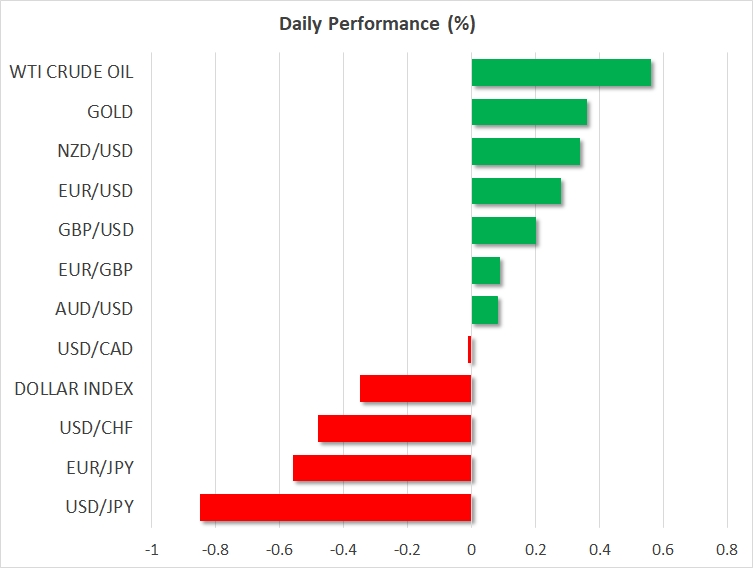

Here are the latest developments in global markets:

- FOREX: The dollar index traded nearly 0.4% lower on Tuesday, as concerns over rising US deficits and the nation’s long-term debt sustainability continued to pressure the world’s reserve currency.

- STOCKS: US stock indices advanced yesterday, recovering some of their recent losses. The Dow Jones led the pack, climbing 1.7%. The Nasdaq Composite rose by 1.6%, while the S&P 500 finished 1.4% higher. Despite the two consecutive days of recovery, markets still appear to be on shaky ground, as futures tracking the Dow Jones, S&P 500, and Nasdaq 100 are all in the red, suggesting that these indices could open lower today. Investors will probably keep their eyes locked on the US inflation data that are due on Wedensday, as they could go a long way in determining whether the recent turmoil will intensify or subside. In Japan, the Nikkei 225 and the Topix closed lower by 0.65% and 0.9% respectively, possibly weighed on by the latest gains in the yen, as a stronger currency curbs the profits of Japanese exporting firms. In Hong Kong, the Hang Seng advanced by 1.5%, though in Europe, futures tracking the Euro Stoxx 50 are in negative territory.

- COMMODITIES: Oil prices gained somewhat, with Crude Oil WTI and Brent crude both being up 0.6% today, possibly supported by the recovery in risk sentiment and energy stocks. Despite this modest recovery though, the precious liquid has tumbled notably in recent days, weighed on by signs that US production is rising rapidly. In this respect, the IEA monthly oil report that is due out today will be closely watched. Any potential upward revisions in the US production forecasts could amplify the recent over-supply concerns and thereby, keep oil prices under pressure. In precious metals, dollar-denominated gold was nearly 0.4% higher, potentially boosted by the broader flight to safe assets as well as the tumble in the greenback.

Major movers: Trump proposes higher deficits; yen gains amid flight to safety

The Japanese yen surged during the early European morning Tuesday, with dollar/yen and euro/yen falling by 0.8% and 0.6% respectively, with no clear fundamental catalyst behind the move. A possible explanation is that investors are moving into safe haven assets like the yen, given that the stock market turbulence does not appear to be over yet. This view is amplified by the fact that other safe haven assets, such as the Swiss franc and gold, are higher today as well. It is important to note that the aforementioned safe havens did not react much to the equity turbulence in recent days, perhaps because investors viewed the selloff as a “healthy” correction in overvalued stocks. However, the longer the uncertainty and the volatility last, the more likely it becomes that investors will seek the safety of these assets.

