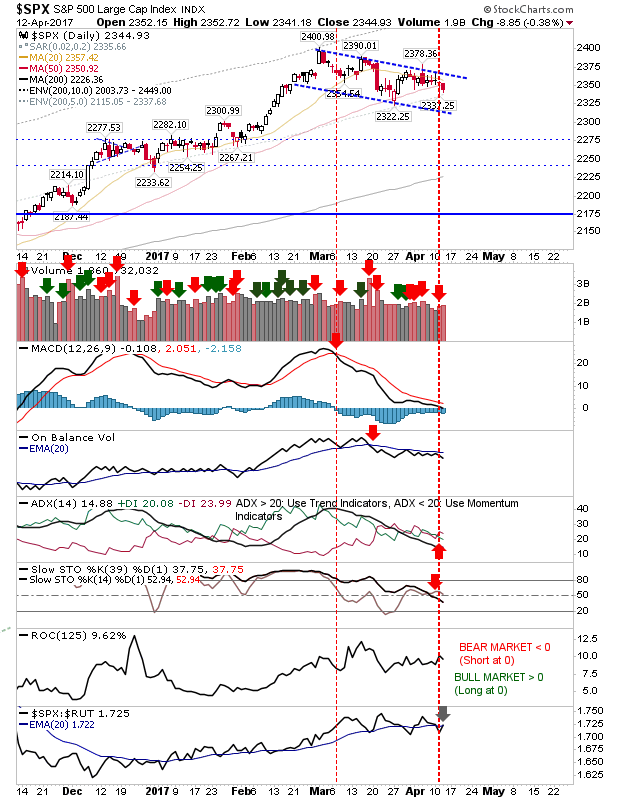

The good work from Tuesday was undone with yesterday's selling. The S&P posted a clear break of the 50-day MA on modest volume and will next be heading to test support of the declining channel - which at the moment looks more like a 'bull flag'. Technicals for the index are net bearish, but are close to a recovery. It might look worrying, but the index could benefit in the long run.

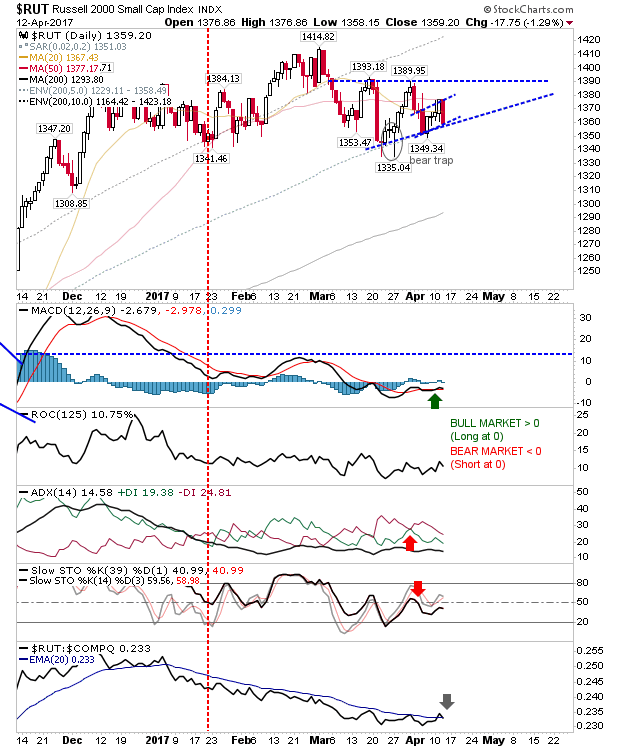

This selling was not limited to the S&P. Despite finishing on the 50-day MA after four days of gains, it wasn't able to break through. Instead, another 1%+ loss was delivered. The Russell 2000 is in consolidation triangle, within which is a 'bear flag'. The 200-day MA is the next target.

