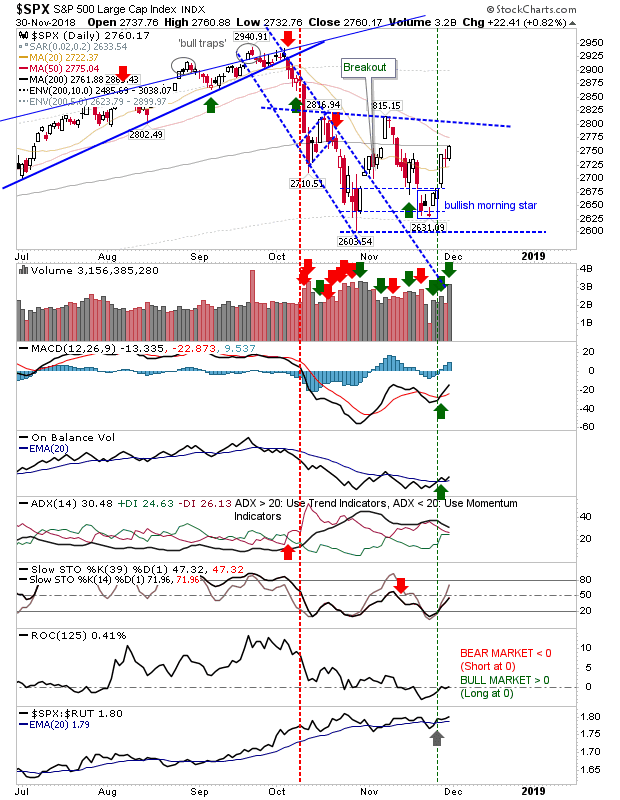

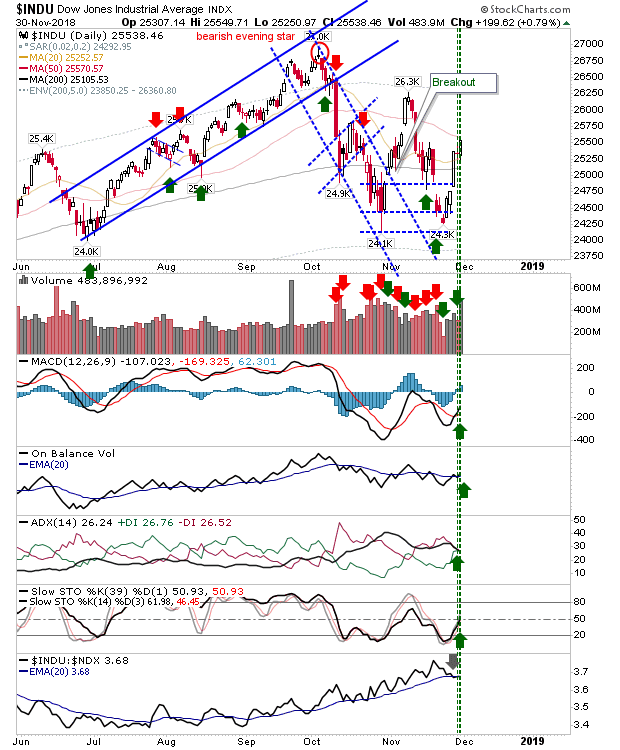

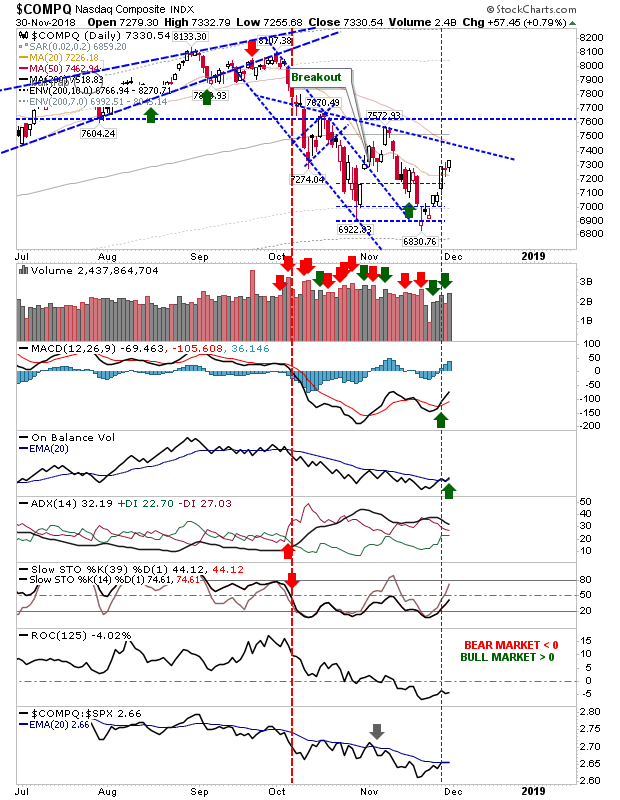

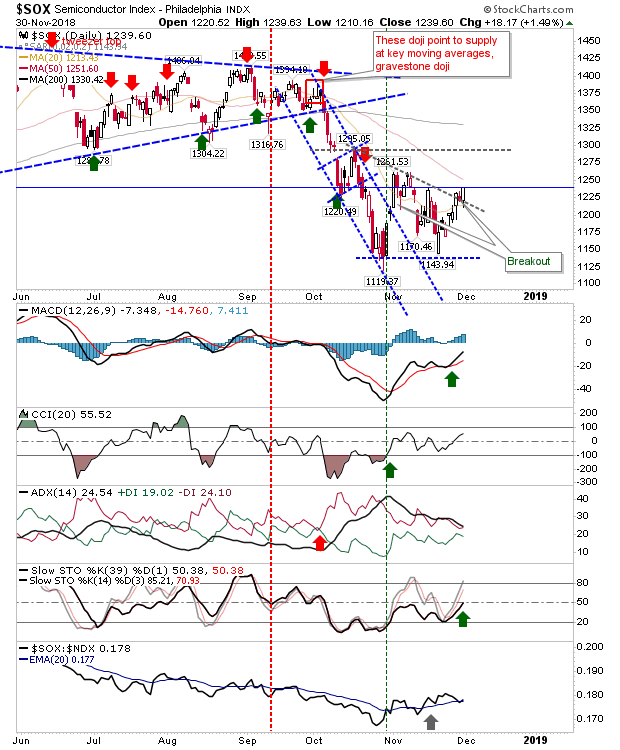

A good finish to last week left no doubts as to which side had control of the market this coming week. Bulls stepped up Wednesday and added a finishing touch Friday. Volume climbed in confirmed accumulation. Where possible, I have drawn new resistance lines connecting October and November swing highs which are the new upside targets for current market rallies.

The S&P hasn't turned fully net bullish (in technical strength) but it's only a couple of days away from doing so. The index finished Friday on its 200-day MA which may offer some resistance on Monday. Get past that, then there is the 50-day MA before the index gets to challenge the resistance line from recent swing highs.

The Dow Jones Index did manage a net bullish technical turn. It's the only lead index to have a higher November swing high than October. It has already managed to clear its 200-day MA and has only the 50-day MA (which it finished on) as the last major point of resistance before opening up for a test of all-time highs.

