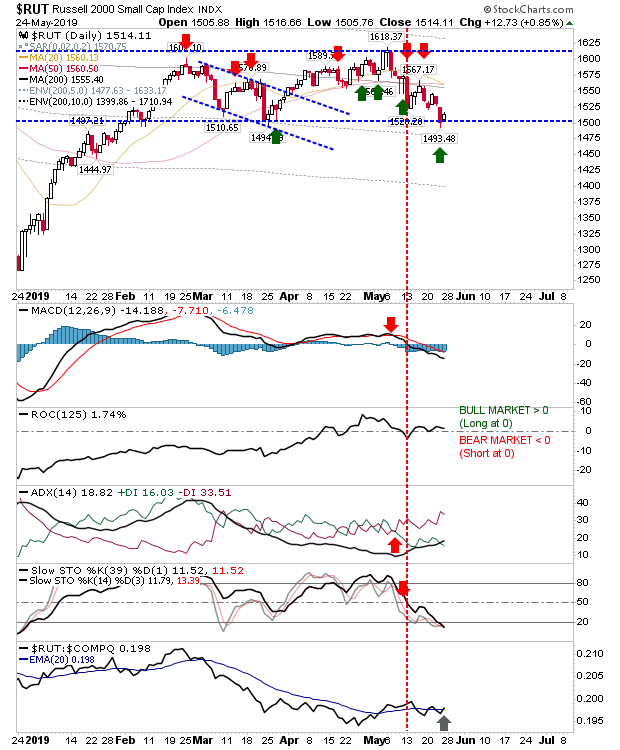

Friday was a bit of a mixed bag. The Russell 2000 was able to defend horizontal support as it continues to build a sideways pattern. While it trades sideways it will keep other indices in check until there is a confirmed directional turn—either a break of current support (for bears) or a rally back to, then beyond 1,615 resistance.

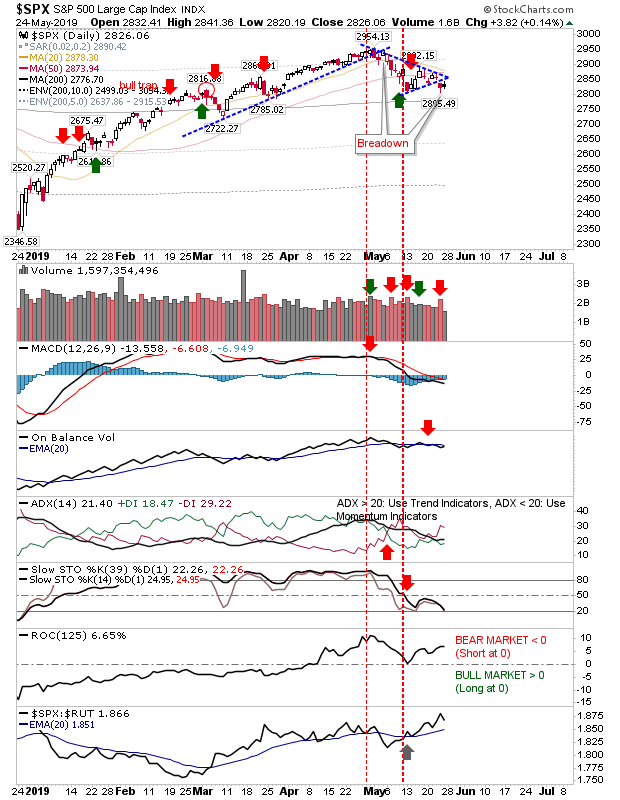

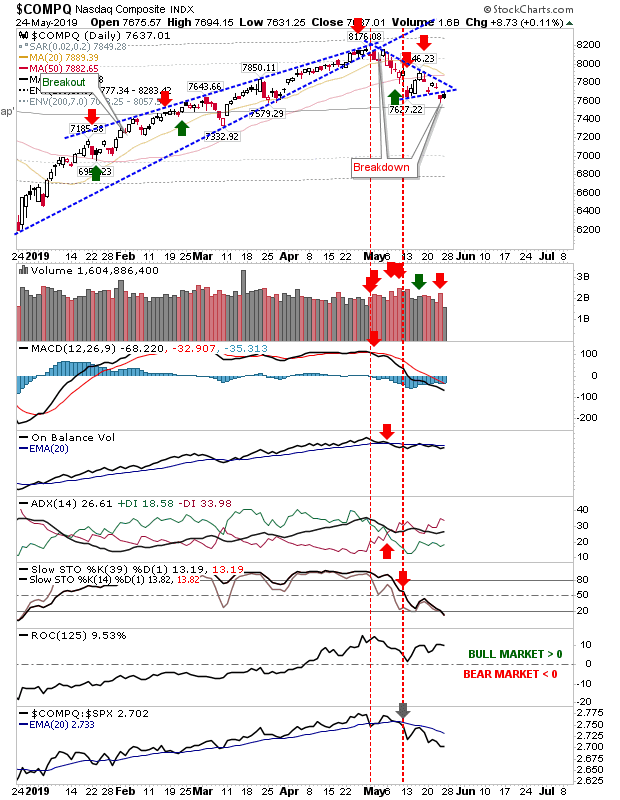

With the Russell 2000 caught inside a trading range, the breakdowns in the S&P and NASDAQ are caught in a bit of a no-man's land. As the Russell 2000 failed to break its support, both the S&P and NASDAQ are vulnerable; not just to additional losses, but also to a 'bear trap' and a rally through their respective consolidation triangles.

