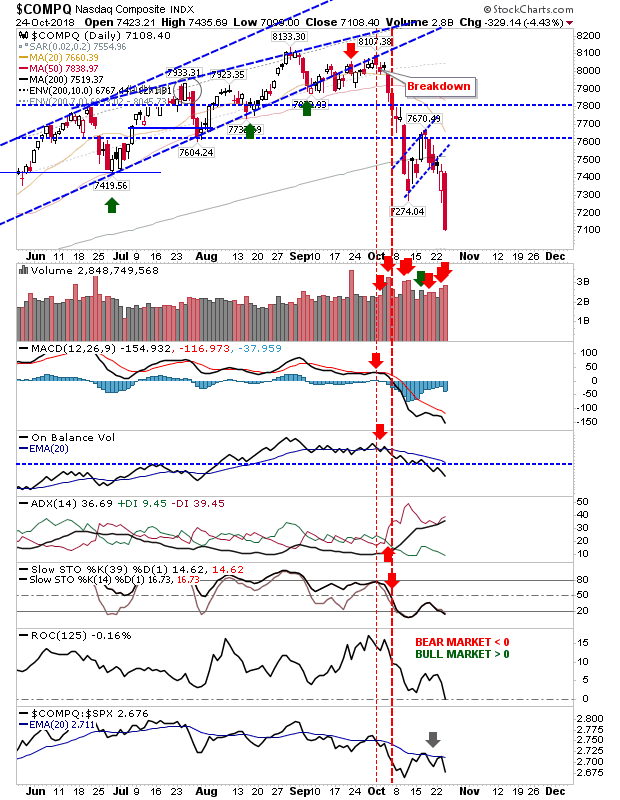

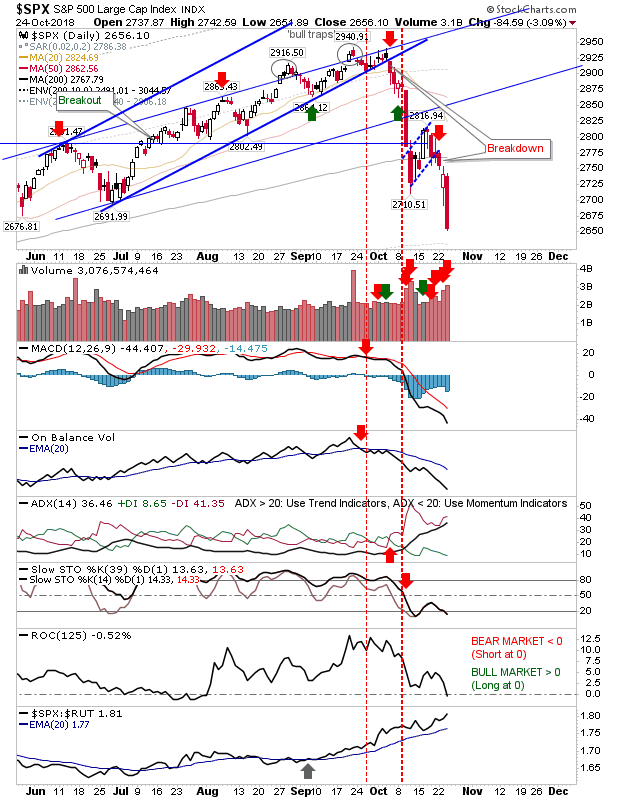

Yesterday it was 2001 all over again, as lead indices registered 3% losses on a day of solid selling and registered distribution. The 'bear flags' are history but their effects are still very much in effect.

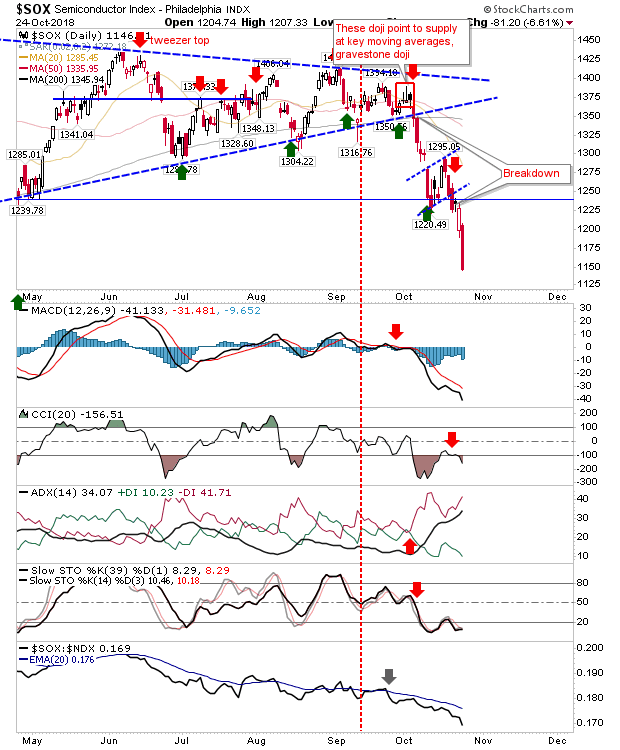

Worst affected was the Semiconductor Index as it gave up nearly 7% in a move which has the makings of a measured move lower. The initial target is 1,115 which doesn't look entirely unreasonable after yesterday. There was nothing bullish as relative performance (vs the NASDAQ 100) accelerated lower.

