Investing.com’s stocks of the week

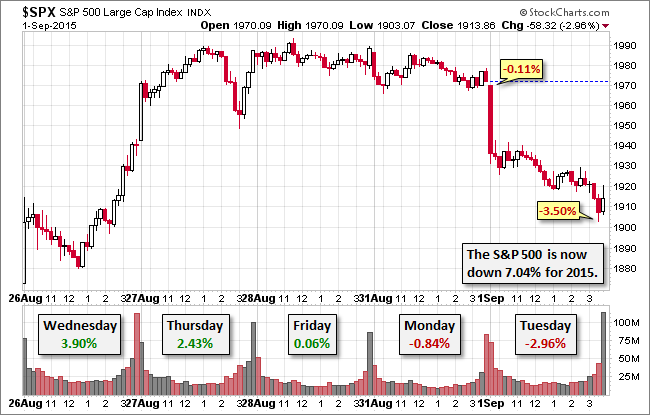

Global markets took a beating yesterday. The Shanghai Composite was only down 1.28%, but the Nikkei dropped 3.84%. The Euro STOXX 50 lost 2.47%. Our benchmark S&P 500 plunged at the open, drifted sideways until late morning and then sold off further in a couple of waves to its -2.96% close, just fractionally off its -3.50% intraday low.

The 500 is now down 7.04% year-to-date and back in correction territory, 10.18% off its record close in May.

The yield on the 10-year note closed at 2.17%, down 4 bps from yesterday's close.

Here is a snapshot of past five sessions:

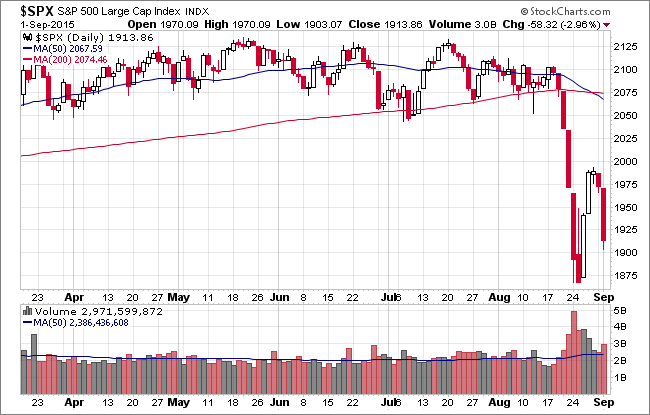

On a daily chart we see that volume saw a modest increase on yesterday's selling:

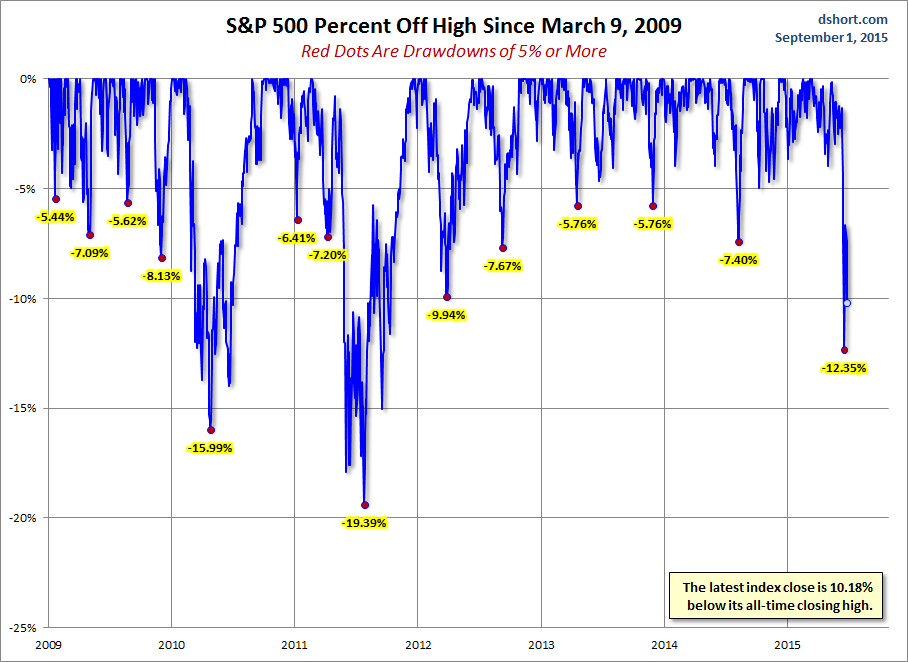

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough:

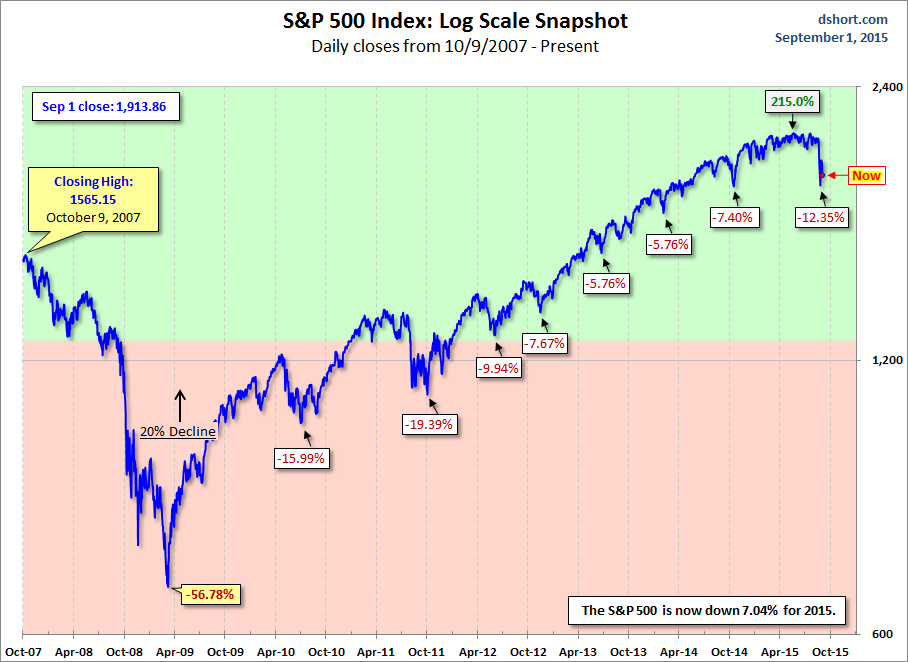

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession: