Friday was another day of small margins, but even with this there were still important moves to consider.

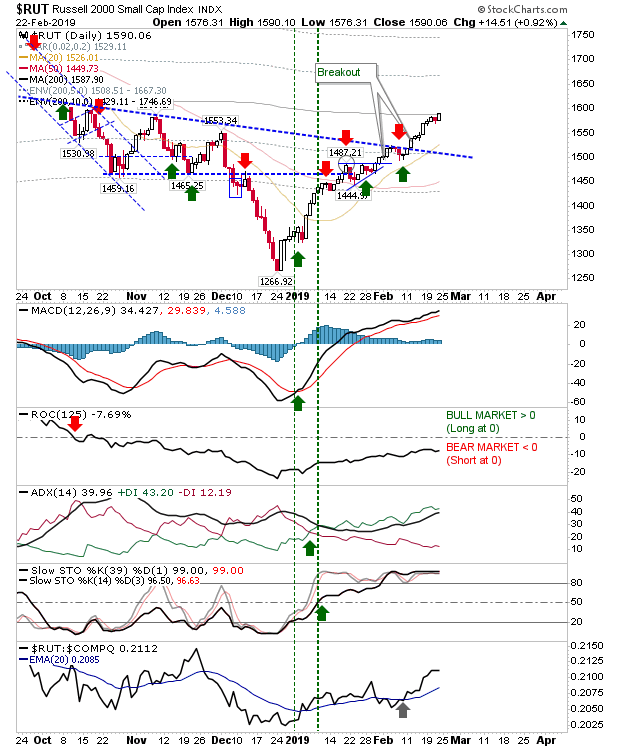

The Russell 2000 finally achieved what other indices had done a week earlier and tagged its 200-day MA. Other technicals are in good shape but ROC is still in bearish territory. Still, the index is outperforming the NASDAQ.

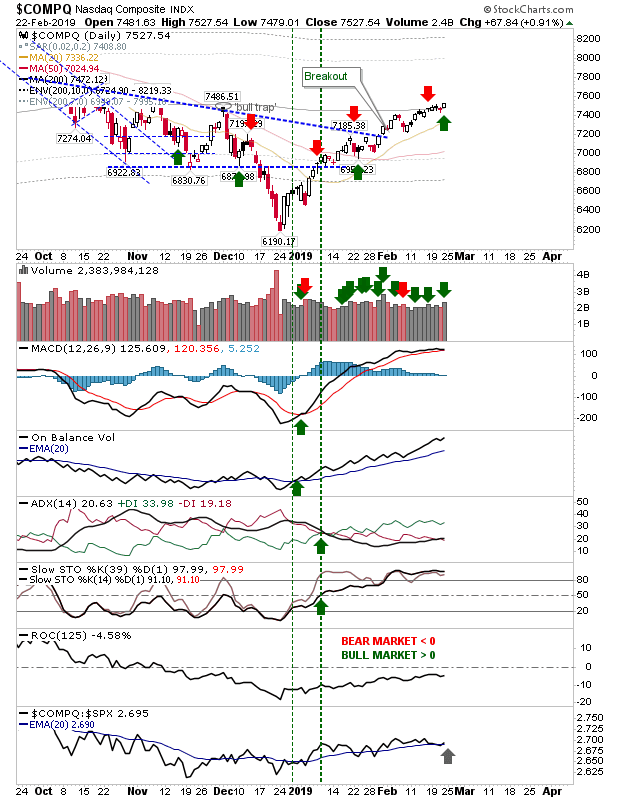

Speaking of the NASDAQ, it was able to gain some love off the Semiconductor Index. While it wasn't substantial it did manage to break through its 200-day MA on higher volume accumulation. There was also a recovery uptick in relative performance against the S&P.

