Investing.com’s stocks of the week

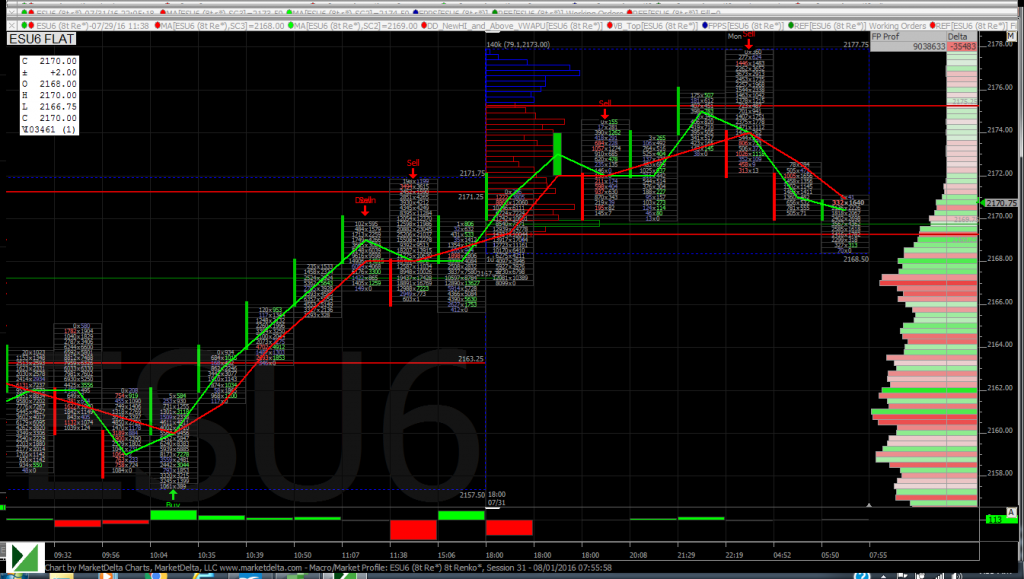

Friday’s trade was a good example of traders taking time off. Crude oil sold off and rallied. The S&P 500 initially sold off a little and then started to take out the buy stops above 2168.00 to 2171.75. The S&P futures, the Dow futures, and the Nasdaq futures all closed nearly unchanged. At the end of July the S&P closed up 3.6%, the Dow closed up 2.8% and the Nasdaq futures closed up 7.5%.

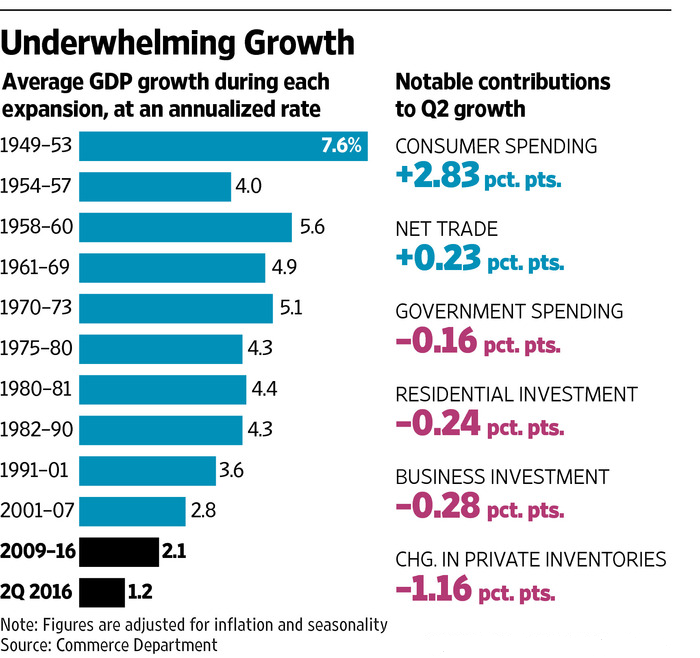

The second quarter GDP came in lower than expected at 1.2%, weaker than the expected 2.6%, and consumer spending came in stronger than expected. Business spending came in weaker than expected which will probably push the fed's potential rate hikes out past September and possible not until 2017.

Crude oil sold off below my level at $41.00, down to $40.57 a barrel, but rallied all the way up to $41.67 before settling at $41.56 for the month. NYMEX crude oil futures were down a whopping 14%, but still up 12.3% in 2016.

Almost two months ago when crude was trading $50.00 to $51.00, I said the next $4.00 to $6.00 move would be down. When the futures started trading $44.00, I said they would see support at the $43 to $41.00 level, and that I expect some type of bounce. The sell off again renewed fears of drilling oversupplies.

