Investing.com’s stocks of the week

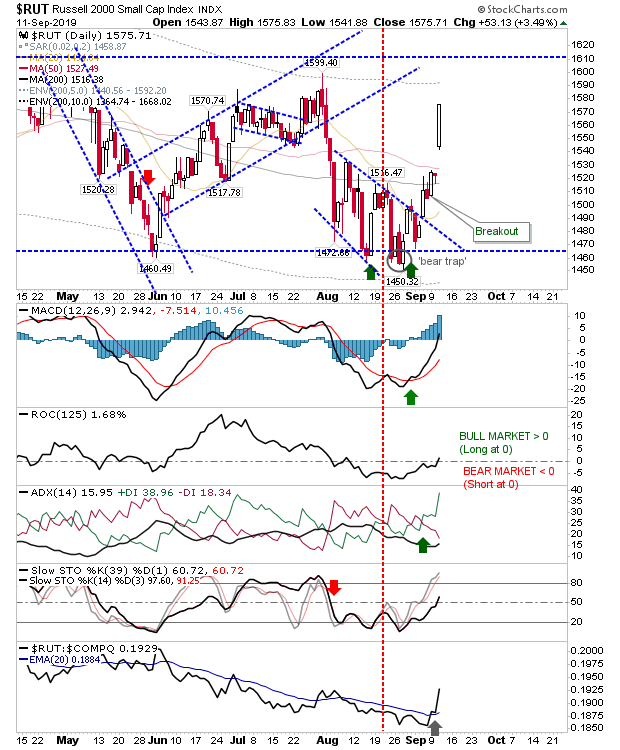

A big day for bulls yesterday as two key economically sensitive indices made strong moves. Best of the action was given over to the Russell 2000; a 3.5% gain keeps things buoyant but it's also smack bang in the middle of the trading range.

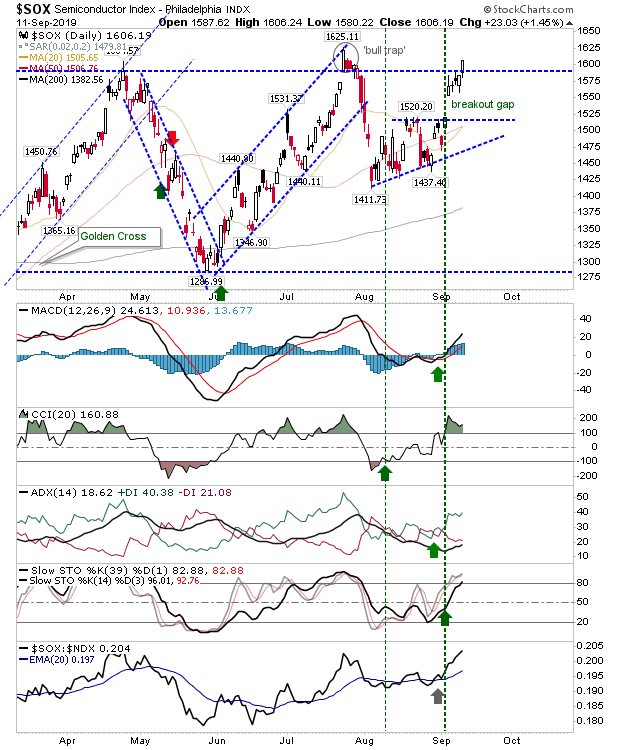

The strongest index is Semiconductors as it works on a challenge of the July 'bull trap' which was a false breakout of a long standing consolidation. Strength in this index will help the NASDAQ and NASDAQ 100.

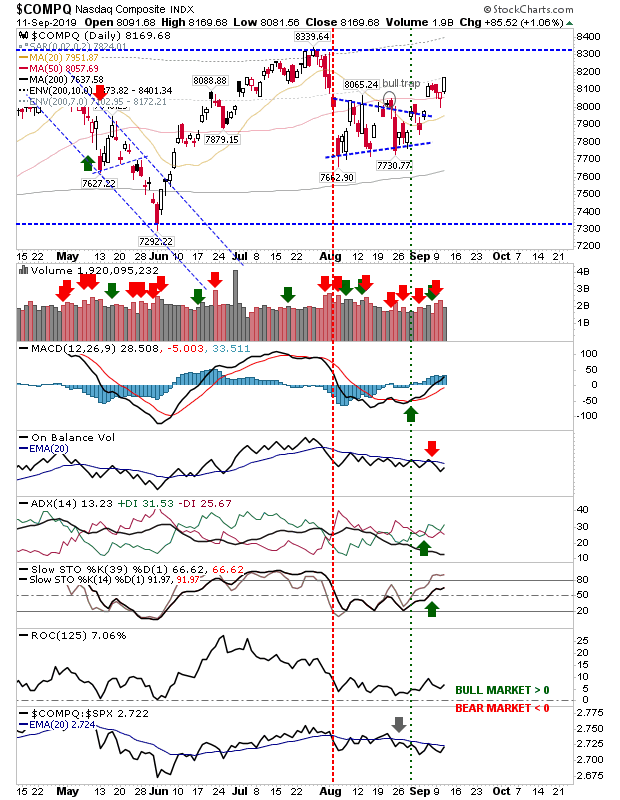

The NASDAQ is still range bound and a few days away from challenging resistance. However, unlike the Semiconductor Index, it's still vulnerable to churn.

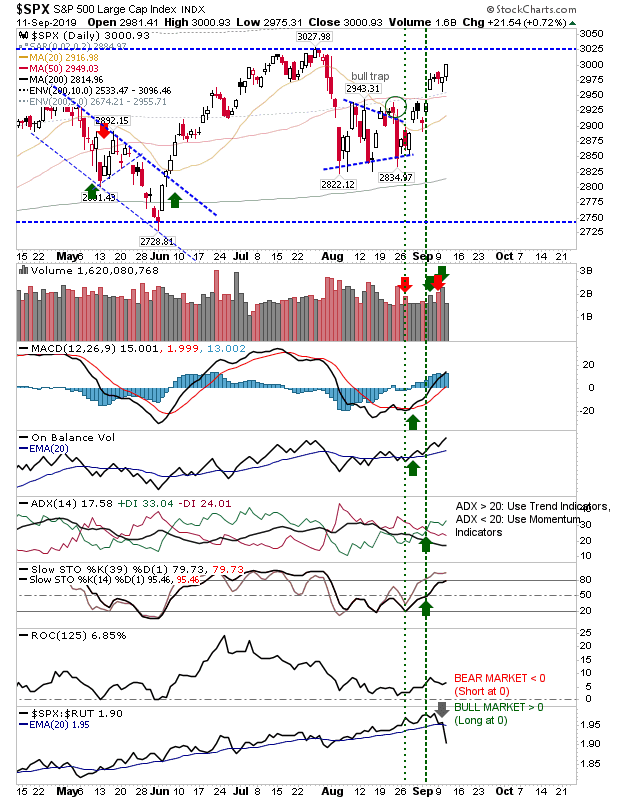

The S&P is in a similar position as the NASDAQ but is closer to resistance. There was a sharp drop in relative performance against Small Caps—which is bullish for the broader market but it may slow further gains in Large Cap indices.

For today, it will be about the Russell 2000 consolidating its gains and the Semiconductor Index maintaining its challenge of the 'bull trap'