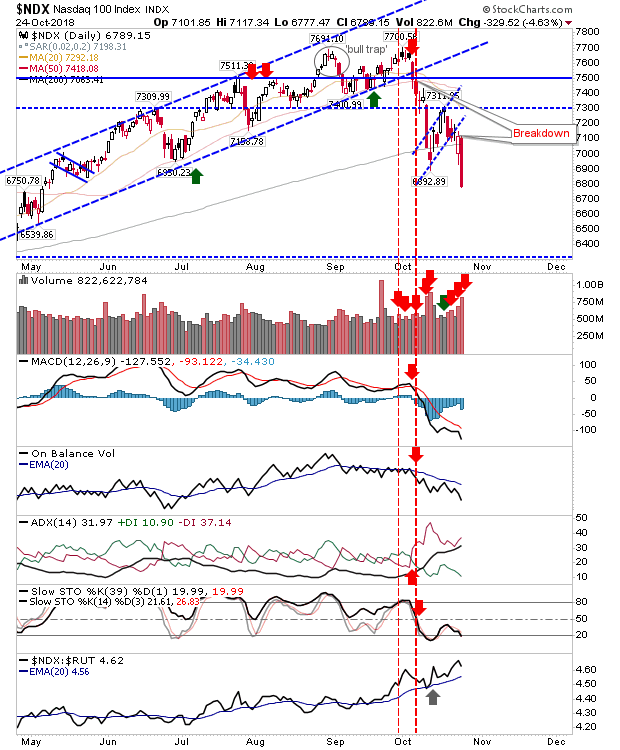

The patient got their rewards from the NASDAQ and NASDAQ 100 as 'bear flags' managed a belated break—but a break nevertheless. The NASDAQ maintained its sustained relative loss against the S&P as the ROC looks to lose the zero line (confirming the bear signal) thereby entering bearish territory. Measured move targets of 6,800 for the NASDAQ and 6,700 for the NASDAQ 100.

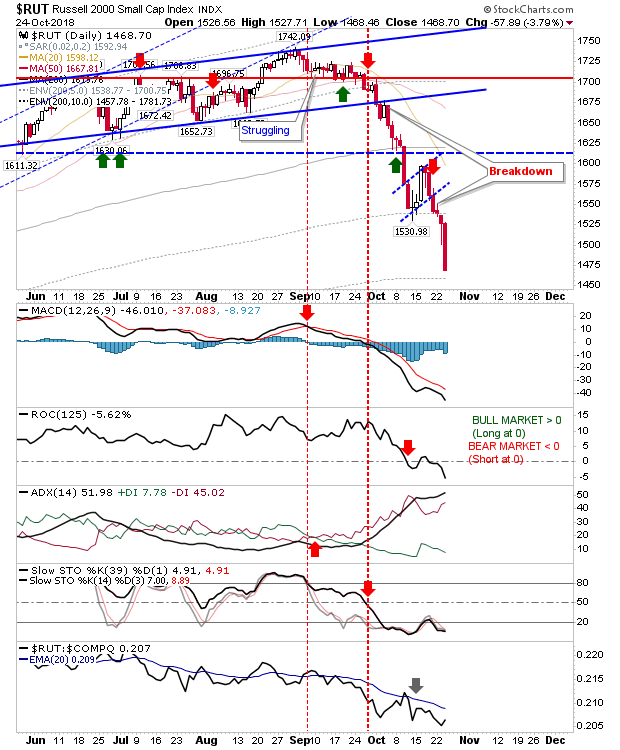

The Russell 2000 remains on course to reach the measured move target of 1,390

The S&P has a measured move target of 2,585 and has a good chance of making it there.

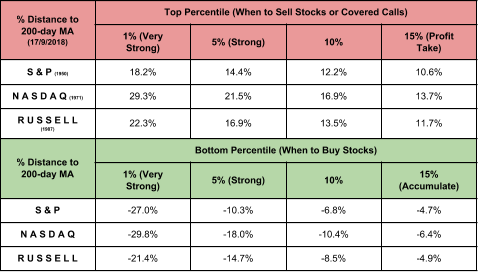

The targets we are now looking for are offered in the table below. Investors can look to buy when the relationship of the indices to their 200-day MAs reach the levels detailed below.

It should be noted, the S&P has entered the 15% zone marked for accumulation and the Russell 2000 is in the 10% zone. The NASDAQ hasn't yet reached the first zone. Such buying opportunities are rare - the last such time coming in 2016.

Investors should feel confident in taking advantage of putting money to work here and to continue to do so should prices fall further. The key thing is not to put all your money to work at this time, but to spread the buying opportunities across a 12 month period to maximize the opportunity weakness offers.