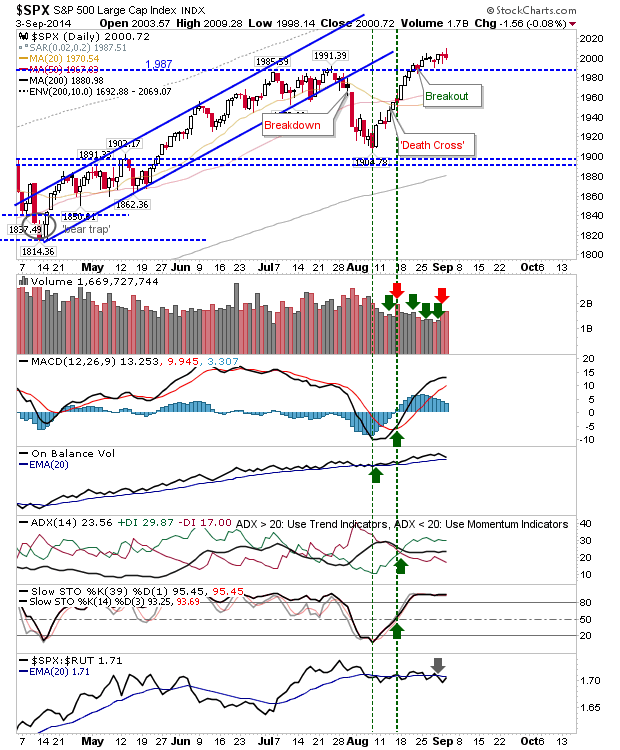

Another day of relatively modest action yesterday, although the S&P 500 did finish with a bearish inverse hammer which may lead to further weakness today. A retest of 1,987 would still honor the trading range delivering a down day, but would keep the larger bullish picture intact.

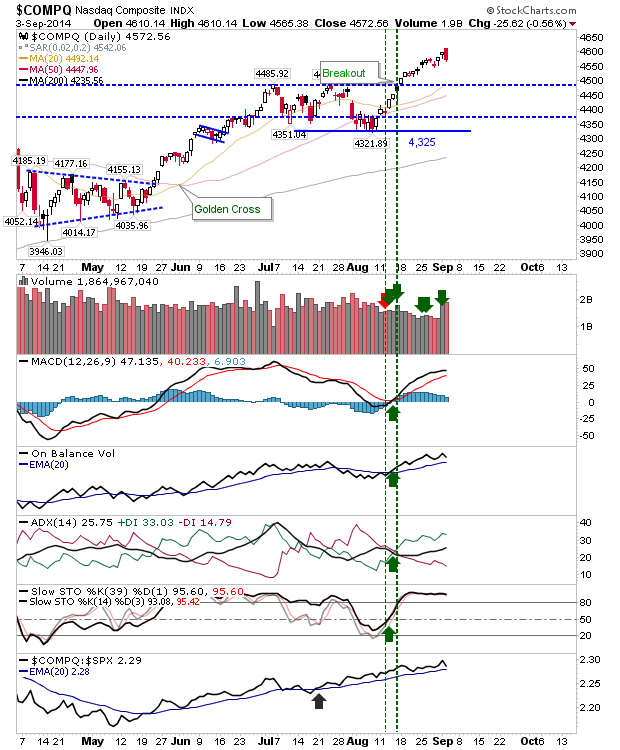

The NASDAQ Composite closed the day with a bearish engulfing pattern. Yesterday's close leaves room for a larger move down, with the 20-day MA the most likely target.