The NASDAQ hasn't made it as far as its 200-day MA and will run in the October-November swing high resistance line first. It has a similar technical picture as the S&P but it's slowly recovering its relative performance edge against the latter index.

The Semiconductor Index has offered an interesting sideshow as it clears declining resistance which remains the challenge for both the NASDAQ and NASDAQ 100 - this favors a similar test and break of comparable resistance for the aforementioned indices.

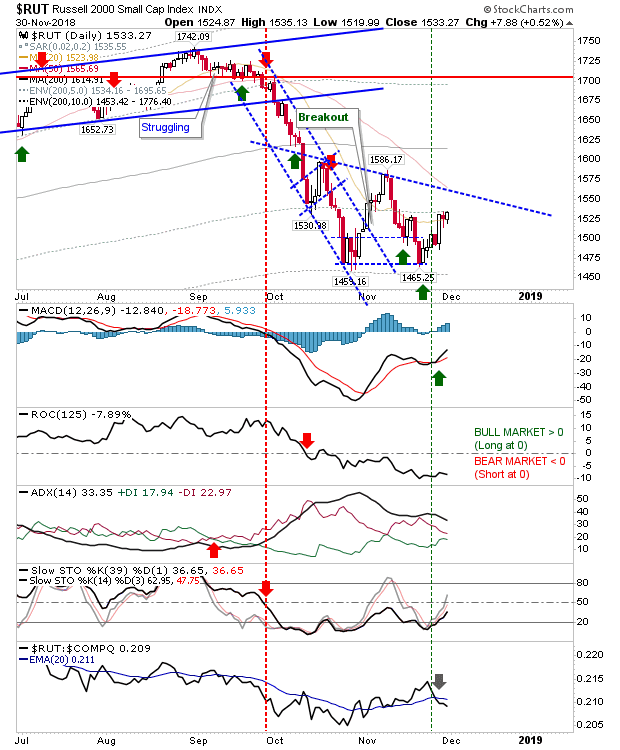

As for the Russell 2000, it lost some relative ground against the NASDAQ and didn't quite enjoy the same relative gains as other indices but it hasn't lost the bullish tendencies which November's swing low started.

For today, we will want Friday's gains to be respected with either a tight inside day or (preferably) a late day surge to further squeeze shorts.