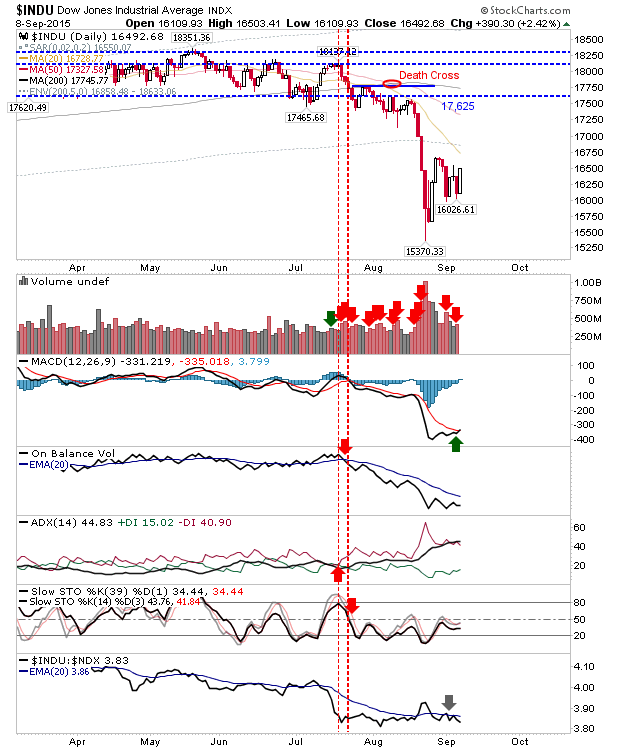

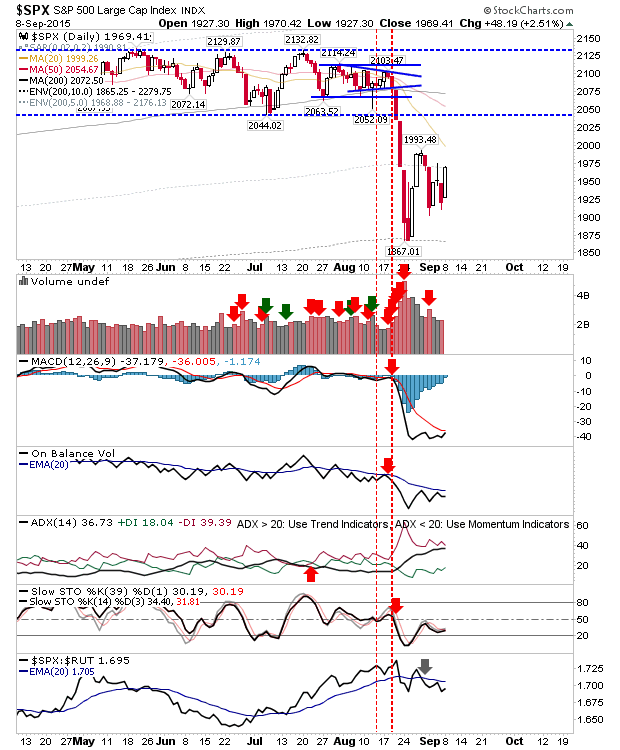

The S&P and Dow Jones are tightening into a coil, and coils typically lead to big reactions. It could be a few days before the coil is tight enough to spring, but both markets are consolidating on declining volume. However, the Dow edges in favour of bears with some distribution days in the mix, although it's countered by a MACD trigger 'buy'.

