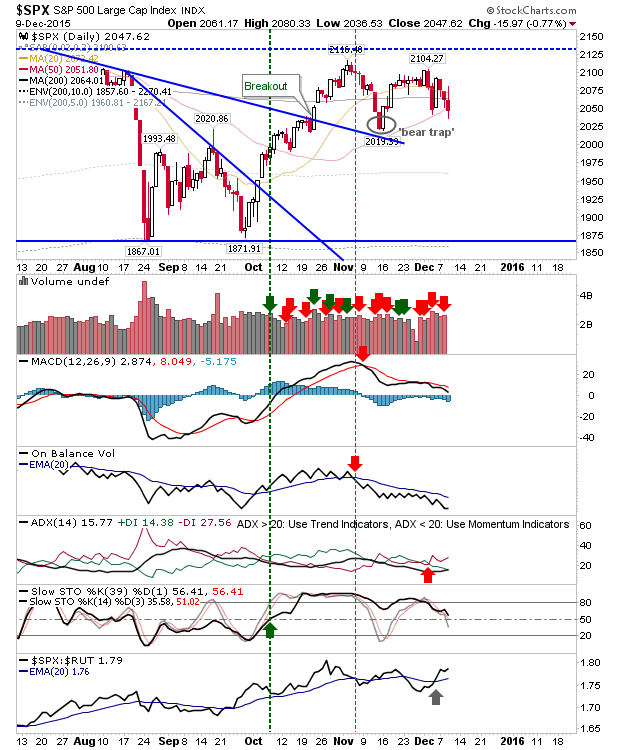

The S&P is more bearish with an undercut of the 50-day MA. The 'bear trap' is next on the challenge list with 2,019 marking support of the trading range. The chief concern for bulls looks to be the steady stream of selling marked by On-Balance-Volume below its 20-day MA.

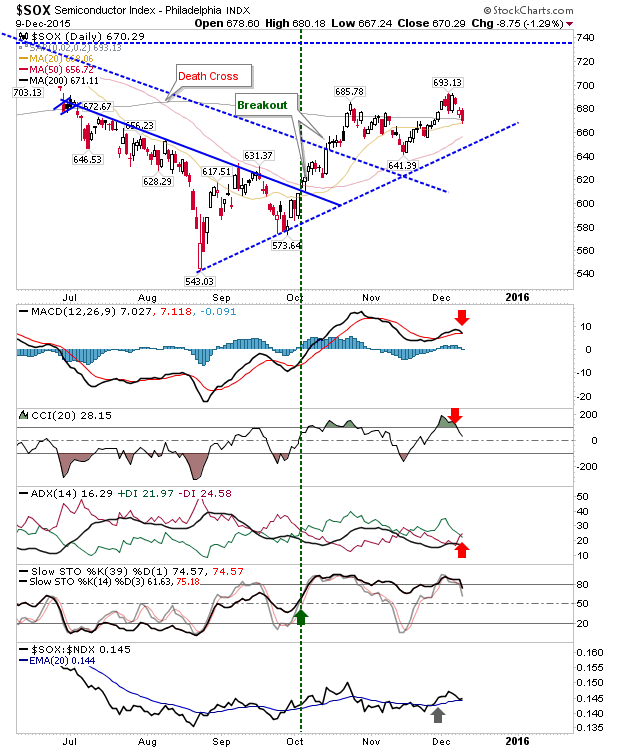

As a final note, the Semiconductor Index is back at its 200-day MA with the 50-day MA close to a 'Golden Cross'. Buyers may find joy here as its outperforming the NASDAQ 100, and ticking higher in the process. The relative performance has been in a base since August - following an extended decline - but looks ready to break higher.

Today could once again be about the bears, but with range support coming into play I would be looking for a late surge if there is early day weakness.