There was another sweep lower yesterday, as indices returned to, or swept aside, moving average support.

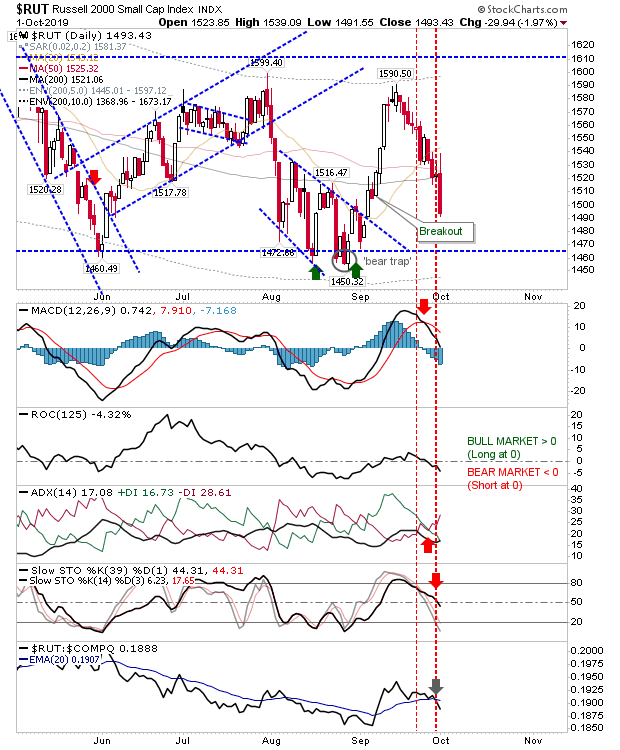

Hardest hit was the Russell 2000 as it undercut both its 50-day and 200-day MAs. The index is charging towards 1,465 support with little in the way of technical support to lean on. Stochastics are at the mid-line which is historically a bounce level for stocks in bullish markets, but it would seem unlikely this will happen here.

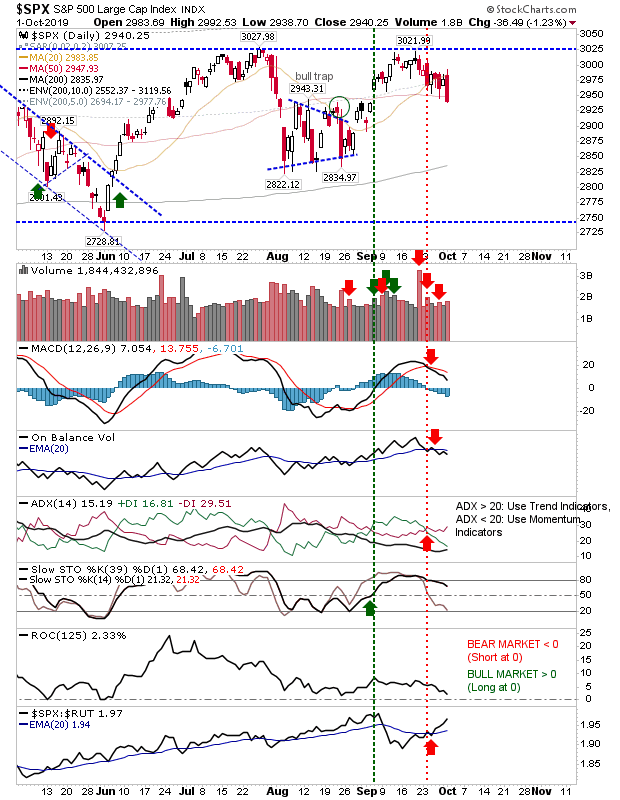

The S&P came back to its 50-day MA which may be support today, but there isn't much in the way of wiggle room for buyers to defend this support. Volume rose in confirmed distribution to add to its troubles but on the flip side it did accelerate its relative performance to its peers.

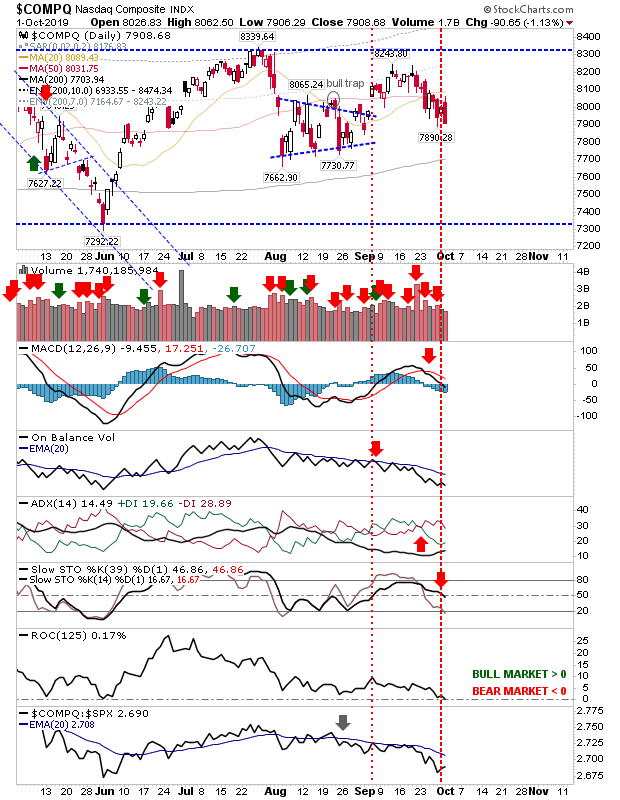

The NASDAQ went the other way with a reversal off 50-day MA resistance. It's getting squeezed between the 50-day and 200-day MAs but this is also a 'neutral' zone—meaning any action here (up or down) has to be taken with a pinch of salt.

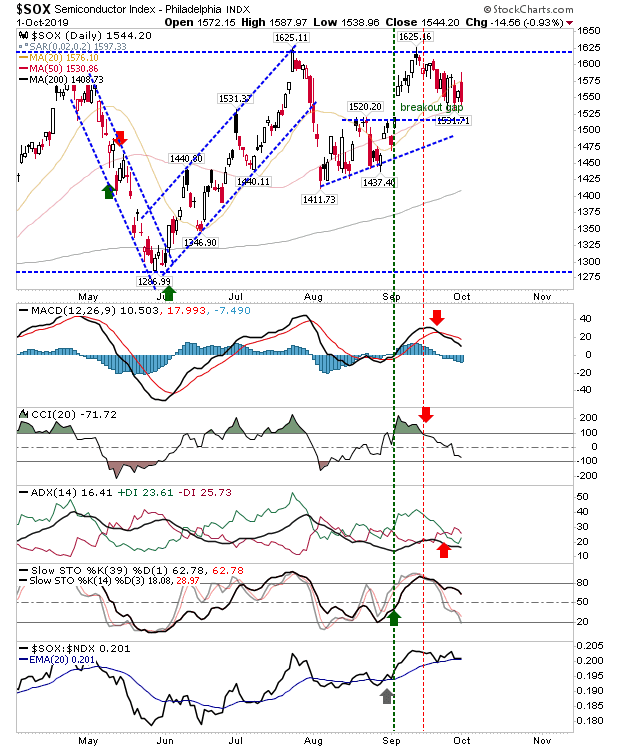

Helping the NASDAQ (and NASDAQ 100) will be the Semiconductor Index. It got off lightly with the breakout gap still intact.

Focus today is concentrating on Small Caps. If the Russell 2000 can't halt the slide at 1,465, then it will be curtains for other indices and their long-standing trading ranges.