The BOJ said in its latest policy statement that it was planning to buy more ETFs. The yen fell -2.6% while the U.S. stock market has seen a sharp rebound.

The disappointing GDP shows that economic growth and cautious business spending is hampering the economic recovery. Economic growth is now tracking at a 1% rate in 2016—the weakest start to a year since 2011.

Many economists think the weak business environment is a ‘lingering growth restraint,’ and according to a Thomson Reuters survey of analysts, companies in the S&P 500 are likely to report the fourth straight quarter of declining profits, down 3.7% from second-quarter 2015. Revenues are expected to decline 1.2%.

So who do we believe? The public has been taught that when the stock market is good, so must be everything else. So do we believe the Dow Jones and S&P, that are trading at new all-time contract highs? Do we believe the Nasdaq Composite, which is trading at the highest it’s been since the 1999-2000 tech bubble, or do we believe in the weak growth and lower earning expectations?

If you are an old school trader that looks at the big economic indicators as stock market drivers it just doesn’t make sense. Some of the hottest high end housing markets are starting to cool, but in West Palm Beach, Florida sales are still going strong.

So what should we believe? The one point that all the economist, analyst and market timers seem to miss out on is there has never been a time when the global central banks have lent so much support to the markets. Clearly all the quantitative easing is not only rewriting how the markets operate, but also how the economist, analyst and market timers view the markets.

As I have said many times we live in an ever changing world. Tools that we used to use to make money don’t work and the things we find that do don’t last very long.

In the end these are not our fathers' markets, nor are these our fathers' charts. Never forget rule no.1: ‘Don’t fight the Fed’.

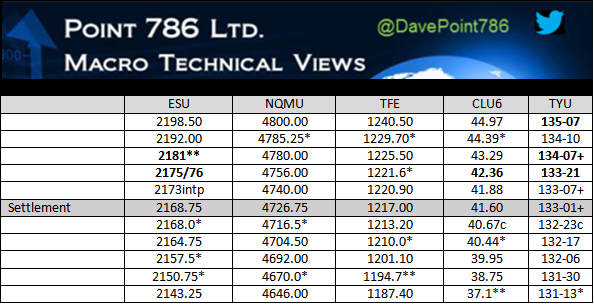

Overnight, the ESU16 gapped higher to open at the 2174.25 price, then filled the gap early in globex before rallying to a new all-time high at 2177.75. After that, the ES traded back to the 2169 area and is currently trading 2170.50, up 2.25 handles on just 150K volume at 7:20 am cst.

In Asia, 9 out of 11 markets closed higher (Nikkei +0.40%), and in Europe 8 out of 12 markets are trading lower this morning (DAX -0.01%). This week’s economic calendar includes 27 reports, 2 Fed speakers and 15 U.S. Treasury events.

Today’s economic calendar includes a 2-Yr Note Settlement, a 2-Yr FRN Note Settlement, a 5-Yr Note Settlement, a 7-Yr Note Settlement, PMI Manufacturing Index, ISM Mfg Index, Construction Spending, a 4-Week Bill Announcement, a 3-Month Bill Auction, a 6-Month Bill Auction, and Gallup US Consumer Spending Measure.

Our view: Last Wednesday when there was $-1.4 Billion in SPX to sell on the close, it looked right that the July month-end could see some type of ‘sell S&P / buy bonds’ month-end rebalance, but come Thursday and Friday, the big MOC buying showed right back up.

What is clear is that there was a lot of month-end selling in the energy sector, so there was some S&P rebalancing going on but it was small. Additionally the semi-negative month-end stats didn’t work either, it was just too thin.

Today is the first trading day of August. According to the Stock Trader’s Almanac, the first trading day of the new month has the Dow down 12 of the last 18 occasions. The way I see it, there was buying on the July month-end, and there will probably be buying on the first few days of August also.

Our view is to sell the early rallies and buy weakness. If the ESU closes above 2175-2176 it’s going to be a quick shot to 2190+.

- In Asia 9 out of 11 markets closed higher: Shanghai Composite -0.87%, Hang Seng +1.09%, Nikkei +0.40%

- In Europe 8 out of 12 markets are trading lower: CAC -0.61%, DAX -0.02%, FTSE -0.40% at 6:30am ET

- Fair Value: S&P -5.65, NASDAQ -6.52, Dow -78.03

- Total Volume: 1.7m ESU and 8.1 k SPU traded