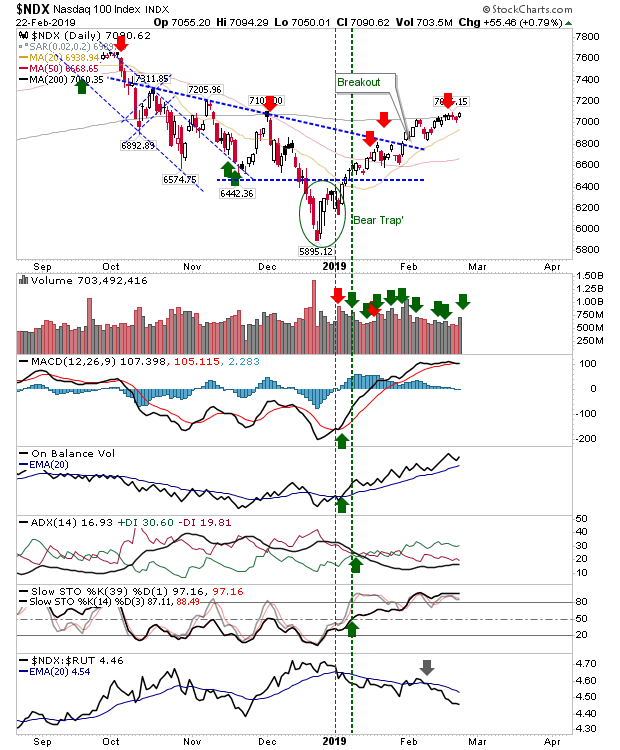

The NASDAQ 100 wasn't as fortunate as the NASDAQ in it didn't clear the 200-day MA to the same degree, but it did benefit from higher volume accumulation.

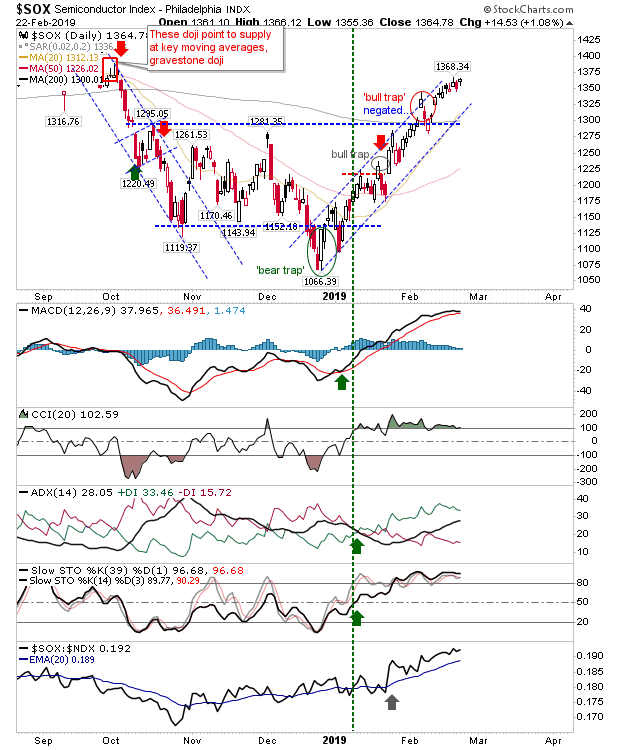

Feeding into the NASDAQ and NASDAQ 100 is the strengthening Semiconductor Index. The rate of advance is slowing but Thursday's 'bearish cloud cover' was negated.

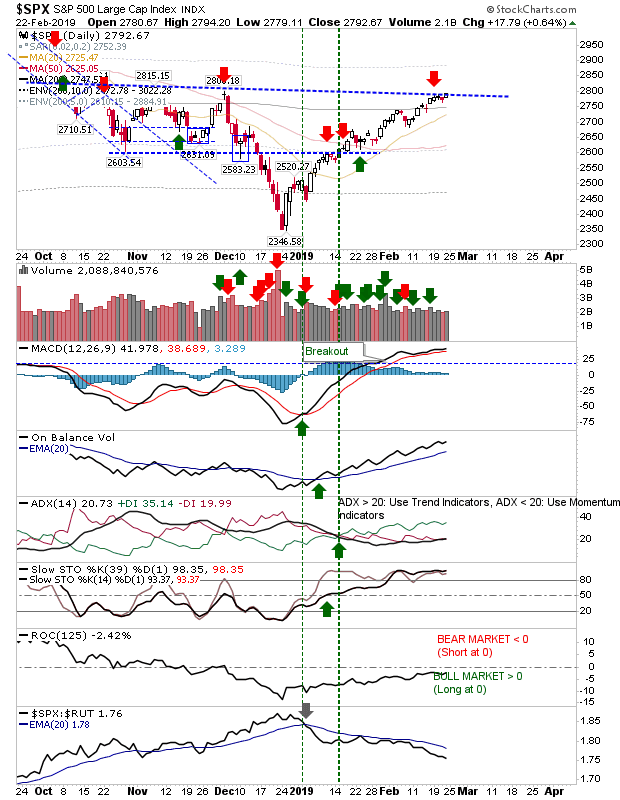

The S&P remains pegged by declining resistance but managed a small gain on a small increase in buying volume.

For Monday, bulls will be looking for further advancement in Tech indices, with the Semiconductor Index driving the advance in both the NASDAQ and NASDAQ 100. This action may be sufficient to deliver a breakout in the S&P. Shorts can use the tag of the 200-day MA in the Russell 2000 as a short play should Large Cap and Tech indices struggle to follow through on their gains.