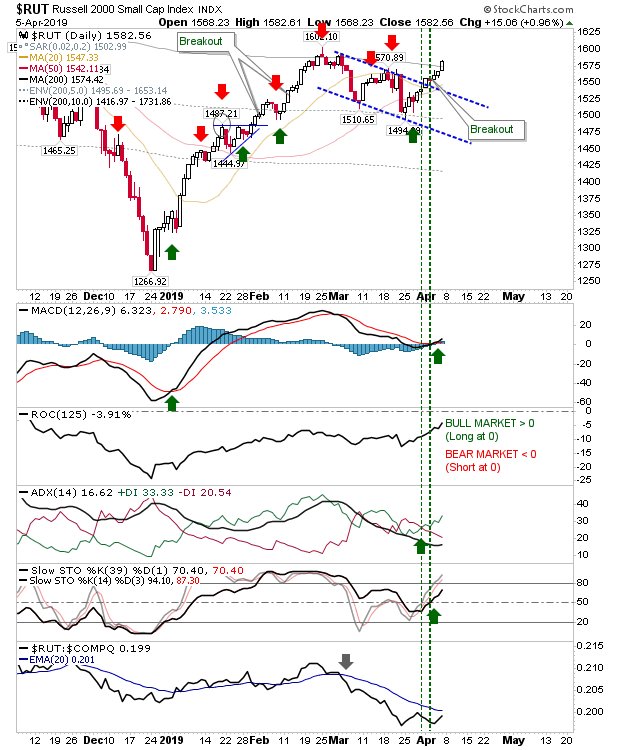

There wasn't a whole lot to Friday's action, but the best of it was given over to the Russell 2000.

The Russell 2000 cleared its 200-day MA in a near 1% gain. Technicals are net bullish and any short positions will have been cleaned out by the close above the 200-day MA. The question now is whether the rally off March's low can build a rally continuance, but the initial signs are good.

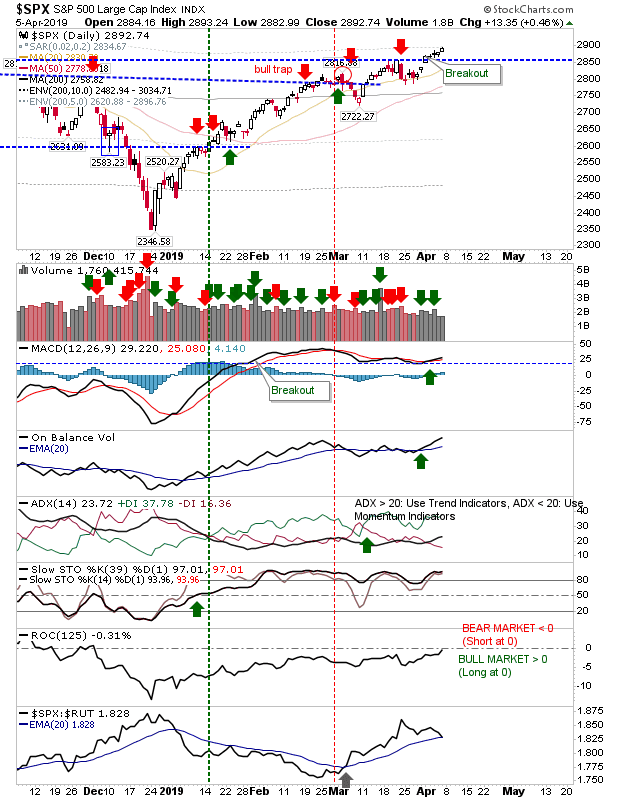

The S&P edged a little higher and technicals are positive. Volume was light and relative performance continued to lose ground against the Russell 2000—this is good news for a broader rally, but not necessarily for the S&P.