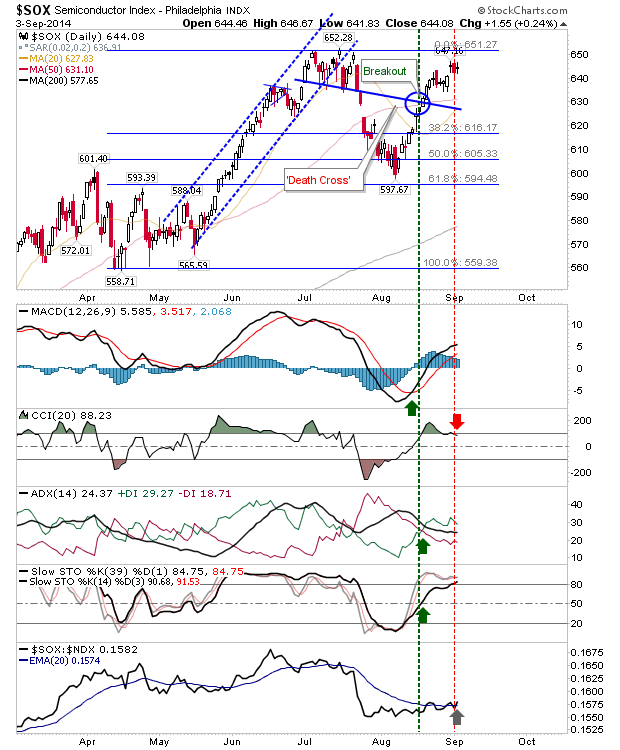

The Semiconductor index didn't expand on Tuesday's bearish engulfing pattern, but the inside day is a swing trade opportunity: trade break of high/lows - stop on the flip side.

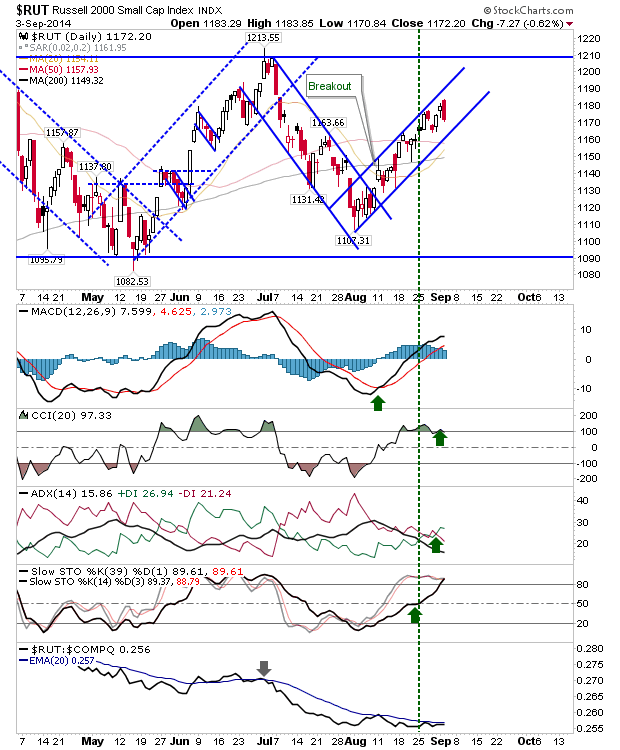

Like the NASDAQ, the Russell 2000 finished with a bearish engulfing pattern, although the downside target is nearby channel support.

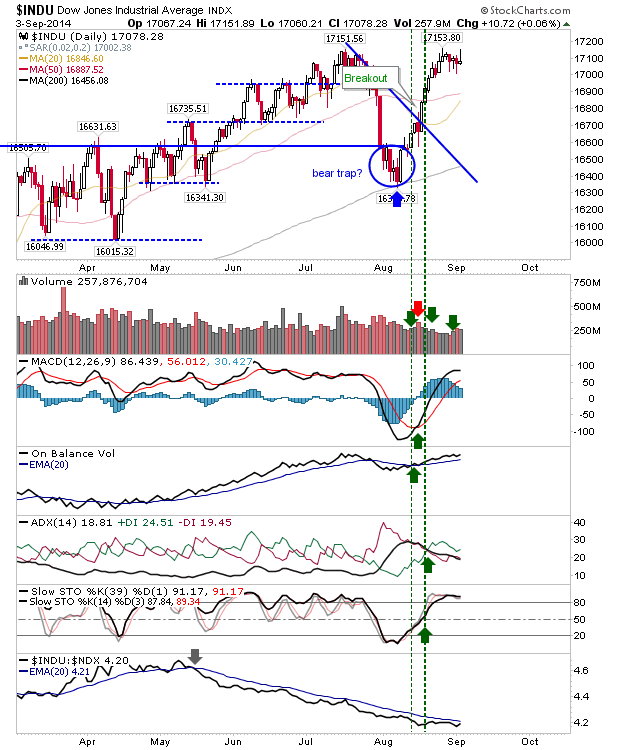

Finally, the Dow 30 closed with a 'gravestone doji' as it failed to close above 17,100. There is a potential double top despite the 'V-recovery'.

Today is best set up for bears to follow through on indices' bearish engulfing patterns. More flexible traders can look to swing trade the semiconductor index; longs may also find some joy here.