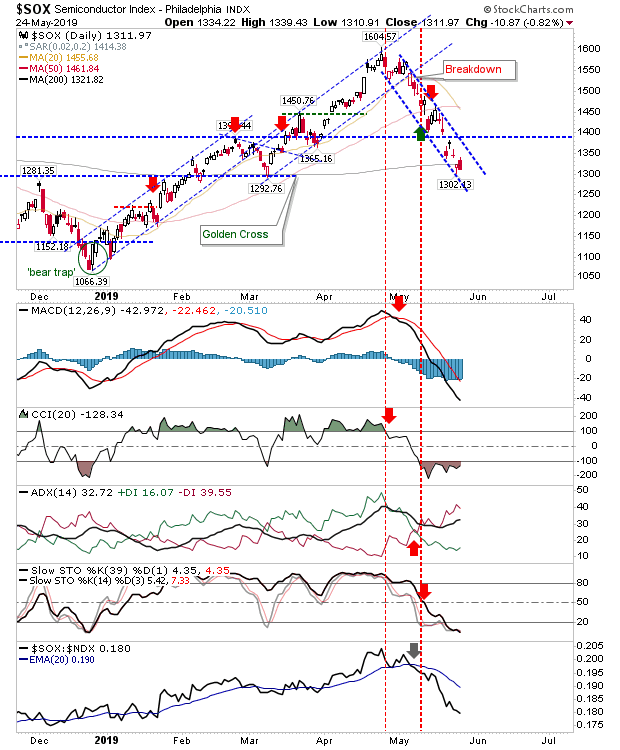

While the Russell 2000 is defending support, Semiconductors are heading in the other direction with an undercut of the 200-day MA. Further losses in this index will drag the NASDAQ and NASDAQ 100 with them.

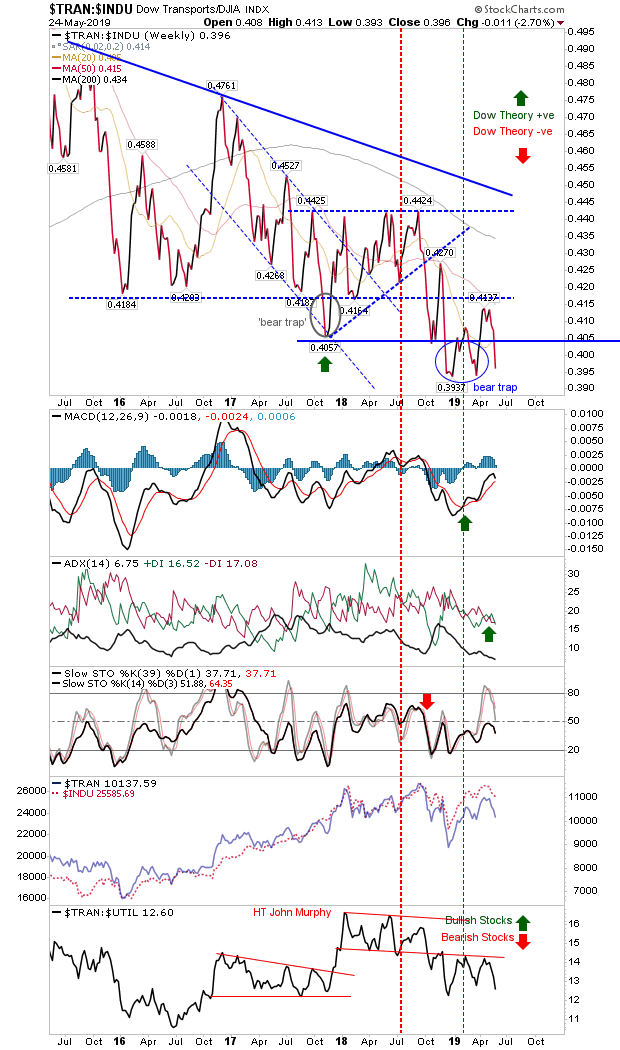

Finally, the relationship between Transports and the Dow Jones Index continued to struggle as it returned deep inside the prior 'bear trap'. This bearish relationship could pick up speed if 0.395 is lost. This indicator suggests a far more bearish outlook than any other index.

For Tuesday, watch the Russell 2000 if bullish and the Semiconductor Index if bearish. My hunch suggests bears are going to edge it but let price action be your lead.