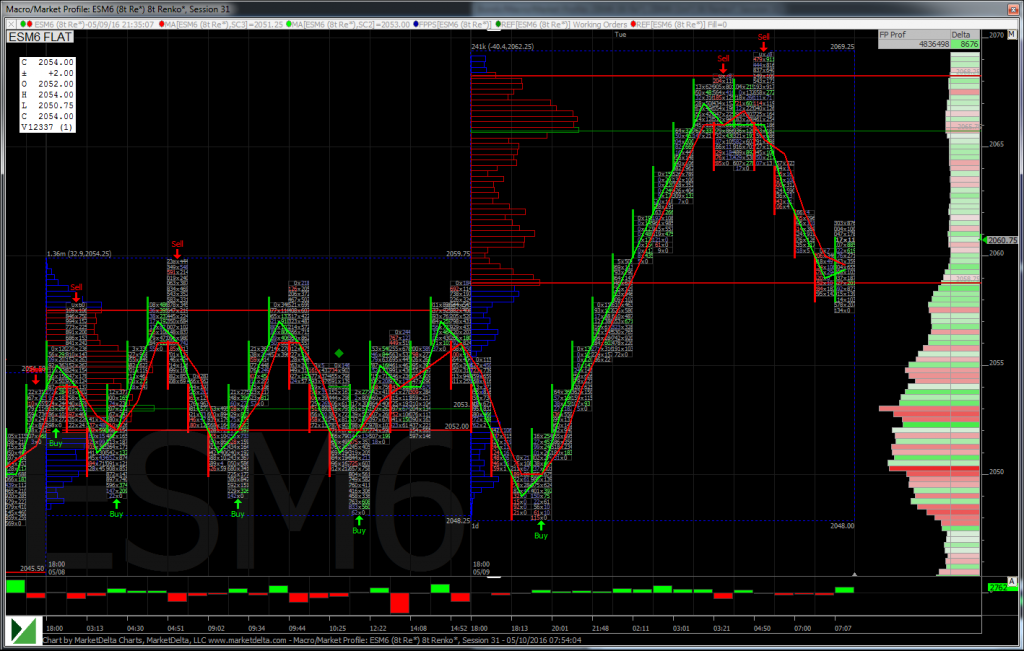

Yesterday the S&P 500 futures continued the low volume grind that began in globex. On the cash open, the ESM opened at 2050.50 and popped higher to make an early high of 2058.75 in the first hour of trade before selling off and breaking the globex lows, printing 2048.25. Then a rally going into midday helped maintain a sideways chop during the afternoon that leaned to higher prices, and a retest of the 2058.75 high, before weakening into the close. The market-on-close imbalance showed around $100 million to the sell side, and the ESM closed at 2054.50, up a tick on the day. Total volume was 1.36 million on a light calendar day, and if you read yesterday’s Opening Print, you’ll know that price maintained where we thought it would and not expand the globex range.

Overnight, the futures sold off 5 handles on the open but then maintained a bid throughout the Asian session after the China CPI and PPI release. The ESM made a high at the 2069.00 area early in the Euro session before travelling down 10+ handles to 2057.50, and currently sits at 2060.00, up 5.75 handles on the session. Volume is relatively better, with 225K mini’s trading before 6:30 am CST, but still is not impressive. Heading into the cash open we are still watching the 2050 level to the downside. This round number was a support area for much of yesterday’s globex and cash session trade, as well as offering some support early last night in globex. A first touch of this area today will offer a fair buy, but on the second test we lean to thinking this area will break, opening the door to last week’s low. To the upside, 2069.25 was this mornings globex high, we believe the 2070 area offers a good initial fade on first test but a break above this level leads to last week’s 2077 high and more.

In Asia, 10 out of 11 markets closed higher (Shanghai +0.02%), and In Europe, 11 out of 12 markets are trading higher this morning (DAX +0.30%). Today’s economic calendar includes NFIB Small Business Optimism Index, Redbook, JOLTS, Wholesale Trade, a 4-Week Bill Auction, and a 3-Yr Note Auction.

Our View: Sell in May opened and saw a 3.5% sell off from the highs of the year. However it looks like momentum to the downside is drying up with volume this week. With the mid month rebalance coming up we think that the lean will be to cover some of the short side from last week, however, this is pre-expiration week and we tend to look for the Pitbull’s rule on Thursday or Friday. For today and the remainder of the week we will have an open mind and let established price areas dictate our trade. We lean to buying early weakness and selling late day strength as this seems to be what is working as of late.

The MrTopStep BootCamp is May 16-20. It’s a very impressive line up of traders that would be hard to find any place else. We have always considered our traders as part of a collective, sharing ideas, price levels and any pertinent news that may be moving the markets. This bootcamp is especially loaded with with top tier traders. If you have never joined the bootcamp I suggest you do. Not only will you see how they do it, you will be able to watch the live trading. There really is no other trading education service like this, and it’s unique to the retail trading business, but it’s not all retail. Many of the things we use and talk about are exactly the same stuff we worked with on the trading floor when we were talking to the big banks and hedge funds (too bad they didn’t listen). That said I have posted the weekly schedule for you to review and the link to the sign up.

- In Asia 10 out of 11 markets closed higher: Shanghai Composite +0.02%, Hang Seng +0.43%, Nikkei +2.15%

- In Europe 11 out of 12 markets are trading higher: CAC +0.30%, DAX +0.33%, FTSE +0.18% at 6:30am CT

- Fair Value: S&P 500 -5.41, NASDAQ -5.88, Dow -72.48

- Total Volume: 1.37mil ESM and 4.3k SPM traded

- E-mini S&P 5001986.25-12.00 - -0.60%

- Crude

- Shanghai Composite

- Hang Seng 20242.68+85.87 - +0.43%

- Nikkei 22516565.19+349.16 - +2.15%

- DAX10016.38+35.89 - +0.36%

- FTSE 1006129.76+14.95 - +0.24%

- Euro 1.1374