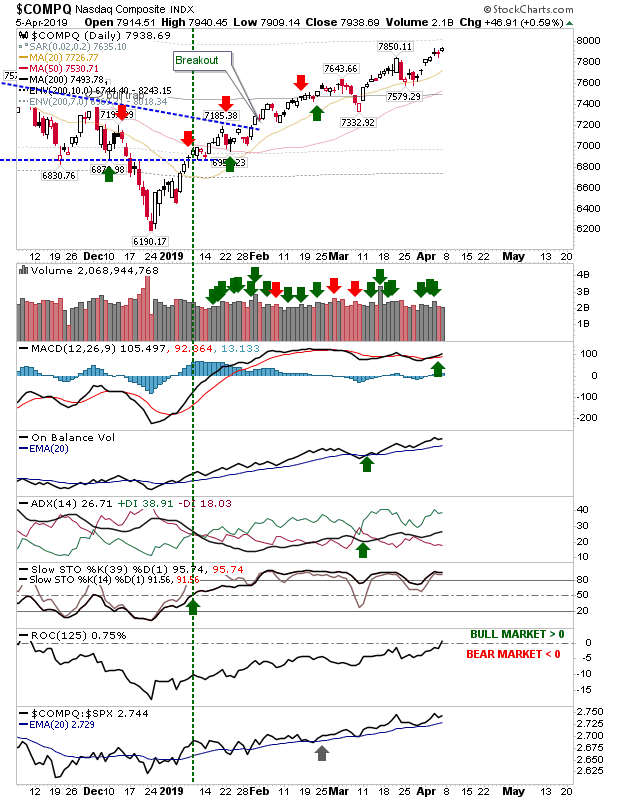

The NASDAQ is caught between the gains of the Russell 2000 and S&P, but is managing to maintain performance ahead of the S&P—inline with a bullish market rally.

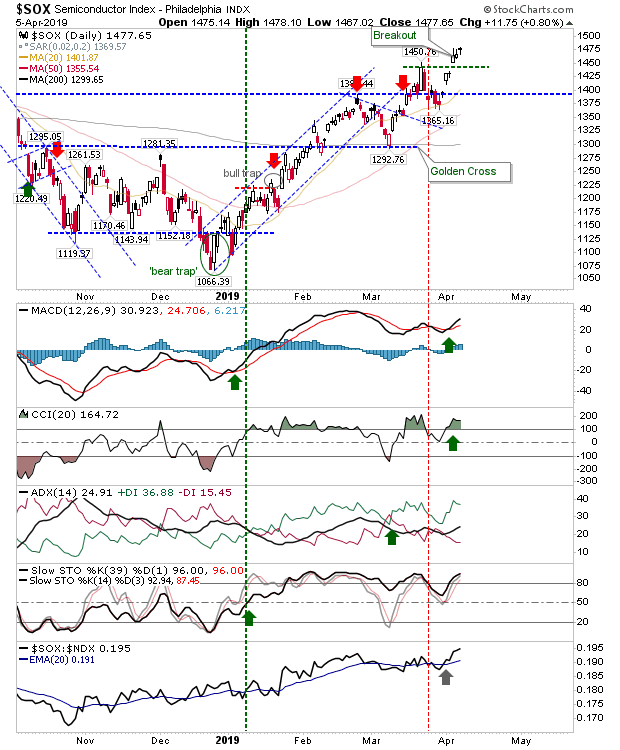

The Semiconductor Index had a quiet finish to the week after decent gains. I will be looking for these gains to fuel further advances in the NASDAQ and NASDAQ 100, assuming last week's breakout holds.