Yesterday, the US administration unveiled its budget proposal for the fiscal year 2019. This budget seeks to increase spending on infrastructure and the military, while it would cut the funding of popular health care programs like Medicare. Overall, the proposal would widen the federal budget deficit even further, making the long-term debt trajectory of the US economy even more unsustainable. It should be noted though, that this is simply an initial proposal that lays the foundation for a budget discussion between the White House and Congress, and thus is highly unlikely to pass Congress in its current form. Still, it shows that the already-large US budget deficit could widen further, a factor that is likely to keep bond investors on edge and the yields on US Treasuries elevated.

Elsewhere, Reserve Bank of Australia Assistant Governor Luci Ellis said overnight that policymakers are a little more confident that wages and inflation will eventually pick up some speed. However, she also noted that the up-to-now weak income growth is very risky given the high debt levels of Australian households. Nonetheless, the aussie reacted little to her comments.

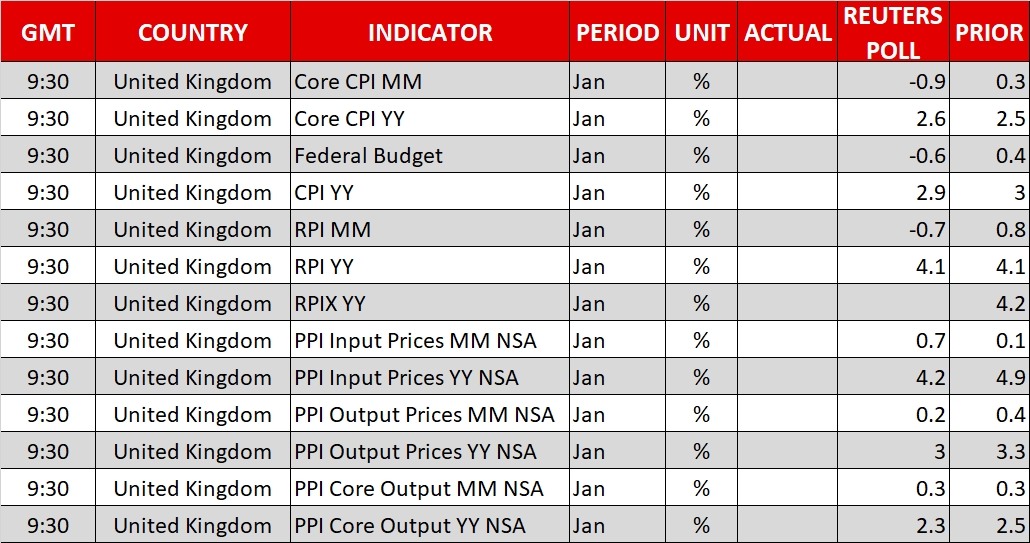

Day ahead: All eyes on UK inflation

UK data and specifically inflation figures for the month of January are dominating attention in Tuesday’s economic calendar. Those are due at 0930 GMT and undoubtedly have the capacity to lead to positioning on sterling, by among others shifting market expectations as regards the timing at which the Bank of England will deliver additional interest rate increases.

On a monthly basis, headline CPI is projected to contract by 0.6% – with the fall being attributed to seasonal factors – and on a yearly basis to expand by 2.9%, continuing to ease after hitting a near six-year high of 3.1% in November and lending support to those saying that it will start to gradually slow, moving towards the BoE’s target for annual inflation of 2%; though it might be early to conclusively state that a gradual slowdown is taking place. Core inflation, which excludes prices of energy, food, alcohol and tobacco, will also be attracting interest. Annually, it is expected to grow by 2.6% versus 2.5% in December.

Data on January’s producer prices and retail price inflation – a measure used to calculate payments on instruments such as index-linked government bonds and other contracts such as indexed-pensions – will also be released alongside CPI figures; another important release out of the UK later in the week (Friday) are retail sales for the month of January.

Cleveland Fed President Loretta Mester will be speaking on the US economic outlook at 1300 GMT. She holds voting rights within the FOMC in 2018.

In oil markets, the API report including information on crude oil stocks is due at 2135 GMT, while the IEA monthly report that cover issues affecting the world oil market is scheduled for release at 0900 GMT.

In equities, the earnings season continues to gather attention, having the potential to affect market sentiment.