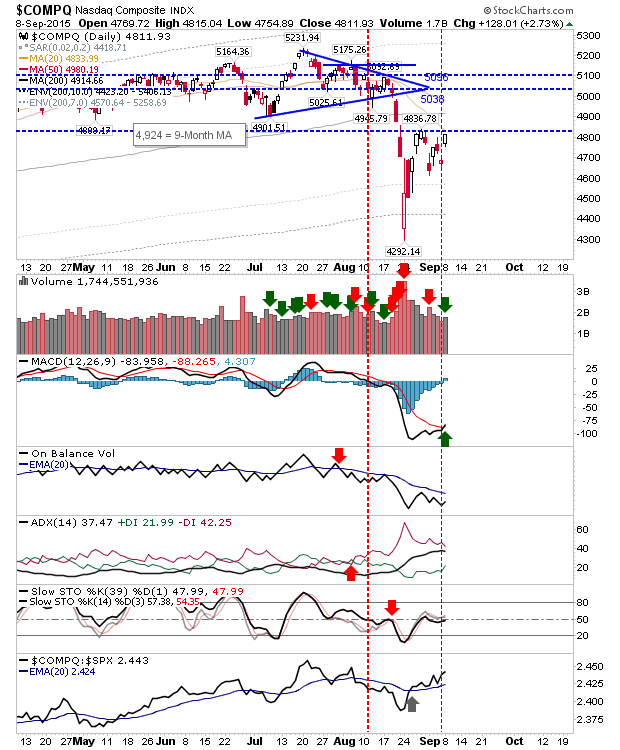

The NASDAQ is knocking on the door of resistance around 4,835 with a MACD trigger 'buy' and an accumulation day. Get past this and 5,000+ opens up.

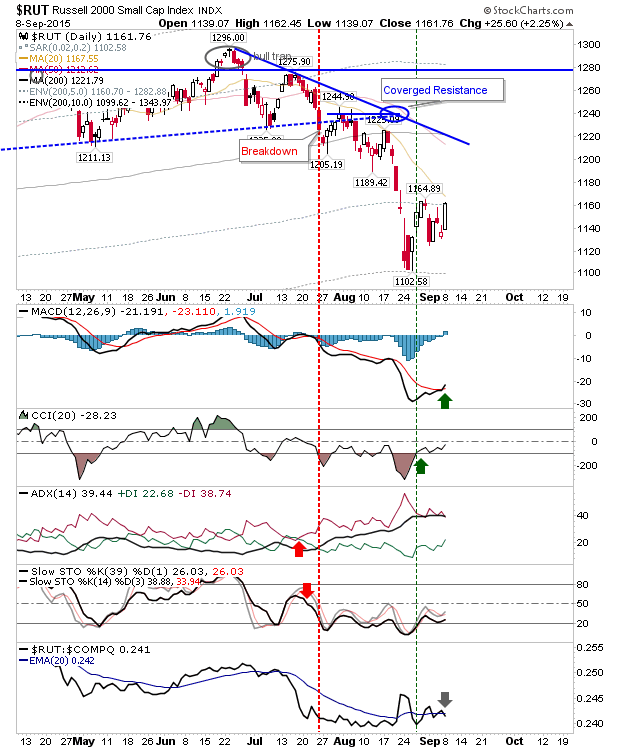

The Russell 2000 is also on a MACD trigger 'buy', but it will soon find itself up against 20-day MA.

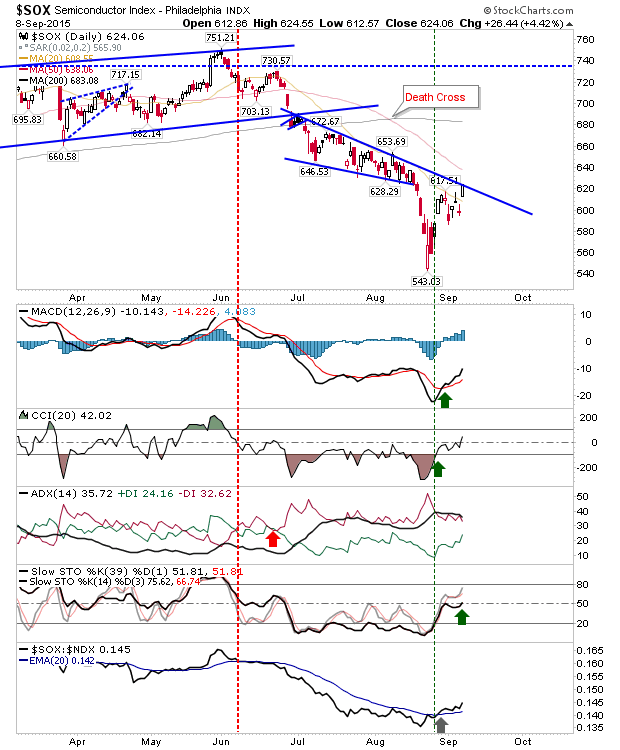

The Semiconductor Index continues its recovery, but is currently at resistance. Technicals have enjoyed a marked improvement with momentum turning bullish on the cross of the mid-line.

Today will see the bears' resolve tested for Tech indices. Should Tech break higher, then the likelihood for the Dow and S&P to come out of their coils to the upside increases.