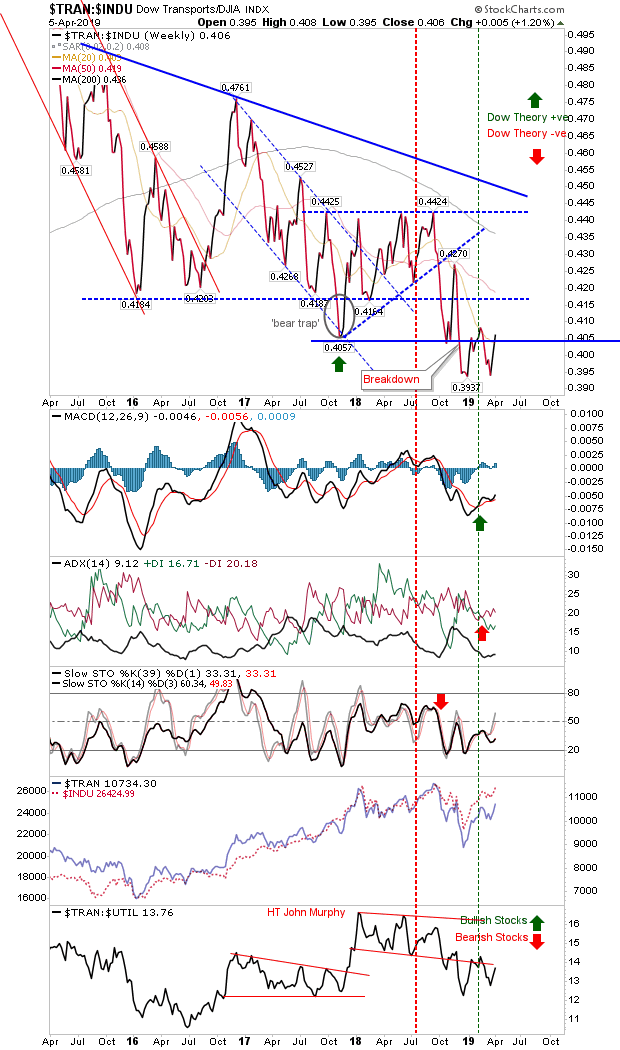

On longer term charts the relationship between the Dow Industrials and Transports is entering a new consolidation, but a consolidation driven by a breakdown in the relationship, with bears in control (i.e. Transports underperforming the parent Industrials).

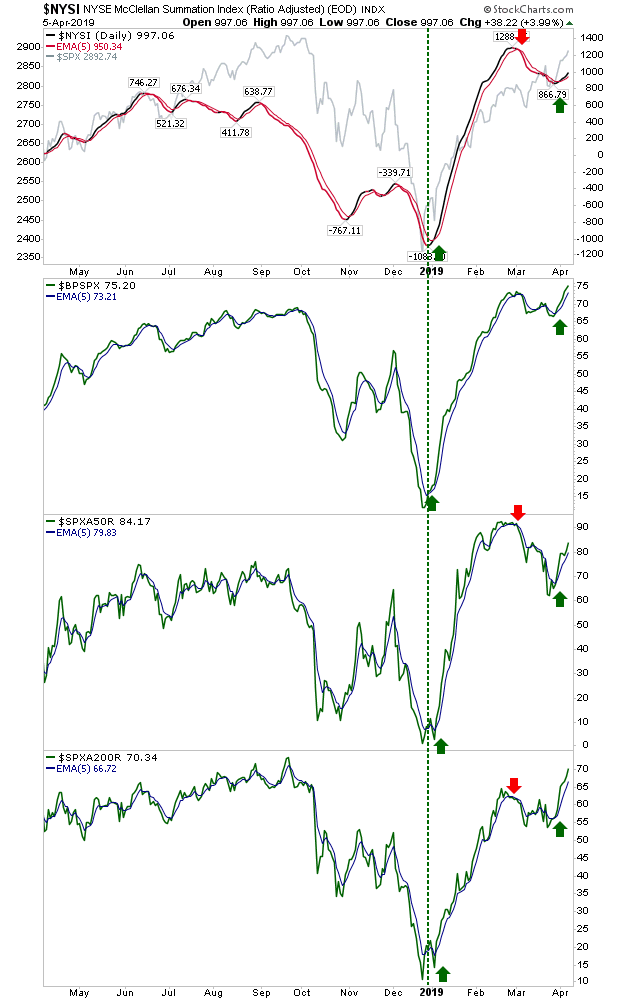

Breadth metrics for the NYSE have returned a net bullish set-up although these metrics are near overbought.

This week will be about sustaining the advance, even if these gains are baby steps. Look for Tech to push on with Russell 2000 holding its market leadership position.