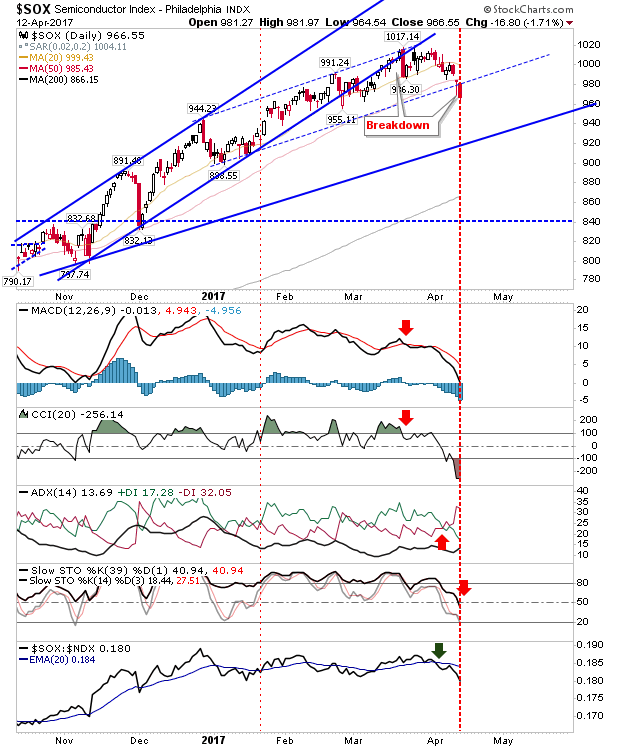

The Semiconductor Index was more decisive in its action yesterday, as it made a clear cut break from its tentative rising channel. The index gave up nearly 2% on yesterday's sell-off, and this could have implications for the NASDAQ and NASDAQ 100.

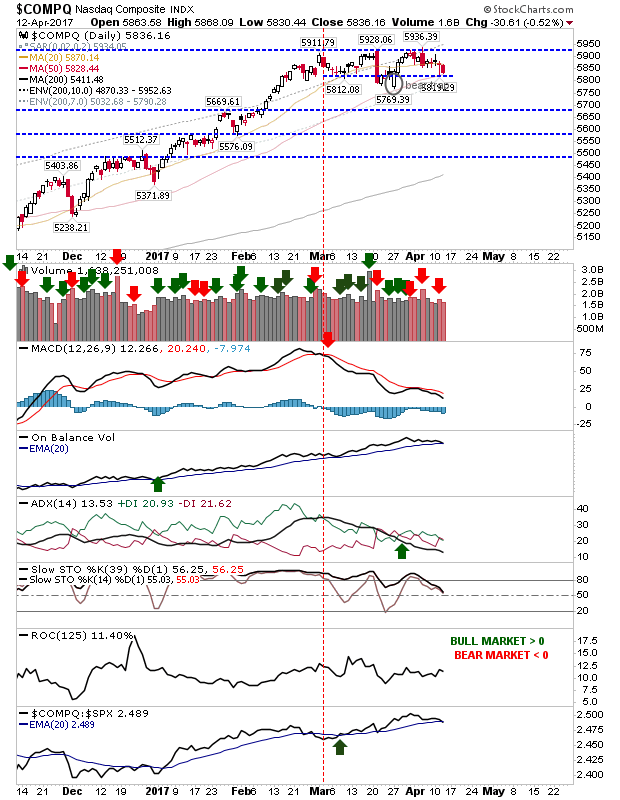

The NASDAQ is coming back to the former 'bear trap' but hasn't yet challenged. The 50-day MA is available to lend support, which also might encourage buyers. Selling volume was lighter, which may represent an easing in profit-taking, especially given support has held.

While yesterday's selling was worrying, it's still got a good chance of encouraging buyers to step in given the proximity of 50-day MAs (NASDAQ, Dow Jones) and support (NASDAQ and NASDAQ 100). Shorts might look for expansion of selling in the S&P given it's not near support and the risk/reward is better.