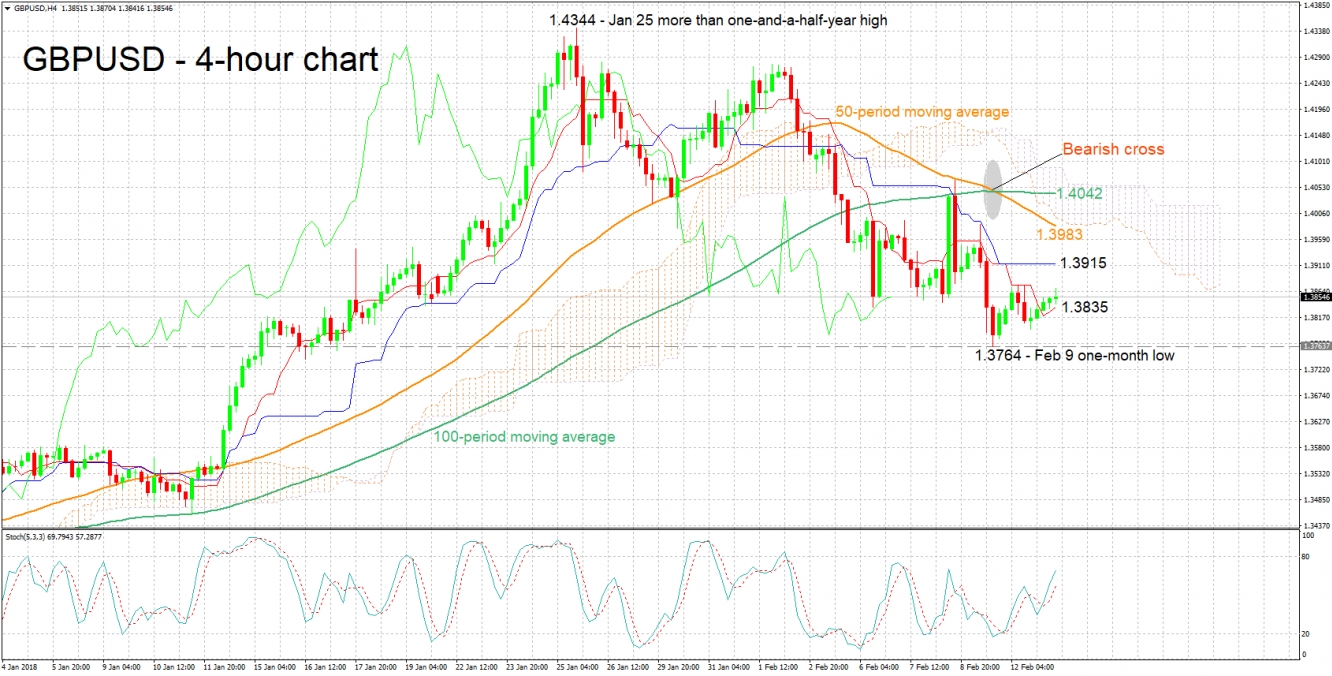

Technical Analysis: GBP/USD further distances itself from 1½-year high; bullish signal by stochastics in very short-term

GBP/USD has lost ground after hitting a more than one-and-a-half-year high of 1.4344 on January 25, eventually recording a one-month low of 1.3764 last week.

The Tenkan- and Kijun-sen lines are negatively aligned on the four-hour chart, projecting a negative picture in the short-term. However, the Tenkan-sen has started heading higher and the Kijun-sen has flatlined. These could be early signs of a change in momentum. Moreover, the stochastics are giving a bullish signal in the very short-term, as the %K line has moved above the slow %D one, and both are advancing higher.

Should UK data on inflation support the case for a rate hike by the BoE sooner rather than later, then the pair is anticipated to post gains. The area around the Kijun-sen at 1.3915 could act as a barrier to the upside in this case, with stronger bullish movement shifting the focus to 50-period moving average at 1.3983 – the range around this point also encapsulates the lower Ichimoku cloud (1.3997) and the 1.40 handle, a potential psychological level.

If, on the other hand, the figures push expectations for additional BoE tightening back in time, then GBP/USD is likely to decline. In this scenario, immediate support might come around the Tenkan-sen at 1.3835 – price action is currently taking place not far above this level – while further below the attention would fall on last week’s one-month low of 1.3764.